Comstock Inc: Transformational 2026

Panels, fuels, batteries, silver...

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian AD: THE LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

LODE 0.00%↑ Comstock Inc. is a sort of small-cap conglomerate, a precious metals mining company that, in recent years, has pivoted to solar panel recycling, biofuels and battery recycling, while still owning a mining asset and a bunch of real estate. And while that description raises alarm bells for many investors, after doing my due diligence, it has become one of my favourite investment opportunities. It offers two main businesses, both of which have the potential to 10-100x the stock price in the coming years, and multiple non-core assets that the company is looking to monetise, with the monetisation value potentially exceeding the current market cap.

This is my longest write-up yet, and I did a lot of DD on it. As I kept researching Comstock, I kept trying to find out whether there was something seriously wrong with it that I was missing. I found some things that can be interpreted as red flags. There are many potential risks. But I found nothing to invalidate the core thesis. The valuation is cheap, if I may be so bold. It is a great risk/reward, if you don’t mind me saying so.

Basic Info

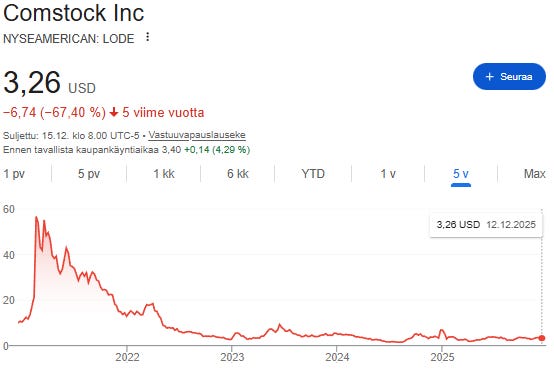

Source: Google

Market Cap = $167 million USD

Shares outstanding: 51,264,247

Warrants outstanding: 1,293,334

I started a position just about a month ago (My Announcement tweet). My current cost basis is $3.08, and it’s a top-5 position in The AlmostMongolian Portfolio. Shout out to Miguel Investing for telling me about this stock.

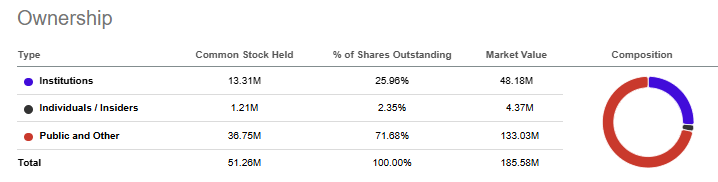

Source: Seeking Alpha Premium

In August, Comstock raised $31.8 million at $2.25 per share, with no warrants, to clean up its balance sheet and carry it to profitability. The raise also brought on over 30 new institutional investors.

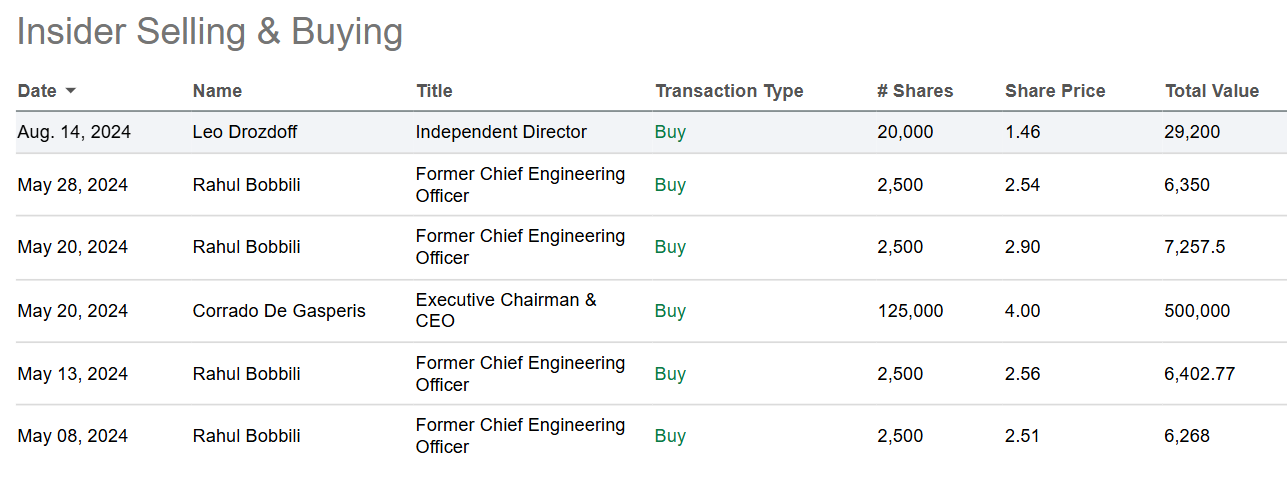

Insider ownership is quite low at 2.35%, though partly due to dilution from the aforementioned raise. It’s worth noting that the CEO bought $500k worth of shares last year at a 4$ share price, and there has been no reported insider selling for years.

Source. Seeking Alpha Premium

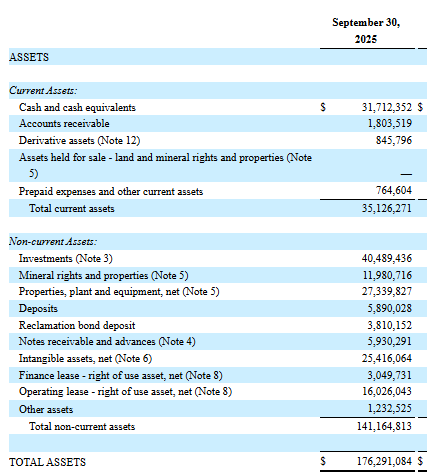

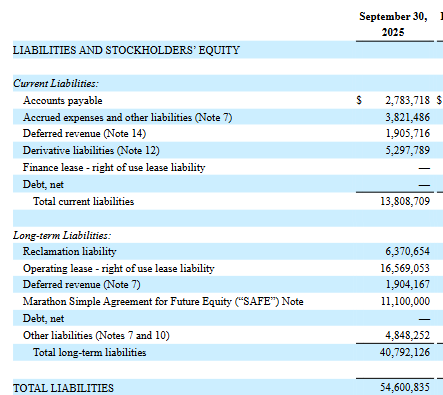

Balance sheet:

Source: https://seekingalpha.com/filing/14789564

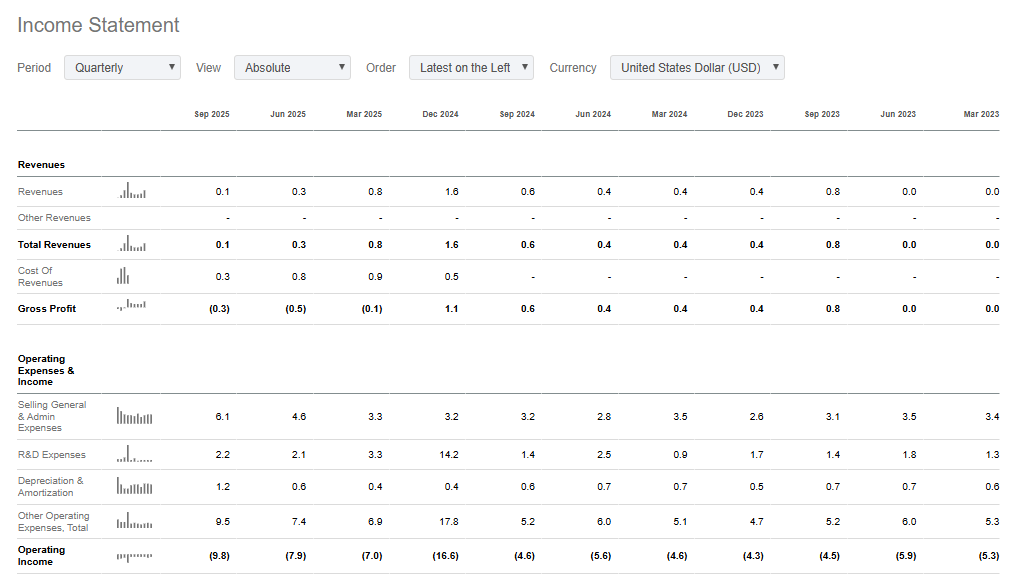

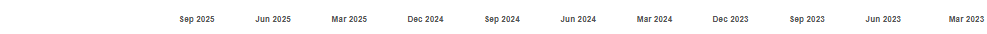

Source: Seeking Alpha

As you can see, they have been losing a lot of money in the past years, but that should change next year, and the balance sheet and cap structure are clean.

This write-up breaks the business down into 2 sections:

Comstock Metals is the core of the thesis and its path to near-term profitability, and will be covered first.

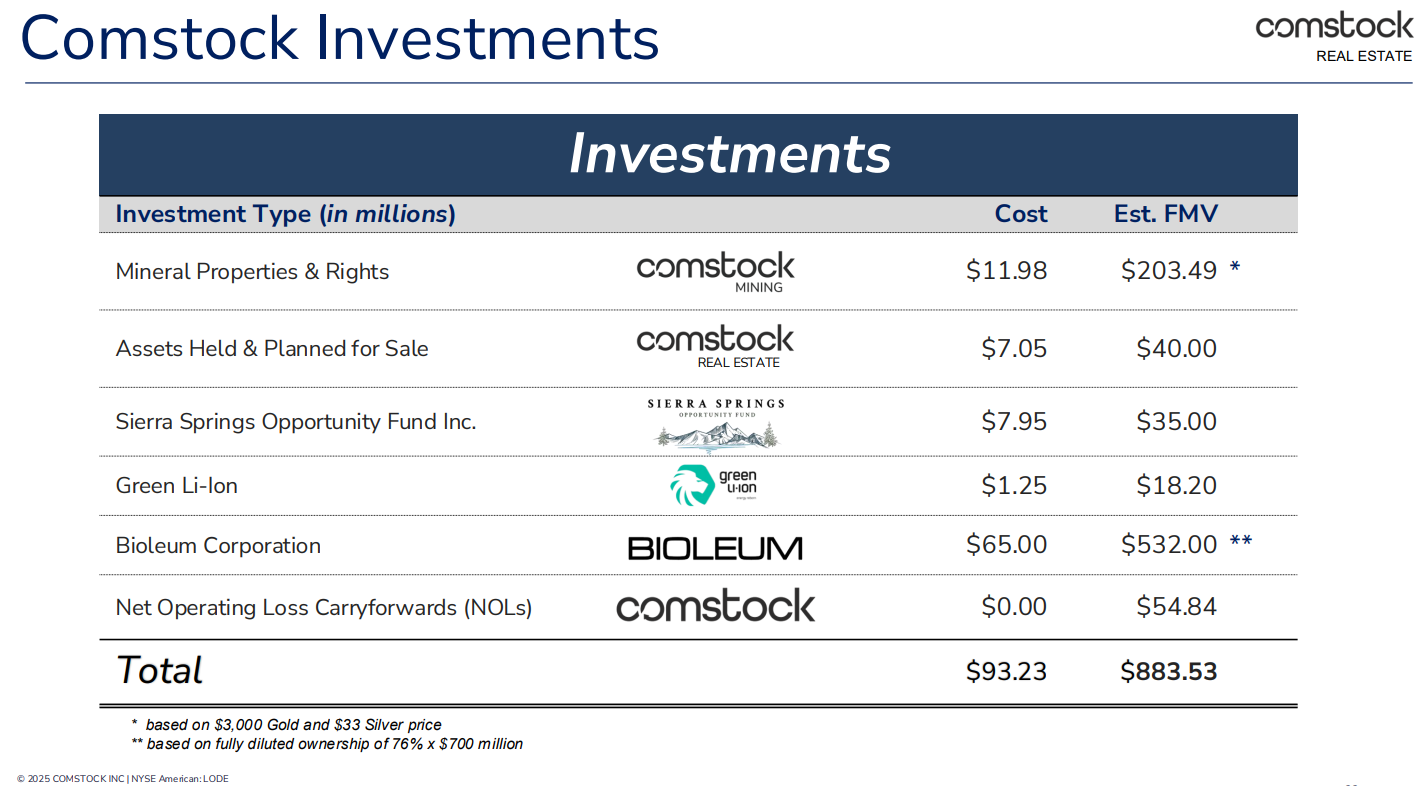

Comstock Investments comprises various assets, of which Bioleum is the most significant investment, arguably holding more potential than Metals and the rest being candidates for monetisation:

Source: https://comstock.inc/wp-content/uploads/2025/10/Comstock-Corporate-Overview_2025-10.pdf

Solar Panel Recycling Business: Comstock Metals

Solar panels typically have a lifespan of 25-30 years, and once they have expired, they are generally disposed of in landfills because they are extremely difficult to recycle using current prevailing methods. In the US, 90% of panels are landfilled, and 10% are recycled, with similar figures globally. Landfilling creates many environmental hazards, as toxic heavy metals contained in the panels dissolve and contaminate soil and groundwater. If you have been following debates over which energy source is best or worst in terms of efficiency and environmental impact, the difficulty of solar panel recycling and its consequences are among the biggest arguments against solar energy.

