Africa Oil: The cheapest oil stock I know

and a company with a new direction

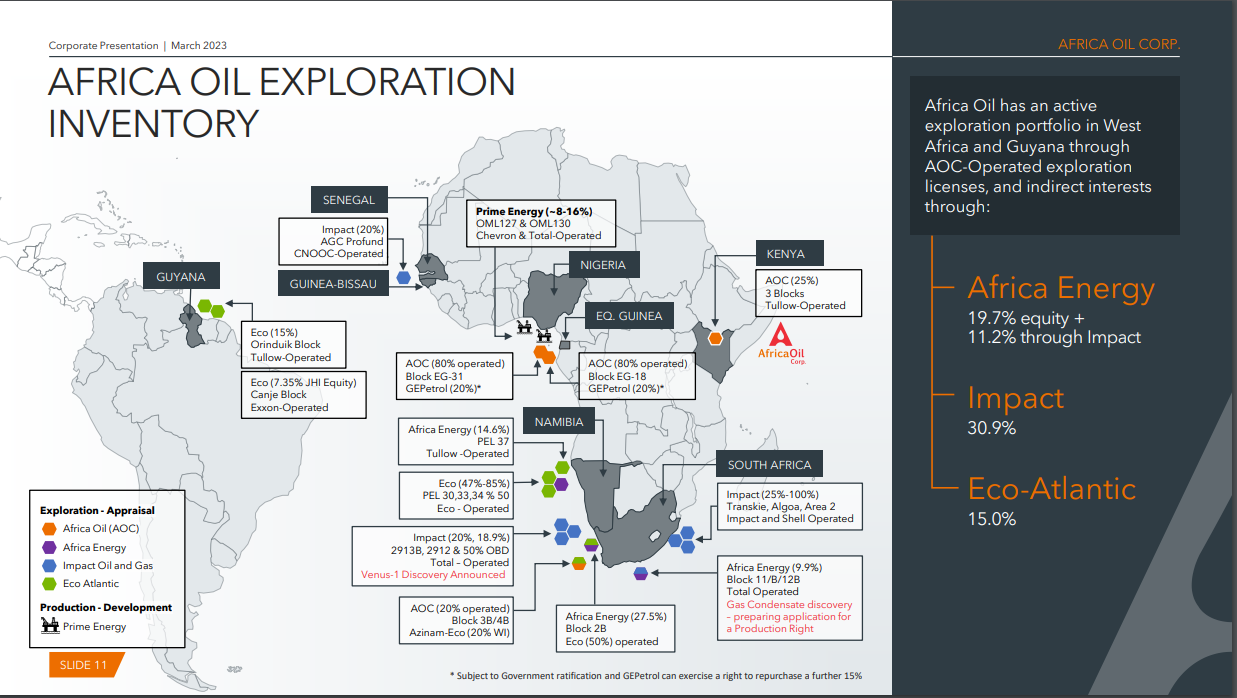

Africa Oil has been cheap for a while, but it has also been confusing, and directionless, but in recent months there has been a shift within the company, because of management changes. A new direction that I like. Maybe some of you have looked into this company in the past and you have seen this monstrosity.

Source: Africa Oil corporate presentation March 2023

This was the corporate presentation during the previous management. Most of what you see above is pretty inconsequential. There are only about 4 assets that are important in that picture. 4 assets that make this company an amazing risk/reward.

This is from the latest presentation from the company.

Source: Africa Oil presentation January 2024

It’s much more cleaner and now it shows the relevant assets.

I’m going over the basics before I try to evaluate these assets based on available information.

Africa oil has a market cap of 907m USD and EV of 705,5m USD(at 2,64 CAD stock price). No debt. Cash and Cash Equivalents of 201,5m USD.

They own positions in 2 public companies (Africa Energy, Eco Atlantic) and 2 private companies(Prime, Impact).

Their Africa Energy position is worth around 32m USD at market prices and their Eco position is worth around 6.9m USD atm.

These positions are pretty irrelevant even if ECO goes up 10x the profit will be around the same as what they earn every quarter.

I hope they sell these positions at a good moment and they have indicated this in the last call. If I want to invest in these companies I will invest in them directly. I would rather have this cash given to shareholders or invested in their assets.

Now to the 4 important assets.

Prime, Nigeria

Source: Africa Oil Corporate presentation October 2023

The lion’s share of the market value of African oil comes from their Nigerian assets. This is their cash cow. Or maybe I should say Cash Buffalo or Cash Wildebeest.

