Mind Technology: Highly Asymmetric Opportunity

and an insane roller coaster

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. It’s all opinions. Everything I have written here could be totally inaccurate. Trust nothing you just read.

Before I start talking about why I think this is a great investment etc. I will show you what you might be in for if you decide to get involved. As a warning.

Well, there was news that day 23 of October, but they announced 5m$ order before the market opened, and as you can see the market opened DOWN on that news and then went up 57% on the same day, and then the next day it went back to 5$. Why? because this is an illiquid micro-cap, but it seems like Mind is erratic even among them. I have not seen a movement like this in other stocks. So this is what you will be experiencing as a mind shareholder. The stock price movements short-term will not make sense. This does allow you to add on weakness and maybe take some profits on these crazy up moves.

The Thesis

Mind provides all kinds of gadgets for offshore O&G exploration, offshore wind, some military applications, and offshore building applications through their SeaMap business unit. In their words:

“A MIND Technology Business, Established in 1987, designs, manufactures and sells a broad range of proprietary products for the seismic, hydrographic and offshore industry. With engineering, manufacturing, sales and support bases located in Singapore, The United Kingdom and Malaysia, Seamap is able to respond to customer’s needs anywhere in the world 24-hours a day.”

You can look at their website to see all of the weird contraptions they sell. Most importantly the majority of their business comes from the offshore O&G exploration sector. You might see a trend among many of my investments. In 2022 I had many oil investments that had gone up a lot and did not look as asymmetric anymore. So I tried to find something to rotate to that does benefit from the strong oil market but has not yet seen the benefits reflected in the share price.

Source: Google

And it has still not seen the benefits reflected in the share price. I got involved about a year ago at around 5,8$ and it has of course continued to go down while periodically spiking to 7$ almost 8$ once and then going back to 4$ without much logic in the moves.

Source: SEC

If you look at the latest pro-forma financials(post-Klein sale) they have no debt, They have more cash than the current market cap and they are pro-forma EBITDA positive for the six months ended July 31. And EBITDA is a decent metric for this company because they don’t really do CAPEX or have any interest payments.

So just based on that info 6,45 million market cap sounds insane, but it’s actually not too good to be true, because there are preferred shares. And Mind needs to pay 947 000$ per quarter of preferred stock dividends before they can pay any dividends to common stockholders or do buybacks. If they do not pay preferred dividends it basically accumulates so you have to pay them later if you want to reward common shareholders. Also if Mind does not pay preferred dividends for 6 or more quarters preferred holders have the right appoint to 2 board members.

Mind declared recently that they are starting to pay preferred dividends again after not paying them for many quarters. They owe about 4,7m of preferred dividends. If they just keep up with the dividend from here this number will remain the same. They have the liquidity now to pay all of it, but I assume they won’t do that all at once as they are being conservative and want to maintain a strong liquidity position.

The good thing is there is really not much of a bankruptcy risk, because the preferred shareholders can’t take the company bankrupt even if they do not pay dividends for years. They would get the 2 board members, but their impact would obviously be limited. And like I mentioned Mind has no debt right now.

Profitability and the sale of Klein

Mind sold Klein on August 22. This business was mostly for military customers. They had some cool products, but they were losing money. Mind sold it for 11,5m$. Around 1 p/s of unprofitable revenue, seems like a decent deal to me.

As this was always an O&G play to me I always looked at Klein as something that had potential but was not core to the thesis and considering that and the fact that it was losing money I was happy to see it sold. This allowed Mind to pay back their high-interest debt and start paying preferred dividends again which avoided the board members preferred holders could have appointed if Mind deferred payments again.

So I was happy about it, but the market wasn’t. Because the stock is down around 25% since then. Wait actually market was happy about it. It was up on that news. Why is it down 25% then? Maybe because there was a reverse split a month ago to stay on the Nasdaq. And the earnings weren’t as good but that was telegraphed earlier as this business model has fluctuating earnings per quarter based on the timing of orders.

Source: SEC

This is for 2022 basically only January of 2023 is included. You can see how Klein was contributing to losses. It would have lost money even without it, but at the end of 2022 and the beginning of 2023, you can start to see a turnaround which is what I was betting on.

Source: Seeking Alpha

Q4 and Q1 were the first EBITDA positive quarters in years even with the money-losing Klein. That strong performance was driven by Seamap which is the only business Mind has left.

It’s kinda annoying to be fundamentally right, but still have the stock down, but that’s the market.

The preferred stock has moved more in line with fundamentals. This is probably because the preferred stock is the first beneficiary of the turnaround as it starts receiving the dividend. I think the preferred stock is also a good bet, but lacks the upside I see in the common stock. It has around 100% of maximum upside based on stock price appreciation. And I mean maximum it cannot go up higher than a certain point and it offers a high yield in case Mind keeps paying dividends. But in the bullish case, common stock will be a bigger beneficiary and I will go into why is that later.

Backlog

On July 31 Seamap had a 17m$ Backlog. But during Sep 13 earnings call they said they have received 5,4m$ orders since then and after the earnings call, we got 2 press releases Oct 3 and Oct 23 one announcing 3,4m$ of orders and the other announcing 5m$ for one order.