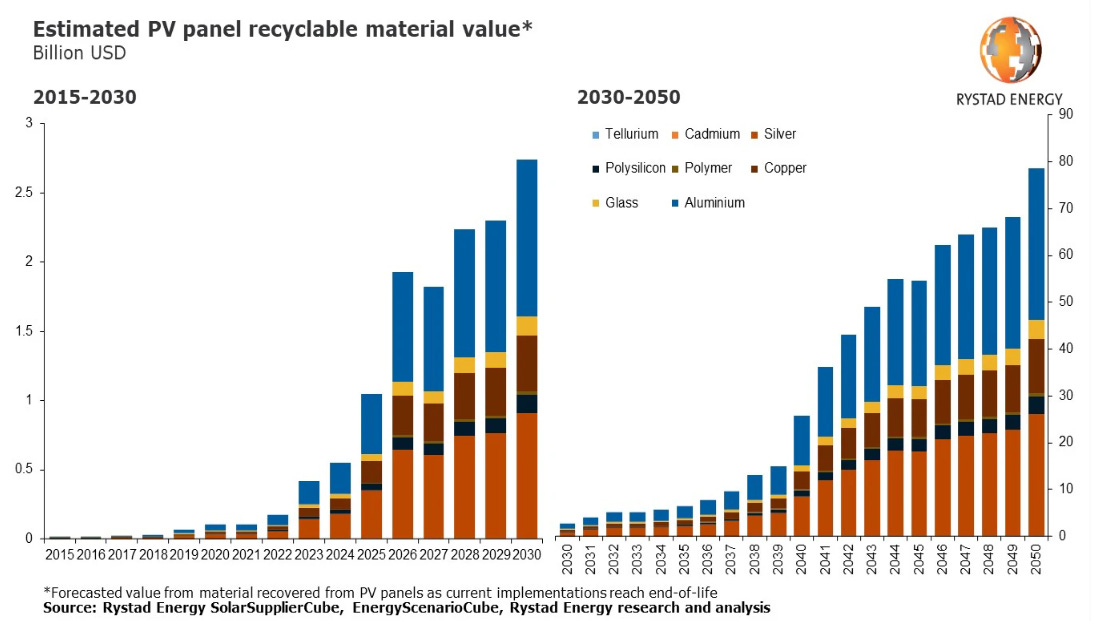

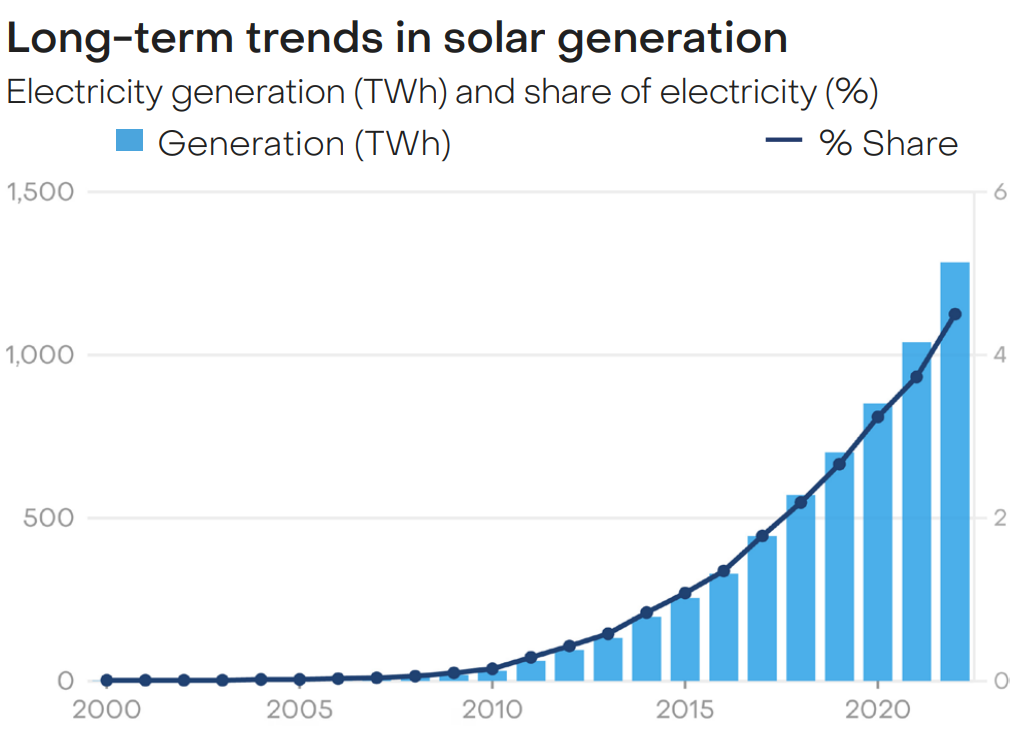

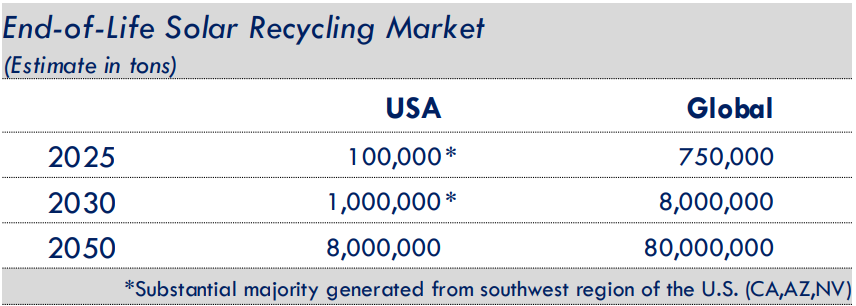

A huge number of solar panels are nearing the end of their lifespans in the coming years and decades, increasing the need for economically viable non-landfill recycling solutions.

Source: Rystad Energy

Solar panels have an average lifespan of 25-30 years, which means the panels being landfilled and recycled now are from the late 90s and early 20s, when solar energy was still relatively niche. After that, solar energy has experienced massive growth, and the world will face a tidal wave of expired solar panels that need to be disposed of in the coming decades.

Source: https://ember-energy.org/app/uploads/2024/11/Global-Electricity-Review-2023.pdf

The Rystad graph only shows the value from the recyclable materials, of which silver and aluminium are the biggest contributors, but the bigger share of the recycler’s revenue comes from the “tipping fee”, which is what the recycler gets just from taking the waste.

