Sintana Energy Update

Stock lower, Risk/reward better

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian short AD: THE LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

Sintana

I released my Sintana Deep dive on February 17th when the stock was at 72 cents CAD and had experienced a drop to that price from 1-1.2$ due to a bad drilling result in one of their blocks. Now the stock is at 51 cents CAD, while based on what’s been going on, it should be higher. I, of course, have loaded up.

Source: Google

There has been news. Developments. It hasn’t been only positive news, but on net, the news has been positive.

The market cap is now only 138 million USD. What a great gift! O brave new world, that has suck stocks in it!

Now, let’s examine the positive and negative or perceived negative developments that have occurred since my last post and draw a conclusion on whether the risk/reward has gotten better or worse. This includes the Galp earnings call that took place yesterday.

Positives

3X

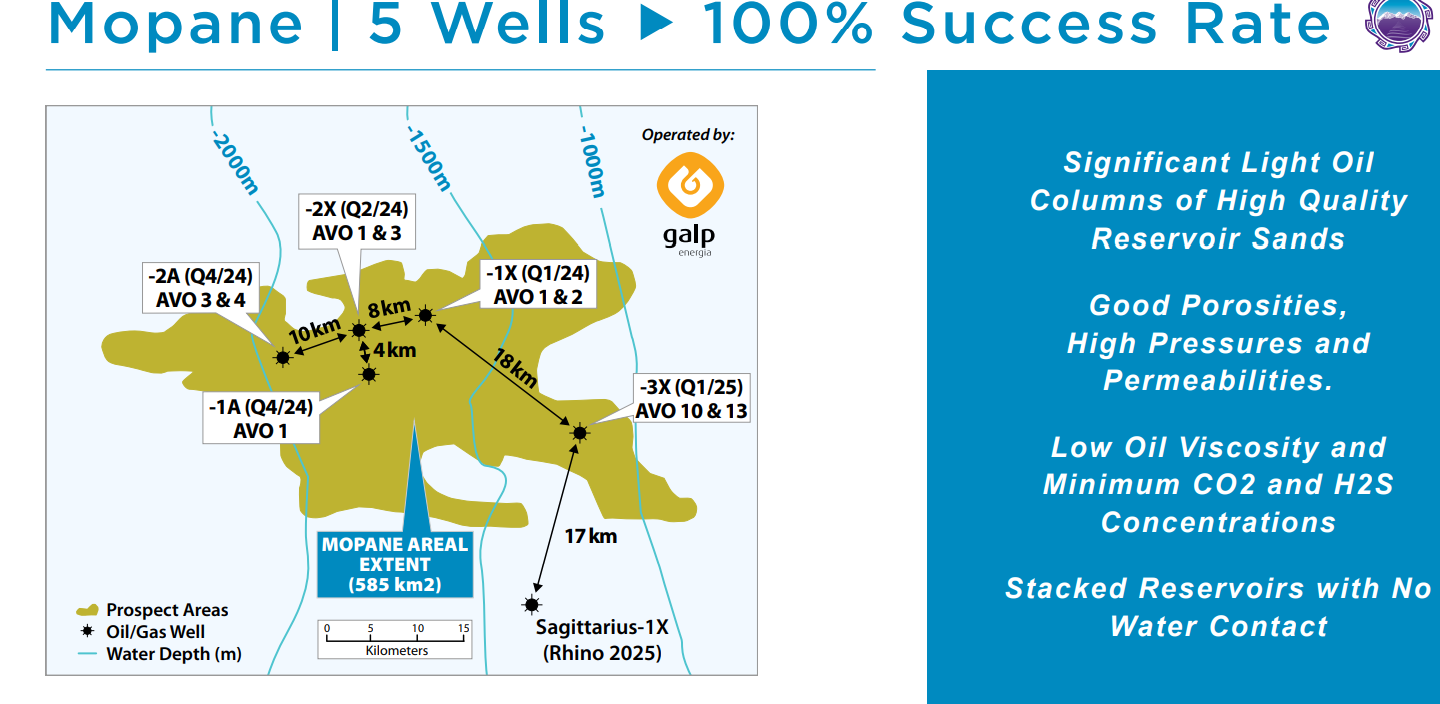

At the time of the write-up, investors were waiting for 3X drilling results on PEL 83.

