Eco Atlantic Oil And Gas: Rare Exploration Bet

Multiple paths to success

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

Eco Atlantic Oil And Gas

This is one of my longest posts and sometimes the posts don’t fit in the email. Substack almost always warns me that “Post too long for email” and it still usually fits, but not always. If it cuts off abruptly for you the rest can be read from the website or the Substack app.

I like to invest in commodity stocks, but I don’t like to invest in pure exploration and development stocks because these stocks tend to be dilution machines with low success rates and require a higher level of expertise to get an edge over the market. That being said. I like Eco Atlantic Oil and Gas which is a pure exploration play. It’s my most recent pick.

Eco Atlantic has many paths to stock price gains. They have multiple assets in the best oil exploration spots in the world. They have cash coming in from a deal that allows Eco to avoid dilutive raises and they have another deal that reduces their share count by 16,16% on a diluted basis.

These attributes make Eco distinct from its peers in the exploration space. They should not have to raise money in the foreseeable future and instead of increasing the share count Eco will have a lower share count.

The stock is also trading at a very low price compared to what it could trade at if even one of its assets starts gaining traction.

Source: Google

We can see from the stock price that Eco has disappointed investors in the past, but as we know, there is a difference between price and value. I think this long stretch of decline has sucked all the excitement out of this stock and allowed it to get to a price where it has become very asymmetric. Now we are getting close to the multi-year lows at the same time as near-term catalysts are approaching.

Financials, Valuation and Capital Structure

market cap now= 48.26 million USD

market cap using post-Africa Oil transaction share count(USD)= 40,46 million USD

Source: Seeking Alpha Premium

16,16% of shares in the Corporation(public) section are owned by Africa Oil and those shares are going to be deleted based. More on that later.

We have some warrants and options out there, but if you look at the exercise prices this stock would have to already be multi-bagger before these become a problem.

Source: https://wp-ecooilandgas-2020.s3.eu-west-2.amazonaws.com/media/2024/08/Eco-Atlantic-June-30-2024-FS-FINAL.pdf

It’s an exploration company it has no revenue or cash flow apart from a farm-out deal.

Operating costs are about 1 million USD per quarter.

June 30 balance sheet

Source: https://ceo.ca/content/sedar/EOG-2024-08-29-interim-financial-statementsreport-english-fa84.pdf

Farm-Out provides cash

This balance sheet does not include a farm-out deal they recently completed which provides ECO with 19,8m USD.

Source: https://ceo.ca/@accesswire/eco-atlantic-oil-and-gas-ltd-announces-completion-0160c

They are due to receive 8,3m based on this PR released on August 28th so I assume they have received it by now and will receive 11,5m USD on the spudding of the first exploration well on their block 3B/4B which is expected to take place in the first half of 2025.

With this money based on current operating costs, ECO can avoid raising money for near- and mid-term.

Africa Oil Transaction

Another positive attribute of Eco I mentioned was the decreasing share count. Eco recently announced a great deal with Africa Oil. And by a great deal I mean great for Eco and bad for Africa Oil.

“Agreement to sell a 1% interest in Block 3B/4B South Africa in exchange for cancellation of all of Africa Oil's shares and warrants in Eco (worth C$ 11.5m)”

“Africa Oil currently holds, in aggregate, 54,941,744 Common Shares and 4,864,865 Warrants (collectively, the "Eco Securities"), which, assuming conversion of the Warrants, would equal 16.16% on a diluted basis (c.15% non-diluted) of the total outstanding common shares of Eco worth approximately C$11m.”

This is the deal and when closed it means a 16.16% reduction in the share count of Eco on a diluted basis. The weird thing about this deal and what is great for ECO is that Africa Oil already owns about 1%(0,94% non-diluted and 1,01% diluted basis) of Block 3B/4B through their investment in Eco shares. So they did not gain anything by letting go of their shares for 1% of 3B/4B and only lost exposure to other assets Eco has. So for the existing Eco shareholders, the effect is increased per share ownership of all of Eco’s other assets and the same per share ownership of 3B/4B.

Eco’s management showed some good deal-making skills here.

There is a general lesson here for investors in micro- and small-cap investors. If a larger company like Africa Oil wants to something like for example in this case consolidate its portfolio and get rid of these non-core investments like Eco Atlantic shares there is an opportunity for the smaller company like Eco to get a beneficial deal because Eco cares more about 16,16% of their market cap than Africa Oil cares about a deal that is worth 2% of their market cap. In this case, executing its plan to consolidate its portfolio is more important to Africa Oil than getting a good deal on something only worth 2% of its market cap. So Eco can get a better deal because Africa Oil just wants to see it done and Eco is hard negotiating so It’s more likely that Africa Oil will give in to Eco.

I have seen similar dynamics for example when larger companies are divesting from oil and gas fields in a particular region. Smaller companies that are willing to invest in those assets can get a great deal. Like Valeura got with a Mubadala acquisition and Tenaz Energy with NAM offshore acquisition from Shell and Exxon, Both deals have multiplied the stock price of Valeura and Tenaz.

A bit of a detour there. This deal with Africa Oil is a clear net positive for Eco. It’s not a huge catalyst, but it will be a positive news event when it closes. If you happen to be the CEO of Africa Oil reading this post don’t back out. It’s a good deal for you. I was joking the whole time.

