Valeura Energy: Relentless Climb To Fair Value

There is oil in Thai waters.

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

I added an update to the end of this article on 28.11 covering new developments.

As a natural dip buyer, it’s tough to buy into stocks that have already moved up a lot. There is a thought that the stock has already exhausted most of its upside if it’s already up 10x like Valeura was when I got in. But when I got this thought I had to remind myself that this thought was idiotic, because thinking like that is putting the cart before the horse. Buying the dip is usually a good strategy if you do it with the right stocks because that means you can get the stock at a lower valuation. But a stock can be at all-time highs and still have a very low valuation. And valuation is what matters at the end of the day.

Source: AlmostMongolian, X

This is when I got involved. This is where the stock was irresistible. Almost too good to be true I was thinking. Extremely cheap even for an oil producer.

Source: Google

After that, the stock has gone up a decent amount and the valuation is higher so it must be less attractive. Right? Not necessarily. And I will talk about why later. First a quick overview and valuation.

Valeura owns oil production in Thailand and a natural gas project in Turkey. All the focus of this article and all my interest in this stock is because of the oil production in Thailand. They acquired these Thai fields in 2022-2023 and it has been only success after that.

Valuation

All of the following numbers are in USD

Market Cap= 406,7M

Debt=0

Cash=193,6m

EV=213,1m

2023 results

Source: Valeura full year results presentation

2024 estimate

2024 production guidance 21.5 - 24.5 B/D

A quick calculation about potential 2024 financials. It will be flawed. But it will be in the ballpark.

I’ll use 23k oil production because according to a recent press release the company has already achieved this level.

“Highlights for Q1 2024

Oil production averaged 21.9 mbbls/d, quarter exit rate of approximately 23.0 mbbls/d”

Revenue at 85$ Brent(Brent currently at 90$+Valeura receives a slight premium to it, but I’m being conservative here so I will ignore that) = 713 575 000

Royalties roughly 100mil (could be off a couple tens of millions)

Opex guidance 205 - 235 million

Capex guidance 135 - 155 million(about 1/3 growth capex)

SG&A roughly 30mil

713-100-235-155-30=223 pretax profit(using higher end cost estimates and conservative production and oil price estimates)

The tax rate is 50% but one of their fields that produces about 5k per day has a tax loss shield so 21.7% of profit escapes the 50% tax

48,4m(profit from the field that doesn’t pay tax)+92,1m(Rest with 50% tax taken out)=140,5m after-tax profit after everything

But they also own a royalty that will make them roughly 10m per year. I don’t know if that is taxed differently nor do I care.

I have seen many models and many estimates about this company they are always a little different. The thing about my approach is that I want my stocks to be so clearly cheap that I do not need very accurate models. If I need to go on Excel and count every cent to determine whether it’s cheap the stock is already not cheap enough.

If Valeura makes 100-200m of profit after all the costs at 80-90$ Brent the stock is cheap. The enterprise value is 213m.

We are looking at 1-2 EV/E or EV/FCF without making any bullish assumptions about oil production or oil prices.

Ad break:

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

Why is it cheap?

The usual reason given as to why the stock is cheap is that they have low reserve life and high decommissioning obligations(+200m), but every year they find more oil and replace the reserves, and as long as you find more oil you don’t have to decommission the field and paying off the decommissioning obligations is moved further into the future.

Even before Valeura took these fields over in 2022-2023 the reserves were consistently replaced, but after Valeura took them over and injected some cash they were able to show that the rumors about the death of these fields were greatly exaggerated. This news hit in February.

Source: Valeura 20.2.2024 PR, ceo.ca

219% reserve replacement is very good. This news was the reason why I said earlier the stock is not necessarily less attractive now even after it went up about 50% from where I got in in January, because this news was so important as it addressed the biggest worry of the market. People knew the stock was cheap based on near-term cash flow, but how long would these fields be able to produce was questioned.

With this news, the company proved there is still a lot left. If they can continue a similar pace of reserve replacement I think the stock would trade at a much higher multiple.

What else? Catalysts?

Catalysts

Tax restructuring

I mentioned earlier that one of their fields doesn’t pay taxes because of past Tax losses. Valeura acquired that field from a company called Kris Energy in 2023 and they had around 400m of tax losses attached to that field. What if you could apply those tax losses to all the fields Valeura has? Valeura management believes they can do this by mid-2024. This would mean Valeura would not pay any tax for about a year starting from mid-2024.

