AlmostMongolian Annual Review+Portfolio Update

Portfolio update, closed positions, returns, lessons and predicting returns for 2026

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian AD: THE LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

2024 was a year of rabid development, and 2025 has been a year of exponential refining. And Clarity. At the beginning of 2025, due to the rapid development in 2024, I started to know what I was doing a little bit, but ultimately, I still didn’t know what I was doing. Throughout 2025, AlmostMongolian has been exponentially refined. And now, starting 2026, I exponentially know what I’m doing. From here it’s a different ball game; there will be no mistakes.

2025 Performance

In last year’s recap, I presented my estimates for 2025: “I’m mega bullish The AlmostMongolian Portfolio for 2025. It’s perfect.[It was not] My conservative estimate for 2025 is a 100-300% gain. My optimistic estimate is too outlandish to even say. You wouldn’t believe I can estimate a number that high. You have no idea how high I can estimate.”

My 2025 return was about +40%. It would have been so much more if not for… But I have to face the facts. Unfortunately, I missed my 2025 conservative estimates by a lot, but as I said, I didn’t even know what I was doing when I made those estimates, and now I do, which means that when I put out my 2026 estimates at the end of this article, it’s going to be a totally different outcome this time.

Current Portfolio, updates, and return of each position:

This section shows the current AlmostMongolian Portfolio positions, listed from largest to smallest, along with each position's cost basis and return from cost basis. Most stock price charts shown are trailing 12 months to showcase 2025 performance, while simultaneously showing the share price from January 2026. This is what we call: to hit 2 flies with one slap.

Hydreight/Victory Square Technologies combo

VST German listing Cost basis(CB)= 0,19€ Return from Cost basis +116%

Hydreight Technologies CB = C$1.71 return from CB +126%

Source: Seeking Alpha

By itself, VST would still be the biggest position, and Hydreight by itself would be fifth. I bought Hydreight first in early April, during the trade-war stock-market dip.

Then, in early July, I converted half of my Hydreight position to VST, which has since outperformed Hydreight.

Since establishing the initial positions, I have added to both many times, but mostly to VST. Raising my cost-basis as the company has executed, as the fundamental value of the company has increased more than the stock price in my view. I added most recently last Friday. The stock price dropped because they raised money, and the market hates it.

Many investors say the timing is bad and that it signals they will release poor guidance. Because if the guidance is good, why not do it after it at a higher price? Why was there a half-warrant? Why was there a discount? They are profitable with a strong balance sheet. Why did they need to do it?

The management argument: They don’t need to raise out of financial necessity; they have a strong balance sheet and are cash flow positive, but they have many near-term opportunities to accelerate growth and scale the business, and with the proceeds from the raise, they can pursue more of these opportunities at the same time, instead of sequentially. They are launching new products and increasing pharmacy capacity, both of which require upfront capital. Platform and operational scaling. Bringing multiple higher-margin initiatives live at the same time.

And the arguments for the discount with half a warrant and the timing before the guidance from Shafin:

“If demand was strong, why a discount and half warrant? Because this is market-standard structure for a financing of this size and stage when bringing in institutions that intend to be long-term holders.”

“Why raise before guidance? Because the opportunity in front of Hydreight is time-sensitive operationally, not narratively. Q4 execution validated the model in a very real way. Coming out of Q4, we had: • Confirmed demand • A deeper pipeline of higher-value product lines • The ability to launch multiple initiatives in parallel, not one by one Waiting until after guidance to raise would not have improved execution. It would have slowed it.”

So the investors say the stock is already cheap, why dilute when you don’t need to, and the management says it’s worth it to grow even faster.

My take is that, given their strong track record, I’m giving Hydreight the benefit of the doubt. They have earned some trusting the plan. They have something cooking. Let them cook. Will this, approx 5% dilution, approx 7.5% with warrants exercised, matter much 6-12 months from now if they can grow significantly faster, taking advantage of these opportunities? That depends on their execution.

How was their execution in 2025?

Source: https://hydreight.com/docs/Hydreight-Deck.pdf

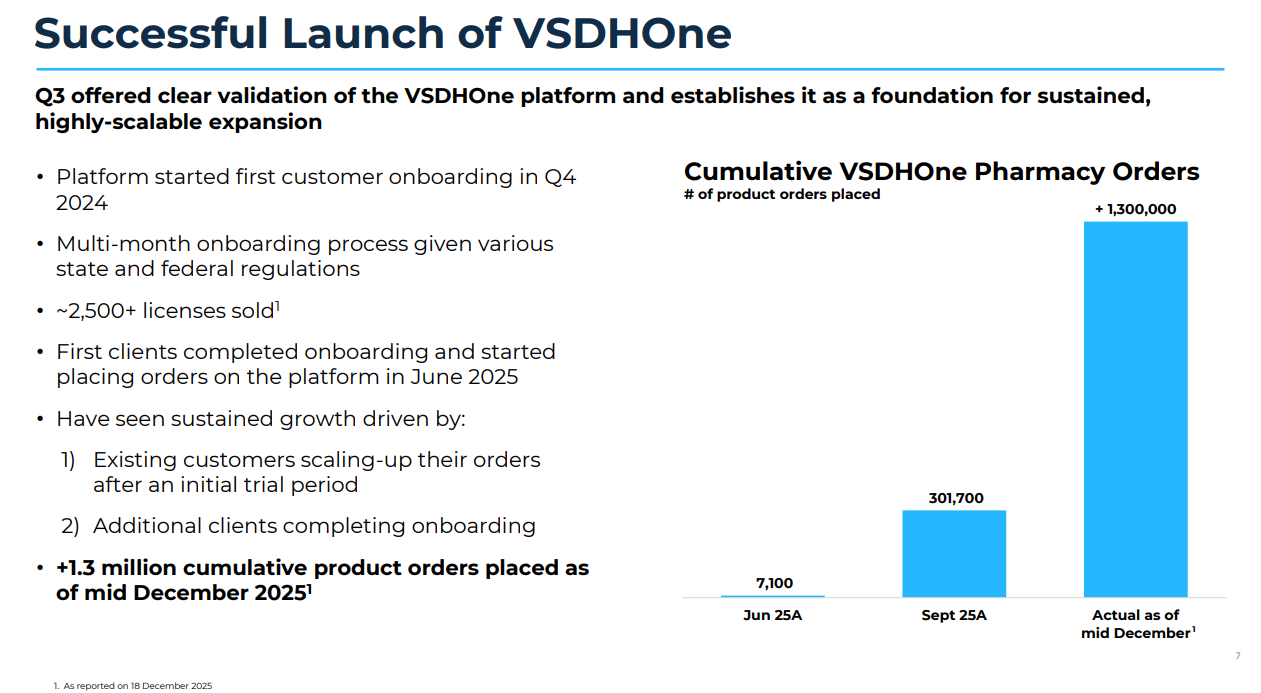

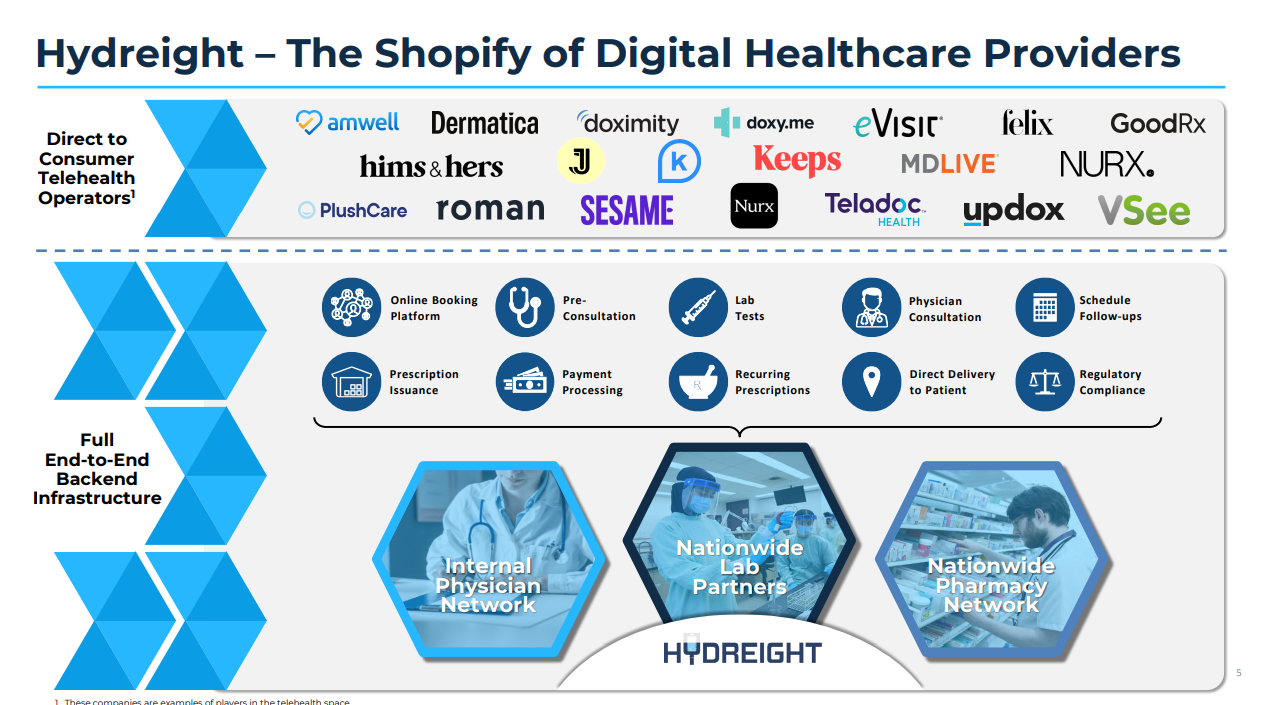

They guided 1.3 million orders for 2025. A number that was seen as outlandish when they announced it in late 2024. They achieved that number in december 18th. Although with a significantly lower average order value than originally expected. Still, given where the company was before and what the market actually expected, I would call this a big win. Revenue increased by +94.4% from Q2 to Q3, when VSDHOne was first starting to ramp up.