Anyway, this is the only producing asset Africa Oil has.

It is owned through Prime. Africa Oil owns 50% of Prime which owns stakes in huge offshore oilfields operated by major oil companies. Prime owns 8% of OML 127 and 16% of OML 30. These fields are operated by Chevron and Total.

Because Africa Oil owns such a small portion of these fields and they are operated and majority owned by the majors it reduces the risk of operating in Nigeria. And risks of Africa Oil screwing up something operationally because they can’t.

But even a small stake in these fields is huge for Africa Oil. BTW everything below is net to Africa Oil’s share of Prime. No need to halve the numbers they have already been halved.

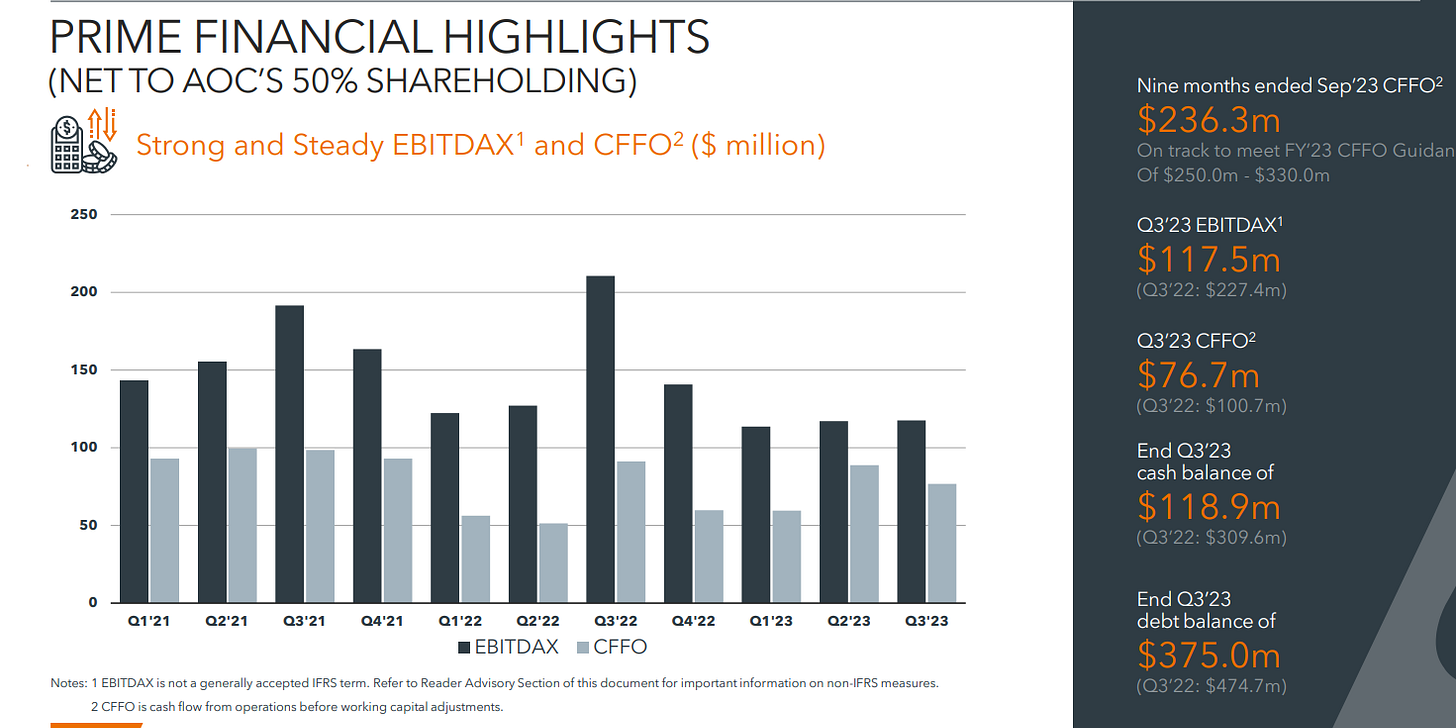

Source: Africa Oil presentation November 2023

This is the operational performance net to Africa Oil’s share of the company. You might notice surprisingly strong 2021 and 2023 compared to 2022. This is because Africa Oil was hedged through the Covid period so they did not experience the highs and lows of Oil price fluctuations. But at the end of 2022, they changed their hedging strategy and now they are more in the mercy of oil prices for better or worse. I think for better because I am bullish on oil. Not as bullish as I was before. I am cautiously bullish nowadays. Aware of the difficulty of predicting commodity prices.