This would mean around 200m of extra FCF.

With around 211m EV. This would be a big deal. The EV/FCF for the next 12 months after tax restructuring could drop below 1 although oil price will play a big part in that.

If the management can’t pull this off with the Thai government then the tax losses will just be used more slowly with the field producing about 5k B/D.

Drilling

Source: Valeura 2024 Full-year presentation

With drilling they can replace and grow reserves and grow production. Valeura’s 2024 production guidance is 21,5-24,5k P/D as an average production for the year, but the exit rate for 2024 could be significantly higher. Here are the fields and the company’s plans for them.

Source: Valeura 2024 Full-year presentation

Wassana is the field that doesn’t pay taxes currently.

Source: Valeura 2024 Full-year presentation

They will of course try to optimize every field, but based on what they say here and earnings calls we can assume Growth in Wassana(but not confident enough to give a number), growth in Nong Yao(to 11k B/D in q2 now at around 8k B/D) and relatively stable/small decline in the rest.

So if we assume they can do what they say in Nong Yao and they can at least keep the rest stable we get 26k B/D for the second half and I would be happy with that. Add the potential tax restructuring 26k B/D with no taxes for a year at let’s say the current oil price at 90$ Brent. That would be humongous cash flow and none of those expectations would be grazy.

Acquisition or Buybacks?

Valeura has about 50% of their market cap in cash and no debt so capital allocation is a big question at the moment.

You would think at this valuation I would want buybacks above all else and not want the company to do a potentially bad acquisition. But in this case, it’s different the 2 Thailand acquisitions Valeura did are the best acquisitions I have seen during my long investing career of 4 years.

Source: Valeura July 2023 presentation

Still makes me shake my head how they got these things as cheap as they did. These assets have already paid themselves back multiple times.

The reason they could do this was motivated sellers who did not understand nor want the assets and an inefficient market(Thailand offshore oil is quite a niche and unknown market). The Kris Energy assets were bought from bankruptcy.

https://www.energyvoice.com/oilandgas/asia/407624/valeura-energy-buys-thai-oil-assets-from-bankrupt-krisenergy/

Quote from the above article “An industry source that has followed the demise of KrisEnergy described the deal’s price tag as an “insult to those who believed and promoted that KrisEnergy’s value was nearly US$1 billion (Kris Energy’s stated group assets were US$886 million in 2016), as these two Thai assets were a large chunk of the company.”

And Valeura buys them for 14.3m. I love to hear it. And I love to see it.

Sean Guest, president, and CEO of Valeura, commented that “the acquisition will rapidly transform Valeura into a significant licence holder and new oil producer in Thailand, and in doing so will establish a platform for our goal to acquire further high-value cash flowing assets in the region.”

Yes, it did. Valeura is now Thailand’s largest independent oil producer.

From when they started these Thai acquisitions in June 2022 the stock is up 10x while the oil price is down.

The stock is “ #1 company in Peer Group in 2022 and 2023, and YTD in 2024” according to the company in terms of share price performance.

And they seem to believe they can do it again.

Source: Valeura June 2023 presentation

I’m not going to assume the next acquisition will be as good as the 2 last ones. It’s possible, but I would assume other companies have seen what Valeura did in Thailand and there is more eyes looking at that market now and amazing deals are harder to find. But I’m not 100% sure about that and Valeura has a great track record so I want them to find another great deal in Thailand and I would prefer that over stock buybacks.

They did so much with 24.7m$. What could they do with 200m$?

This is what some guy who works at the company answered in a recent investor conference when asked about implementing a buyback or a special dividend.

“next question have you considered implementing a dividend and I'm going to bundle that together uh actually there's another question follow up I knew this was coming or a share buyback and listen we historically have taken the approach that with a strong and stable production base and high margins our intent is to um stockpile cash resources in order to support our strategy which is growth oriented and um largely predicated on opportunities within the m&a market so we are very keen to ensure we have maximum optionality when it comes to being able to transact on additional m&a opportunities that said it is difficult to deny that um a purchase of valura shares would be a good investment and I suspect the market would take note um now this is this is obviously a board level decision to be made um comments like this we do feed up to the board I suspect our board is listening um and and as such I expect that this is the sort of thing that they will deliberate on in their next meeting as to whether it's appropriate to think about uh some form of direct shareholder returns as for whether that would be a dividend or special dividend or a buyback I don't know I think the decision first would need to be do we want to engage in direct shareholder returns and uh if so what mechanism so the idea is really continue watching the m&a market and in so far as we see compelling opportunities for Value ad that would be our preference um but we also need to pay attention to shareholders and uh and and definitely this is something that we will be discussing”

Short version: Acquisitions are our number 1 focus, but we are open to the idea of doing direct shareholder returns.