Licensee growth significantly exceeded the company's guidance. Hydreight guided that it would have 1000 licensees by the end of 2025. On December 18th, they announced that they have approximately 2500 licensees. And in that same announcement, they mention that the order volume so far was driven primarily by the initial 400 licensees (Link to PR). Meaning there is a lot of growth from here baked in for 2026, just from ramping up with the newer licensees.

That Dec 18th PR, compared with a Dec 1st PR, provided us with a run rate for the month if order volume remained the same for the rest of the month.

To determine the full order count for December, based on recent PR's and assuming orders continue at the same pace:

The company reached 887,000 orders as of December 1st (end of day) and 1,300,000 as of December 18th (end of day).

This implies 1,300,000 - 887,000 = 413,000 orders added from December 2nd to December 18th.

That period covers 17 days (December 2nd through 18th inclusive: 18 - 2 + 1 = 17).

This implies a daily average rate of 413,000 ÷ 17 ≈ 24,294.12 orders per day.

Assuming this rate applies uniformly across all of December (including December 1st and 19th–31st), project over the full 31 days: 24,294.12 × 31 ≈ 753,118 orders.

Their projections had December at 400k.

They crushed expectations on licensees and orders. The average order value AOV has been the only thing where the result was worse than expected, or did not exceed the expectations. And it’s an important part. Earlier in 2025 Investors and analysts were projecting more than US$100 per order, but the company was always less confident in projecting this metric. The higher AOV expectation came mostly from assuming a higher percentage of GLP-1s, which were priced higher, but due to GLP-1 prices falling and the company diversifying into other lower-priced products and giving discounts to early adopters of VSDH, the AOV turned out to be significantly lower. In the 2nd half of 25, the management had made it clear it would be closer to $30-50 CAD.

The company has not provided a clear AOV number for a while. In the Q3 call, they said: “AOV climbing fast. As Shane mentioned, getting to about $40 on an AOV by the end of the year and then pushing that $50 - - north of $50 as we go into 2026.”

Here is a calculation by Rollercoaster using very conservative order numbers for 2026:

Source: Rollercoaster

1 million orders per month for 2026, given the December data, would be a major disappointment. The AOV would be lower than the management is targeting, and the margin would be around their target. The valuations of $188 million market cap for Hydreight and especially the $69 million for VST (still trading at a discount to its NURS holdings) both seem ridiculously cheap under these assumptions.

We have seen that Hydreight is willing to dilute to grow faster (PerfectsScripts acquisitions, convertible, raise), which shows again why VST really should trade at a premium, as their 10% profit share isn’t diluted by dilution on the Hydreight level. It only grows in value, assuming the dilutive growth measures lead to higher future profits.

And I’m not against dilution for growth if they deliver the growth. Many investors have the value investor notion that when a company becomes profitable, it is not supposed to raise money anymore. But Hydreight is a hypergrowth story. They are going for it. They are trying to take over the market. Profitability is a plus.

Source: https://hydreight.com/docs/Hydreight-Deck.pdf

They will be diluting in the future. And the shareholders always think the stock they are holding is undervalued, because they wouldn’t be holding it if they didn’t believe that, so when they inevitably dilute again, shareholders will be saying they shouldn’t have done it when the stock is undervalued. It’s always a bad time to raise, because the next re-rating catalyst is always around the corner. You can see the problem when it’s a growth-focused company.

In closing, the VST/Hydreight combo is by far my favourite investment currently. It’s difficult to imagine a scenario in which Hydreight would have failed 1 year from now, absent a black swan event.

The CEO's email said the 2026 guidance comes out this week.

ADUR 0.00%↑ Aduro Clean Technologies CB= US$1,97 return +648%

Source: Google

Despite the volatility, the stock performed well for the year, as it tends to do every year. My mindset with Aduro remains the same. As long as the long-term thesis stays intact, I’m holding. Because as long as it does, the stock is on a path to a multi-billion-dollar valuation. And the story is staying intact and progressing allthough slower than initially expected. My recent Aduro update contains my full thoughts on the current situation: Link.

Significant news for 2025 was the building of the Pilot plant, starting site selection and design for the Demo plant, 3rd party validation that their product works in a steam cracker, raising a lot of money for the pilot and demo plant and partnerships with Ecoce and Cleanfarms.

What is expected for 2026 is the results from the pilot plant, which the management has said they expect to improve from R2. That will be important for proving the scalability of their tech. And now that they recently raised $20 million, they have the money to build the demonstration-scale facility, which will eventually be scaled up to commercial. So 2026 will still go without material revenues, and seemingly the company is moving slowly, but the company is tackling such a big issue with such a high promise, that if they continue to execute, the stock will continue to outperform even if the progress to commercialisation is slow.

$CERT.V Cerrado Gold 2nd Round CB= C$0,65 Return +185%

Closed position on 3.2.2025 Cerrado 1st round +21%

Source: Google

I held this stock briefly at the beginning of the year and then sold it at 46 cents due to the Lagoa Salgada Acquisition. This was a mistake, although I still agree with my original assessment of the acquisition. The stock was already a slam dunk, but the acquisition caused a material amount of dilution while adding unnecessary risk and harming the company’s reputation among investors due to a conflict of interest. And the potential return from it was not enough to warrant all that, in my opinion. But I should have held the stock anyway. And I eventually came to my senses and returned.

Most of the return from Cerrado has come from rising gold and silver prices, which I did not predict. So I would say I have been lucky with the stock, because the company-specific catalysts have been delayed or only partially realised.

We haven’t gotten the LOM increase announcement, although they did expand the drilling program from 20k to 70k metres, which is a good sign. They revised their 2025 full-year production guidance down from 55-60k to 50-55k, due to a delay in underground production ramp-up. On a positive note, they successfully started underground production. The environmental permit for Lagoa Salgada was delayed. The Lagoa Salgada updated feasibility study is also late. Because of the lack of progress, my write-up from June has remained decently relevant: Link

The execution has been a mixed bag, but the Cerrado thesis never needed perfect execution. The valuation was so low that the stock should be a multibagger if they could execute half of what they are saying, and they are still on track to do at least that.

In december they said they have achieved 4000-4500 GEO per month for the Heap leach operation. Combined with the CIL operation, that should be at least 15,000 GEO per quarter.

Which would put them at a run rate of 60k for 2026 without the underground operation. We have no guidance on underground production, but it is higher-grade, and the company has facilities with a 100k capacity.

Today, the company announced that the hedges were completed. Allowing the company get the full benefits from the higher gold prices.

Source: https://ceo.ca/@GlobeNewswire/cerrado-gold-announces-conclusion-of-gold-hedging-program

Crude calculation for 2026 without UG production at the current gold price of $4600

60k*4600=$276 million in revenue

AISC 60k*1800=$108 million

Mine operating income=$168 million

Around $10 million G&A and then 35% tax(I’ve seen people use 25%, but i’ll use 35% now)

US$103 million post-tax profits, current market cap US$180 million

Based on how the underground operation performs, we could see materially higher production next year. Now they have 4-5 years of LOM on Argentina with plans to significantly increase it through their drilling program and underground development. In addition, they have US$147M in post-tax NPV for Lagoa Salgada and a post-tax NPV of $1.6 billion for Mont Sorcier. And both of those latter NPVs should get an upgrade, with updated studies scheduled for release in the first half of 26. Precious metals prices are the wild card in the equation.

I think Cerrado is still a great risk/reward and has plenty of upside left.

$LODE Comstock Inc. CB= US$3.08 Return +31%

Source: Google

The return is measured from the last market price, so if there is after-hours trading (jälkipörssi), the return is measured from that.

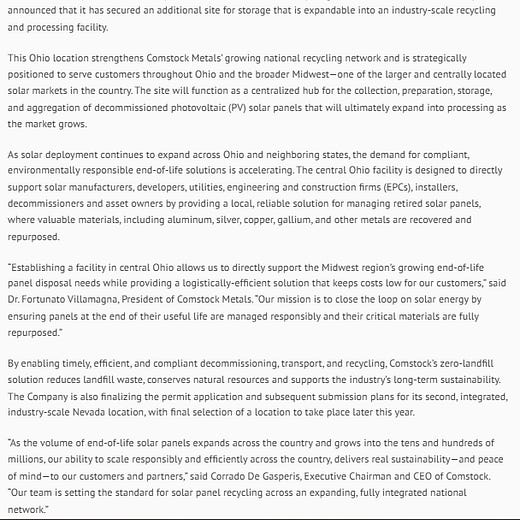

Since I released my Comstock write-up in mid-December, there have been some new developments:

And there has been a surge in silver prices, which helps Lode by increasing the value of their mining assets that they are trying to monetise, and by improving the economics of their solar panel recycling business, as solar panels contain silver.

