Tenaz Energy, Kenmare Resources and Majestic Gold

Stocks from the people

I put out this Tweet and I got a lot of responses. If a stock has a valuation even close to EV/FCF of less than 2, it’s worth looking at. I went through the stocks in the responses and I picked out the most interesting ones to write briefly about in this article.

There were 19 stocks suggested in the replies(some of them are in the replies to replies). If you want to check out all of them here is the link to the tweet: https://x.com/AlmostMongolian/status/1818685449034256404

I looked at all the suggestions and picked 3 for this article. These three stocks immediately intrigued me. All commodity producers of course. I’m drawn to commodity stocks. It might be in my DNA. I’ve been involved with some tech stocks during the last 2 years with varyin results. I hate it! I’m going back to the mines!

That’s actually a real picture of me entering my local mine.

Let’s begin. Stock picks from the people.

Majestic Gold Corp $MJS.V

When I start looking at a new stock I always check the forums to see what people are complaining about. You can find out stuff that is not in the financial statements and the corporate presentation. I’m always looking for posts like the one below.

Source: ceo.ca

From this message above I get that this is a company that makes good money has a pile of money, but with a management that is un-friendly to shareholders and the shareholders do not trust the management to allocate the profits and the money pile in a shareholder friendly way. There is also an expectation of an acquisition which has been delayed. Let’s look at the financials.

Market cap=67,7m CAD (all of the following numbers are in Cad)

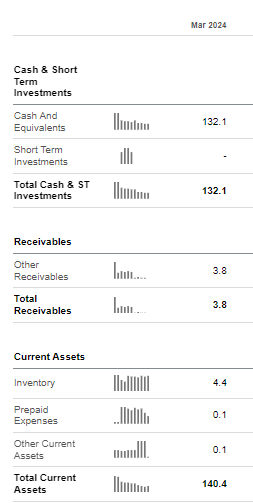

Source: Seeking Alpha Premium

Cash and Cash equivalents vastly exceed the market cap+liabilities. The EV is deeply in the red. Basically you are getting all the operations for free+some of the cash and cash equivalents for free as well. This company must be losing money. Right?

Source: Seeking Alpha Premium

The company is also quite profitable. Profitable operation for free. If this was a normal company this valuation would not hold, but this company has been stuck with this type of valuation for a while.

Source: Google

So the question here is how bad is it because the valuation is so low. You don’t need much to get it higher.

The first problem seems to be the management. They most likely should be buying back stock or paying dividends. They are not. They supposedly have an acquisition target. This could be a big bullish catalyst, but clearly the market has no confidence about that.

The second problem is the jurisdiction. They operate in China, which I think is not the worst jurisdiction to do business actually. There is a reason China has been able to have an economic boom, but due to the geopolitical situation with China and US and China and Taiwan. Western companies that are only doing business in China will have a permanent discount. Especially with what happened with Russia. When Russia invaded Ukraine. The West seized Russian-owned assets located in the West and Russia seized Western assets located in Russia.

If China invaded Taiwan the same thing could happen. West would apply sanctions and start seizing Chinese assets and the Chinese would seize Western assets in retaliation. They would seize Majestic Gold’s interest in the Songjiagou gold mine, which is their only mining asset.

Source: https://majesticgold.com/site/assets/files/4092/20240524-mjs-corporate-presentation.pdf

The mine has a lot of reserves and they predict to increase production in 2025. Also as we know the gold price has been on the run this year so the cash generation should be quite high atm.

Considering the situation with the balance sheet even if the worst geopolitical scenario were to happen the shareholders would still be left with more liquid assets than they paid for the stock even subtracting all of the liabilities. So the jurisdiction is still not the main reason for the low valuation. I have looked at other companies that do business in China the valuation is not this low. And the mine is definitely not the reason for the low valuation either.

So it seems to really come down to the management. The market doesn’t trust them. There must be a reason for that. Because of the valuation, I will have to look at this more. Because it really seems easy for this management to get the stock up if they would start heavily buying back stock or paying dividends. The market cap is 62m they could pay 62m special dividend and they would still have more cash than the market cap. How insane is that?

This is not a deep dive. This article is me looking at 3 interesting stocks writing this as I’m researching them so I don’t have the full scoop about this company. If there are some long-term shareholders or ex-shareholders reading this I would appreciate your thoughts on the comments.

Kenmare

This stock does not fill the criteria in the tweet like most of the stocks suggested in the replies didn’t. I didn’t even expect it when I tweeted it. I just put up a high bar so people will pitch the cheapest stocks they know.

Source: https://www.kenmareresources.com/application/files/8817/1638/2614/2024-05-22_TP_ICAP_conference_presentation.pdf

Another single asset producer in a non-ideal jurisdiction. But this asset is really a gem. +100-year mine-life. 7% of global titanium supply. High profit margins.