In the picture above there are these operational numbers for Prime, but we care is what Prime distributes to Africa Oil. Prime pays dividends to Africa oil from their earnings. In 2022 Prime distributed 250m USD and during 2023 distributions have been Q1=0 USD, Q2=62.5m USD, and Q3=62.5m USD.

This is quite significant considering the 705,5m USD EV.

I said earlier that Africa Oil has no debt. This is true. But Prime has debt. Some people like to include this in the EV. I do not. Well, it doesn’t matter if do or not as long as you’re aware of it. The debt of Prime is handled within Prime and what matters to Africa Oil is what Prime spewes out. Prime has no issues dealing with the debt they have low breakevens, a lot of cash(118,9m USD), and a large amount of undrawn credit available within their credit facilities(250m USD).

Source: Africa Oil

According to these 1P NPV, 2P NPV etc. The value of the Nigerian assets alone exceeds the market value of Africa Oil. But who cares about these NPVs? The market doesn’t. I have seen it over and over again in companies trading at 10-20% of NPV.

What matters is this. At normal oil prices, Africa Oil owns an entity that gives them around 150-300m USD annually to use for whatever. What is that worth? More than their EV? Most likely. More than their Market cap? Probably.

But of course, you have to take into account the jurisdiction. Nigeria, but there are some things that make Africa Oils’ position in Nigeria not as risky.

First of all the majors are operating the assets. The assets are mostly owned by the majors and the majors have a lot of power in Nigeria. You know this if you have seen some documentaries.

There are also problems in Nigeria like Oil stealing. People are stealing oil straight from pipes. But Africa Oil’s assets are offshore and are not impacted by this or any other BS that happens inland.

The tax rate for Nigerian operations was also reduced from 50% to 30% in 2023. And OML 130 got a 20-year license renewal. OML 127 has its license renewal this year and I expect them to get that quite easily. So the signals from the government have been good.

Nigeria is also relatively stable compared to its neighbors. I know that is like saying the tallest midget when there is a coup wave going on in Africa, but it’s something. The jurisdictional and operational risks are not significant in my opinion. Of course, relatively speaking.

It’s not Texas, but it’s not Venezuela either.

They also sell their oil at a few dollars premium to Brent.

The way I see it. This asset alone is worth more than the market cap. But that alone would not make me invest.

There are a lot of companies out there that can make a case that they are undervalued. If Africa Oil only had Prime I would say it looks cheap, but I can understand the valuation if this was their only asset and I would not see a big upside from there.

The next assets are what gives Africa Oil the upside potential. Prime enables them to pay dividends, do buybacks, and put more capital into these following assets.

Venus, Namibia

Africa Oil owns 31% of Impact Oil & Gas, which is a private company. Impact Owns 9.5% of the Venus discovery with full carry to first oil and they own some other assets that are not really relevant to Africa Oil.

Source: Africa Oil corporate presentation March 2023

Venus is a big discovery and through Impact Africa Oil owns 3% of it. Doesn’t seem much, but that could be 10-30k barrels per day to Africa Oil or to whoever buys it from them eventually based on estimates we have. Africa Oil used to have 6% just recently, but Impact made a deal with the Majors who are developing this (mainly Total). And this cut Africa Oils ownership in half, but I think this was good news. Why?

Source: Africa Oil, Impact Farmout Transaction, Management Presentation, January 2024

Impact gets some cash, but the key is the carry. Now Impact does not have to put any money into this development and they only pay back development costs from after-tax cash flow once the field is in production. And if the project doesn’t work out for one reason or another they do not have to pay anything back to the majors who are putting money into the property. It derisks this project from Impact’s perspective. It is somewhat similar to a royalty.

If Impact stayed at its previous predicament a large chunk of Africa Oil’s cash flow would have gone into development costs for Impact. Now this deal frees up Africa Oil to do buybacks, dividends, or acquisitions.

This does not necessarily mean Africa Oil will stay in Venus until production, but this allows them to wait until the project gets more drilled and evaluated. Then Impact will also be more valuable to a potential buyer. I feel like Impact selling out now would have been too early, because we have seen a lot of exploration success in Namibia and Total who has the most information seems very eager to develop this property.