Source: https://sintanaenergy.com/wp-content/uploads/2025/03/sei_corp_presentation_mar25.pdf

Source: https://ceo.ca/@GlobeNewswire/pel-83-second-campaign-update-5-additional-discoveries

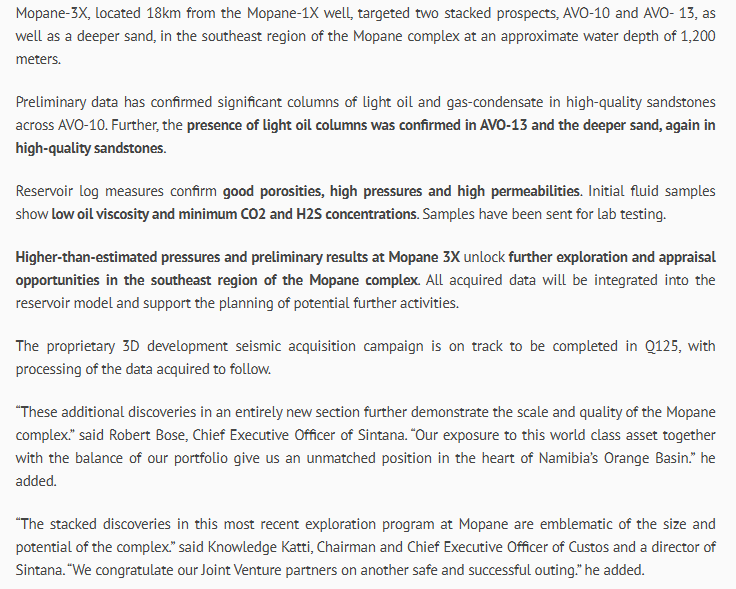

Multiple oil discoveries were made.

AVO-10=”Preliminary data has confirmed significant columns of light oil and gas-condensate in high-quality sandstones across AVO-1”

AVO-13= “the presence of light oil columns was confirmed in AVO-13, again in high-quality sandstones”

Deeper Sands=”the presence of light oil columns was confirmed, again in high-quality sandstones”

Some of them were described as significant. Also, more discoveries in “deeper sands” which is a positive and unexpected result, as this drill was originally just targeting AVO-10 and AVO-13.

And the discoveries, like all the Mopane discoveries, possess favorable geologic characteristics for commercial oil extraction: good porosities, high pressures, high permeability, low viscosity, minimal CO2 and H2S, and no water contact.

This was, of course, amazing news, stock shot up next day, even hitting 98 cents at the peak.

The CEO, Robert Bose, said this about 3X in an interview.

“This fifth well was focused on a completely different part of the Mopane complex, located in the south and eastern portion of the complex, targeting two entirely different AVO anomalies called 10 and 13. And, you know, the punch line is this well, was probably one of the best wells that was drilled in, in, in the complex of, of all of them. The results were better than expected across almost every parameter. Better porosity, permeability, better reservoir quality. The pressures were excellent. There was intersect with multiple reservoir US returning high quality columns of both light oil and condensate, you know, high quality sand. So this is had the potential of opening up an entirely new potential development hub in the complex, which is just a fantastic development. So that was, you know, some really, you know, fantastic news.”

These are some statements from Galp’s Q1 earnings call regarding 3X.

“In Namibia, well number five was safely drilled. This is another successful well unlocking now the Southeast region of the Molpane Complex, an exciting area for us.We are now focused on integrating all the data collected and working towards evolving the ongoing feasibility and development concept studies.”

“It’s good characteristics what we’ve found and what we’re still discovering so far. And again, I keep going back to the fact that this well was ended halfway through the quarter, so there’s still a lot of information coming. Having said this, all the information we’re getting is still confirming what we saw and shared initially. So high permeabilities, good porosities, we had higher than expected pressures, which we see as a good sign, very low CO2, no H2S concentration.”

This is good. All the new information confirms that the discovery is as they originally presented it.

We’re still integrating and analyzing all the income data. I think it’s fair to say that if you look at the Southeast Region where Mopane 3X took place vis a vis the Northwest, what we see in the Southeast is in line with our expectations, and it’s certainly oilier than the Northwest Region. So, oilier with good permeability, higher than expected but manageable pressures.

Northwest is 1X, 1A, 2X, and 2A wells, and the 10 billion BOE in place estimate was based on those wells, and now they are telling us the Southeast, which is 3X, is a “certainly oilier” region. Huge statement.

“There is great potential in mopane, a large number of AVOs, but right now, again, we’re very focused on making sure that we get the right development concept for what we already know about the Northwest Region and for the Southeast Region. We are not at this stage moving forward towards the third hub so far. We believe that making sure that we catch up with all the information we got from the first initial exploration and appraisal campaign is critical and that’s what stands in our decision tree at this moment as being the more value accretive approach for the asset.”

When Galp made their discoveries in the northwest, the estimates for production were around 150k barrels per day. Now they are focused on getting the “right development concept” also for the Southeast. 300k barrels per day new estimate?

It seems like we are going to have to wait a bit before the next drilling. Bose is saying Galp is focusing on finding a partner, which means a supermajor taking an operating stake and starting to pour money into this block.