Numbers in USD

Market cap=405m

Normal EV=345m

Mongolian EV(Market cap-total liabilities+current assets)=298,2m

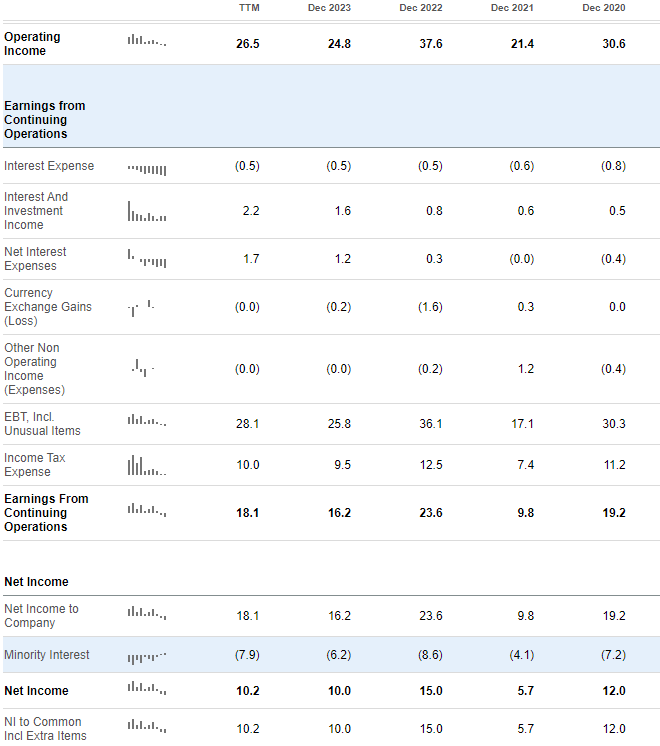

Net income

Source: Seeking Alpha Premium

Cash flow

Source: Seeking Alpha Premium

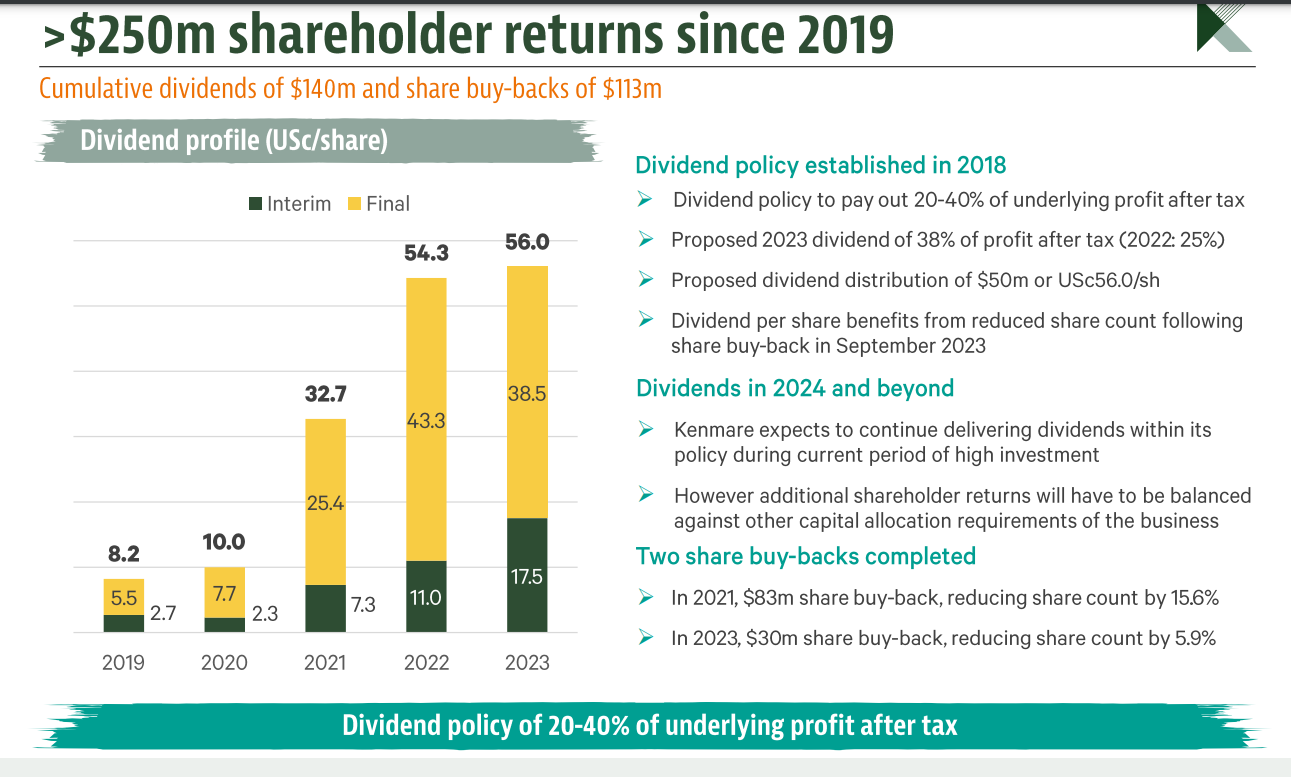

So we get Mongolian EV/free cash flow of around 3. Which is cheap of course. A lot of that money is being returned to the shareholders with a high dividend and share buybacks.

Source: https://www.kenmareresources.com/application/files/8817/1638/2614/2024-05-22_TP_ICAP_conference_presentation.pdf

Source: Seeking Alpha Premium

They are also predicting a big deficit for titanium which according to the below chart is happening right now.

Source: https://www.kenmareresources.com/application/files/8817/1638/2614/2024-05-22_TP_ICAP_conference_presentation.pdf

Is there anything else? Is there growth?

Source: https://www.kenmareresources.com/application/files/8817/1638/2614/2024-05-22_TP_ICAP_conference_presentation.pdf

They have some projects and a lot of the capex is happening in 2024-2025. It would be nice to get in at a cheap price at the end of 2025 with a lot of the scheduled capex done and looking forward to the WCP B production increase. But will the stock even be cheap by then? What if titanium price rises a lot due to the undersupply or this stock starts getting attention as a dividend payer?

There is definitely an attractive situation here.

I think Kenmare is like Alphamin Resources, but cheaper. Great asset, shareholder-friendly management, but a bad jurisdiction. I said in my Tin article I don’t think Alphamin’s valuation is cheap enough to invest in a horrible jurisdiction. In Kenmares’ case, the valuation is cheaper than Alphamin so I would actually consider Kemmare despite the jurisdiction.

What about the jurisdiction?

Source: https://aimnews.org/2024/03/01/mozambique-is-relatively-stable-despite-terrorism-nyusi/

Doesn’t this headline just tell you everything you need to know? It’s Africa.

What about Kenmare compared to majestic gold? Similar situation. Majestic gold is cheaper based on EV/FCF, but Kenmare has a shareholder-friendly management which does not seem to be the case with Majestic which makes Kenmare more appealing at this moment in my opinion. But majestic could very quickly turn more appealing if certain things happen.

Tenaz Energy

Tenaz made a very good acquisition recently that will make the company a cash flow machine.

