Mind Technology: Delicious Dip

Mind Mind Mind

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

Last year I wrote about Mind Technology. But it was not a moment in time at that time. Now this time is the moment in time.

There have been some changes to the company and there is a dip happening right now and this is the time to pay attention to Mind. I added on this dip(on friday) and it’s time for an update.

Here is my article from last year and here is the common stock performance since then.

Source: Seeking Alpha Premium

Here is the preferred stock performance since then:

Source: Seeking Alpha Premium

Mind common stock has done quite poorly since then.

Mind preferred stock has done better(up around 10% from the same time period) because the management decided to hold a vote on whether to convert every mind preferred stock to 3,9 mind common stocks.

I reacted to this decision by switching 3/4 of my common to preferred

Whole tweet: https://x.com/AlmostMongolian/status/1788228121700753887

Even after making this move Mind has not been a profitable investment because of this recent dip, but switching most of my shares to preferred stock allowed me to lose less money. But this is all in the past. And like we all know the past doesn’t matter.

Now the conversion has happened so I’m back to 100% common stock and I have bought this dip. This is a big position right now.

Current situation

As we saw from the chart we have gone down. I believe there are 2 causes for this

-The market fears that mind preferred shareholders will dump their mind common shares post-conversion. I think the dip happened in anticipation of this. And usually, this means it’s priced in as we speak. The conversion happened last Thursday and Friday Mind closed up 0,93% after falling almost 5% earlier on the day. The stock also had 3x the normal volume. Maybe this was it and it was priced in. But my Nordnet shares were still showing up as preferred shares, but untradeable so this means it might not be it. But I don’t care about this. This is just some speculation about the share price.

-Another reason for the stock price being weak this fear about preferred holders dumping their shares is happening while the company has not been releasing any positive news. The last time they announced a new order was March 11th. This doesn’t mean they haven’t gotten any orders as they don’t press release every order, but this does make me think they have not landed any big orders. Like last December they announced an order of 10,2 million USD. I doubt they would not make a press release if they got another one like this. That would be very shareholder-unfriendly inaction.

We also have earnings very soon(11.9). I think the market is expecting a weak backlog number based on the lack of news about new orders.

Fear about dumping+no positive news=stock goes down

Both of these are short-term issues. This means if you have a long-term positive view this is the time to add or buy in.

Mind last year was a company with like 5-7m market cap with no debt, but had around preferred stock liability of about 46 million USD attached to it. This was a company with a lot of torque because of this.

After the conversion happened a couple of days ago the company has a current market cap of 26m USD no preferred stock liability and also no debt.

Less torque, but less risk, simpler and better capital structure, more real earnings, can return capital to common shareholders more easily, etc.

This conversion basically increased Mind’s quarterly real earnings by 947k USD per quarter which was the quarterly preferred stock dividend that was accumulating as a liability. As Mind could not pay the dividend, but the unpaid dividends would still accumulate and Mind could not return capital to common shareholders before all of the accumulated dividends were paid which would be +5m USD by now on top of the quarterly 947k. Now that is all wiped out with the preferred shares. Massive weight off Mind’s shoulders and also well-timed because Mind has been turning profitable and can now use those profits for the benefit of the common shareholders instead of paying back accumulated dividends to the preferred stock shareholders.

Financial situation

Based on the last financials ending which was the quarter ending on April Mind has 29.5m USD in current assets

-0,9m in cash

-9,4m in accounts receivable

-16,4m in inventories

-3,3m in prepaid expenses

They have only 5.4m of non-current assets. Most of it has been depreciated over the years. However, this does not reflect the value of their non-current assets. You could have a 100-year-old asset worth tons of money, but it shows up as nothing on the balance sheet because of depreciation.

They have 11.2m of liabilities. This consists of

-1,7m account payable

-5,3m accrued expenses

-leases 1,7m

-taxes payable 1,9m

-unearned revenue 0,6m

Based on these last quarterly financials Mind inventories are higher than normal and their account receivable compared to AP is higher than normal. This should mean higher cash generation during upcoming quarters.

