AlmostMongolian 2024 Recap+Portfolio Update

AlmostMongolian UPGRADED

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

Mongolian short AD: THE LINK Long AD: LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

Before the article, I’m announcing that I have activated referrals.

If you use the “Share" or “Refer a Friend” buttons to share my Substack and it generates free or paid subscriptions you can get access to all the paywalled content for a certain period of time based on how many subscriptions you generated. These rewards are stacked as you reach higher levels. Meaning your 12 months will get added to your 6 months.

This post is too long for email. Press “show full message” when the email ends abruptly.

It has been a great year for my development as an investor. In 2023 I didn’t know what I was doing. During 2024 and in particular the 2nd half of 2024 I have been developing rapidly and my investing powers have been scaling up exponentially as we have approached the end of the year. According to my calculations, my investing power has increased by 10x this year.

Make a helicopter hat almotsmongolian and tophat almostmongolian to signify progress. Helicopetr hat at the beginning and it develops to tophat

If my investing power keeps increasing at this rate it will reach a level where it can no longer be contained in the vessel and as you can see from the graph the estimates are showing an extremely high rate of increase going forward.

As you all know investing power is more important than investing performance, but I will also talk about the returns

2024 performance

I will not be providing an accurate number. I will provide an inaccurate ballpark number. The reason for that is that there are many accounts and money moving between accounts so it would take time to calculate it accurately and even if I would calculate the accurate number I would still not swear by its accuracy and would never prove it. What I did is I went to the accounts and eyeballed the return for 2024.

And the AlmostMongolian return for 2024 is around +45%

SP&500 +23%

Nasdaq 100 +25%

MSCI World Index +19,9%

OMXhelsinki -3,18%

Mongolia Stock Market MSE Top 20 Index +24,38%

I’m beating the world and the indexes of the most important countries.

It’s not my best year for returns. 2021 had way higher returns, but that was all luck. 2024 was all skill. No luck involved. From now on my returns are going to be completely skill-based and luck is not going to be a factor.

The AlmostMongolian Portfolio Update

Today is January X. The stock charts are going to be trailing 12 months not 2024. We need to have up-to-date prices. Let’s not live in the past.

Valeura Energy cost basis 3,94$ return from Cost-basis +102.79%

Source: Google

This is when I started this position at the end of January 2024 and after that, I added 4-4,2$ when their Wassana field was shut down temporarily which raised my cost-basis to 3,96$.

My big write-up for Valeura is 100% free and it has been updated to include some recent news.

The valuation has moved up, but so has Valeura’s production, and cash position and they completed the tax restructuring which will increase profits for the next 2 years. The valuation is still cheap, but I don’t think the stock is as attractive as it was at 3-4$. I would say after we get past 9$ there needs to be another transformative acquisition or some amazing operational performance for me to justify Valeura over other positions. And I have already cut around 1/4 of the position to add to some other stocks.

But we are still very cheap. Trading at under EV/FCF of less than 2 using current oil prices combined with a management that has been executing oper

Mind Technology cost basis 3,69$ return from CB +87.75%

Closed position: Mind Preferred stock converted to common 4.9.2024 +2%

Mind Preferred stock before conversion.

Source: Google

Look at that dip to 3-3.25$ post-preferred stock conversion.

Didn’t I tell you it was in fact a “delicious dip" when the stock was 3-3,25$ in September?

Mind would be my biggest position by far if I didn’t cut around 40% of the positions recently at high 7s and low 8s.

I thought that the move to 6-8$ was the easy money portion. We didn’t need much to get to that level. Mind gets some positive order activity and the shareholder base turns over from the preferred conversion.

Now that we are at X$ and the market cap is X the market is starting to price-in some growth. It is expected that Mind will deliver better results. Meaning if they don’t the stock will go down. But on the other hand, the stock has a lot of momentum and if the company can deliver the stock has way more room to run. They made a big statement in the Q3 earnings press release that they have a pipeline of pending orders that is more than double the backlog. The backlog was 26,2m$ at the end of Q3.

“We expect this trend to continue in future periods and have an active pipeline of pending orders and other prospects that total more than twice our backlog of orders received.” Q3 PR

Source: Google

You can see Kraken Robotics which I have mentioned in relation to Mind in the past has done even better and it’s showing what kind of valuation a company in the marine technology sector can achieve when it gets unleashed. Kraken is not even listed on Nasdaq like Mind is where stocks reach highest valuations.