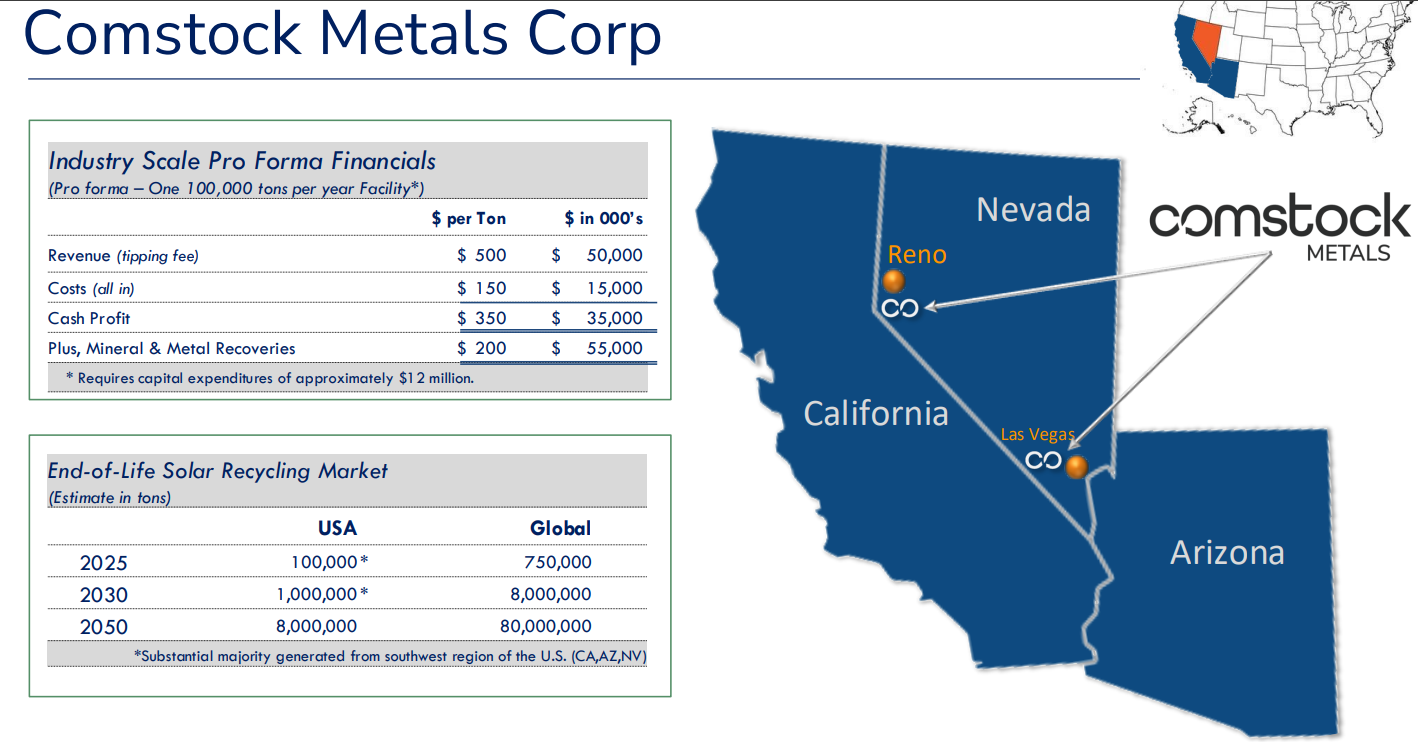

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

The economics Comstock presents for its solar business, if realised, are insane.

Based on Comstock’s pro forma calculations, a 100,000-ton-per-year facility requires only 12 million USD of CAPEX and would generate 55 million USD in annual profit.

100 000*500=50 000 000 tipping fee revenue

100 000*200=20 000 000 metals revenue (higher than this at current silver prices)

100 000*150=15 000 000 all in costs

=55 000 000 USD annual profit

And initially, the profits are going to be tax-free for Comstock due to the NOLs it has accumulated over the years.

And with profits from 1 year at full capacity, Comstock could fund CAPEX for multiple new 100k plants per year.

Comstock is commissioning its first 100k plant in Q1 of 2026, with ramp-up in Q2. From their recent raise, Comstock has cash to finance the first facility and to last until Q2, when they expect to reach profitability. If all goes to plan, of course.

Their goal is to have a 2nd 100k plant commissioned in Q1 of 2027. By 2028, they expect to have at least 3 plants up (annual profits of $165 million), and by 2030, potentially 7 (annual profits of $385 million). If they can execute on this, given it’s a high-growth business with a strong future outlook, the market cap would be in the billions.

So it really sounds amazing; they are in this hyper-growth niche with a massively profitable business model. And the current market cap is only $167 million with a clean cap structure and balance sheet. So obviously, the market is not pricing in that Comstock can actually execute this. And of course, it shouldn’t be priced fully, as a company can always project all kinds of futures without being accountable for delivering on them. We all know the disclaimer:

“…Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements…”

But in this case, the market is not giving them much credit at all, especially when you consider all the other assets Comstock also has(covered later).

So let’s see what’s going on with their technology, construction progress, partnerships, permitting, proof, certifications… maybe we can find a reason for this pessimism in the market.

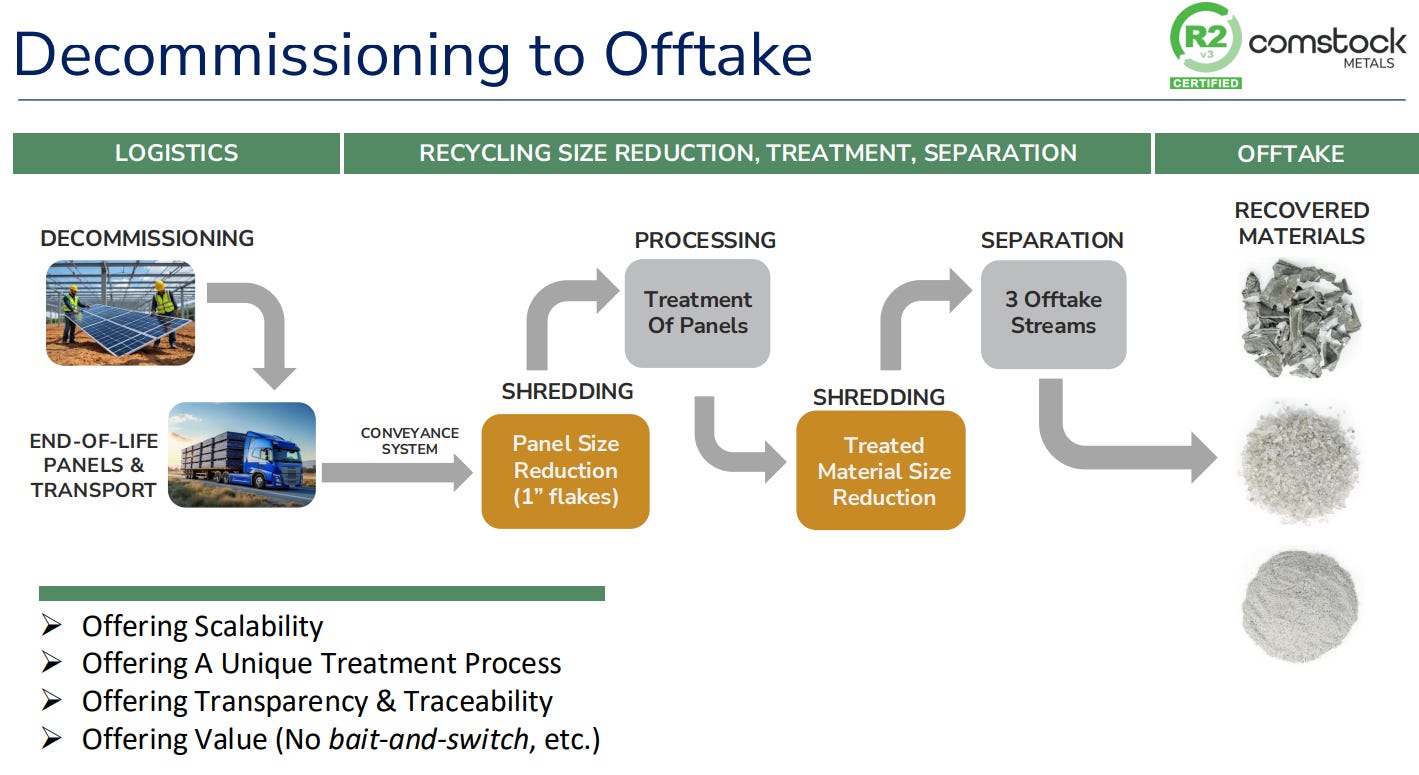

Comstock has a solar panel recycling technology that gets rid of 100% of the solar panel, recycling the valuable materials and incinerating the other stuff. The end products are aluminium flakes, glass pearls, and metal tailings.