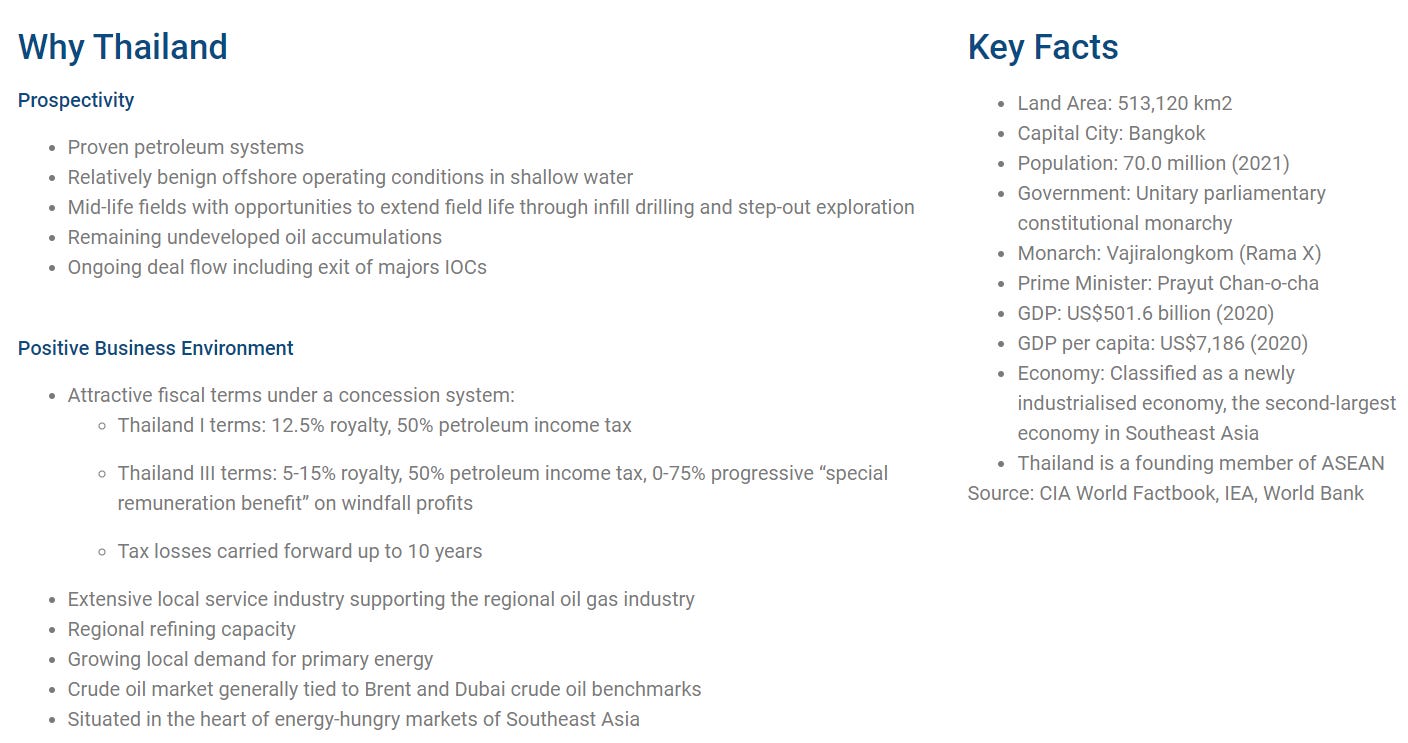

Thailand as a jurisdiction

The thesis is they can continue to grow organically and inorganically production and reserves and if they can do that they should not trade at 1-2 EV/FCF. Right? Maybe if the company was operating in somewhere like Venezuela or Turkmenistan that would be fair. But what about Thailand? I think we can all agree that 1-2 EV/FCF is too low for Thailand. But What is a fair valuation for an oil company operating in Thailand?