Kraken is trading at 5.82 P/S while Mind is trading at 1,36 P/S Both companies are profitable. And Mind is debt-free while Kraken has 15m of debt. If Mind can start growing consistently like Kraken they could reach a similar valuation.

Mind finally put a corporate presentation on their website which I recommend checking out.

I took some profits after the easy money was made, but because I’m still bullish on the company and its sector I’m holding the majority of the position because I think Mind is ultimately going higher.

Aduro Clean Technologies cost basis 1,97$ return from CB +199,5%

Source: Google

I haven’t done anything with the Aduro position in 2024. I got a small position in 2022 and added a bit in 2023. That’s all my transactions for this stock and it has been the right decision.

In 2022 I thought that if Aduro is successful I don’t need to have a large position, because if Aduro can do what they say they can it will be 100x or more if they don’t get acquired. And I still think that way about the stock, but now it has grown into a big position due to the stock going up and not without reason. Aduro has kept proving the technology further and getting large companies as collaborators.

In 2025 the biggest catalyst will be their pilot plant which is targeted for commissioning in Q3.

Source: https://ceo.ca/@GlobeNewswire/aduro-clean-technologies-engages-global-leader-zeton

If this Plant works like planned I expect a lot of upside for next year. Other than that I would expect more companies added to the customer engagement program and more existing clients to move to the collaboration phase with Aduro or potentially even to the commercialization phase.

“If the reason for buying a stock no longer holds, you must decisively sell it regardless of how much you lose” Stanley Druckenmiller

I don’t think the above quote is good advice for every scenario, but I think it applies to Aduro specifically. If there is news that derail the investment thesis of Aduro then I need to sell it no matter how much the stock goes down.

But I don’t think it’s smart to blindly follow this advice. For example, you have a mining company they have 2 mines 1 in Africa and 1 in the USA

They have 50 million of cash and no debt

The us mine makes 50m per year of FCF

The investment thesis is based on the mine in Africa starting production very soon and beginning to make 500m per year. This is why you bought the stock.

the market cap is 1,5b

But some rebel group takes over the mine in Africa just after the mine starts up.

“Kubadibaduu democratic revolutionary liberation front”

The market cap drops to 100m within 1 second. It’s really an incredibly fast day in the market. If you would follow Druckenmillers advice you would sell this stock.

But we are trading at EV/FCF of 1. And that the remaining FCF comes from a safe jurisdiction. The market overreacted and buying the dip would be the smarter move than selling despite your original reason for buying no longer holds.

It’s situation-based.

But for Aduro I’m going by that Druckenmiller quote because if the investment thesis breaks there is no bottom. There is no pivot or other assets that could save the thesis or make it a buying opportunity at a certain price. It would be a total dilution death spiral.

But as long as the investment thesis moves forward with more proof that the technology works as expected and Aduro is getting more collaborations the stock will keep going higher.

Now after Aduro is uplisted to Nasdaq the upside potential is even higher. A lot more people have access to the stock. For example, some of the brokers I use Nordnet and Degiro did not have Aduro available before uplisting and now Aduro can be accessed with both. I know people who did not buy Aduro because they did not want to open an IBKR account just to access Aduro. Now they can buy it at a higher price on their existing accounts.

Voxtur Analytics cost basis 0,18$ return from CB -72,22%

Voxtur the goat of small-caps. Everyone loves this stock. The problem is that it’s boring. Just good news all the time. Another strong quarter after another. Beating market expectations. Can we get a weak quarter for a change? Just to have some variety.

Source: Google

But seriously guys, I’m being serious now. Everyone hates this stock. It’s the goat of plummeting stock price and underperforming expectations, but they have a new leader. New Khan. New Pomo. New Führer. He is over there cracking the whip, collecting skulls, integrating, amalgamating, discombobulating, and depopulating.

I have been adding at 0,08, 0,06, 0,055, and at 0,05 CAD. I can’t wait to add more at 0,04 and 0,03 and at 0,0001 CAD. My motto is “Buy very very low and sell high”. It requires balls and my motto is”The future belongs to those who show up.”

Take it lower sellers! Make my day. Say my name. I’m the bid. I’m the one who buys.

I will sacrifice a thousand accounts before I let this company die!