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

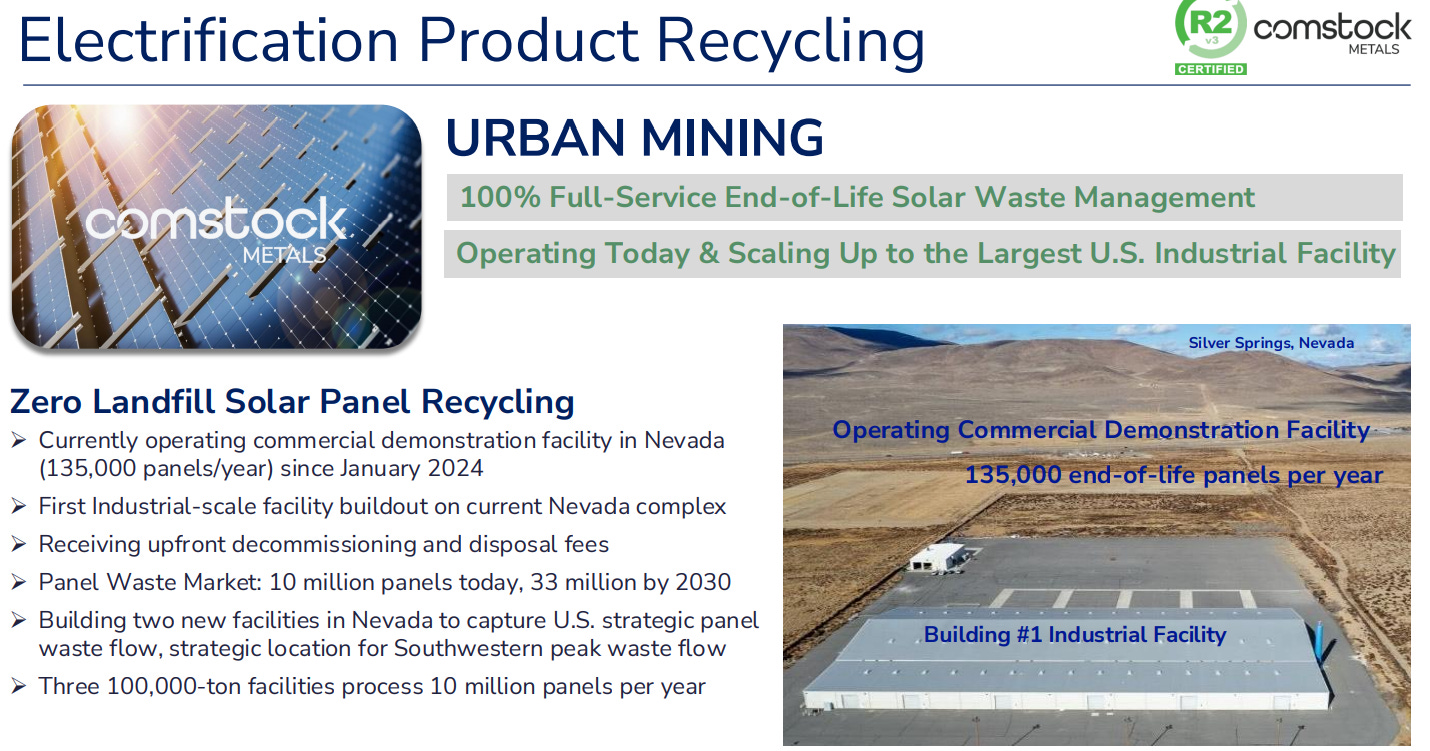

The slide above shows their 135k-panel-per-year demonstration-scale facility, which has already proved that the technology works as intended at that scale. And to not get panels and tonnes mixed up. Their large plant commissioning in Q1 is 100k tonnes per year, which is equivalent to 3 million panels per year.

From the metal tailing, silver is the highest revenue generator. “What was really a surprise is the grades of silver that were concentrating in the metal tailings. We would have been probably pleased with 15–20 ounces of silver per ton. We’re consistently depending on how fine we screen getting 30, 40, sometimes 50 ounces per ton of these residual materials.” With those recoveries of silver, Comstock's new plant would be among the largest silver “mines” in NA.

Comstock doesn’t refine the silver, so it doesn’t get the full value from it( they get 50-60% of silver value), although they have said they are planning to do this in the future, as they are a former pure mining company that still owns mining assets and has expertise in the sector.

The recent silver price surge has raised estimates for their mineral & metal recoveries per tonne from 200$ to over 250$, “…pushing $40 an ounce. That increase in price just over the last year contributed our estimates from going from $200 a ton recovery to almost $250 a ton recovery to now slightly over $250 a ton.” Now the silver price is already at 61$, so the already insane economics at 200$ a ton, which was used for the earlier calculations based on their pro-forma, are going to be even better if the silver price remains high.

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

In their presentations, Comstock outlines 4 major advantages of their technology as the CEO puts it: “There’s four very, very key things that we believe are novel that our technology does that nobody else can do.” These quotes are from the CEO during the Q2 nd Q3 earnings calls presentations explaining these four “key things”:

“We thermally destroy at the molecular level. We’re breaking carbon bonds and we’re thermally destroying these polymers, these laminants, these plastics such that they are broken down and ultimately reassembling with very very safe emissions. CO2 going up the stack. So we have air quality controls, we have scrubbers, but we do not have any harmful emissions and we eliminate all the contaminants.”

“We don’t harm the metals. We don’t carbonise, we don’t destroy, we don’t burn the metals in our process. And into that point, if laminants and plastics are sticking to the silver or sticking to the glass or sticking to the aluminium, they’re not salable. In fact, if you do that, you’re just generating new hazardous materials. And the permitting regime that we work under wouldn’t even allow that. So we have a zero landfill solution because those aluminums, those glass and those silver tailings come out clean, free of those contaminants.”

“It also has the lowest variable and operating cost in the industry. We don’t see anyone that’s even close to our variable cost profile” -“It’s ridiculously efficient. Our variable cost are less than 7% of our revenue. Less than 7%. Most of that is natural gas and the rest is electricity. But in reasonably and relatively small quantities for what we’re doing”

“And then the fourth, which I think is the most powerful is, it’s fast. Do a panel every 7 seconds. What does that mean? Of course it means we have incredibly high throughput, low variable cost, high speed process, but it’s more than that because that speed is what enables us to scale. One production line can do millions and millions and millions of panels per year. 3.3 million panels per year from one production line. We don’t know anybody that can do that.”

In summary, it’s the fastest, has the lowest variable cost, produces clean end products, and doesn’t produce harmful emissions. Comstock's technology addresses the main problems with recycling solar panels: high cost, difficulty producing a clean end product due to contaminants sticking to it, and dealing with toxic elements.

So far, we have 2 important points of validation that this technology works as intended: the demonstration facility and the 3rd-party validation.