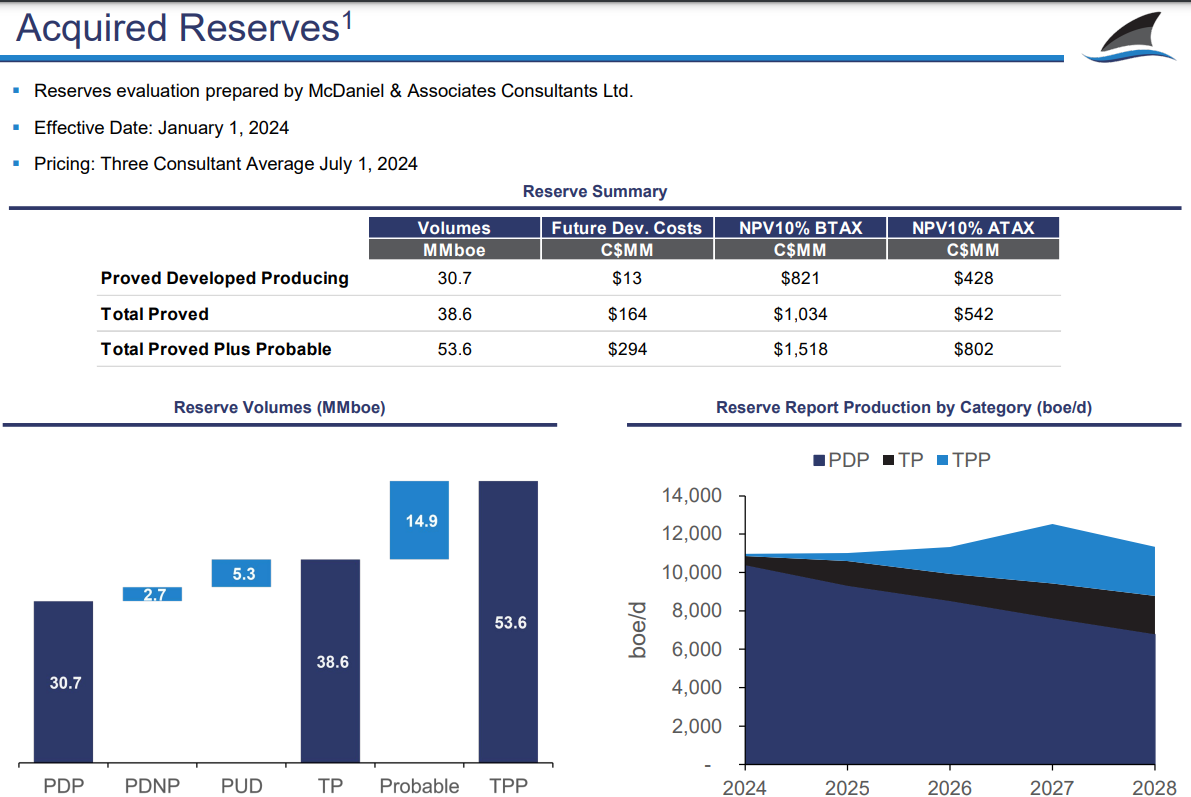

Source: Tenaz July 2024 NOBV ACQUISITION presentation

The $ figures above are in Canadian dollars.

Current market cap=217m

EV assuming they use the whole debt capacity=299m

And pro-forma FCF of 140m. Not bad.

https://www.newswire.ca/news-releases/tenaz-energy-corp-announces-agreement-to-acquire-nam-offshore-b-v--861175170.html

Tenaz will use the cash flow from the acquisition to pay for this acquisition. Which is quite a nice way to do it. Note that it’s 165m EUROS which means 246m CAD. They expect to generate 125m EUROS of Cash flow before closing which doesn’t leave much to pay the full base purchase price. And they have debt capacity. So this acquisition seems quite good. Too good. Why would the seller do this?

There are still other payments Tenaz will make to the seller in addition to paying them a significant chunk of their FCF generated by this acquisition.

Source:https://static1.squarespace.com/static/6164cf34a8e54b2e687f89e3/t/66a33033469a06505e6379ce/1721970747565/Tenaz+Energy+-+NOBV+Acquisition+Deck+-+July+18%2C+2024.pdf

But even still the acquisition seems very good. The seller basically said. Do you want to just take this asset? Just take it.

Like someone gives me a store to run and says pay me the store profits for 2-3 years and then you can keep it.

Tenaz is also hedging 46% of its production. Which I don’t mind because I have no particular bullish view about natural gas prices in Europe.

Source:https://static1.squarespace.com/static/6164cf34a8e54b2e687f89e3/t/66a33033469a06505e6379ce/1721970747565/Tenaz+Energy+-+NOBV+Acquisition+Deck+-+July+18%2C+2024.pdf

There is that.

And here is this.

Source: https://static1.squarespace.com/static/6164cf34a8e54b2e687f89e3/t/66a33033469a06505e6379ce/1721970747565/Tenaz+Energy+-+NOBV+Acquisition+Deck+-+July+18%2C+2024.pdf

First-world jurisdictions tend to trade at higher valuations.

Source: Google

Should I chase? Sometimes you have to chase. Like with Valeura. But I don’t like this stock as much as Valeura. And even Valeura gave an amazing dip buying opportunity recently. Maybe Tenaz could dip to 6$ after such a run. Then I would get really interested.

Summary:

I find each of these appealing. All cheap. I would not be surprised to see some of them in the AlmostMongolian portfolio at some point in the future. Good stock suggestions from the people. What is my favorite? Tenaz or Kenmare. Majestic maybe. Or maybe Kenmare. Hard to say. It’s Kenmare. Kenmare is my favorite. That’s it! Or maybe Tenaz.

And because these are not deep dives I haven’t done the full DD on any of these companies. I appreciate any comments from people with knowledge or opinions about these companies. What did I miss? What should I know that I do not know?

Thanks for reading AlmostMongolian! Subscribe from the blue button below to receive new posts directly to your email.

After Subscribing take a look at this Mongolian ad below.

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

I really appreciate your work. Thanks.

I bought my first VLE in May 2023 below 2 C$. It is my biggest position meanwhile. Your analysis of VLE is the best i found.

I forgot to answer on X so here my tip for EV/FCF<2 . You should take a look at PNOR (Petronor).

MC ~ 133 MUS$

Cash 97 M$

EBITDA Q1 28,7 M$ my estimate for year 70-75 M$, Netprofit Q1 14,1 M$, i have no number for FCF

IMHO PNOR is the cheapest africa based O&G not AOI

Production in Republic of Congo (Brazzaville) - Development in Nigeria

Soon will pay 25 M$ divi (profit from farm-out deal)

Some trouble also ;-)

You could also have a look at AET, FCF% could be ~ 48% in my calculations