Illumin cost basis 1,79$ return from CB +24,2%

Source: Google

Illumin investment thesis was that it has a very low valuation and very high margin of safety due to it’s large cash pile. If they can return to growth the stock has massive potential, but if they don’t the stock doesn’t have much downside.

My free write-up goes into the investment thesis more deeply and in my recent paywalled update, I analyze the Q3 earnings.

In Q3 Illumin had their return to growth, but they need to prove this growth was not a fluke for a few more quarters before the market believes it and starts to price the stock like a growth stock. The stock went up after Q3 was released, but it’s still not trading anywhere near a growth valuation.

After Mind had a strong quarter with a great outlook given the stock was unleashed and unchained. Illumin just kind of took a look out of the cell window, but didn’t rip the bars open. Seems like we need more strong showings from Illumin before the stock can rip like Mind. There is still a lot of doubt afoot.

The easy money rally that happened with Mind has not yet happened with Illumin, which is why I’m not selling any stock yet and looking for any dips below 1,9$ CAD as great adding opportunities.

Africa Oil 2nd round cost basis 14,21 SEK return from CB +13,86%

Closed position: Africa Oil 1st round -19%

Source: Google

I sold Africa Oil at -19% loss and then recently I got back to Africa Oil with a much larger position a couple of months after I sold it and have been adding to it in December. I explain the reasoning for this in this article.

I also believe my previous bet in Africa Oil was a grave mistake while my current Africa Oil bet will turn out to be a great success.

When I wrote the Article “Africa Oil: The cheapest Oil stock I know”. I should have not owned the stock at that time. This is because Africa Oil had no clear path to stock price appreciation at the time. It was more expensive and the catalysts were farther away. It was cheap, but that was not good enough.

Definitely a tragic mistake. Unforgivable. I disavow my successful Africa Oil article that generated a lot of new subscribers and I avow my new much less successful Africa Oil article.

Africa Oil is a total no-brainer 50-150%. Not any more than that. Know the potential of your stocks. It also has a low downside and will have a +10% dividend yield.

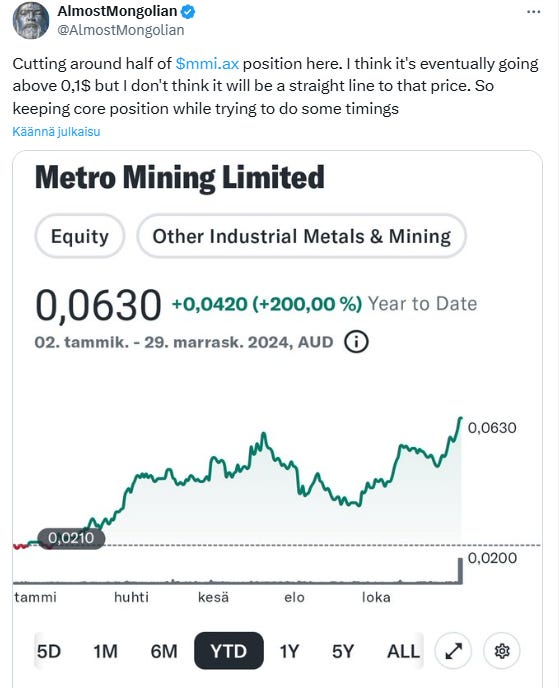

Metro Mining cost basis 0,0408$ return from CB +32.35%

Source: Google

Metro has been a decent performer this year. As You can see I cut this position in half. it was getting very big and the stock had been running and I wanted to increase other positions. Still Metro is a significant position.

They have performed pretty badly operationally. Not horribly they have increased production, but they have had delays and problems.

Source: https://wcsecure.weblink.com.au/pdf/MMI/02900641.pdf

The green part is their guidance. This has been more than offset by the very strong bauxite price which will be showing in Metro’s earnings in the first half of this year.

Source: https://wcsecure.weblink.com.au/pdf/MMI/02890921.pdf

If Metro doesn’t completely fail operationally and the bauxite price stays around these levels the cash flow to the valuation is quite cheap.

Market cap=306m with 63m net debt

Source: https://metromining.com.au/wp-content/uploads/2024/12/Research-Petra-Capital-Dec-2024.pdf

There are different scenarios for what can happen with bauxite price and operations, but I see Metro stock being higher than currently in most of those scenarios because in almost every possible scenario Metro ends up in a significant net cash position in comparison to the current net debt position and is returning capital to shareholders as opposed to now with no distributions to shareholders.