Source: https://comstock.inc/press-release/comstock-metals-awarded-the-first-r2v3-rios-certifications-for-zero-waste-solar-panel-recycling-in-north-america/

Why is this significant? R2(R2V3=the newest version) is a leading international standard for the recycling of electronic waste(e-waste), especially in the United States. It not only validates the technology but also increases their business partners’ ESG scores, reduces their legal and financial risk, and, most importantly, helps them get regulators on their side to secure permits. The screenshot below is from the official website of the EPA (United States Environmental Protection Agency). Showing that the US government is encouraging companies to get R2 certification:

Source: https://www.epa.gov/electronics-batteries-management/certified-electronics-recyclers

Pathway and progress to commissioning the largest US solar panel recycling facility in Q1

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

Comstock has operated this demo facility for almost 2 years and has been generating small amounts of revenue from it. The new facility commissioning in Q1 is around 22x the capacity(from 135k to 3m) and will be in the same location

Source: https://ndep.nv.gov/uploads/documents/PUBLIC_Comstock_Metals_Written_Determination_Application_V3.0.pdf

Comstock is building a large inventory of panels to be ready for commissioning:

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

Other progress includes:

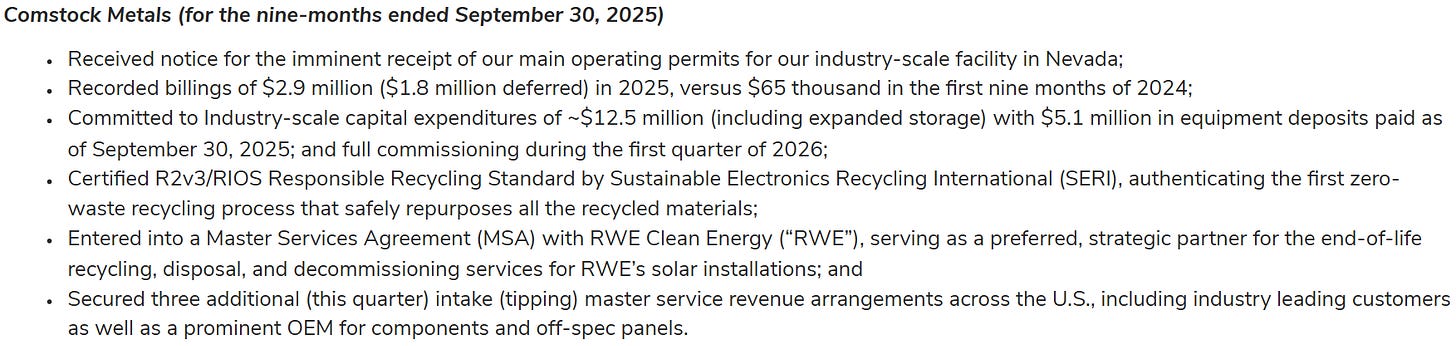

Source: https://comstock.inc/press-release/comstock-announces-third-quarter-2025-results-and-corporate-updates/

They have also started “advanced activities for the next three site selections for U.S. facilities and storage capacities”.

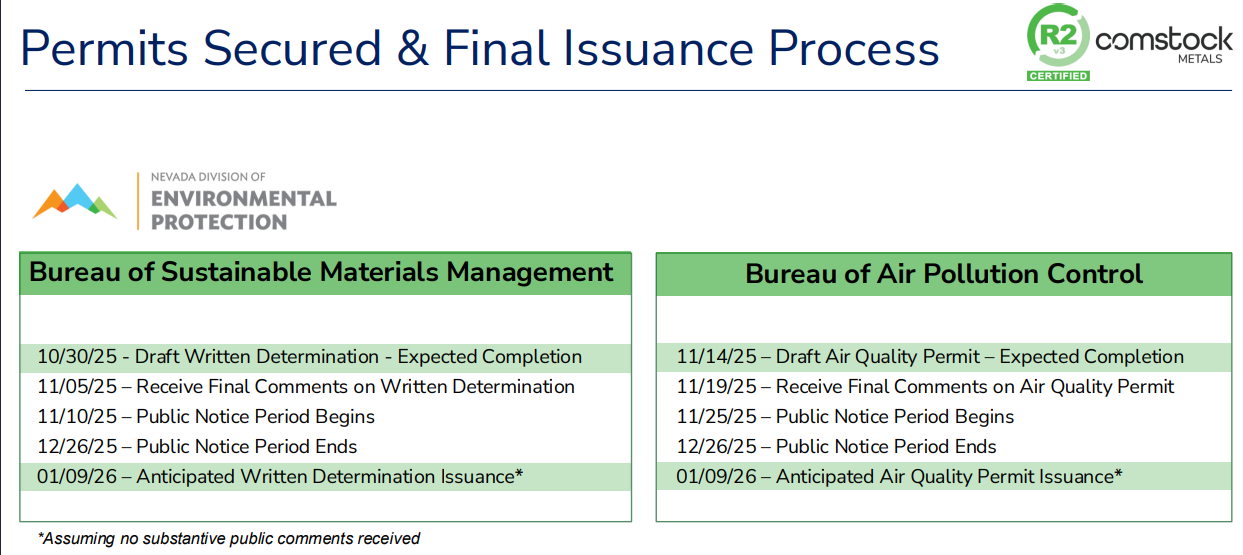

The permitting situation:

This is what they said in the last update “We just received affirmation on the imminent issuances of our remaining permits, on schedule”, This is the schedule:

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

So far, they have received:

June 5th, Expanded county storage permit for recycling ramp-up.

November 5th, received notification of eligibility for a Written Determination Permit for solar panel processing.

November 24th, received notification of eligibility for an Air Quality Permit.

The permits are moving forward pretty much on schedule. The last two permits are subject to public notice periods that have started, during which, if problems arise or someone objects, the final issuance could be in danger.

Permitting risk is never zero, but I would say it’s very low at this point due to the R2V3 certified status, no issues or delays so far, the company having already operated the Demo in Nevada at the same location and Nevada being a great business jurisdiction. And to top it, they just press released this:

Source: https://comstock.inc/press-release/comstock-metals-receives-recognition-for-its-business-development-from-economic-development-authority-of-western-nevada-edawn-and-nevadas-publicly-elected-officials/

“Comstock Metals was also honored to receive official recognition from U.S. Senator Catherine Cortez Masto, U.S. Senator Jacky Rosen, and Nevada Governor Joe Lombardo.”