Now, the Silver price is $93 and here is a calculation from Jay to highlight the impact of different silver prices for one site operating at full capacity.

While the silver price going up is nice, it’s not the crucial part of the story. Now that they are permitted, what will be important in the 1st half is successfully commissioning the facility in Q1 and then proving that the technology works as presented when scaled up. Not being able to procure enough panels or ramping up slower than expected are risks, but if they can prove that they have a technology which they can deploy to multiple locations, spending $12 million in Capex per facility, and when scaled up, each will make $55-82 million of profits annually. If they prove they can do that, it will eventually result in a multi-billion-dollar market cap.

A quick tip for my fellow influencers. On top of the great investment thesis, this stock is great for engagement. Even without putting in any effort. You can just regurgitate the news or keep posting that it’s a silver play.

$SEI.V Sintana Energy CB = CA$0,64 Return -27%

Source: Google

Sintana has been a big drag on my performance this year. I have kept it as a large position and added to it multiple times, while the stock has kept going down.

Was this a mistake? When I use the word “mistake” in this article, I mean whether I think I made the correct move based on information that was available at the time and the risk/reward that presented. And I don’t think holding and adding to Sintana was a mistake, other than maybe buying a bit too much. However, I also sold Sintana shares a couple of times to get liquidity to buy other stocks. But it remained a big position. The risk/reward has been strong throughout the year, and the odds have been in favour of the longs given the valuation and the assets, but many risks that were possible, but not likely, materialised, and many of the catalysts didn’t happen or didn’t live up to expectations.

The reasons behind the stock price fall is more like a death by a thousand cuts than due to one big negative news release: PEL 90 dry well, Oil price weakness, Shell write down, No FID on Venus, Namibian politicians not getting fiscal stability legislation done, insider selling, Operator walking away from PEL 87, hated Challenger energy, and PEL 83 farmout disappointing investors.

Here are the potential catalysts going forward:

The market cap is now US$172 million, and in my opinion, risk/reward remains strong at the current price.

LibertyStream Infrastructure partners CB=CA$0.27 return +404%

Source: Google

This is the price on Friday’s close. After closing, they announced a raise priced at $1.10, so I would expect a drop when the market opens today.

I didn’t expect such a fast surge for this stock. I only got a small initial position because it started running right when I started accumulating, which is why it’s not one of the biggest positions despite it being one of the biggest percentage gainers. If I had known how fast the stock would go up, I would have bought way more. Trust me.

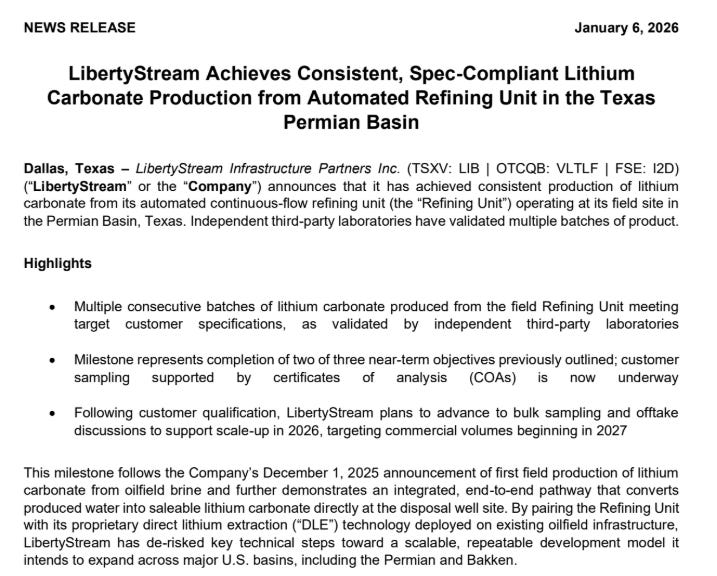

I don’t have anything to complain about with Liberty in terms of execution. Everything is moving on schedule:

Signed an MOU with Packet Digital, a battery manufacturer that sources critical minerals: Link to PR

Advancing towards redomiciling to Texas and towards a future U.S listing: Link to PR

Successfully commissioned the refining unit and 3rd-party validation of the product:

Source: https://www.dropbox.com/scl/fi/aa412hm7fxryqrzv4guqe/260106-LIB-Consistent-Carbonate-Production.pdf?rlkey=ui8ezr8684n1gf4d7z726tx2k&e=1&st=q3zmjxqh&dl=0

They recently completed a raise of C$10 million at 65 cents with added warrants with an exercise price of 1$, which, after all exercises, would result in about $15 million in extra proceeds. So if the stock price stays above 1$ for most of this year, they are pretty much set to fund themselves to commercial production without needing additional raises or government grants.

I wrote that before they raised another C$12.5 million, now at $1.1 shareprice with warrants with an exercise price of $1.5. I don’t really mind it; the market is throwing money at them, and they are still basically pre-revenue. They are taking advantage of it to move to the next stage.

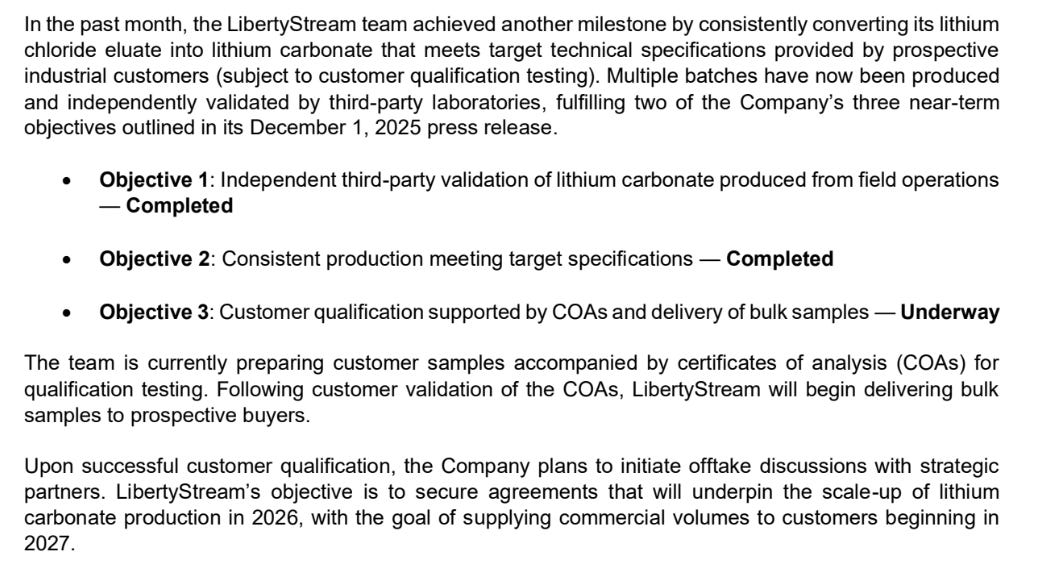

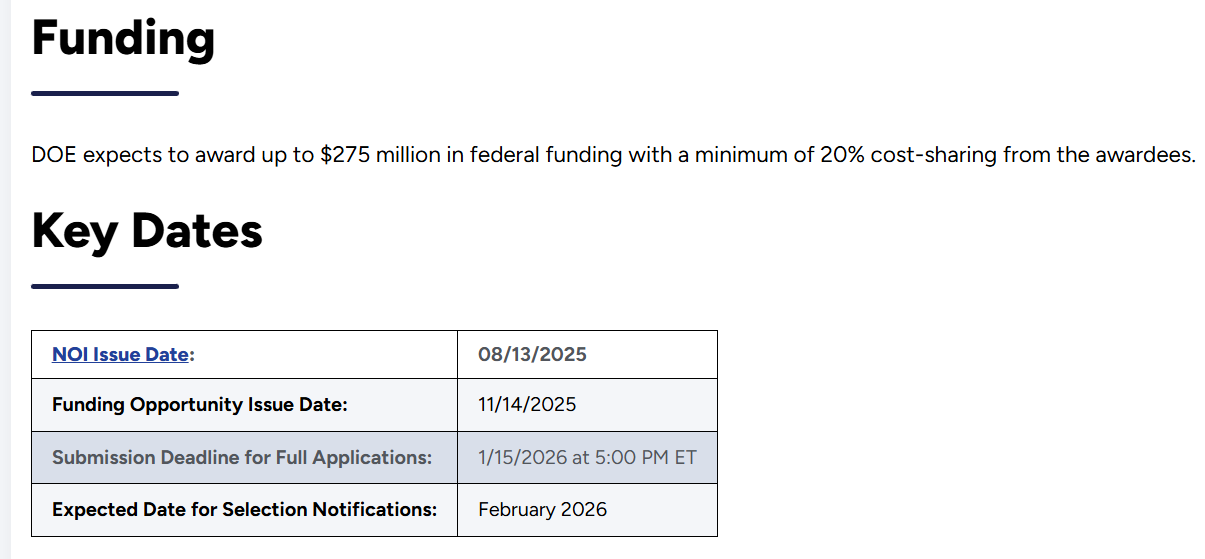

Back to the topic of grants, Libertystream might receive a Department of Energy(DOE) grant in early 26, which is the potential moonshot scenario for the stock. The bull case works well without it, but this would accelerate everything. This is the biggest near-term catalyst.