This is a turn-around play and despite some problems and delays the turn-around from a high debt money-losing company to a strongly cash-flowing, strong balance sheet company that’s returning cash to shareholders is happening and along with it the stock price is re-rating.

Globex Mining Enterprises cost basis 0,81$ return from CB +64.2%

´Source: Google

Globex is a very cheap stock. It has a great margin of safety. They have multiple assets that could multibag the stock. The risk/reward is amazing, but they are a very slow mover. Which is the only problem with this stock. Which is why it’s not at the top of this portfolio. Globex is basically a one-man operation and he is an old and patient man who has been running this company forever. The good thing about this is that he isn’t going to do anything stupid to jeopardize the shareholders, but he is not going to be very aggressive in getting the stock price up either.

Source: https://www.globexmining.com/documents/2024SeptemberGlobexPresentation_En.pdf

If a new CEO came in who wanted to multibag the stock quickly what he could do is just slam the buyback. Start selling shares of other companies from their portfolio to buyback stock and start making option deals quickly to get more news flow and cash and rotate that cash into more buybacks. You can see how many assets Globex has and most of them are not optioned. If there was a person who didn’t negotiate as hard as I have heard the current CEO does this new CEO could make a lot of deals. For the long-term, the strategy of the old CEO is likely better as he wants what he sees as the best price for his assets and then he gets the money and buys more of what he sees as undervalued assets, but for short and medium-term someone could multibag this stock quickly by slamming the buybacks and starting to liquidate this portfolio.

But this is not the case. The old CEO is most likely going to keep running the company. This is why I consider Globex as a staple in the portfolio almost like my preferred version of cash. It will be there as long as it’s as cheap as it is, but if I need to tap into some position to get cash to buy something else Globex may have to be sold a bit. Then if Globex has a dip I might buy those shares back.

There is something that could transform the whole Globex thesis. This is the Ironwood gold project. Globex is currently drilling and the CEO has been talking about possibly putting it into production. This would be a break from the usual business model of Globex, but could multibag the stock. This is a small very high-grade gold project that should not take a long time to put into production and at these gold prices it would make a lot of money, but there is a lot of uncertainty around how much could it make and possibly Globex is just drilling it to a get a better optioning deal from it.

Sintana Energy cost basis 1,04$ return from CB -4,81%

Source: Google

My second newest pick.

I had known about this stock for a bit, but never really researched it, which was a mistake, but when I was making my Eco Atlantic write-up I also researched the Orange Basin in general, and while I was doing that it became clear that Sintana is the best way to play Orange Basin exploration boom.

I sense a potential future write-up, but for now, I direct you to the corporate presentation.

Smith Micro Software cost basis 1,96$ return from CB -30,61%

Source: Google

This is a situation where the late 2024 BEAST AlmostMongolian had to take care of some issues created by the earlier iterations of AlmostMongolian.

Source: AlmostMongolian, Substack Notes

Due to the BEAST AlmostMongolian loading up at the lows, I’m starting to close in on my cost basis with this stock that went down -93% from my original purchase price. Now I’m down only -30,61%.

Early this year I was bagholding a small position with very little conviction, but took a deeper look after it had a massive crash and decided to load up at the lows. Of course, I should have sold it way earlier and then gotten back in when I loaded up. Not selling this stock earlier is an unforgivable mistake and also not loading up at the lows would have been another unforgivable mistake. One unforgivable mistake was made and one avoided.

Here is my partially paywalled write-up from December where I explain everything.

Now we wait. We play the waiting game. If they can get profitable next year before having to raise money again this stock will go up a lot and there is some good stuff happening with the new European carrier client Orange.

Eco Atlantic Oil&Gas cost basis 0,2$ return from CB 0%

Source: Google

Eco Atlantic is in my view the riskiest pick I have. I know some goofy goober would say “Actually🤓☝ Voxtur is your riskiest pick”, but no it is not. This is why I’m not planning to make Eco a big position unless it becomes a big position due to share price appreciation like Aduro.

This is my huge partially paywalled Eco Atlantic write-up. It’s still up to date as there have been no new developments since it was released.

2025 makes or breaks Eco. 2025 determines the faith of their 2 most valuable assets Orinduik and 3B/4B.

They need to drill Orinduik in 2025 or they lose the license. And they need to find a larger oil company as a partner to do that.