Rhino Finds

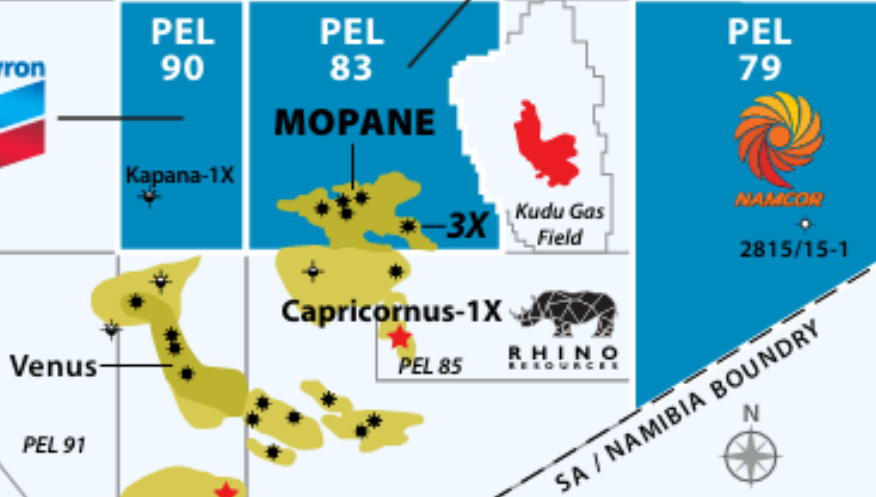

There have also been 2 additional discoveries in the neighboring block of PEL 83.

Source: https://sintanaenergy.com/wp-content/uploads/2025/04/SEI-25-04-2025.pdf

Sagittarius-1X, which is closer to 3X than other discoveries of PEL 83 and Capricornus-1X, is shown below Sagittarius. Both of these found oil.

“if you look at the results that Rhino recently obtained, those are consistent with a notion that the basin is oilier closer to shore.” Galp Q1 earnings call. Promising statement for Sintana regarding their close-to-shore block PEL 79.

Source: https://www.upstreamonline.com/exploration/enis-upstream-boss-reveals-juicy-detail-on-namibia-discovery/2-1-1786209?zephr_sso_ott=x7B0eL

Source: https://www.reuters.com/business/energy/african-energy-explorer-rhino-resources-finds-light-oil-off-namibia-2025-04-24/

I like to see this due to the proximity to Mopane and also PEL 79 Sintana’s other block, which they are trying to farm out.

The discoveries are also close to Block 1, located below PEL 79, which Eco Atlantic owns 75% of—another AlmostMongolian portfolio stock, which is a much smaller position than Sintana.

The last positive development is that Chevron is considering drilling PEL 82 in 2026 or 2027.

Source: https://www.reuters.com/business/energy/chevron-mulls-drilling-new-exploration-well-offshore-namibia-2025-04-24/

Sintana has 4.9% of PEL 82, and it’s carried for Sintana, meaning Chevron will pay the costs of drilling. This is good news as it’s pure upside for Sintana, but because of the uncertain timing and the fact that it’s not this year makes it less important for now.

This also bodes well for Eco Atlantic, which is seeking to farm out 4 Walvis Basin blocks, of which three neighbor PEL 82.

Another positive development is the prospective resource estimate completed for PEL 87, which is covered in my paywalled Pancontinental article released today.

Negative developments

Despite all of these positive developments. Mainly 3X. The stock is down.

What has caused the stock to fall to 51 cents?

-CEO selling

-Oil price and the market went down

-Galp releasing contingent resource misunderstood by the market

-Woodside leaving PEL 87, meaning PEL 87 drilling is pushed back.

-No new drilling in the short term

Now I’m going to break apart every single one of these so-called negatives and tell you how they don’t really matter or that they are actually positives.

-CEO selling

Source: https://ceo.ca/insiders-dashboard?symbol=sei

This happened right after they announced 3X results. He sold 2.45% of his position. He still has a position worth 12 million CAD in a pure exploration company. I think that shows strong conviction. Why did he sell? Maybe he wants to buy a fancy car or a boat. Maybe he was intending to sell for a while, but had to wait until the drilling results were released. I saw some people on the internet saying he must know something negative, so he is selling because of that. He would be taking a risk doing that as it’s illegal. And if Bose was the type to do that, why didn’t he dump his shares before the Kapana dry well result? Or buy a lot before the 3X result and then dump into the initial rally? Why didn’t he sell more than 2.45% of his position? I don’t think this is likely. We don’t even know how much these majors doing the drilling are telling Sintana. In conclusion, not a big deal. But it didn’t help the sentiment around the stock.