DOE will award up to $275 million, and we should know whether LibertyStream got any of it in February

Source: https://www.energy.gov/hgeo/funding-notice-mines-metals-capacity-expansion-piloting-product-critical-minerals-and

Reading the full document from DOE of the Notice of Funding Opportunity(NOFO) sounds very promising, as they are basically describing what Libertystream is doing:

This NOFO invests in American industrial facilities that have the potential to produce valuable critical materials from existing industrial processes and legacy waste streams[Libertystream produces lithium from oil production wastewater]. Industries such as mining and mineral processing, power generation, coal, oil and gas, specialty metals, and basic materials have the potential to recover valuable materials that will address many of America’s most severe mineral vulnerabilities. The goal of this NOFO is to increase domestic critical material production.

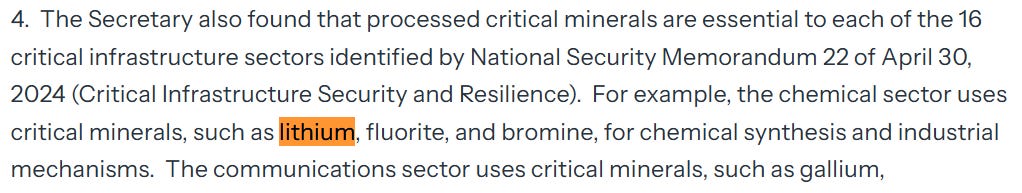

LibertyStream produces lithium, which DOE considers a critical mineral, from oil production waste stream. And Lithium is a mineral vulnerability for America, as China is the dominant Lithium refiner in the world, and America’s capacity is insignificant.

“The goal of the planned NOFO is to facilitate the development of large pilot-scale facilities to recover domestic critical minerals and materials (CMM), including rare earth elements (REE), graphite, and other value-added products from operating industrial facilities. Example industries with byproduct production potential include: phosphate, fertilizer, oil and gas, smelting, mining, waste management. Goal-related resources will be eligible in this program.”

Source for these quotes: Link

LibertyStream is building large-scale pilot facilities to do exactly what they describe in the NOFO. So I would say they have a strong case to get a DOE grant. Of course, it’s not for certain, and I would expect the stock to go down if they don’t get it at least in the short term, as it’s going to be the market’s number 1 focus in the near term. Strengthening the case further, on January 14th, the White House released a proclamation treating critical minerals such as lithium as a national security issue:

Source: https://www.whitehouse.gov/presidential-actions/2026/01/adjusting-imports-of-processed-critical-minerals-and-their-derivative-products-into-the-united-states/

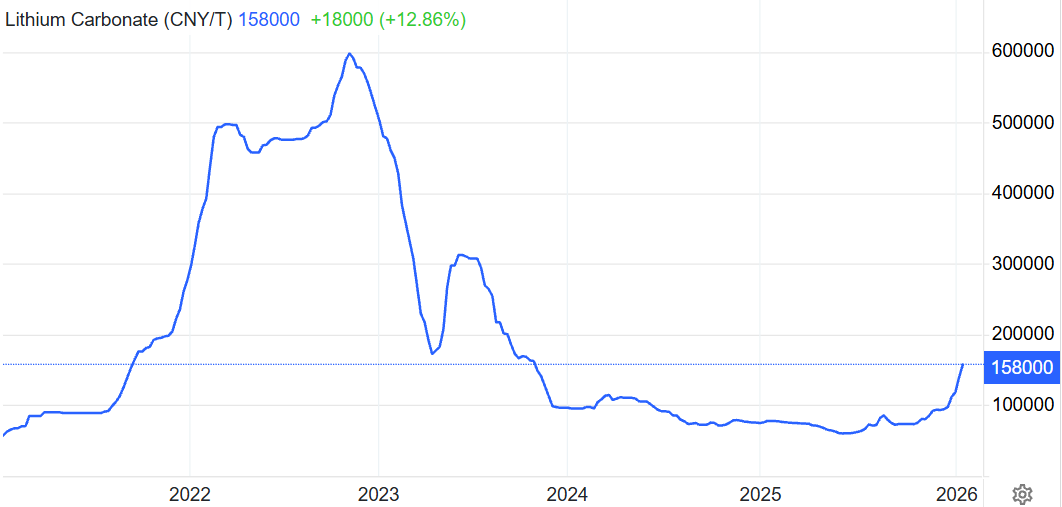

Another favourable development is the rebound in lithium prices, which is not particularly relevant for Liberty from a revenue perspective at the moment, as they are not producing on a material scale yet, but it’s good for sentiment and for any long-term contract negotiations as they get closer to commercial production.

Source: Trading Economics

Western Gold Resources CB = A$0.115 Return +109%

Source: Google

If you’re wondering why the stock was up 17% today without news, it was because this stock was extremely underfollowed, and a first big Fintwit account with 43k followers just posted about it.

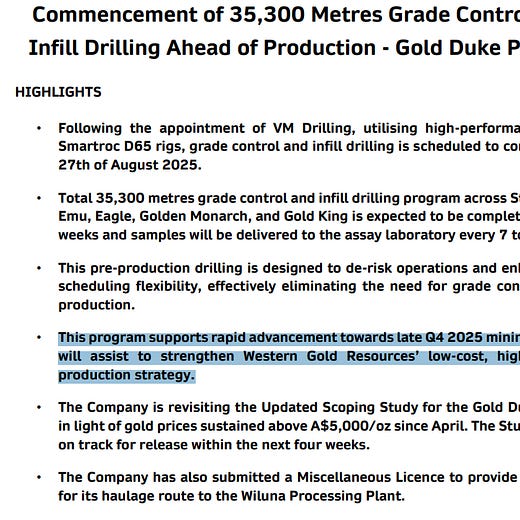

I found Western Gold Resources at 11 cents, and I saw it as the ultimate laggard of the gold bull run that would catch up violently once it got to production. First small position, but then added to it and then the stock went up, so now it’s a decent-sized position. A low-risk, low-capex, fast-payoff gold project in Western Australia that, once in production, will print more than its market cap annually, ready to be put in production unhedged to take advantage of the high gold price.

They are doing it, but are delayed from their original schedule, of course.

Oct 7th raised $6.75, which fully funds them to production

Dec 24th Decision to mine, mobilisation starting Q1

Dec 29th completed grade control drilling and updated mineral resource estimate from 214k to 277k using the same cut-off grade.

So we should see revenue in Q2 or Q3, depending on how fast they can move things along.