3B/4B should be drilled in the first half of this year and 2 exploration wells are carried for Eco.

If the 3B/4B exploration wells don’t work and they lose the Orinduik block. This stock is crashing. But both of these assets can single-handedly multibag the stock. This means the investment can still be successful if they fail at another but succeed at another.

Other than that Eco won’t need to raise money. And they have other earlier-stage assets that could be potentially big in the future due to their location. They have a deal that reduces 15% of their share count that closed today. This deal is very favorable for Eco.

Source: https://ceo.ca/@accesswire/eco-atlantic-oil-and-gas-ltd-announces-block-3b4b-d9c54

I’m planning to hold and I see the risk/reward as favorable.

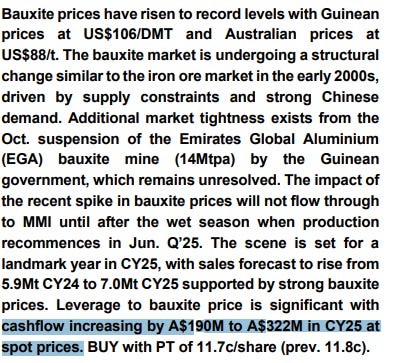

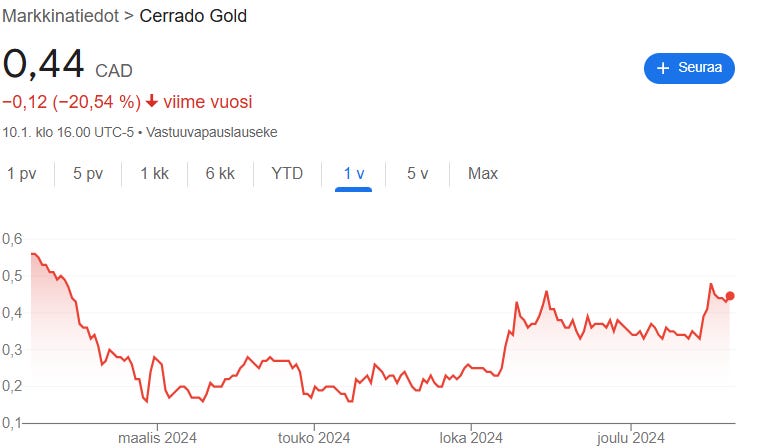

Cerrado Gold cost basis 0,38$ return from CB +15,79%

Source: Google

This is the first time I’m talking about Cerrado. My newest addition.

Market cap=32m USD

They can repay their debt with money coming from option agreements and most of it has already been received.

Source: https://www.cerradogold.com/assets/Corporate-Presentation.pdf

They retain 2 assets.

Source: https://www.cerradogold.com/assets/Corporate-Presentation.pdf

5-year life of mine gold mine in Argentina that makes 42m USD of FCF at 2646,3$ gold price with current gold price being 2717$. There is also the potential to significantly increase the life of mine.

This is the other asset.

Source: https://www.cerradogold.com/assets/Corporate-Presentation.pdf

This is an iron ore project in Quebec. I have known about this for a while because Globex holds a royalty for this, but I did not look at Cerrado by itself for a possible investment before once again user named Geodan from ceo.ca posted about it. The same person who told me about Valeura Energy. Definitely worth a follow.

In addition to the stock trading at cheaply compared to its gold mine in Argentina, they have a 1,6 Billion NPV iron ore projection in a good jurisdiction, Cerrado has cash flow from Argentina and an external funder for the project as well.

Source: https://www.accesswire.com/807405/cerrado-gold-appoints-the-toronto-dominion-bank-to-be-the-mandated-lead-arranger-for-export-credit-agency-supported-project-financing-at-its-mont-sorcier-iron-and-vanadium-project-in-qubec

Cerrado at a 32m market cap making 42m free cash flow and 1,6b NPV project. I sense the potential more much more detailed write-up coming.

Only reason why this position is down here is because it just started moving up immediately after I started buying it at 0,34 CAD and then I didn’t want to chase, but I think I might have to chase. I already chased a bit.

Closed Positions

15.8.2024 ASTL 0.00%↑ Algoma Steel +54%

This was the 2nd biggest position going into 2024 and then I even added more at the 6-8$ area during the summer having it briefly as the biggest position. And it was a good choice to sell it because the stock is down from where I sold and I used that money to buy the dip in stocks that ended up performing way better like Metro Mining and Valeura.

