2 stocks I'm watching: Metro Mining and Peabody Energy

Cheap miners with production growth

I find these 2 mining stocks quite interesting. They are strong candidates for The AlmostMongolian Portfolio. This article is 2 short write-ups going over what I have found out so far and why these companies caught my interest.

Metro Mining

Metro Mining produces bauxite in Australia. Bauxite is mostly used in Aluminium production. It’s a simple deleveraging+production growth+cheap valuation story

Source: Google

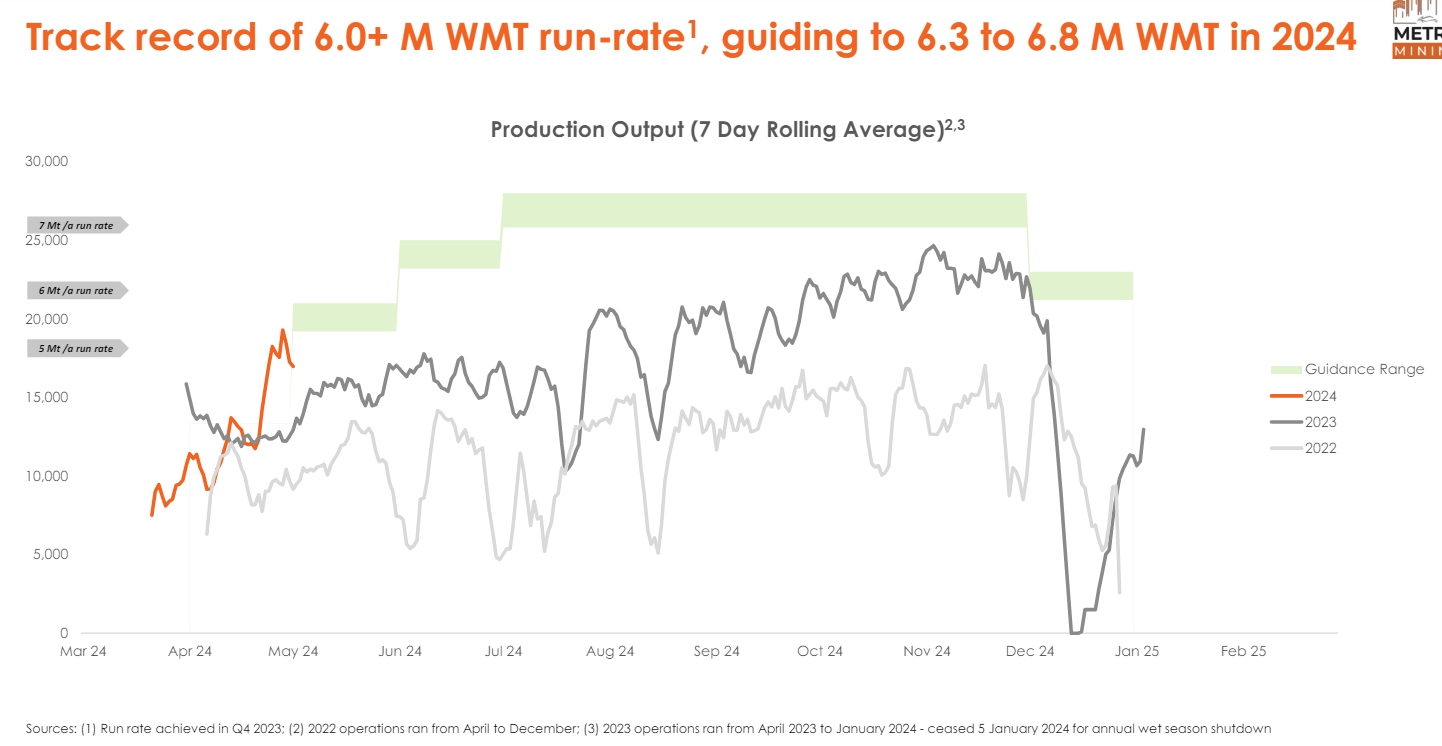

Source: Metro Mining march 2024 presentatio

Source: Metro Mining May 2024 presentation

Based on NPV this company is cheap and you can see the torque to the bauxite price here. It’s important to note that mining companies at least from my experience tend to trade at a discount to NPV so the thesis is not that the gap will close. The current Metro mining stock price is 0,041 aud and the NPV at the April Bauxite price is around 0,13 AU$ so that would be 202% upside if the gap were to close. I used the April price because for some reason it is difficult to find up-to-date prices for this scorned and hated commodity of bauxite. Everyone passionately hates bauxite. Even though we need it we all hate it for no good reason. It’s one of the mysteries of life.

Numbers. They are doing a raise so these numbers will be pro-forma that raise

Share count around 6b post raise using 0,043 share price

Market cap =258m AU$

EV=318m AU$

This EV is counted with the below Pro-forma

Source: Metro Mining May 2024 presentation

There is reasoning for the raise. So this valuation is in contrast to these predicted earnings.

Source: Metro Mining April 2024 presentation, ShawandPartners

This is using around current Bauxite prices and it’s clearly cheap if they can increase production without big issues. With these numbers, this is a 500-1000m AU$ market cap company easily.

Here are some slides about their plan to make this production increase happen.

Source: May 2024 Metro Mining presentation

Increasing production, deleveraging, and becoming a cash flow machine combined with cheap valuation. Compelling. What could go wrong? Some problems with increasing production(This is mining) and bauxite price going down.

Peabody Energy

This company was one of my best investments early in my investing.

Source: Google

That was the initial Covid recovery run also paired with the energy crisis. 10x for me and 20x from the absolute bottom. The coal price went up a lot much more than I predicted.