Market cap= A$68 million

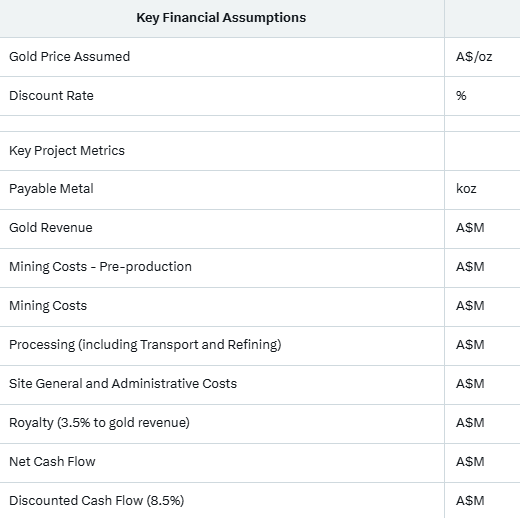

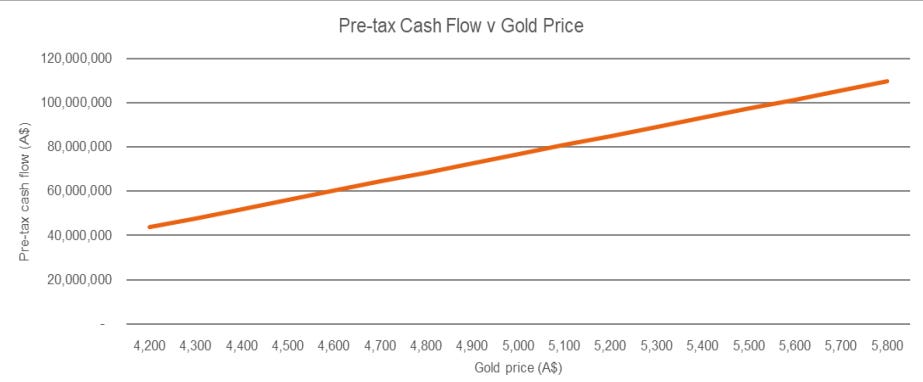

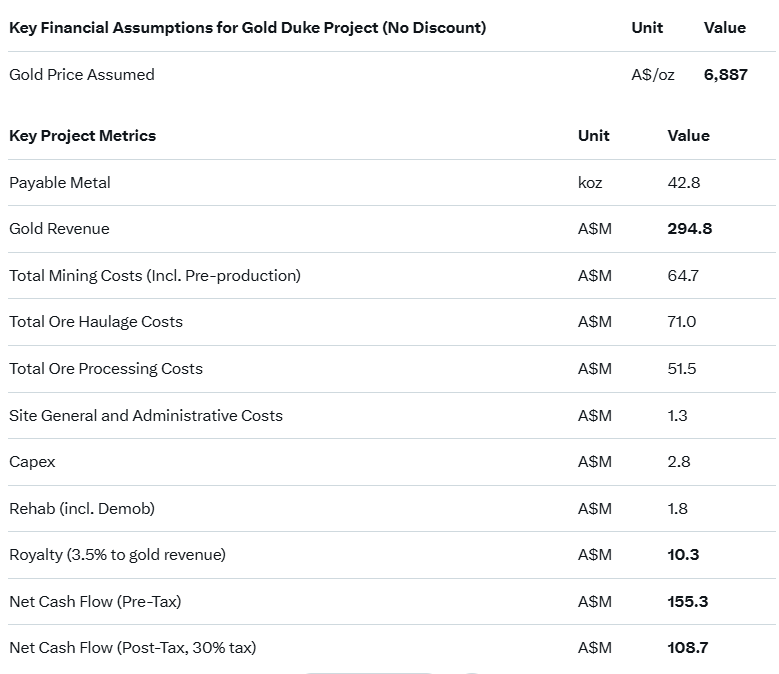

Pre-tax Cash flow in the first 14 months (stage 1). Take 30% off to get post-tax. Current gold price is A$6887.

Source: https://wcsecure.weblink.com.au/pdf/WGR/02997936.pdf

Take 30% off to get post-tax. Here is the calculation using the current gold price based on the company’s scoping study.

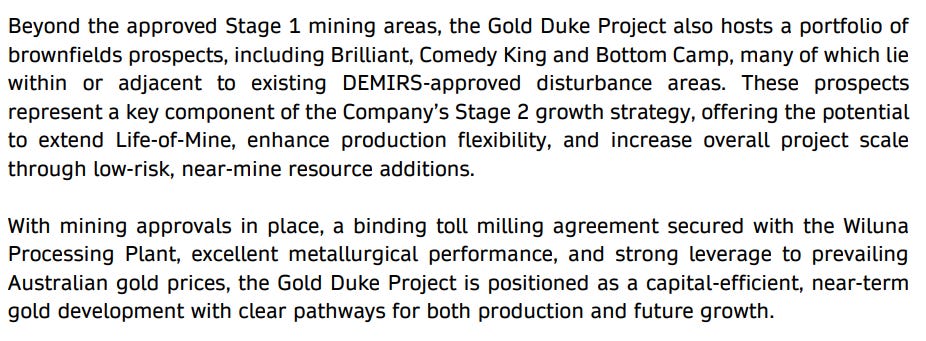

Based on forward P/E or EV/FCF, I haven’t seen a cheaper gold miner, and it’s operating in a tier 1 jurisdiction. The LOM is the main concern. Phase 1 includes 42.8k ounces(LOM of 14 months); the estimated resource is 277k ounces, and they will be working on increasing that, once they are cashed up from stage 1:

Source: https://wcsecure.weblink.com.au/pdf/WGR/03041954.pdf

Assuming the company successfully brings this project to production and increases the LOM, it should significantly re-rate with gold trading anywhere above $3000. Given the upside, the development risk is quite low, a tier 1 jurisdiction, open pit, near surface, fully financed, permitted, binding milling agreement and selected mining contractor.

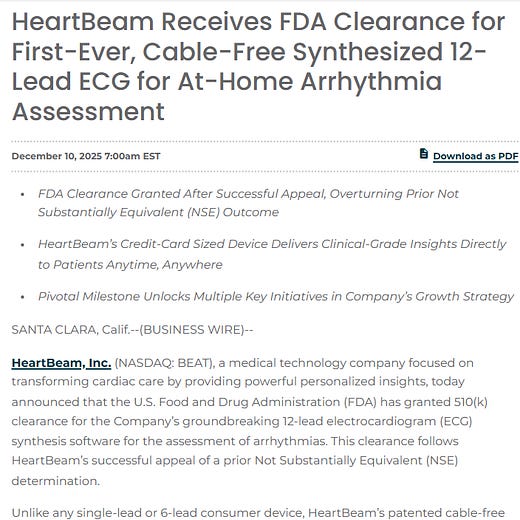

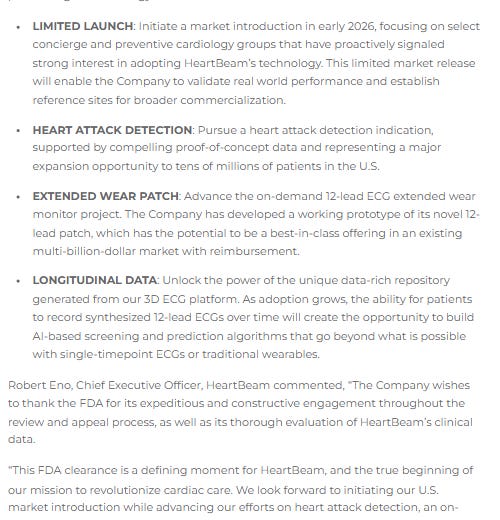

Heartbeam 2nd round CB= US$1.31 return +61%

Closed position on 21.11.2025 Heartbeam 1st round -60%

I first bought Heartbeam last March at 2.16$. Released a write-up about it. And waited for the FDA approval. Then they got a negative letter from the FDA, which could have resulted in significant delays or never getting the FDA approval, so I sold it immediately at 80 cents, which was -60% from my cost basis at the time. I don’t disagree with that sale. Based on the information that was available at the time, I think it was the right move. Then they unexpectedly had the issues with the FDA resolved quite quickly, and I jumped right back in at 1.31$ with a larger position than I sold because the stock was cheaper that day than it was pre-FDA approval, which was ridiculous.

Source: Google

The price action has been wild. First, the stock went up a lot with Massive volume. This sub-100 m market cap stock was the highest-volume stock on Nasdaq for 2-3 days, then it dipped seemingly due to profit-taking and heavy short selling, and now it’s hovering around $2-2.5. The company has not released any news since the FDA approval, and everyone knows they need to raise money.

Source: https://finviz.com/quote.ashx?t=BEAT&ty=si&p=d

What we are experiencing is a vicious and outright evil short-seller attack. Heartbeam’s product will save lives, and these short sellers are trying to drive the price down, which makes it harder and less attractive for Heartbeam to raise a lot of money, which slows down their commercialisation, hence slowing down the distribution of these life-saving devices. Following that logic, shorting this stock is kind of like being a serial killer and just as serial killing is illegal, shorting this particular stock should be illegal.

Now, Heartbeam is ready to commercialise the only 12-lead equivalent, FDA-approved, cable-free ECG device. Pressing matter is the funding. The company had a low cash level at the end of Q3. They have most likely used their ATM to raise money, but I expect a larger raise with MDB capital at some point.

Valeura Energy CB = CA$3,94 Return +117%

Source: Google

Valeura Energy was my biggest position going into 2025, and the stock is pretty much trading at the same price now. Now it’s down here as I have gradually sold shares to buy other stocks, most recently last Friday, to buy the Hydreight/VST dip. The stock’s performance has not been that bad, considering the falling oil prices and Thailand's ongoing conflict with its neighbour.

I don’t have much to complain about with Valeura’s execution. The production is ending the year strong. They got the tax restructuring done. Strong reserve and resource growth. The gas project in Turkey is finally progressing. Wassana redevelopment started. Entered into a JV with the Thai national oil company that seems to have very favourable terms for Valeura. I would have liked to see more deployment of cash to acquisitions and buybacks, but that’s all I can complain about. As the biggest negative factor for the stock, the weak oil price, is out of their control.

Valeura has a strong track record of acquisitions, and the company is now well positioned to pursue them, with net cash of US$304.7 million and no debt, compared to a market cap of US$643 million, and cash flow remaining strong even at current oil prices.

Valeura is cheap, and the company has a good track record for capital allocation and operational performance. The problem is that it’s just an E&P at the end of the day; it doesn’t have the same potential as the other picks like Hydreight, Heartbeam or Aduro. I guess another transformational deal is always possible, but it’s not going to provide the same upside as when the company had 90% lower valuation, and I don’t think deals as good as the Mubabdalalada Energy deal present themselves often, no matter how good the management is at finding them. I still like the stock, but it’s kind of a placeholder in my portfolio. That might be liquidated first when I find another Hydreight or Comstock, given the lack of multibaggernes at the current valuation.

Illumin CB = CA$1.64 Return -38%

Source: Google

I added recently, but it was mostly as a trade on a potential run-up caused by the end of tax loss selling and the resumption of buybacks, and both have happened, and the stock is not going up.

My Q3 earnings take: Link

Now the market cap is C$52.7 million, and I guess I still like the R/R from here.