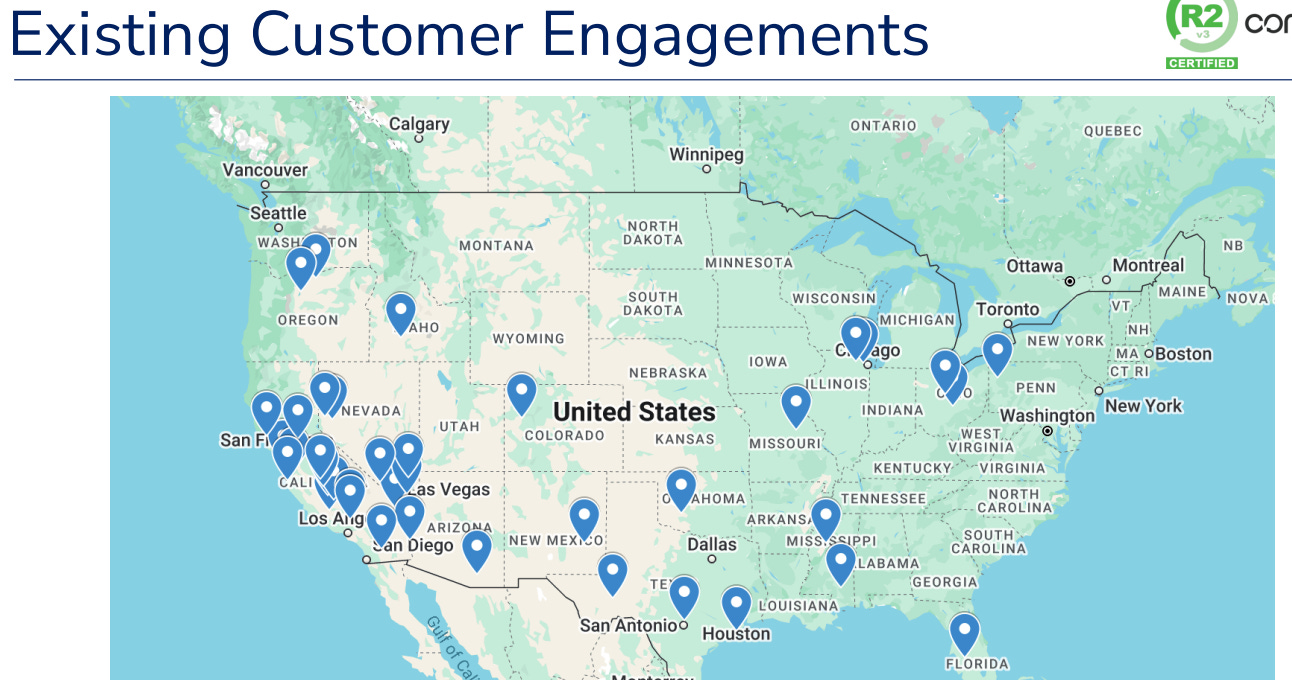

To secure a supply of solar panels and customers for the end product, Comstock is engaging with potential customers and signing MSAs (master service agreements) with significant players like RWE Clean Energy:

Source: https://comstock.inc/press-release/comstock-metals-and-rwe-clean-energy-enter-strategic-solar-recycling-partnership/

They also signed three other MSAs with unnamed big companies in Q3. Utility, E-recycler and a manufacturer:

“We signed three meaningful new MSAs just in the last quarter. I know we signed more than that, but I’d like to say three because remarkably we signed a major utility which is our bread and butter and we’re targeting and what we have the most of. We signed an e-recycler which is prominent and big volume potential. And we even signed an OEM like an original manufacturer. Not a lot of solar panel manufacturing in the United States, right? Most of it’s in Asia. Those businesses it’s a little counterintuitive. They’re not end of life. They’re beginning or unfortunately panels that never are born because something went wrong, you know, but it’s steady Eddie businesses, you know. So we signed three of those. We’re very excited about that. And that’s our strategy, right? To build the biggest market share in the industry through these master service agreements.” Q3 call

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

Permitting, construction, customer engagements, funding, and inventory buildout. Everything seems to be going according to plan so far.

Risks for the solar business

Permitting risk is low, as I went over.

The financing risk is low if the facility performs and starts turning a profit in Q2; they should have more than enough cash to cover Q4 and Q1 burn and the capex.

While the technology works, the scale of the new facility is way larger. Many potential technical issues could arise during scale-up that I couldn’t even name, as I’m not an expert with machines or recycling.

Slow ramp-up, which could delay profitability.

Once the facility is in production, if the economics are not as good as the company has presented, it’s a risk. However, the market is not presently pricing in those economics.

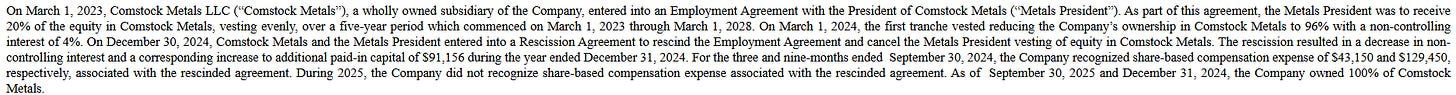

There was an agreement to give 20% of the metals business to the President of the division, Dr Fortunato Villamagna, who joined Comstock in 2023 also developed their recycling tech “Dr. Villamagna developed the proprietary process for recycling of end-of-life electrification products, which Comstock Metals is commercializing first in solar”

Source: https://www.sec.gov/Archives/edgar/data/1120970/000143774925032230/lode20250930_10q.htm#notes

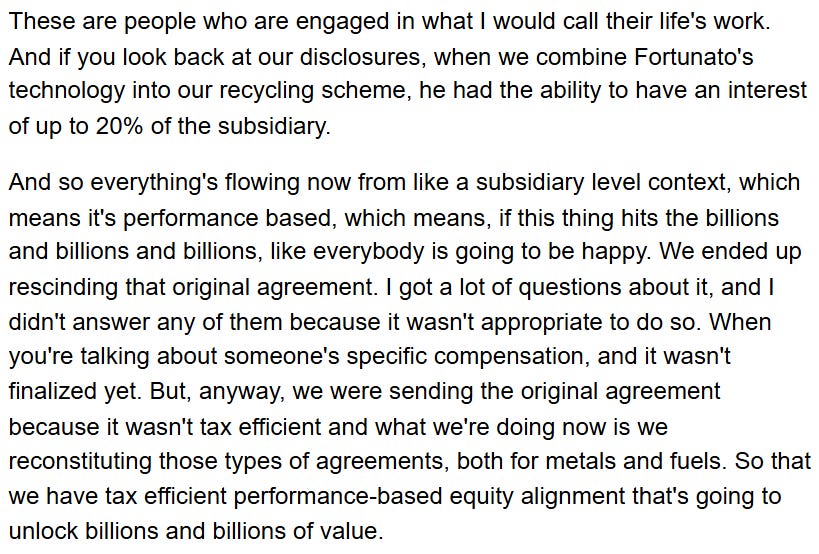

The agreement was cancelled, and now Comstock owns 100% of the metals. It’s generally presented to investors that way, but shareholders should not be surprised if, in the future, Fortunato gets a big cut of the business or some other major form of compensation. He likely didn’t give up his 20% for nothing. And just based on how the management explained this situation in the Q1 call, it sounds like they are just executing something of similar scope differently for tax purposes:

Source: Seeking Alpha Q1 transcript

Also, the CEO said in an interview published on 25.5 after the 20% was officially cancelled:

“20% of the equity going to the founders, which by the way is exactly what we did with Comtock metals, Fortunado, and the team. 20%.”

So it sounds like there is an unofficial agreement, even if the financials show 100% ownership and no agreement. So, I would conservatively assume 80% ownership of metals in the long term.

Slow ramp-up could be caused by technical trouble or a lack of panels, which would delay profitability.