That is 13.8m$ of orders which we know of in less than 3 months. They do not announce every order so there is most likely more than that. We know that in the past for this company to be EBITDA positive they needed like 12m of revenue per q, but that was when Klein was hurting their profitability. Now they need less to be profitable. If you go back and look at the pro-forma financials they were EBITDA positive 6 months ended July 31 this year with 18,155m of revenue which means they now need around 9m$ to be EBITDA positive. And we already know of 13.8m$ of orders in less than 3 months.

But the key for the common share price to rocket is not just to be EBITDA positive or net income positive. That was the first step in the turnaround. To stop the bleeding. For the real gains to be made they need to get their profitability higher than the quarterly preferred dividend. Which is 947 000$ per quarter. After that, the value starts adding to the common share which is trading at a 6,4m market cap. So the ultimate bull thesis is to wait for them to get to 2-4m of profits per quarter which would be effectively 4-12m yearly going to the common shareholders who paid 6-8m for their shares. Where is the common stock market cap at that point? maybe 40-120m.

Some Speculation

What amount of revenue to get to that ultimate bullish case? I’ll speculate a bit based on the 6-month pro forma financials. If we assume the same gross margin of 41% and the same operating costs as in the pro forma. They would need about 11,7m per Q to get the pre-tax profit around the same where the preferred dividend is. 15m would mean 2,3m of pre-tax profit. 20 would get them to 4,35m per q. But this is pre-tax and pref div is paid from after-tax earnings. So take that into account. I also would not make the assumption that the operating costs would stay the same if sales increase a lot. This was just some speculation.

But we are already seeing high order activity so 15m per quarter in the future in the oil market I see is not far-fetched in my opinion.

Market conditions for Mind

You can read all these articles about how oil production growth is going to come from mostly offshore in the foreseeable future.

https://www.eenews.net/articles/offshore-oil-is-about-to-surge/

https://www.reuters.com/business/energy/this-decades-oil-boom-is-moving-offshore-way-offshore-2022-08-31/

https://www.reuters.com/markets/commodities/offshore-oil-spending-rise-more-than-20-this-year-slb-2023-06-21/

And everyone kinda knows this we had the largest oil discovery in 2022 Venus which is offshore. I have exposure to that one through Africa Oil $aoi. They are exploring that discovery with big money and Minds’ main business is making equipment for this application.

We know about the offshore oil boom going on in Guyana and Suriname. Also in Brazil which I wrote about in my Petrobras article. They are increasing production faster than any major oil company with their offshore fields.

We have oil exploration moving offshore in general and I think we will have strong oil prices which will further incentivize exploration.

Then there is the offshore wind

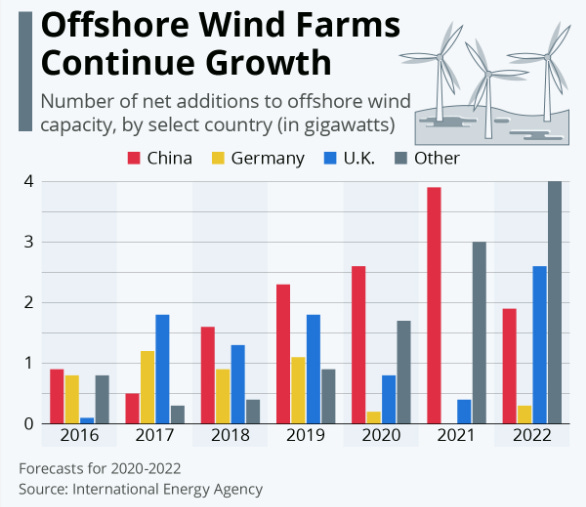

Source: International Energy Agency

It’s growing fast and while it is still a smaller segment of Minds business it is a segment and I expect it will grow as a percentage of Minds revenue.

Source: Mind Technology

Then we also have some defense products although their defense exposure is not as high anymore after they sold Klein. They still have their “Sea Serpent” product. This is from the latest call

“Within the maritime defense and security market, we continue to believe that our Sea Serpent passive array system, which is derived from our commercially developed SeaLink system, is a significant and economical solution for a variety of demanding applications within the space.”

Here you can see the “Sea Serpent” https://mind-technology.com/sea-serpent/

And as we all know people are shooting each other at an increased rate so this also benefits Mind.

https://www.sipri.org/media/press-release/2023/world-military-expenditure-reaches-new-record-high-european-spending-surges

Spending in all these sectors that Mind services is increasing.

comparison to peers

Mind doesn’t have many peers it’s kind of a niche company, but the closest peer I could find in terms of products and size is Kraken Robotics. And Kraken Robotics has less revenue than Klein. If I look at the past 3 quarters it has been less profitable than Klein, but it has an EV of 79m USD. I use EV because it takes into account the preferred shares. Mind has an EV of 48m USD. Kraken doesn’t even have a Nasdaq listing like Mind has. For Mind to have a comparable EV to Kraken the common stock would have to go up 5-6x. But It’s different companies different histories, different shareholder bases, different everything, etc. It’s still an interesting comparison.

Summary

I’m playing this for the longer term. Waiting patiently as results improve with the common share has massive torque to that improvement because of the very low market cap. Market conditions are favorable. The risk is reasonable. Risk/Reward is really good IMO. Am I looking to add more? Below 5$ is definitely a zone my adding zone, but I have so many stocks I want to add to so we’ll see. I added a bit recently at around 4,6$. I’m really optimistic about Mind.

Thx!

Thanks for sharing