The problem is. That is what I have been saying for a while, good r/r, great r/r. Margin of safety, etc. Well, it had a margin of safety, which was the net cash, and here we are around the margin of safety. I think the problem here is that I focused too much on valuation and the margin of safety, while having a weak bull case for the stock. This is the summary from my article Illumin Update: Amazing Set-Up:

It’s like AI written, and a summary can be like that to (be fair to the author), but the problem is: that was it. What you see in the summary was/is my investment thesis. There is no more to it. For example, I never had a clear idea or even pretended to have one of whether Illumin is actually superior to competitors. I don’t know if it is. The thesis was/is like a collection of features I like to see in an investment: Buybacks + low multiples + insider buying + margin of safety + new CEO with a track record = good investment. I think a thesis like this can work, but when it doesn’t, I’m left with a stock trading at near net cash, which I have trouble deciding what to do with. Also, all of those features I listed with Illumin are known to the market. It’s harder to get a crazy edge over the market with that type of thesis. More is needed.

I don’t think investing in Illumin was an unforgivable mistake. It’s a forgivable mistake. The reason I’m holding now is that the downside is quite low from this price. I don’t think it will trade below net cash, although that net cash has been steadily going down; the market cap being close to net cash offers resistance to broader market downturns, so I think Illumin is acting as a kind of cash alternative with upside. That is a nice cope I just made up to justify holding this, you have to admit. And due to the valuation and the sentiment, any good quarter could 2-3x the stock quickly, like after Q3 of 2024. And I don’t think the results have been that bad. They don’t need much improvement to turn the sentiment.

eXoZymes CB US$13.7 Return -16%

Source: Google

Am I supposed to update eXoZymes? I have barely mentioned the stock even though it has been in the portfolio since early 2025. 2 reasons for that: Nobody cares about Exozymes on Twitter. Tweeting about it is like talking to a brick wall. And the reason I haven’t written it up is that Slack capital is the guy who knows all about eXoZymes, so I have directed people to his quintessential write-up when they ask about it:

And this is the quintessential update:

Everything I say now assumes you know the thesis. Post-IPO, eXoZymes hasn’t had any negative news, but it underperformed investor expectations in 2025, which led to weak stock price performance. The company has talked about landing a significant partnership/JV that hasn’t materialised. They also rebranded from Invizyne to eXoZymes. I get the name change, but overall, I think the rebranding has been a failure. The new website sucks. Looks very cheap and amateurish. I think I could make that, and I’ve only made 1 website for a school project. And why is the new visual style so black? And the nighttime urban backgrounds. The company should evoke green and nature combined with labs and science. It should be green, blue and white. Which is what they had before. Someone needs to get fired. Look at these, and think whether you want to join the dark dystopic Biomanufacturing revolution

Source: file:///C:/Users/jobsd/Downloads/(v3.8)%20EXOZ-pitch%20Oct-2025.pdf

Oh, it’s horrible. The new videos are also mediocre. They should copy Aduro. Walk around and show off the facilities, have a scientist holding a jar of something, etc. And while the company uses AI, the way eXoZymes constantly mentions it like a buzzword, combined with the other problems with the style and the website, raises red flags for many new investors, especially when the company is a microcap. So, combined with the weak rebranding and no JV news, tax-loss selling, the expectation of a raise in the 1st half of 26, and the stock having a tight ownership structure and low volume, I understand why the stock price is where it is.

On the positive note, while the thesis is progressing more slowly than expected, it is progressing. They got a $300k grant from the National Institute of Health in April. $3 million grant from the U.S. National Science Foundation in June. Launched NCT-X subsidiary with a goal of commercialising a product with massive potential to market, only economically possible with their tech, and are in the process of successfully proving they can scale production, with a goal of commercialisation in 2027.

VanityFair Germany article about eXoZymes’s breakthrough with NCT: Link

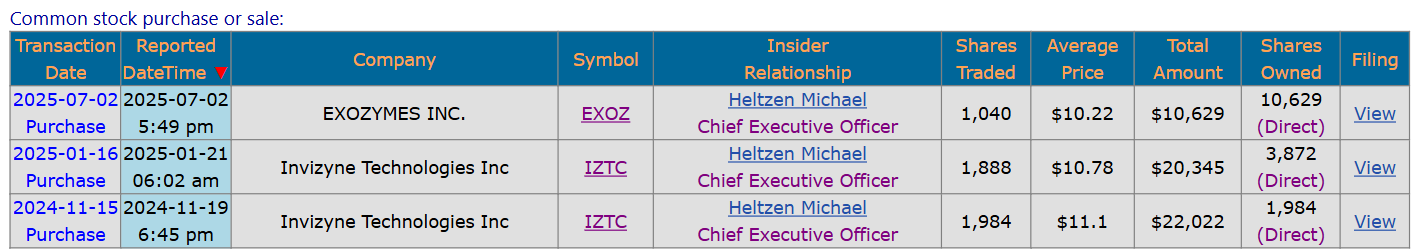

I sold a third of the position around 13-16$ to buy other stocks in the autumn, but recently the stock went below 10$ so I added some, and the CEO also likes to buy at around $10-11.

Source: https://www.secform4.com/insider-trading/2010788.htm

Among the stocks in my portfolio, eXoZymes could have the most long-term potential. So I want to have some shares. But how long it takes them to get momentum is another question. The path to multibagging is less clear than for most of my other positions. So I don’t want to tie too much capital in here.

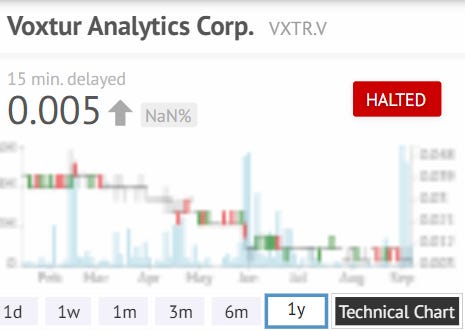

Voxtur Analytics CB= C$0.11 return -99-100%

Source: ceo.ca

Stock is halted, and the company is in restructuring. Last traded price on the over-the-counter market was $0.0001, according to Seeking Alpha.

My worst investment in 2025 and my worst investment ever.

I started the year out bullish on Voxtur. Imagine that. Now, looking back, it was always a very flawed, or at least very risky, investment thesis, but at least there was an investment thesis at the start of the year. However, I was clinically insane for not selling after the Q1 results and after the Bluewater and Anow lawsuits. Unforgivable mistake. The proceeds would have been small, but that’s better than nothing. I say clinically insane, because I kind of knew selling was objectively the right decision; the logical part of my brain was telling me to sell, but I still held. The sunk cost fallacy was exceptionally powerful after holding for many years, probably hundreds of hours of DD, making all those posts, a write-up and many interviews, etc. Getting too involved like that can be dangerous. Psychologically harder to sell the stock when it needs to be done.

The investment thesis at the start of the year was basically that they are going to monetise one or several of their assets to deal with the debt, dramatically cut costs and then grow with their new offerings they were hyping up such as Voxtur Verify and Voxtur Rate Advisor, but when 2 of their most valuable assets Bluewater and Anow got entangled with lawsuits and we could read the contents of the lawsuits, the chances of success for this turnaround plan became very slim.

Voxtur’s lender, Bank of Montreal, sold Voxtur Debt to Hale Capital. The company hasn’t released financials since Q1, and it’s in financial restructuring. The stock is halted. Some businesses appear to have been sold, as they no longer show up on the company’s website. The result of the restructuring I expect will be a complete wipeout of existing shareholders, or effectively a wipeout, where maybe the existing shareholders will own some small piece of the restructured Voxtur. I think a complete wipeout is more likely at this point. I don’t follow the situation that closely, as it’s not actionable anyway. The position is technically not closed, but effectively, I would put it as -99-100% loss.

I’ve thought about making a long video or article about the whole timeline and all the lessons I learned from this disaster. It’s not a relevant topic at the moment, given the company’s situation, but I might make that video or article someday. One good thing about going through the insane rollercoaster of investing in Voxtur is that I learned a lot and became a better investor :)

Closed Positions in 2025, date of closing and return of each

The percentage return, for simplicity, is the gain or loss from the cost basis when the position was closed, with dividends added if any were received.

The list is ordered by the amount of money made or lost(not %). With the Biggest gains or losses first and the smallest last:

Position closed on 19.2.2025 Mind Technologies +186%

This was a big position. Late 2024, Mind cleaned up its cap structure by converting the preferred shares to common, but the stock had no interest or momentum at the time, and then in December, they released a strong quarter with a bullish outlook on the earnings call. This fueled a sentiment shift, and the stock ran, and I decided to sell. I closed this position at 10.68$. The stock peaked at $14.29 and is now at $10.66.

I have been following the stock loosely, and based on what I see with their results and valuation, I have no interest in buying back in. I’m surprised how well the stock price is holding up. Even looking back at my old investment thesis, it wasn’t that great. Although the stock was set up for a run-up after the preferred conversion, it was pretty lucky for me that the strong quarter caused such a big run-up.