Source: Trading Economics

The stock never priced in the very high coal prices so it didn’t fall nearly as much as the coal price. Above is the Australian Seaborne coal price they have a lot of operations in Australia. The price also dropped in the US.

Source: Statista

Regardless of the lower prices the company is still making good money at these reduced coal prices and they have paid off most of their debt they have started buying back shares while at the time of the initial 10x rally, they were issuing shares. A pretty good measure of the change in the company is the shareholders’ equity(total assets-total liabilities) which was 1,8 billion $ when the stock was at 28$ and now when the stock is at 22$ the shareholders’ equity is 3,5 billion $.

Valuation

Market cap=2.75b

EV=2,34b

Cash=855m

Debt=400m

TTM net income=530,5m

The latest quarter's net income was only 40m, but according to management, this was caused by some irregular factors that are “behind us” according to the management.

Source: Peabody Energy q1 2024 results press release

So I think we should expect to be in the quarterly range of 100-200m per Q if there are normal operations at around current coal prices for met and thermal. Which already makes the company trade at a cheap EV/E of 3-6.

A lot of the profits are going towards stock buybacks,

Source: Ycharts

I wanted to include a longer time frame because you can see how the company was issuing a lot of shares during the Covid recovery rally and the stock went up 20x from the 2020 bottom. So a coal company issuing shares while rallying sounds like something that only happens with tech, but the share issuance kept Peabody in business and the market cap was so low that if the company were to survive it would be ridiculously cheap. It was at 300m market cap when I bought my first shares and about 6 months from then it made 379m FCF in one quarter. In a situation like that the share count going up doesn’t really matter. But now as they are not in danger anymore they are buying back stock and the share count is going back down.

There is also a small dividend, but returning capital+cheap valuation alone does not make this company that interesting to me. What puts this company in the interesting pile from the not interesting pile is that they are restarting an idle mine that should provide significant free cash flow. I like mine restarts when a company is already cheap based on current operations. This is one of my favorite situations in the mining space. Same situation as Eastern Platinum in the AlmostMongolian portfolio which is already up 90% from cost basis after getting in a few months ago.

Source: Peabody Energy press release December 19th 2023

Source: Peabody Energy corporate presentation February 2024

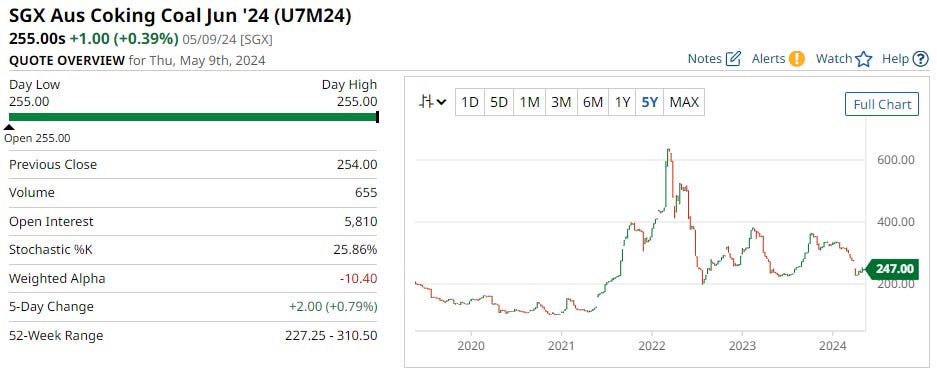

This thing should really start ramping up in 2026. The capex per year doesn’t seem so high as to interfere with the buybacks too much. This also improves Peabody’s product mix. We know that the market is not a fan of thermal coal and coking coal-focused companies receive a better valuation. This mine is in Australia and Australian coking coal price is at 255$

Source: Barcharts

They say their cost per ton is 95$ and with the current price the profits in 2026 should be

(3 700 000*255)+(3 700 000*95)=592 000 000 I assume this is in Australian dollars. If I had a position I would figure this out for sure, but this is a watchlist-level DD.

So converted to USD this would be 392m dollars of profits. I’m also not sure if in this 95$ costs includes costs like taxes, corporate costs, royalties, etc are included it could be just cost at a mine level. So how about we cut 92m professionally and say 300m USD of profits from this mine or something like that. Watchlist-level DD.

If Peabody conservatively makes 400-800m from current operations and we add 300m that makes it 700-1100 million per year in 2026 and forward.

The current EV is 2,34b, for according to Peabody the largest private coal company in the world with operations in safe jurisdictions USA and Australia is would be quite cheap.

With a situation like this, you would think the Market starts pricing in the Centurion restart the closer it gets, but as we all know the market does not always work like that. There is a possibility that you could buy this in late 2025 without Centurion restarting in 2026 being priced-in much. That would be an ideal entry. This seems to be happening with Algoma Steel the EAF project is getting closer to commissioning and the market doesn’t seem to care. Sometimes the market needs to see numbers in the earning release before it wakes up.

But if one was to buy now there is still a cheap company that is buying back stock aggressively.

Summary

From these 2 I like Metro mining a bit more, but I could see both in my portfolio in the future. With commodity producers, I like to have a view on the commodity and by view, I mean whether I think that commodity price is going to increase, decrease, or stay at a similar level. For example Metals X, Eastern Platinum, and Valeura energy I have a view on tin, platinum, and oil, but I don’t have a view on met and thermal coal and bauxite. That is one thing causing me hesitancy with Metro and Peabody, but I don’t have to have a view on the commodity if the company-specific fundamentals are strong enough so that’s still not a deal breaker.

Peabody expects around $300 million of annual free cash flow from Centurion beginning around 2026. That's over 10% of the current market cap and about 13% of the current enterprise value and that's all incremental free cash flow. I just hope they buy lots of stock before 2026

Nice article! Longe BTU