“So we’re commissioning in Q1. I would love it if during Q1, we had 15,000, 20,000 tons of material sitting there. So that’s certainly possible. We already have almost 5,000 as you saw the pictures of. And then we’ll ramp up starting in Q2 with the production plan. We don’t have total clarity at 20,000, 25,000 tons, we’re making money. So that’s our first milestone, then it will ramp up from there.

I wouldn’t imagine that, that facility would be running full probably until the end or the latter part of 2027. The data points that we’re getting suggest the quickening, right? But it’s just still too early. When you talk about, well, oh, we got 80,000 panel order last -- the beginning of this year, we’re super excited. Now you’re talking about orders that are like 3x and 4x that size.

It gets very exciting. So the preliminary data points tell us it’s coming sooner. But we just don’t -- we don’t have certainty to that, but it’s coming. We’d like to get Site 2 up at the beginning of ‘27. We’d like to get the Site 3 up at the beginning of ‘28 or earlier, right?” source: Q3 call

Not getting enough panels, competition and tipping fee erosion. These risks are bundled as if there is greater competition for end-of-life panels, and fees for removing them from the utility's hands would decrease as they become more sought after. Also, if Comstock expands in the US faster than the market can catch up, there would be a similar effect. Lower tipping fees and reduced supply, which would prevent them from running machines at full capacity, would result in worse economics. Of course, these risks would be later problems when Comstock has already succeeded and de-risked in many other ways, and the stock would be way higher than it is now.

They have reduced supply risk through the MSAs, but as the company scales to multiple plants, they might struggle to secure enough supply to run the machines at full capacity in the next few years if there is competition.

Source: https://comstock.inc/wp-content/uploads/2025/11/3Q25-Earnings-Call-Slides.pdf

The market is growing rapidly as the wave of old panels is coming to the end of their lives, but the new facility is 100,000 (3 million panels) tonnes per year, and, based on this, the market in 2025 is 100,000 tonnes. If competitors enter the market, the supply could get tight.

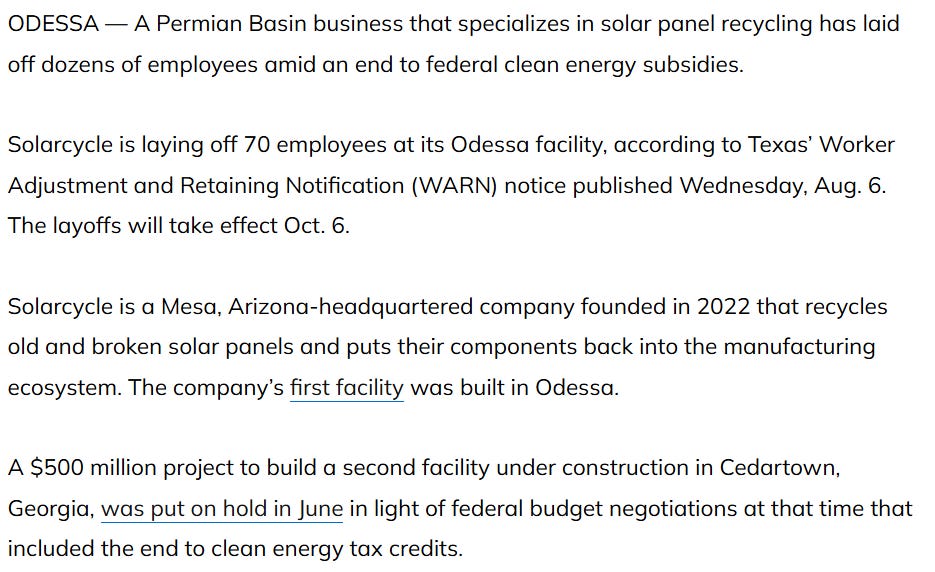

Their main rival in the US is Solarcycle, which recently expanded its facility to produce 1 million panels per year. Many sources say they are on track to recycle a million panels this year.

Solarcycle had/has a plan to build a facility in Georgia(US state, not the country in central asia) with an initial capacity of 2 millon panels per year and to be scaled to 10 million panels per annum, and bad news for Georgia, but good news for Comstock, the construction of this project has been halted due to end of subsidies under the new US admin.

Source: https://www.mrt.com/business/article/solarcycle-odessa-layoffs-20809558.php

And while this is great news for Comstock, because this facility would have been their biggest competitor. This article raises another important point about Comstock's advantage. Solarcycle’s technology has such high capex that they needed government subsidies—$500 million for a 10-million-panel-per-year plant. Comstock, according to them, needs only $12.5 million for a 3-million-panel-per-year plant. Comparison Capex/panels per year, Solarcycle 50m and Comstock 4.16m. Solarcycle has 12x the capex when equating the recycling capacity.

There are other companies with plans for scale-up over the coming years, but these are small and private (OnePlanet, We Recycle Solar), and the information on their economics, progress, and ability to secure funding is sparse, so it’s hard to take their statements seriously.

If Comstock can execute, it is well-positioned to take the US market. And if the company has only 30% market share after a couple of years, the CEO considers it a failure:

“As I said earlier, if we do one a year for three years and we have a 30% market share I’ll personally feel like we dropped the ball. If we have a look, I want 100% market share, but we’ll see what happens, right? We get 50%, 60%, 70%, it’ll be because we went for it all, not because, you know, we were satisfied with less. So when you when you have $55 million(annual profit) a facility, you start thinking about five, six, seven facilities and remember everybody we’re only talking about the United States. We haven’t talked about anything else. So it’s big.”

We can talk about 4-7 facilities by 2030 and $220-385 million of cash flow, and put some multiple on that, but it is not the most relevant right now. What is most important right now for this business is to prove the Metals business model with the first facility. Can they actually build something, for $12 million, that generates $50-60 million in annual profit? Proving this will be the biggest catalyst; it will be a bigger catalyst than the initial cash flow itself, because it will get the market’s imagination going. Investors will start making models about how many facilities they will have in the US, and after that, internationally, and what multiple they could put on those earnings, etc. Now, the market is still hesitant to believe it until they see it. It sounds too good to be true. But putting it all together, while there are risks, I don’t see any huge red flags for the solar recycling business.

The solar recycling business was my main reason for investing in this company. It alone presents a very strong risk/reward case, but they have another business, Bioleum, which is in an earlier stage, less de-risked, but has higher future potential and has the highest valuation of Comstock's businesses, based on multiple transactions. On top of that, Comstock has multiple non-core assets with material monetisation value, which will all be discussed next.

This was around 40% of the article. The other 60% is behind a paywall and covers Bioleum(the biggest section), the mining assets, green Li-ion, real estate assets, the bear case, the catalysts and the closing thoughts.

-33% Christmas Discount available until 31.12. The subscription will stay on the discounted price as long as it’s not cancelled.

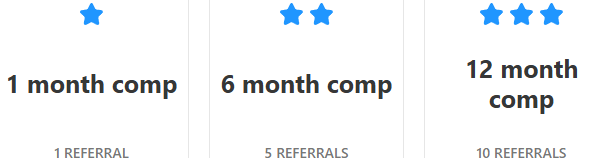

If you want access to the paid content without paying, use the two buttons below to generate AlmostMongolian subscribers. Free subscribers count. The rewards are stacked

Bioleum: Highest Potential Business of Comstock

…