So far I have been building the base for the thesis. We are starting off with cash coming in, the share count going down, the warrants and options not until the stock price goes up a lot. Low risks from the financial side.

Eco is about to drill on one block in the first half of 2025, attempting to find a partner to drill another block in 2025, trying to farm out multiple blocks, and upgrading one block. They call areas where they are looking for oil and gas “blocks”. That’s kind of an industry term.

STOP EVERYTHING! The new shorter and better SA Premium Ad is here!

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium and support AlmostMongolian with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

Where are Eco’s blocks?

Hottest oil exploration spots in the world

Eco has their assets in Guyana, Namibia, and South Africa. Let’s look at these places in general before going to the specific assets.

Guyana

Guyana is the fastest-growing oil producer in the world.

Source: https://www.statista.com/statistics/1260886/crude-oil-production-guyana/

Guyana’s oil boom is located on the Stabroek block with an estimated resource of about 11 billion barrels.

Source: https://energycapitalpower.com/eco-atlantic-farms-into-orange-basin-block-1-offshore-south-africa/

Eco has 100% interest in the Orinduik block next to the Stabroek block with 2 oil discoveries. I will go into more detail about this block in the asset deep dive section.

Also, Look at how rectangular these areas are. Kind of blocky. I guess that’s why they call them blocks. Orinduik Rectangular Area just doesn’t have the same ring to it.

Orange Basin, Namibia, and South Africa

Orange Basin located in Namibia and South Africa is the hottest oil exploration spot in the world. You can see the amount of activity in the below picture. It’s a bit outdated. It’s even busier now.

Source: https://wp-ecooilandgas-2020.s3.eu-west-2.amazonaws.com/media/2024/07/ECO_Investor-Presentation-JUL-FOR-WEB.pdf

The Mopane discovery is estimated to hold +10 billion barrels.

According to NAMCOR(National Petroleum Corporation of Namibia) Venus, Graff, and Jonker discoveries are estimated to hold up to 11 billion barrels.

Source: A user named Manudonuts posted this on ceo.ca I don’t know where it is from originally.

About 140 million years ago South America broke up from Africa. This has caused oil and gas to be here. No need to explain that further. But you can see by comparing 2 pictures above how the Post-Rift isochore map shows quite well where the oil companies are exploring.

New wells drilled in Orange Basin have hit oil around 80% of the time which is an amazing success rate.

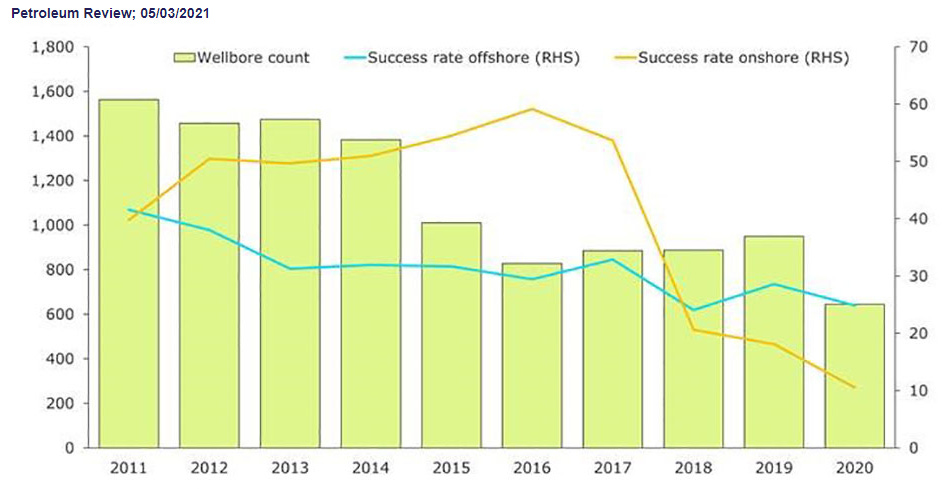

Source: https://knowledge.energyinst.org/search/record?id=115186

Here are the average success rates for new wells. As you can see the 80% success rate is amazing for offshore and onshore oil wells compared to the averages.

Another exciting thing is how unexplored this basin still is. Because more explored areas tend to have higher success rates and less explored areas tend to have lower success rates. This makes the success rate of Orange Basin even more impressive.

The exploration boom started very recently. It was set off in 2022 by the large Venus and Graff discoveries.

The resource estimates vary from different sources and are changing as more data comes in. Also, the estimates of how much is recoverable economically are changing.

But what is clear is that there is a lot of oil here and the exploration has just started. Orange Basin (Namibia and South Africa combined) could easily be in the top 10 in the world in terms of reserves after a few years of Exploration. And Eco is positioned there with a small market cap.

Source: https://en.wikipedia.org/wiki/List_of_countries_by_proven_oil_reserves

Eco also has 4 blocks on Walvis Basin in Namibia. More about that later.

This was about 1/3 of the article. Below behind the paywall is the 2/3 which is the asset deep dive section going into detail on Eco’s main assets which are Orinduik Block, Block 3B/4B, Block 1, and the 4 blocks on Walvis Basin in Namibia+my closing comments.

This was the appetizer. Below is the main course.