Source: Valeura website

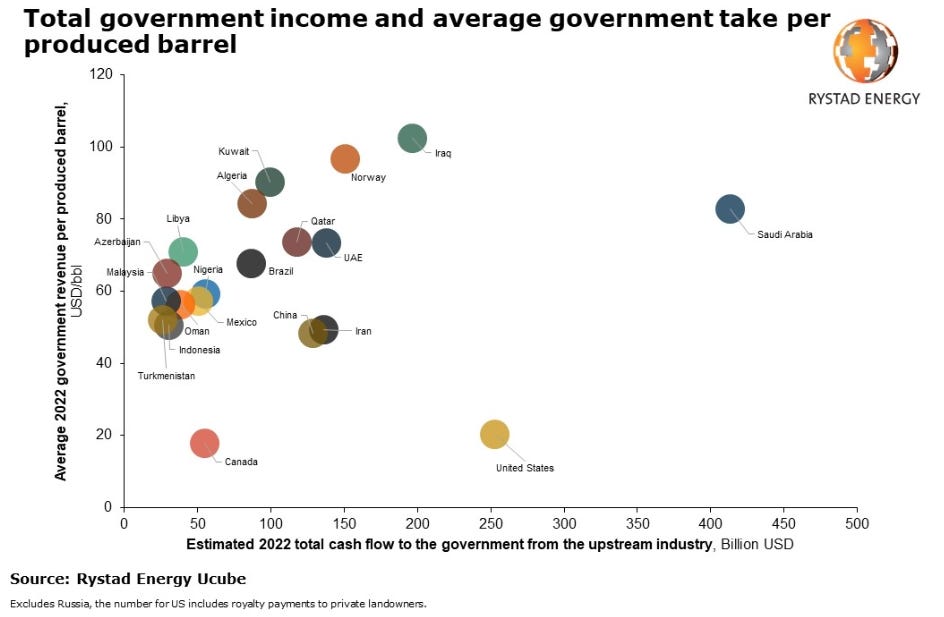

That government take is high, but it’s quite normal for the oil industry.

Source: Rystand Energy, Offshore

Only Canada and the US are nice to the oil companies. They might talk trash about the oil companies, but they are nice to them. But for us investors, the government take does not matter. Why not? Because the current government take is already priced into the stock. What matters is the direction of the government take. Is it increasing or decreasing in the future? Just the fear of government take increasing or other anti-oil policies possibly being enacted can send oil companies' share prices tumbling. Like the national oil companies Brazilian Petrobras and Colombian Ecopetrol in 2022 when leftist presidents were elected in their countries.

Could Thailand experience something similar? It’s always possible, but not very probable in my opinion. Thailand is a mix between a monarchy and a flawed democracy. It’s a second-world country. They scored highly on the World Bank’s ease of doing business index in 2020 when that was still around. Thailand was 21st out of 190 countries. And had been improving their placement over the years. This is quite a positive for Valeura as they intend to be in Thailand for a while and they need to work with the government to get the tax restructuring done.

Thai voters and the government are not very climate-conscious compared to the West. This is good for Valeura as they are less likely to get attacked from that angle. In 2nd and 3rd world countries the bigger risks are usually things like expropriation and political instability. There is usually populism behind expropriation ”Let’s take the wealth from the rich oil companies for the people” But because oil is not one of the biggest industries in Thailand like it is in Brazil and Colombia the oil industry is not as big of a target for populism. Most voters probably don’t even know Thailand produces oil. So it’s more likely the companies can keep making their money in hiding and the government stays supportive to keep the tax revenue going.

But still, anything can happen.

As an answer to my earlier question about a fair valuation for an oil company in Thailand. EV/FCF of 5-10 seems pretty reasonable and I think Valeura can get there.

Summary

I named this article “Relentless Climb to Fair Value” because ever since these acquisitions were completed that is what Valeura has been doing and is doing. Valeura is executing and the market is gradually realizing that this stock is very cheap. Remember how I named my Africa Oil article “The cheapest oil stock I know” That was before I knew about Valeura. Shoutout to Geodan in ceo.ca who told me about Valeura. I don’t know maybe based on reserves+cash flow Africa Oil is still the cheapest(Venus), but just based on FCF nothing I have seen in the O&G space comes close to Valeura. If you know a stock that does, tell me about it.

UPDATE ADDED 28.11 from this article LINK

Source: Google

Valeura should be up way more because we finally got the tax restructuring. Which was one of the big catalysts I talked about in my original write-up.