54% is from adding the dividends received to the return. This tweet from August still mostly reflects my thoughts about this stock. They have given more information about the EAF ramp. Not everything I wanted, but the production guidance is here.

Source: https://ir.algoma.com/static-files/2513615b-0974-4aca-8b77-85698878f077

I originally thought they could get to 3 million faster.

The weak steel prices are also hurting Algoma stock and the tariff fears. If the stock dips to below 7$ again I will be looking to get back. Now at 8,23$. Dipping.

3.1.2024 $RZE.V Razor Energy -65%

I already talked about closing the Razor position in my 2023 recap, because I closed it just at the start of the year and the recap was released after that. But because it was closed in 2024 I have to talk about it again.

Basically, I thought the Razor was done at the end of 2023 and was just holding it in case there was a post-tax loss season short squeeze and there was so I was able to unload my shares into that Rally and after that rally, the company went bankrupt. So I’m happy I sold the stock, but this pick was really a horrible pick from the start.

The current AlmostMongolian would never make an investment as bad as this. And I don’t mean an investment that returns -65%. I’m sure I will have investments with those types of losses in the future. Because things I won’t expect will happen even with a good investment thesis. Or bearish things happen that I knew could happen but thought were unlikely.

What I mean is that currently, I would not make an investment with an investment thesis as bad as Razor. It was a weak investment thesis from the start and it also relied on a higher oil price. I will not make another commodity investment that relies on a higher commodity price. I will not make another “torque to X commodity investment” Torque to a commodity is a bonus and underlying the torque needs to be an investment that works with the current or preferably also lower than the current commodity price.

For example, Metro Mining has a lot of torque to the bauxite price, but the investment thesis does not rely on a high bauxite price.

28.5.2024 $MLX.AX Metals X +67%

I needed Metro Mining and I was thinking about getting out of Metals X anyway. This turned out to be a good move because Metro mining is +35% from 29th of May 2024 and Metals X has gone down -14% from the same day.

Apart from getting more Metro Mining I thought that the easy money was made in Metals X. When the stock was at around 30 cents we only needed the buyback to be announced and some strength from the tin price which was enough for a 67% rise. This combined with the large cash pile that provided a strong margin of safety made Metals X a great risk/reward.

I’m still following Metals X. It’s cheap, but I don’t see a clear path to a significantly higher stock price without the help from the tin price, and like I just said during the Razor part. The investment needs to work with the current or below the current commodity price. Metals X is also buying stakes in other public companies(First Tin) with their cash pile. WHICH I HATE. Why wouldn’t I just buy first tin shares instead of Metals X shares if Metals X management thinks that is the best use of their funds? The same question arises when any public company buys shares of another public company. If a public company makes an investment It needs to be something I don’t have access to with my brokerage account. Otherwise, what’s the point?

17.5.2024 $ELR.TO Eastern Platinum +83%

This was a small position with a nice gain in a short time.

The stock was 0,22 CAD when I sold it and now it has dropped to 0,15 CAD. I’m not interested in getting back in at the moment. I don’t really understand what is going on with this company to make a high-conviction bet. It was a lucky gain.