What is Africa Oils’ Impact position worth?

It’s really difficult to say at this point. But there are some things we can look at. There was a capital raise last April to pay for Impact’s share of Venus development costs. This was reimbursed in the farm-out deal. All the owners had to participate or they would lose a share of the company.

Source: Cision, ceo.ca

So Africa Oil increased their position by 0,2% in this raise. How much did they need to pay more to get 0,2%?

95*0,309=29,355 This is what Africa Oil needed to pay to retain their positions

31.4 This is what they paid

31,4-29,355=2,045m USD for 0,2%

If 0,2% cost 2,045m what would 100% cost with the valuation the Impact owners gave it in this raise?

2,045/0,002=1022,5m USD for 100%

1022,5m*0,311=317,9977≈318m USD

I think that makes sense. Comment if you don’t think it does.

This is the closest thing we can get to a valuation of Africa Oils’ impact position.

Source: Upstream

Other ways would be to try to use NPVs or a calculation based on the number of recoverable barrels, but there is still a lot of uncertainty about how many billions of barrels are recoverable.

Will Namibia steal this or have surprise taxes? I doubt they will steal it. I have not seen any indication of this. They need the investment in this sector and it seems like they understand it. Surprise taxes or stuff like this is possible, but we do not have to care about that for a while as it’s still in development. And even the UK had a windfall tax so these things are hard to avoid. This is offshore of course which will make it safer from violent events. In general, I’m not worried about the jurisdiction here very much.

A lot of money is going to be put into Venus this year. I’m expecting that the Impact position will increase in value.

3B/4B, South Africa

Source: Africa Oil presentation November 2023

3B/4B is close to Venus, but it is under South Africa’s jurisdiction.

As you can see the P50 prospective resource is 4bn boe(recoverable) This would be huge, but the prospective resource is just an estimate

“Prospective Resources

Prospective Resources are those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from undiscovered accumulations.”

Quote from SPE international.

Source: PSE international

P50 is the best estimate it means the estimate is done with 50% confidence.

Source: NextInvestors

Management says the whole area is covered by 3D seismic.

4B boe would be huge, but it needs to be proven.

Africa Oil recently increased its position in this asset by buying 6,25% from Eco-Atlantic for 10.5m USD. This transaction values the asset at 10.5/0,0625=168m USD

And Africa Oil owns 26,25% directly and another 3% through their ECO position.

168*0,2925=49,14m USD is what this deal values Africa Oil’s stake in 3B/4B.

But a few successful drills could easily 10x that.

If this happens then Africa Oil will benefit greatly, but a pure exploration and development play like ECO will skyrocket as ECO has 20% but only a 50m USD market cap. But I don’t know whether the drilling will be successful so I rather hold Africa Oil which is cheap even without this asset and will still benefit greatly if it turns out to be big.

This project is going through a farmout currently according to the management and they are predicting it will happen this year.

EG-31 and EG-18, Equatorial Guinea

Source: Africa Oil Q3 2023 presentation

Africa Oil got into this block at the beginning of 2023 and they are currently in the process of farming it out.

They have 80% operating interest and the rest is owned by the state-owned company GEpetrol and Gepetrol has an option to acquire an additional 15%.

Africa Oil has put 7m USD of work expenditures into this project since its purchase. This area was also covered by 3D seismic before they bought it.

This is what was about the property in the initial PR

“In Block EG-31 the Company has identified several gas-prone prospects in shallow water depths of less than 80 meters and close to existing infrastructure, including the offshore Alba gas field and the onshore Punta Europa Liquefied Natural Gas ("LNG") Terminal. Potential future discoveries could present low-cost, low-risk gas development opportunities targeting international LNG markets.

In Block EG-18 the Company has identified a potentially large and highly prospective basin floor fan prospect of Cretaceous age, that is similar to those within the Company's exploration portfolio in Namibia and South Africa.”

I don’t have much to say about this project, but it seems that a farm-out is imminent and I’m waiting for it eagerly because I don't think this is getting much value from the market currently, but the words from the management are quite encouraging. Below is a bit from the Q3 earnings call

“Shahin Amini (IR)

Roger, you mentioned the data room for EG 31. There are a number of questions for EG 31 farmhouse and 3B and 4B. Just wondering what could be a possible timeline for that farm out process.