Valeura had a lot of tax loss carry-forwards, but they were only being used for 20% of their production meaning the benefit was being realized slowly. Money now is more valuable than money in the future so the faster they can utilize those tax losses the more value the market will attribute to them.

Source: ceo.ca

According to this PR, they have 397m USD of tax losses as of September 30th.

Note that Jasmine field is excluded from this arrangement which is around 30% of the production. But going from 20% to 70% of production being able to take advantage of these tax losses is a huge benefit because Thailand has a 50% tax rate on profits for oil companies.

These percentages of production are rough numbers.

Let’s do some math. I’ll use this year’s cost guidance higher range because we have higher production now and current oil production and current oil price to count the next 12 months with these tax benefits

73,8$(current brent)*26 000*365=700 362 000

“Royalties for Thai I licences are a flat 12.5%, and for Thai III licences are a sliding scale between 5% and 15% based on sales volumes” I did not find more details so let’s say royalties 10%=70 036 200

opex=235m

Capex=155m

SG&A=30m

Exploration=8m

Pre-tax profit=202 329 800 USD

70% of it has no taxes=141 630 860 USD

30% has 50% tax=60 698 940*0,5=30 349 470 USD

171 980 330m USD After-tax profit rough estimate for the next 12 months using the current Brent oil price and they would have 194 670 200 USD of tax losses left after this. So basically another year.

This is how I understand it would work, but no promises and they have not given all the details yet.

This company has a 406m USD market cap and 250m USD EV. (156m cash and no debt according to Q3 operations update) EV to after-tax profit based on that calculation=1,45

Also, the Nong Yao C production increase was another catalyst that was achieved.

Source: https://ceo.ca/@accesswire/valeura-energy-inc-announces-nong-yao-c-production

Source:https://ceo.ca/@accesswire/valeura-energy-inc-announces-q3-2024-operations-and

Nong Yao is now their biggest and it always was their most profitable field and now has access to the tax losses.

This is from my original write-up Link to the Original write-up

So they have achieved both of these catalysts Nong Yao and Tax thing. The one factor that is out of their control is the oil price which has gone down from 90$ Brent to 73,8$.

The stock performance is +48,4% from when I first bought, +29,7% from my cost basis, and -4,45% from my original write-up. The last one only reason for it is the oil price, but as I went over in my calculation the cash flow is very strong even at the current oil price.

The other 2 catalysts for Valeura are reserve replacement and capital allocation. Reserve replacement results will come out early next year. I’m expecting strong results like last time. And capital allocation is the 1 catalyst we are still waiting for as Valeura has been hoarding cash.

They are obviously working on an acquisition which is their speciality. They did the best acquisition I have ever seen. This was the Mumbadaalalalala acquisition. The Kris acquisition was very good as well. They got those tax losses from the Kris acquisition and are applying them now to Mumbadala fields. Very nice synergy there. Usually, I don’t want the companies I invest in to do acquisitions, because so many times they are not good or they take a long time to pay off, but with Valuera I want them to do acquisitions because of their track record.

From their new presentation, we can get some ideas for what they are planning on that side.

Source: https://www.valeuraenergy.com/wp-content/uploads/2024/10/2024-10-corporate-update-VF.pdf

They are showing all the fields and different operators in the region. Then later they say this when they are talking about the oil and gas sector in Thailand.

“Reduced # of operators ▪ Major companies exiting due to materiality ▪ Very few operators of Valeura’s scale and capability ▪ Governments seeking proven operators Shallower buyer pool ▪ Diminishing pool of credible buyers ▪ Difficult to raise capital for new entrants ▪ Competitive pricing and unique structures possible”

Major companies exiting. From the companies shown in the picture, Only oil major is Chevron. Mecdo(Indonesian company) and PTTEP(Thai national oil company) are pretty big as well, with revenue in billions so it could be one of those as well.

I would guess it’s Chevron becau😴😴😴

They also mention the usual methods for returning capital

“▪ Potential shareholder returns - Capacity for share buybacks in the short to mid terms - Future growth will support sustainable dividend”

I guess these are 2nd to acquisitions when it comes to management preference. If they can’t get anything done on the acquisition front they will do buybacks and dividends. This has also been my impression from their other presentations and earnings calls. They think of growth as a priority.

Source: https://www.valeuraenergy.com/wp-content/uploads/2024/10/2024-10-corporate-update-VF.pdf

This is our new timeline. A lot of organic growth plans. I’m optimistic about those based on their track record with these assets. They mention maintaining production at the current assets until 2030’s.