Last 2 quarters Mind has been profitable based on net income, but operating cash flow negative as they have been building accounts receivable and inventory.

Last 6 months

Revenue=23,1m

Gross profit=10,4m

Operating income=3m

Net income=2,5m

Backlog during last 12 months:

April 2023 Q=18m

July 2023 Q=17.4m

Oct 2023 Q = 37.4m

Jan 2024 Q= 38.4m

April 2024 Q=31m

The backlog is still up a lot of y-o-y based on the most recent results while the stock is down a lot since then. The earnings this week should show a horrible backlog if this move is justified on a fundamental level.

I’m putting out everything we know so far. What do we have as retail investors to go off? We have the current publicly available information and researched business outlook for the mid-to-long term.

So based on current information what is the earnings potential for their last reported backlog?

31*0,433=13,42m Gross profit

Operating costs based on last quarter 3,5m

so operating earnings of -580k

great but let’s add back depreciation of 1,2m

620k

There is no need to add back tax in this case because net income would still show up negative

I will just add depreciation back without other considerations because this company is not really making any capital investments at least based on current information.

I’m not really making a great case right now. But this is basically the bare minimum just looking at it as a robot.

Ad Break. I like money🦀

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

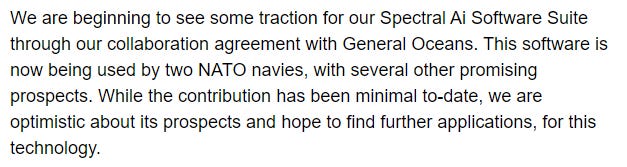

I used 3.5m based on last quarter as operating costs, but the management is expecting that the operating costs will go lower.

Source: June 11th Conf call, SA premium

The management also expects stronger order activity in the latter part of this year and the fact that last year they had a big surge in orders later into the year.

Source: June 11th Conf call, SA premium

They also say they expect the revenue to be higher this year than if they were to annualize the first quarter. If I annualize the first quarter I get 2.8m Operating income. Then you add to that that they expect higher revenue than the first quarter and lower operating costs than the first quarter.

So we have all that. We have solid numbers and expectations. The valuation is quite low. So I think there is a downside in only a very negative scenario.

At the end of the day, it will come down to the orders. But what is great about this company is the operating leverage to increase order activity.

Let’s say they can get their backlog up to 48m that’s usually delivered within a year. I use that number because they briefly reached that level of backlog last December so it’s not an unlikely number.

48m would be 20.7m of Gross profit

They expect more cost reduction let’s say they can get to 3m. That would make an operating profit of 8.7m.

If they can get to 80m that would be 22,64m of operating profit. It’s a Nasdaq-listed company that could get like 200-300m market cap. But I’m being a bit unhinged right now. Let’s stop with the numbers there is a business behind these numbers so what are the fundamentals over there?

The future

I wrote about the business in my original article. And I will quickly regurgitate those points again and talk about some new stuff that has emerged since my first article.

Source: Mind Technology

This is what Mind does. They operate in a very niche market with great fundamentals. They have products that help companies who try to find oil and gas offshore, build offshore wind farms, carbon capture storage, or other structures offshore, or help armies with anti-submarine warfare.

Their biggest revenue generator is the O&G customers still and offshore oil exploration is the future of oil exploration. All of the hottest exploration spots currently are offshore Namibia, Suriname, and Guyana.

Source: https://www.offshore-mag.com/business-briefs/news/55136825/total-offshore-investments-to-reach-almost-250b-in-2025-rystad-reports

Offshore and offshore especially deep-water are set to grow.

Source: https://www.reuters.com/business/energy/big-oil-finds-more-love-deepwater-exploration-fields-2024-05-05/

If you have followed the sector you know that US shale was the biggest production growth source in the last decade. It’s slowing down. Offshore is taking over and Mind is there and nobody knows about it or likes it.

There is also the offshore wind trend

Source: https://www.weforum.org/agenda/2020/08/offshore-wind-energy-growth-energy-transition/

Look at the projected jump from 2024 to 2025. This is also a strong tailwind for Mind.

