Illumin: I like the Risk/Reward

I like the Risk/Reward

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

I added Illumin to my portfolio after the stock had been decimated. In my opinion too decimated and that is providing a really interesting risk/reward opportunity.

Illumin

Illumin is an adtech-company. They are a demand side-platform (DSP) which is software that helps advertisers advertise online.

They have this supposedly amazing new platform called Illumin. I say supposedly because I don’t really know whether it’s better than the competition. I don’t have the expertise to make those comparisons.

Even thou I have watched multiple YouTube videos and even talked about it with an adtech expert. But a lot of that went over my head because long complicated words make me sleepy. So my understanding was not supercalifragilisticexpialidocious.

The point is I have done some DD on the product, but it’s still hard to get a good view when you have never used a product like this yourself and compared it to the competitor products you have also used.

The reviews are good so it’s likely at least a solid product.

Source: g2.com

This product Illumin was launched at the end of 2020 and at the time this company was called Acuityads.

There was a lot of hype around the launch of Illumin at the time and the stock had a massive run.

Source: Google

This was the mega bullish time in the market for everything tech and innovation and Illumin took advantage of this hubris.

They were listed on the Nasdaq in mid-2021 and raised 50m USD at 10.15 USD per share.

Around this time insiders saw that the stock was getting quite expensive and sold their shares en masse to the excited retail investors.

Source: Barchart

Illumin was likely not going to live up to the expectations that were priced in at the time P/S was higher than 10 and even got up to 20.

But as we fast forward to the current day the situation is different.

Instead of issuing shares, the company is buying them back at a much cheaper price.

Source: Illumin q4 presentation

The company did a substantial issuer bid(SIB) last autumn in which they bought back 8,18% of the outstanding shares and that was only about 1/3 of what they were offering to purchase, but there were not enough sellers. Of course, after the offer closed there were suddenly sellers at lower prices and the stock has declined about 30% since then. How about another SIB Illumin? I hope they are working on that.

After that, they did announce a normal course issuer bid in which they could buy back 10% of the float.

Their share count is now below what it was before they raised money and they have most of the money raised during the mania still on their balance sheet.

Source: Seeking Alpha

And instead of unloading their shares insiders have been buying shares.

Source: Barcharts

The last time an insider sold stock was in 2021 at CAD 13.5857. And you can see the last purchase from the CEO recently which is important to note because he is in the process of stepping down.

“The Board of Directors has initiated an executive search for illumins’ next CEO. While there is no specific timeline for the search process, it is expected to be completed during 2024. Once a new CEO is in place, Mr. Hayek will assume his role as Non-Executive Vice Chairman.”

And regardless of that, he is betting on the company.

The company also voluntarily delisted from Nasdaq recently as they said they are not seeing any benefits from it at this time. They do not need to raise money. They were not getting much of a tech valuation in there. And they will save a couple of million a year from costs by delisting according to the CEO. They said they would be back on Nasdaq in the future.

I agree with this move. Even though it probably has contributed to some selling in recent times. Some people and institutions can’t or don’t want to hold a company trading only in Toronto and the OTC market. I like this type of selling because it’s not based on fundamentals. The stock just gets cheaper.

AD

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

Valuation

Market cap 78.91m CAD

Debt 7.99m CAD

Cash 55.46m CAD

EV 31.44m CAD

So the business itself costs 31.44m. Here are the numbers for it in CAD.

adjusted EBITDA 2023 $1.3m 2022 $5.8m

Source: Yahoo Finance, I updated TTM numbers to include Q4

Is it worth 31.44m CAD? I don’t think so, but from the surface, you could make an argument it is based on TTM numbers. Revenue growth has been slow and operating costs have risen more than it. The cash drain is small when you exclude the cash spent on stock buybacks. Which we of course should.

But just getting back to 2021 profitability 11,7m net income and 18m FCF would be a bullish scenario at 31.44m EV for a tech company.

We have to look behind the numbers to see what is going on.

Illumin is ongoing 2 transition

1st: They have the old system their clients were using before Illumin and they are transitioning their whole business gradually into Illumin and then shutting down their old system.

Source: SeekingAlpha

2021 was the first year Illumin started contributing to revenue in a real way. You can see they were able to grow a lot with their old system over the years which they strongly believe is inferior compared to Illumin.

This does make me more confident in their ability to grow with Illumin as well. Based on track record they already have a capable team in place.

Source: g2.com

And as I’m reading their 58 reviews from g2.com nobody complained about the people or customer service. The reviews averaged 4.3 starts, but even the most negative review praised the people. A quote from that review:

“Aside from the actual platform, the people surrounding the setup process and the Illumin team are incredible. They were accommodating with their onboarding sessions, but Illumin is a very hands-on self-exploring platform.”

Most people praised the platform. Some had complaints about it. Some praised and had complaints. And there were some complaints about pricing.

That is a short summary of the reviews.

2nd: Illumin has 2 revenue types managed service and self-service on their old system and Illumin. Illumin is focusing heavily on lllumin self-serve which they believe is their future.

Below is an explanation of the difference between managed and self-serve.

Source: Illumin

Run rate means the last month of the quarter annualized.

Q4 also 33

Source: Illumin q3 and q4 presentations

Illumin self-serve has been growing, but similar to Illumin´s growth as a whole it’s muddled by the transition from the old system because a lot of this growth is the old system clients moving to Illumin. Management has been saying they have also been growing outside of that, but it’s not clear to the market how much.

What also muddles getting a good picture of the growth is that revenue numbers and client growth do not fully correlate. If there is a macro-led dip in advertising spending Illumin could be growing the number of clients, but because they are spending less the revenue could be falling. Or if the old clients are moving to Illumin, but they are not spending as much right away because they need to get used to the new platform, or managed clients are moving to self-serve which can also cause a temporary dip in spending.