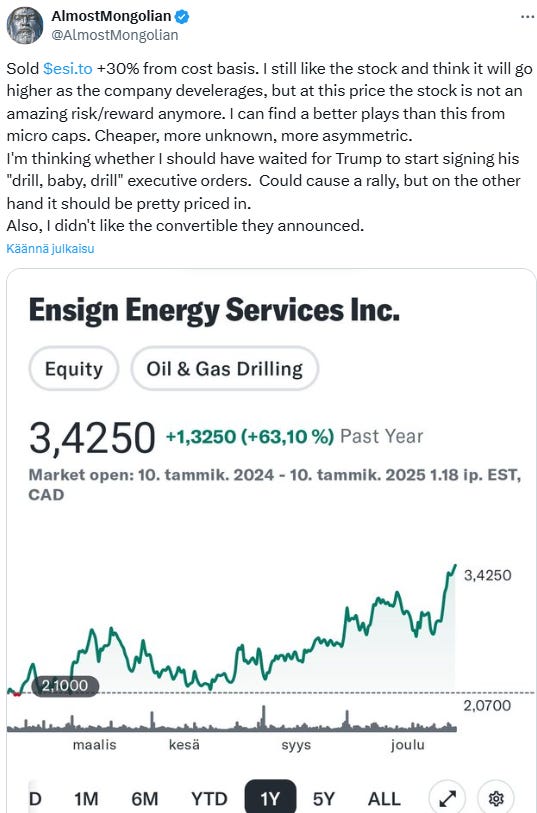

10.1.2025 $ESI.TO Ensign Energy Services +30%

Not much to add to that. I like the stock, but just not enough at this moment at this price. Finding stocks like Cerrado gets me thinking about what I’m doing with Ensign Energy Services. Now at 634m market cap paying back debt 200m per year as a base. Over time the stock shou…😴😴😴

But I’m staying by the Ensign Energy Services bull thesis. I’m not disavowing it and I do not think it would be an unforgivable mistake if I didn’t sell it.

If it drops back to 1.9-2.2$ I’m loading up. Although I doubt it will, but it tends to drop there regularly so maybe this time is not different. And I hope it does drop there now that I’m out. I hope it drops to 1 cent. I’m loading up at 1 cent.

3.1.2024 Nasdaq-100 ETF short -14%

Good thing I closed my Nasdaq Short early before any further damage was done. How stupid is it to short an index because it has a high valuation? Or short anything ever? It’s incredibly stupid. Unforgivable. Again.

4.11.2024 $PEI.V -11%

This is only -11% because I took profits from this stock in 2023 at 0,12-0,14$ and even some in 2024 at 0,09$, but I kept a small position and that went down a lot and I sold the last shares at 0,035$ which was about -56,25% from my cost-basis.

Source: Google

Another remnant of a previous iteration of AlmostMongolian. It was an unforgivable mistake to hold onto this stock even for a small position. I was suffering from the sunk-cost fallacy here because I had been holding it since 2022 and I was coping while I knew that the company was not going to reach their guidance and I was making another unforgivable mistake of waiting for a bounce to unload. Never wait for a bounce if you have lost your conviction.

This is what I wrote in my 2023 recap.

“With Prospera, I’m thinking about an exit plan. I’m not looking to hang out in an oil junior in Canada for the reasons I laid out before. So I will look for a spike in the oil price coupled with Prosperas’ increasing production showing in their financials as significant profit. Then some Youtube videos from Kerry Lutch, Mining Stock Education and maybe another long one from Shubham. Prospera has some relatively popular internet people covering it. To get a nice shot of new retail investors to Prosperas’ arm during their success could give me a nice rally to unload. But maybe I won’t and I get further indoctrinated by Propera and become a long-term investor.”

So at the beginning of the year, I had already lost my conviction and I still held on for another 11 months. Unforgivable. And I won’t regret this sale even if the stock goes up from here(Like it is doing😤) and the company succeeds. It’s possible, but if I think the risk/Reward is not great I should not be in the stock. I’m regretting holding the stock as long as I did. Another unforgivable mistake.

5.9.2024 $QMCI -14%

Another one like Prospera where I had lost conviction but held on for too long waiting for a bounce to unload that never happened. Quotemedia is a way better company than Prospera and I don’t consider this investment another unforgivable mistake, although I consider waiting for a bounce to sell into after losing conviction an unforgivable mistake in this case as well. But the company is good and the investment thesis wasn’t horrible either, but it always lacked something. It lacked the catalysts for a big run.

Source: Google

Then in 2024, Quotemedia lost a few clients which halted their usual 10-20% annual growth rate. This has caused more downside even after I sold. This is getting me to follow the stock more closely. They are saying they will return to growth in 2025 and now the stock is trading at X P/S while slightly profitable. If the stock gets to 10 cents the risk/reward begins to look very good, but even now I see a very high likelihood of rerating to above 20 cents next year.

“Also, during the quarter, a significant client discontinued using our services due to their financial struggles. This not only had the effect of reducing our revenue, but also resulted in a significant increase in our bad debt allowance and expenses over concerns that this client may not be able to pay its outstanding invoices. This has negatively impacted our profitability.

“We have completed several important development projects; and going forward we expect to see our spending reduced in that regard. With several new prospective client signings on the horizon, and with the implementation of additional cost optimization measures, we expect to see an improvement in revenue growth and profitability in 2025.” Q3 PR

Biggest Mistakes, Lessons, and Innovations

I already went through many mistakes, but it’s time to collect them all.