Then we have carbon capture storage, the military. Not much to say there. Those are smaller segments for Mind but also should be quite strong over time.

They also expect to get some software revenues

Source: April 2024 ending quarter conference call, Seeking Alpha Premium

Source: Jan 2024 ending quarter conference call, Seeking Alpha Premium

Mind owned Klein and sold it to General Oceans, but arranged a licensing agreement with General Oceans about this software Mind has been developing. now General Oceans is marketing it. They say it could be a few million dollars a year high margin revenue. A positive development, but not very significant.

Also this

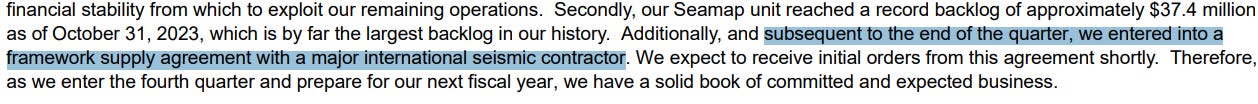

Source: https://ir.mind-technology.com/node/13876/pdf

This was in the earnings release from December 13th last year. During the Nov 2023-Jan 2024 quarter Mind entered into a “framework supply agreement with a major international seismic contractor” After a week Mind announced a massive order that was from this agreement

“THE WOODLANDS, Texas, Dec. 19, 2023 /PRNewswire/ -- MIND Technology, Inc. (MIND) announced today that its Seamap unit has received an order for multiple GunLink source controllers totaling approximately $10.2 million. This order is pursuant to the previously disclosed framework supply agreement with a major international seismic contractor.”

After this, we haven’t heard about more orders from this agreement. Which has made people forget that they even landed it.

Source: Dec 14th 2023 conference call, Screenshot from Seeking Alpha Premium

Considering they did get a massive order from this agreement and it is supposedly a multi-year agreement I would still consider it another positive going forward.

What else? Competition

It’s hard to gauge the competitive environment in this space because it’s so niche and I’m not an expert, but I will put this up.

Source: Sep 14th 2023 conf call, SA Premium

Remember when oil was 90$? I do. I do.

Anyway supposedly for Source Controllers now after many of their competitors went bankrupt in 2020-2022 Mind is “pretty much the only game in town”. Monopoly anyone? This is unacceptable! That 10.2m order from last December part of the supply agreement with a major seismic contractor was Source Controllers.

Source: Google

You can see just from a Google search what kind of market Mind survived. With the energy recovery from COVID exploration recovered last that’s why you had companies going under in 2022 even with very high oil prices, because companies were just restarting production not increasing exploration spending. To this day onshore exploration still hasn’t recovered, offshore exploration has recovered because of hotspots like Namibia and Guyana, but there hasn’t been a broad recovery yet if there is one it will be very good for Mind because it will ramp up offshore exploration even more.

Summary

Combine everything that there is to know about Mind right now.

Why is the stock down? Conversion noise+lack of positive noise

What is the downside? No debt, Current assets exceed the market cap, backlog still decent

What are the long-term fundamentals? Services sectors that are growing over the next ten years.

What is the upside? Can receive lots of orders very fast and has a lot of operating leverage+is listed on Nasdaq so Mind can have significant multiple expansion if it can get a growth company market perception.

Comparable company Kraken Robotics trades at more than 2 times revenue because they have gotten this market reputation.

Also, there is acquisition potential.

An acquirer could save more than 1 million in Nasdaq listing costs+the already cheap valuation+the EX-preferred stockholders now own most of the company and I think most of them would love this option. Potentially someone with synergies like General Oceans who bought Klein and works with Mind on the software or the major Seismic contractor they signed the supply agreement with. This is speculation, but there is a good case to be made about why Mind would be an attractive acquisition target.

I like this dip. Earnings after Wednesday market close. Why didn’t I wait for the earnings to have more clarity and information? Because Mind is dipping now. I don’t know where the stock is going to be after earnings. In the past Mind has been up 50% on a day with minor positive news. This type of volatility works both ways so don’t be surprised if the stock goes down 99,93% because of a minor inconvenience. I’m still adding.

The end