Roger Tucker (CEO)

The exact timeline on EG 31, we weren't going to ask the bids by the -- towards the end of December, mid-December. But because there has been such a level of interest in it, we're not going to get everyone through. We've just extended the bid deadline to I believe February 1 for that. So I think we had to extend that because there's too many people in there.

In terms of 3B 4B, we have had -- we haven't had significant discussions with one major already in that block. And we have just brought into that data room. Actually three other majors have asked to come in and so that one is going to take a little bit longer because I think it's worth standing on the sidelines and not leaping necessarily at the first opportunity, because there has been this sudden uptick in the level of interest in that book. And so I would say that, that one might want to give it the time to get everything in, I think is probably towards the end of the first quarter, probably, depending on the level of interest.”

So there have been so many bidders they needed to extend the deadline.

The deadline has since moved to February 14th.

This could be a very bullish event happening soon.

Direction

Source: Africa Oil January 2024 presentation

We have Nigeria and Venus underpinning the valuation and 3B/4B and EG-31, EG-18 as the wild cards. I already like this setup because it presents an opportunity for a large upside without much downside. I also expect a boost from a higher oil price, but I’m not relying on the oil price. I think oil can stay in the 65-85$ range and this investment can still be very successful.

There is also clarity in their capital allocation now. I said the company felt directionless before the big management changes. The company would just do buybacks randomly and not properly communicate to the shareholders their plan for capital allocation.

The new management has been very clear. They will maintain a small dividend which is 2,59% now and they will prefer buybacks. They will focus on the 4 core assets and not jump into anything new. The M&A will be around their core assets. Most shareholders expect an acquisition from Nigeria in 2024 around or within their existing assets. As they have the credit line and pre-emption right in a block there. This would be a purchase of a producing asset which I prefer over an exploration or a development asset.

Whether they will focus more on buybacks or M&A around their core assets will not be a crucial issue for me. I would slightly prefer buybacks as there is not much that can go wrong with buying back your heavily discounted stock.

Source: ceo.ca

There was also some insider buying from the new CEO Roger Tucker and from Oliver Quinn whose job title was too long to write. I would never waste time in these articles and describe an overly long job title. The job title had 6 words(5 words if you do not include the word “of”).

Summary

This is the cheapest oil stock I know at the moment. Before when someone said why they didn’t like this stock it was usually something about the management, but after the new direction the new CEO has taken I think a lot of their concerns have been addressed. I don’t think I have seen anyone ever make an argument that it wasn’t cheap. When you compare the valuation to their assets it’s hard to say it’s not.

Source: Google

The stock has been pretty much flat since 2022. A stock can stay cheap for longer than expected. And it could continue to do so. But the risk/reward is favorable and when it is the odds are on my side.

There are some good accounts to Follow on X about Africa Oil such as @CharlieFlorimon and others.

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. It’s all opinions. Everything I have written here could be inaccurate. Trust nothing you just read.

Get a 7-day free trial and 25$ discount on your first year of Seeking Alpha Premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

Hmm, my comments keep disappearing, so I'm not sure if anybody can read them, or maybe I just replied 3 times :)

But thanks for your article. Really liked it. The value case is clear.

Only aspect I think I can add to it is this.

While Prime was paying those large dividends to owners, it was also reducing net debt very quickly during 2021-2022. Last year Prime's net debt was more stable, because they were doing a drilling program. This will support Prime's production volumes for next years. When the drilling problem is done, I think Prime can reduce the last bit of debt again, or/and pay larger dividends.

My point being, maybe backwards looking prime dividends is actually Uderstating the forward income to Africa oil, because it doesn't have to keep the pace of debt reductions ongoing.

Good writeup. I also hold share but here some negative points, since we all tend to cover positives well (as does AOI):

Learning from Europe, Africa states might play nice and only after big Capex is spend introduce those taxes, fees, levies, whatever you want to call it. Risk is there.

Prime NPV number to be used with grain of salt: to use 10% as discount rate (it was?) seems too favourable to me, further volumes (p.a.) might decline earlier.

AOI management might be better now, but still holds ample cash, which derisks their job etc (if prime were to blow up tmr we shareholders would lose a lot, but AOI management salary would be safe no?). Further, if there would be great African mna opportunities, ie majors divestsling them cheaply because (ESG (now not so relevant anymore?)) reasons they should (be able to) finance with debt, IMO.