This is not just about whether I did something and then the stock price went the wrong way. It’s more about when it was obvious I should have done something and I didn’t do it.

Not selling Prospera, Quotemedia, and Smith earlier with already weak conviction

I went through how waiting for a bounce or making other excuses to hold onto stocks you have a weak conviction on is an unforgivable mistake. These stocks all were like this. However with Smith later I rebuilt my conviction by doing more research and the valuation became way cheaper.

This mistake is coupled with a lesson. Do not hold any stocks you have a weak conviction on.

Currently, I have strong conviction with every stock I have in the portfolio and I intend to sell immediately if I lose the conviction in the future and not wait for a bounce or make up some other excuses to keep holding.

Not following the Mind situation closely and leaving 25% of Mind as common stock.

This is not really a big loss. I switched 75% of my Mind common stock to Mind preferred stock after Mind management increased their offer to the preferred holders. After that it was clear that Mind management was 100% committed to converting the preferred shares and the preferred shares had more negotiating power. I knew that it was a no-brainer correct decision to convert the common shares to preferred shares at 5-5,5$, but for some reason, I held onto 25% of the common stock. There was no good reason for it. Unforgivable.

Not buying Tenaz below 9$

I included Tenaz in my watchlist article. Then I had some people reach out to me giving some more info about Tenaz and I liked Tenaz even more after that. The stock was 8,20$ at the time. I thought this stock needed to re-rate to around 15$ just based on the recent amazing acquisition they did, but it just had a run. It will probably pull back. It didn’t. Now the stock is 13,86$ and I missed it. The re-rating from that acquisition is mostly done. It could still go up more if they do another amazing acquisition or commodity prices go up, but the easy money has been made. I missed the easy money because I waited for a dip. I know that I can’t predict short-term stock price moves and I knew the stock was a great risk/reward at 8,2$. So this was another unforgivable mistake.

The lesson from this mistake is If the opportunity is obvious just get a position.

Doesn’t matter how much the stock has already gone up or down. Just buy. Even just a starter position is better than no position and then if it dips you can load up.

The lessons from these mistakes are to cut these stragglers out of your portfolio and get a position immediately if you see an opportunity.

Another lesson for this year that I wrote an article about follow your Ex-investments

My re-entry to Africa Oil inspired this article. Most market participants have no clue. When you have done the work on a stock whether it’s your current or Ex-investment you continue to have an information edge in relation to that stock. It makes sense to keep your eye on these stocks, because when the time comes when that stock crashes stock or there is some new development you will be able to make a more informed decision and make them faster than the other market participants who just straggled in tripping over themselves trying to figure out what’s going on.

One innovation I created was the “Adding Zone” Patent Pending. This is a new addition to my strategy.

This new adding zone tweet needs a few months to prove that the adding zone has worked again. I intend to have a winning streak. My hypothesis is that every Adding Zone tweet will age well. I think my patent will be very valuable once I have proven my hypothesis.

I have also created new terms this year that I think will become part of the mainstream financial lingo in the future. These are “Mongolian Earnings”, “Investing Power” and “Death Spiral”.

This year I have also pivoted back to commodities. The biggest reason for this is that this is the sector where there are tons of very cheap stocks at the moment and they are relatively easy-to-understand businesses. In the past 12 months, I came across Valeura, Metro, Cerrado, Africa Oil 2nd round(not the unforgivable mistake 1st round) , etc. I think commodities will continue to be a major part of my investing strategy going forward, but I’m a generalist and will invest in any sector if there is a great opportunity.

First year with no margin, no shorting, no financial derivatives, no trading. But I do intend to do more active selling and buying next year that I do not consider trading but more based on my own risk/reward calculations at X price the risk/reward gets weaker so I’m cutting 30% and adding to whatever is in the buying zone. Basically fundamentals-based active trading around my existing positions while keeping core positions, but not trading. The recent Metro Mining move highlighted earlier in the article is a good example of this.

I’m mega bullish The AlmostMongolian Portfolio for 2025. It’s perfect. My conservative estimate for 2025 is a 100-300% gain. My optimistic estimate is too outlandish to even say. You wouldn’t believe I can estimate a number that high. You have no idea how high I can estimate.

2025 AlmostMongolian will be something else entirely. It will be entirely something else.

Great update. Very interesting tracking your progression as an investor.

Where do you write now mostly? How do I follow your work?