Follow your ex-investments

Don't let them out of your sight

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

Quick FREE article. No paywalls. Let’s all start by watching my AD.

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium and support AlmostMongolian by signing up to SA premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

I started thinking about this topic today and thought it could be a good short post I could post today. This post is about why you should keep following your ex-investments. Meaning stocks that you have sold. Stocks that you once owned and now don’t own. The stocks that you used to invest in, but don’t invest in anymore. You are not invested in these stocks right now, but you used to be. These stocks should be on your watchlist.

Sometimes there is an urge to sever ties completely after you exit an investment and not follow the stock anymore especially if it was a bad investment. You held it for a long time and it did not deliver. You might be mad at the stock. “BAD STOCK! BAD! BAD MANAGEMENT! SEND THEM TO JAIL!” These are the kinds of things you might be saying. But there must have been a reason you were invested so there is still a bull case that might happen and you don’t want to see the stock going up after you sold after having held it for years. This is not a logical reason to stop following a stock, but we don’t always act based on our intellect.

Even if it was a successful investment you might not want to see the stock rising more after you took profits and know that you took profits too early.

There is also a feeling of completion after exiting a position. You might have thought about the exit for months and finally did it. You are done. But you are not done. You are not done until you are actually done and then you are done done but even after that, even after you’re done done, I don’t know if you are even done after that.

In summary, there is the feeling of completion and the urge to sever ties because you don’t want to know that you possibly made the wrong choice based on how the stock moves after you sold it. You don’t want to feel regret about selling it. Humans tend to avoid negative emotions often unconsciously. I noticed a lot of this from my own experience.

I used to occasionally stop following a stock after selling it. Although in the past doing this would not have helped much as I did not even do deep due diligence on my stocks. So there was not much of a knowledge base to tap into later. My “investing” was more like “I’m playing the commodity supercycle with 30 random commodity stocks”, “I’m shorting this sector because of the high PE ratio” or “I’m going long X country because of politics”. This was me during my first 2,5 years in the market.

I started doing fundamental analysis in 2022. Many horrible stock picks from that year (some of them still lingering in the portfolio), but I had to learn. Due to this learning, all of my new picks are amazing.

This advice about following ex-investments is for people doing fundamental analysis. And this is why:

Time investment, knowledge base

This is a lot of times the reason you might not want to sell an investment. You have already invested so much time and money. You have learned everything about the company and the sector it’s in maybe 100 hours of work and then for example to sell it for a 15% loss after 80 years. You don’t want to do it. This is called a sunk cost fallacy. It’s not a good reason not to sell something just because you have sunk so much time and money into it.

But as you sunk all this time into researching the company you are building a knowledge base and even after selling the stock you retain the knowledge base.

This is a potential asset for the future. It takes time to get to know a company and you have only a limited amount of time in a day to research new stocks. How many companies do you know that you could make an investment case presentation based on information in your brain right now? Not that many likely. So you should not be discarding these companies completely that you already have made the time investment on.

You might not like the stock now at the current price, but if the company doesn’t get acquired or go bankrupt it is in the market fluctuating in price and there is some value to it or at least a value proposition. There is a risk/reward-based bull case and that risk/reward changes based on new events and shifts in the valuation.

I don’t “like” any of the companies I invest in. I like the risk/reward at certain prices. So after we sell an investment we retain the information about the company and we should have an idea of what it would take for us to buy back into the stock.

Maybe there is an event that needs to happen for the stock to be attractive again. Or it needs to drop back to a lower valuation.

When we know what needs to happen for the stock to be attractive again it’s easy to react quickly to the event or to the lower valuation because we can tap into that knowledge base we have already built. We don’t have to research the stock again.

Let’s go over 2 quick examples from my ex-investments

Algoma Steel

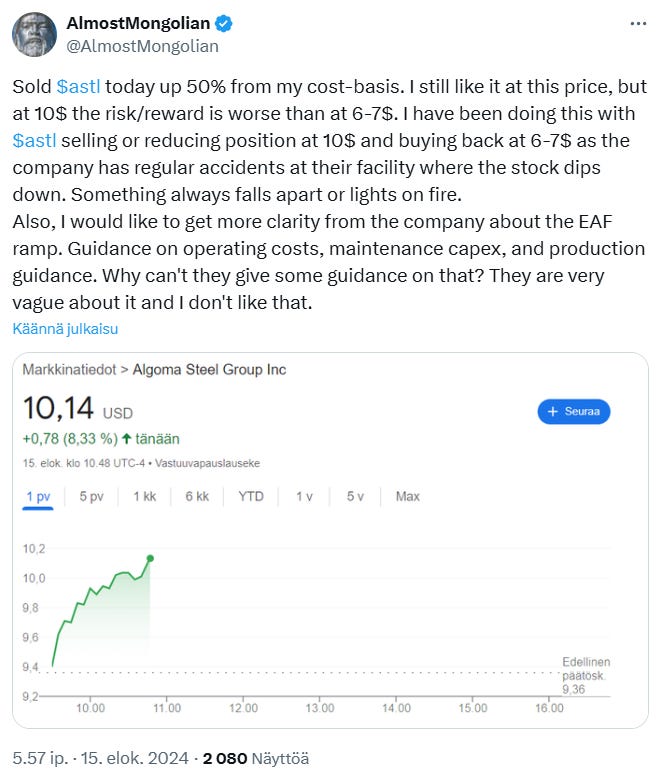

The stock is now 10,34$. Imagine if I held. The gains I missed. In the tweet, there are the conditions for re-entry. I know the bull case but at 10$ with a lack of information about the EAF ramp it’s not good enough IMO compared to other opportunities in the market. So either the stock needs to drop to 6-7$ or at 10$ I need at least some guidance on production, costs, and maintenance CAPEX for the EAF.

But now that I know the company. I have 2 articles about it on Substack (Link to the free one) I know the bull case and the conditions for re-entry it will be easy to return to the stock and make money again if the right conditions present themselves.

There is no reason not to have it on the watchlist.

Peabody Energy

Source: Google

I wrote about this in my watchlist article (Link to that article) It was a 9x for me from early 2021 to early 2022. I always mention my 9x return on Peabody.

This stock is a cheap stock right now, but I don’t see it as irresistible at the current price, because I know it from the past I’m following it and I have 2 conditions for getting back in.

Under 20$ price now or under 30$ price just before they ramp up production in their Centurion project in 2026 which will increase FCF a lot.

Summary

This is how I look at my ex-investments from now on. I think of what needs to happen for me to go long again. I have my conditions. Likely few times a year those conditions will be met and it’s very easy to jump back into a stock where I have already done the work.

Right now I might be out these stocks like Algoma, Peabody Energy, Petrobras preferred stock, Africa Oil, and Metals X, but I won’t let the due diligence I have already done on these stocks go to waste by not following these stocks anymore. These are all volatile cyclical commodity companies and there is a high chance one or more of these stocks will present a great opportunity for a re-entry in the future. A second round.