“Capital / Organic Investment ▪ Capex: Maintain production 20 mbbl/d to 25 mbbl/d into the 2030’s(1) ▪ Expex: Selectively target organic resource growth”

The whole Valeura bear thesis has been their lack of reserves, but they have shown and are showing that if you invest in these assets there is still a lot left. Now they are saying they will maintain 20-25k BPD into the 2030’s which is a huge statement.

I wonder if they will be able to get the production from these assets above 30k BPD before 2030’s. The amount of organic growth initiatives they are doing makes me think that is their goal.

Source: https://www.valeuraenergy.com/wp-content/uploads/2024/10/2024-10-corporate-update-VF.pdf

Another valuation reminder at the end. The sector is cheap and Valeura is the cheapest one in the cheap sector.

update to the update

The next day after this article was released Valeura finally announced a stock buyback

Source: https://ceo.ca/@accesswire/valeura-implements-share-buyback-programme

10% of the float is easy for them to do. I think this is about keeping the shareholders happy while they work on their acquisition. Regardless, this is a very positive development.

Another update to the update 28.11.2024

Source: https://ceo.ca/@accesswire/valeura-energy-inc-announces-jasmine-development-drilling

-26% increase in production in the Jasmine field from before the new wells were added.

-Another five-well drilling program started in Manora, because of the strong performance of Nong Yao and Jasmine I'm also optimistic about Manora. Although it is their smallest field, but this means potentially a much higher increase.

-"We expect the results of these wells, and the recent production rates to be considered as part of our year-end reserves assessment, and to support our target of achieving more than a 100% reserves replacement ratio." This will be a big catalyst next year if they overdeliver on reserve replacement. Which I predict they will.

Valuera also announced a CEO interview on the same day and I made some notes.

-200m extra near-term cash flow from tax losses "supercharging" the company

-This is why the company can do buybacks at the same time as pursuing organic and inorganic growth

-Q4 production 26k BPD and even higher going into 2025

-Expectation for 2025 production above analyst guidance

-"looking at a really good number" talking about the 2024 reserve replacement number

-"Early in January we'll actually release our year-end or quarter-end results watch for the cash flow the cash numbers there we think it's going to be a very good quarter for us"

-Wassana redevelopment to extend production to mid-2030s even potentially to 2040s. Decision on this redevelopment likely in Q1

Source: https://www.valeuraenergy.com/wp-content/uploads/2024/11/2024-11-corporate-update-V3.pdf

As I look at this new timeline I’m quite optimistic as operationally everything except the tax loss restructuring has happened on time. And in that case, they were working with regulators so a lot of it is out of their hands. But in terms of organic growth and reserve replacement, they consistently outperform and are on time and under budget.

The Wassana redevelopment, Jasmine more infill drilling, and new exploration target and Manora infill drilling. I think these will provide positive smaller catalysts paired with stock buybacks while we wait for the acquisitions.

Source: Google

The stock because of its strong performance is not far away from the highs despite the oil price weakness. And I do not think oil prices can go down a lot from here without a black swan event. OPEC+ has already delayed their production increase twice and now there are rumors they are delaying them even further. They clearly don’t want to raise production in this oil pricing environment and I don’t think the US producers will “drill, baby, drill” either at this oil price despite what the new admin does. We have heard this from many big companies in the US. Well, I could go on about the oil price, but my point is the risk from the weak oil price is in my opinion mostly priced in while the reward from potentially rising oil price is not.

Source: https://www.valeuraenergy.com/wp-content/uploads/2024/11/2024-11-corporate-update-V3.pdf

They also have this. I have not done much DD on it. This was their flagship asset and it hasn’t really worked out for Valeura so far, but it’s a huge prospective resource and more than 100m USD invested. Maybe if they can find a JV partner something can happen with it. This asset is not even considered in the valuation of Valeura and if they disposed of it tomorrow I don’t think the market would care, but because it is a forgotten asset valued at zero if there is a positive development with it that would be a catalyst although I’m not betting on it, but as this is a comprehensive Valeura write-up I will mention it here at the end.

If you keep doing DD on Valeura and put it all together I think you will find it difficult to pass it.

Great write up - thanks. I found Globex and Africa Oil before I found you, but your work on Metals X was impressive (and a good return so far) and I like what I see on this name too.

Another great article! Thank you. I bought some Valeura recently.

Oil reserves are the generational buy.