“As far as Q4 is concerned, in general, we're still seeing challenges on the managed side of the business. So, again, Q4 is not going to be the results that we would like to see. And again, I think it's due to the financial situation out there and due to the fact that more and more customers are moving into self-serve. Some of those customers are moving to our self-serve, and it takes them a little longer to start spending to the same levels as it's something new for them. And I do believe we see the results in the future as well.” Q3 2023 call

As they are focusing heavily on self-serve it seems to be a short-term pain long-term gain situation as the spending from the client drops momentarily when they are going through the transition from managed to self-serve. And this seems to be one of the reasons there was slower revenue growth in 2023.

Why focus on self-serve makes sense from the business model perspective?

Source: Yahoo Finance, I updated TTM numbers to include Q4

Revenue is the advertising spending of the clients.

The cost of revenue is the cost of the ad space for Illumin.

So this is why there are no significant changes in the gross margin. What matters is the gross profit compared to operating costs and self-serve sets the business up for more potential revenue=more gross profit while having lower operating costs.

“Nowhere is this more evident than looking at our forward-looking pipeline. You see in Q3, 30% of our pipeline is Self-Serve. When we look into next year, in the first half of next year, almost 50%, 55% of our pipeline is self-service illumin. That’s exactly what we want to see.” q2

“It's not an easy transformation to change the DNA of the company, from the managed side of business to Self-Serve, so I truly, truly thank the community for delivering such a successful year of transformation.

In 2022, we had virtually no illumin Self-Serve revenue. We had no long term contracts and no Self-Serve pipeline. And look where we are today. In 2023, over $20 million in illumin Self-Serve revenue. Most is in long term contracts, and a massive Self-Serve pipeline. This is where the future of our business is, okay.

The growth numbers are masked by the decline in our managed business. And we always communicated that we feel that the managed business is going to decline. But the value of illumin is illumin Self-Serve and we've seen great, great, great indication for the future.

My prediction is, that by the end of this year 2024, our Self-Serve a run rate is going to be higher than managed. And that's one of the main reasons why I personally bought over a million dollars' worth of shares recently, because I believe in this company so much.” CEO on Q4 call

Illumin plan summary:

-Transition to 100% Illumin

-Maintain managed service

-Grow self-service

-Control costs

-Return capital

Considering the large cash position and the low valuation. The downside of the stock remains limited from the current price and the upside if they execute depends on how well they execute.

The story is good and while I can’t say for sure if they have the best product or even one of the best there are many things that skew the risk/reward is my favor.

Stock buybacks, insider buys, low valuation, fast growth business inside of a steady business(value not in plain sight), strong balance sheet, great reviews, management with a track record, oversold, hated(at least based on Yahoo Finance discussion board) and in a transition phase.

I added the last one as a positive because when a company is in a transition phase the numbers are usually not going to be great during that time and this causes low valuation, and if the transition is successful it will eventually show up in the numbers and then people will notice the company and there can be a high valuation.

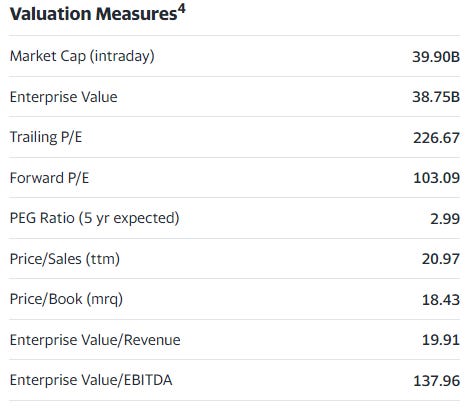

For example one of Illumins’ competitors is Trade Desk which is a huge company, but they are a DSP like Illumin and this is their valuation.

The Trade Desk

Illumin

Source: Yahoo Finance

Of course, Illumin has not performed nearly as well as The Trade Desk based on growth and profitability. Illumin was not profitable in 2023 and grew revenue very little, but if they can get the growth and profitability up in the future the potential for a very high multiple is there. They traded at a similar valuation to Trade Desk in early 2021. This is not a prediction, but a point about how highly a business like Illumin can be valued when it is liked by the market.

The transition from a stock being hated to liked is usually very lucrative.

Ending comments

If you search the internet discussion boards a lot of the talk around this company is quite angry because a lot of people have lost a lot of money investing in this company at +10$, but the stock is offered at us at 1,56$ right now. And at that price, I think the risk/reward is skewed heavily in favor of the longs.

Also curious what the future will bring, and very interesting since the growing part of the business is masked by the declining legacy business.

But good to stress that management seems to have been chronically overoptimistic about the near future, and downsizing the past:

2022-Q2 earnings call: "2022-Q2 earnings call: Illumin sales are growing and on track to reach 50% of revenues by end of year."

2022-Q3, press release: “illumin third quarter revenue rose 78.4% year over year and 29.4% sequentially to $13.2 million, or 46% of total revenue. On a YTD basis, Illumin revenue is $31.3 million.

2023-Q3, earnings call: "We exited Q3 in a run rate of $25 million, which, again, is a great achievement"

2023-Q4, earnings call: "“In 2022, we had virtually no illumin Self-Serve revenue. We had no long term contracts and no Self-Serve pipeline. And look where we are today. In 2023, over $20 million in Illumin Self-Serve revenue.“

At least the CEO has been buying a lot personally.

Great write-up. Have been following this company since the insider buys. Recent sell off provides a good entry, I'll start buying around 1.4 / 1.5.