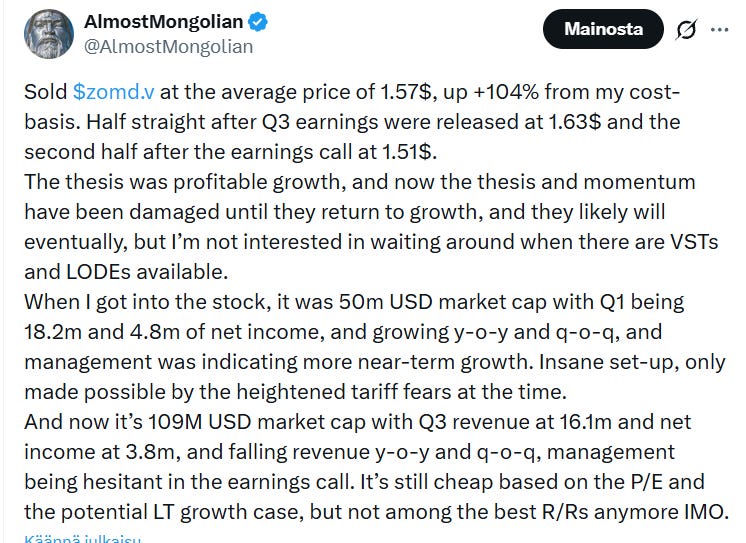

28.11.2025 Zoomd Technologies +104%

Source: Google

While Zoomd was a nice gain, it was a bit bittersweet because it was up more than 3x from my cost basis in October, but then they released a bad quarter in late November, and I ran for the door. Getting out with a double.

source

I don’t have much to add to this. Zoomd was a simple thesis; they started turning around in 2024, growing and increasing earnings every quarter, then Q3 broke that trend.

While I sold the stock based on the information available at the time, Zoomd was an insane R/R during the tariff battle. I regret not buying a larger position in May when I first found this stock; based on Q1 2025 results, it traded at around 2.5x PE and was growing 100% a year. This valuation was only possible during a time of uncertainty. But my bull case outside the numbers and the valuation wasn’t that in-depth; I didn’t have any insights that the broad investor base didn’t, and the stock was a known quantity. So when they posted results that no longer aligned with the thesis, I was out.

21.5.2025 Globex Mining Enterprises +77%

Source: Google

Globex has kept going up after I sold, but in the context of the surging gold price, Globex underperformed its peers. They have many minerals in their portfolio, but gold is their number 1 by a wide margin, and take almost any gold stock with a similar market cap and compare the performance in 2025. I bought the Cerrado Gold position at 63 cents with the Globex proceeds, which has also outperformed Globex.

Everyone involved in the stock knows the positives, which, combined, present a good story; I’ve covered it many times. The business model is nice, and there is a lot of hidden value, intrinsic value or whatever value investing term we like to use for coping, when the value keeps hiding for years and years. The problem with Globex is that there is no clear path to a significant return in the near or medium term. Maybe Ironwood, but it has been moving way slower than shareholders initially expected, and I wouldn’t bet on them fast-tracking it. Given the management’s style of taking pride in being very, very patient. The stock is up because of the gold price surge, and many other names offer more upside to capitalise on it. I think it’s kind of a value trap, one of my favourite value traps, but still a value trap.

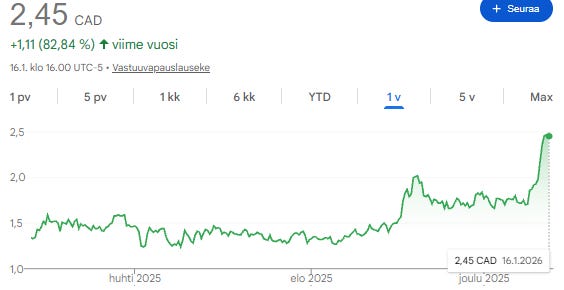

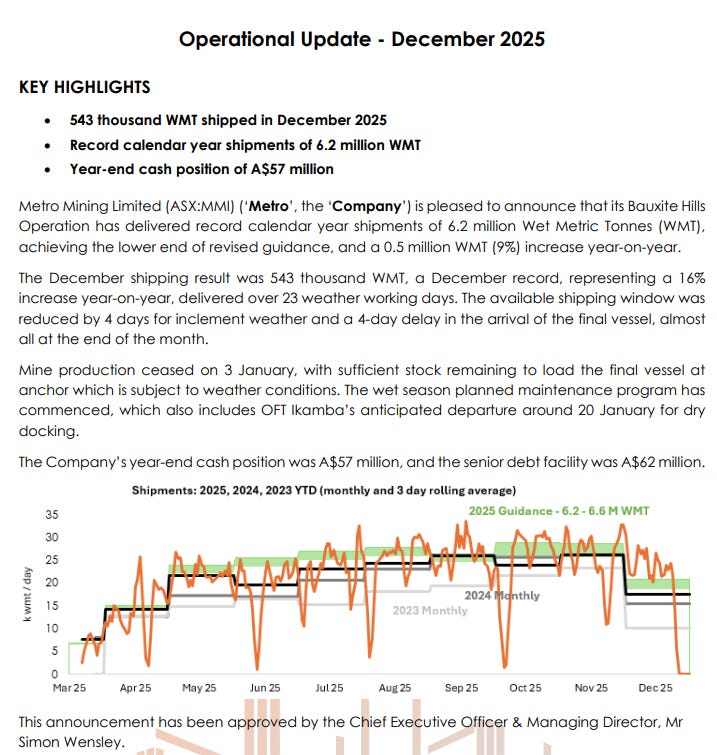

4.2.2025 Metro Mining +52%

Source: Google

I don’t have much to say about Metro. I have no interest in re-entering right now. I’m surprised by how well the stock has held up, given that the bauxite price has fallen significantly since I sold, and they reached only their lower range of the guidance. But I guess, with a low valuation, not much is needed for the stock to go up.

Source: https://wcsecure.weblink.com.au/pdf/MMI/03008836.pdf

3.9.2025 Beacon Minerals +80%

Source: Google

Beacon has kept going up, but I’m not so sad about that as I used Beacon proceeds to buy Western Gold resources, which outperformed Beacon since then. Although Beacon is catching up lately, it is also less risky. I didn’t think change my mind about Beacon, I like the stock, but I found a new gold stock that I liked more, and to add that position, I needed to sell existing gold positions, or else my portfolio would have been too exposed to the unpredictable gold price, which, to my luck, has kept surging, but I didn’t know that was going to happen. How could I have known that?

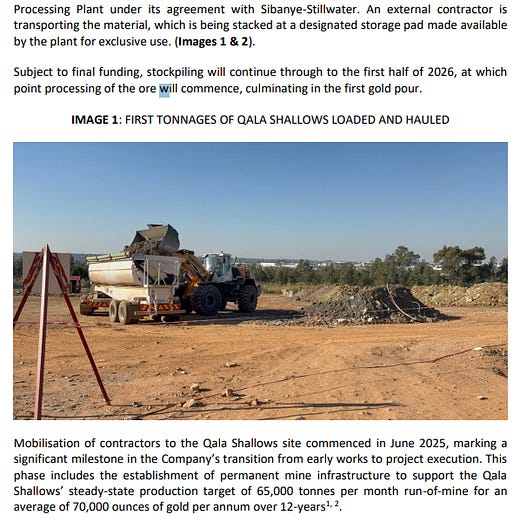

20.11.2025 West Wits +41%

My West Wits timeline:

Source: Google

West Wits has continued to rise since I sold, which is infuriating. I’m very angry about it. I like it when after I sell everything crashes and burns, so I can imagine that I was the glue holding everything together, but it was not the case with West Wits, not yet atleast.

While I’m angry about West Wits's success, I think my decision to sell it and rotate to other positions, Comstock in this case, made sense. So I don’t consider selling it a mistake. But I’m not surprised by the performance. I think it’s a strong investment thesis.

20.5.2025 Smith Micro Software -54%

It hurts to even think about this stock. Not because it was a huge loss, it wasn’t because it was a small position, but just the sheer amount of mistakes, both unforgivable and forgivable, was unforgivable. This was a terrible investment thesis in 2022-2023. But I can kind of forgive myself for investing a small position, as I was such an amateur at the time. I was also trusting too much in someone else's DD while not really doing my research before 2024. I followed and still sometimes follow this guy, Mark Gomes, and he is a smart investor with a strong track record, but nobody has a 100% win rate, so that’s a case of authority bias. Very common with newer investors who don’t know anything, and I fell into that category heavily when I came across this stock.

And in late 2024, the stock had fallen a lot. I was left with a very small position, and I bought more at 68 cents and wrote this write-up explaining why in December 2024.

Then, in early 2025, the market gave me a massive gift. The stock started running up in anticipation of their new product rollout with Orange Spain. Investors were posting the ads Orange was running, etc. I looked at the app downloads, and they were low. Investors weren’t talking about that. The stock still ran to $1.75. I thought now I could get out of this disaster of an investment at almost break even during this hype that wasn’t being reflected in the downloads, but I started thinking it’s going to run to 2$ on momentum. “I want to sell it at a profit. If they ramp up with Orange fast, I’ll look stupid for selling. I just wrote a massive write-up about the company.” All these idiotic rationalisations for not selling when R/R was weak. FOMO combined with the sunk cost fallacy. Makes me furious just thinking about it. Then I waited for the stock to get back to $1.5 to sell it, even though the argument for why it would get back there was weak. Anchoring bias. Latching on to some arbitrary past price.

Eventually, I came to my senses and sold it at 87 cents, and the stock price has continued to decline since to 59 cents now.

The situation with the company currently is a total Deja vu from 2024. The company is forced to raise money in autumn, and the CEO participates with a large amount to bolster investor confidence. The company projects profitability next year, driven by new opportunities. Just like in 2024. Maybe they really do it in 2026, but I’m not interested in betting on it, given their track record and the availability of other opportunities with a way better bull case.

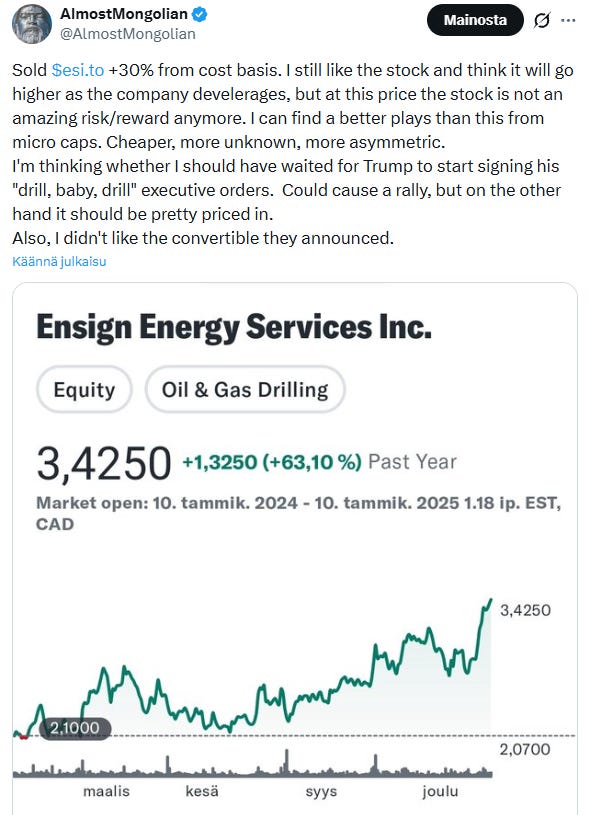

10.1.2025 Ensign Energy Services +30%

Source: Google

I have very little interest in Ensign anymore. The story is solid with the paying back debt, etc, but I have increasingly shifted my focus to higher impact opportunities. This was another relic from the past, still collecting dust in my portfolio that I got rid of at a very opportune time. The stock was rising in anticipation of the Trump administration's more favourable policy approach towards drilling, but ultimately, larger forces at play have caused drilling to continue declining.

Pancontinental 1st round closed 12.5.2025 return +100%

Pancontinental 2nd round closed 19.1.2026 return +50%

Earlier this year, I made a quick double on this stock from 0.007$ to 0.014$. Then I re-entered in October. This is a tiny position because I had one limit order at 0.008$, and it didn’t even fill fully, and didn’t go back to that price.

The stock is mostly moving on sentiment about the farmout. I like the asset; they have cash to last for a while, and I think the farmout is inevitable, but it could take a long time. When the stock gets to A$0,006-0,008, I see it as too asymmetric, and I tend to go long. I have PEL 87 exposure from the Sintana position, which is why I’m not too committed to this stock. I may sell it(trying to sell it now) at the current price. I sold it.

8.9.2025 Eco Atlantic Oil and Gas -27.5%

Selling Eco Atlantic in September was not a mistake. I should have done it sooner.

But not buying back in on 5.12.2025 was an unforgivable mistake. That was a day of unique risk/reward, similar to heartbeam just after the FDA permit. Eco Atlantic revealed a deal with Navitas Petroleum with all kinds of good stuff, and just like with the Heartbeam, immediately after a crucial catalyst happens, the market likely doesn’t price it in immediately, so the people who understand the impact have a special opportunity to take advantage of that moment when the broader market is still digesting news and figuring out the impact. So the stock went up by +20% right after they released the news, and that was the moment to get in. Eco at 19 cents post-Navitas deal was a special situation served to me on a silver platter. For one day, amazing risk/reward, but I was hesitating and doing other things that day, and I didn’t even properly analyse the deal, so I missed that opportunity, and the stock ran up to 52 cents now, which I don’t see as that attractive price anymore when comparing to Sintana at its current price, for example.

I can’t believe that such a recent iteration of AlmostMongolian is still committing unforgivable mistakes, but in 2026, that problem will be fixed. You will not see the term “unforgivable mistake” in the 2026 recap.

3.4.2025 $MER.TO Meren Energy(formerly Africa Oil) 2nd round +6%

This was the second round; the first round was closed in September of 2024 at -19% loss. So Africa Oil in total has been a loss, but mostly an opportunity cost, as I had held it for years with a prominent place in my portfolio.

Holding Africa Oil at such a high esteem as an investment opportunity for so long was an unforgivable misjudgement/mistake. Possibly forgivable after enough time has passed. Although I think holding the stock in 2025 is a forgivable mistake, given that I did have the sense to sell it to buy Hydreight stock, and the stock was cheap, etc.

It’s another value trappish stock. Many assets(unfocused), low multiples, past failed ventures, although it pays a big dividend, which makes the wait for the ever-elusive rerating more bearable. If I were running a dividend-focused portfolio, this would be included, but I’m increasingly getting more interested in these “multi-baggers”.

2025 unforgivable mistake counter: 4

I have a write-up on every stock covered in this article, except eXoZymes. Some are fully free, and some are partly free. Can be found in the archive: Link

Lessons from 2025

When the time comes, don’t hesitate to sell everything or to load up. This lesson is mostly about trusting my own judgment more and not being attached to individual stocks. Being attached to individual stocks makes it hard to sell when it needs to be done to avoid further loss, and to sell just because you need the money to load up on some new opportunity. Knowing when the time comes is just about developing one's own judgment through experience, due diligence, etc, but trusting that judgment more to make decisive moves was my lesson from 2025. You can develop good judgment, but if you don’t act on it, it doesn’t matter. Many times this year, I had the right read on the situation, but didn’t act on it at all or didn’t act with enough impact (didn’t buy enough, didn’t sell everything); examples are scattered throughout this article.

Stop focusing on the “margin of safety(MOS)”, as much. MOS is a popular value investing concept, and it makes sense; it’s a real thing, and in theory, one should focus on it. Investing is a game of probabilities, and it’s inevitable, no matter how good someone is at investing, that some of the picks won’t work out. But if one focuses on MOS and correctly judges the MOS of his investments, in theory, that reduces the downside for the picks that fail, while keeping the upside for the ones that do. Famous quote from Mohnish Pabrai about this: “Heads I win; Tails I don’t lose much” and he has been underperforming in recent years. I was a big MOS believer in early 2025 because it made sense. But in 2025, I started becoming a MOS doubter. Not that MOS isn’t real, of course it is. If a company has a 100m net cash and 150m market cap, no debt and is profitable, it is undeniable that it has a strong margin of safety. What has turned me against MOS: I started noticing that the people with the best performance just focus on having a solid upside thesis, and that among my investments, those were the best performing stocks, while stocks that had a margin of safety underperformed. What do I think are the reasons behind this? It’s not that MOS is inherently bad to have it’s that the companies where you can make a MOS arguments usually have problems and the existence of the MOS argument can distract from those problems: they are unfocused, the valuation is low and never without some reason, the MOS in question could be the theoretical liquiditation value of a collection of businesses(argument for Voxtur’s MOS), or maybe a portfolio of various liquid securities(Globex), and often MOS is used as a cope argument to justify an investment in a stock with a lacking upside thesis, which I have done many times.

There were more lessons from 2025 than these. Those will show up in my “work” in the future.

2026 Return Estimates

In 2026, I think all my positions are going to be winners, but accounting for unpredictable events happening and maybe even flaws in my research. There is likely going to be one or even two stocks that are currently in my portfolio that are imposters. They present themselves as winners, yet they are the opposite. And there will be at least one loiterer, meaning the stock that goes nowhere, like Valeura, was in 2025, and there will be one stock that is a mere double; it’s a bit disappointing, but I’ll take a double, and the rest will be multibaggers.

Using this information, I can create a mathematically accurate formula to estimate the 2026 returns of The AlmostMongolian Portfolio accurately.

I call it: The Mongolian Investing Returns Predictor Formula, TMIRPF for short

So I’m starting the year with 11 positions: I’m not counting Voxtur, cos it’s over, and I’m counting VST/NURS as one position.

The Loiterer 0%

Imposter #1 -50%

Imposter #2 -80%

A mere double +100%

Multibagger #1 +200%

Multibagger #2 +300%

Multibagger #3 +400%

Multibagger #4 +200%

Multibagger #5 +1000%

Multibagger #6 +300%

Multibagger #7 +700%

Now I just feed the TMIRPF into the Grok AI model to know my 2026 return:

The final result +279.1%. That will be my 2026 return.

Thoughtful examination of how margin-of-safety thinking can become a trap. The shift from defensive value investing to hunting asymmetric upside makes sense when operating in microcaps where the real edge comes from spotting catalysts before consensus. I've watched portfolios get stuck in perpetual 'safety' mode,holding undervalued mediocrity while missing moonsots. The observation that MOS often masks underlying business problems rather than protecting against them is spot on.

What a journey in 2025. And we need to repeat all over again in 2026!