- Oil price and the market went down

The oil price going down is mainly bad for oil producers, and usually, day to day, I don’t see a strong correlation with pure exploration companies, and if you look at the historical stock price of Sintana, it doesn’t trade with the oil price. But yes, it’s net negative that the oil price is down because majors have less money to spend on exploration. Combined with the overall market weakness that spilled over to most stocks, I can see why Sintana stock took a hit because of this.

I think this is noise and should be TOTALLY IGNORED and only given acknowledgment for dip buying purposes.

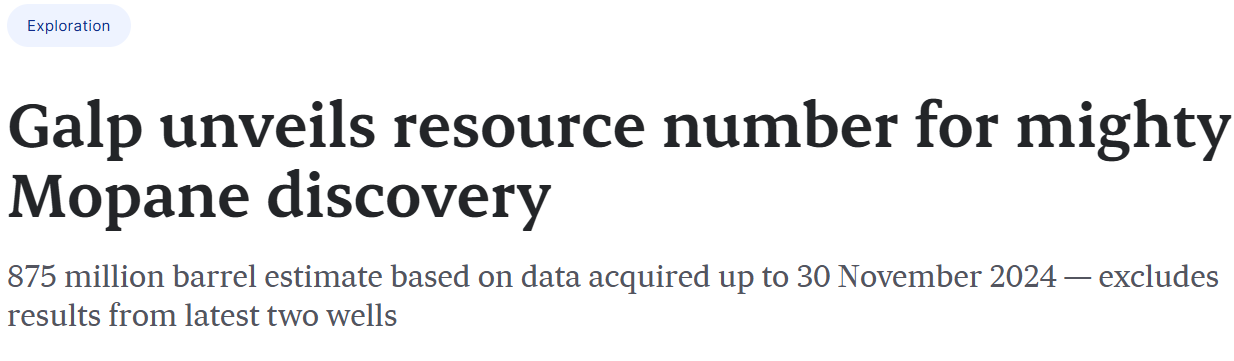

-Galp releasing contingent resource estimate

Galp released a contingent resource estimate based on three wells from PEL 83, and the Sintana stock declined after this news.

Source: https://www.lawinsider.com/dictionary/contingent-resources

I think the negative stock price reaction makes sense, considering that around 70% of the shareholders are retail, but fundamentally, it doesn’t.

I saw people online basically going “875 million barrels!? They told us more than 10 billion barrels!” I like seeing comments like this. Observing the competition.

During yesterday’s earnings call, Galp cleared up the confusion about the contingent resource number and reaffirmed the original 10 billion BOE in place estimate.

“On your question on the contingent and the numbers that we’ve reported, the 10,000,000,000 barrels still stands. They refer to the total of Mopane, and you have to take into consideration that the DMACC information that was public referred to November.

So actually it was kind of halfway through the campaign that we had ongoing at the time. So they’re consistent as we see it. There are of course, know, mean risks in our estimates, and they have the methodology of VMAC, which is different from our models and our internal analytics, but we see them as consistent. We’ve shared with a focus on three Cs precisely because all the work that we have, that we’re doing in terms of development will bring further substance to any 2C figures that we don’t see yet as the most relevant ones to explain the full complex. I think it’s positive to give a few additional notes.

So, if you look at DMACC, those were stated for our share. If you look at the 100% basis, it’s actually 900,000,000 barrels. So I think it’s actually positive that this is an extrapolation for analog discovery. So fundamentally what this tells us is that, you know, there’s reassurance in knowing that there is this type of contingency in our findings with the little information that was known back in November. So, all in all, our 10,000,000,000 barrels still stands, but a lot to learn about the complex.” Galp Q1 earnings call

On the recovery factors and the gas to oil ratio on the 3Cs, So again, very different methodologies, DMACC and our models, and again very different scope, and I think that is critical to always keep in mind. This is the information that DMACC has, which refers back to November, so again that is very partial. Mopane is a rather large system.

What we’re finding is that AVOs have different characteristics, so we don’t have a discomfort or find an inconsistency in the numbers that DMAC presented, but they do not stand for the whole of the complex, the whole of mopane. And again, they’re compatible with our models, but they’re very, very partial and they’re early days in terms of estimates. So I would leave it at that. Thank you.

The 10 billion barrels or higher estimate that Galp provided early on was hydrocarbons in place for the whole Mopane complex, and they, as we saw they just confirmed this estimate again.

“In the Mopane complex alone, and before drilling additional exploration and appraisal wells, hydrocarbon in-place estimates are 10 billion barrels of oil equivalent, or higher.”

Barrels in place refers to the total amount of hydrocarbons they estimate are present in the reservoir, whether recoverable or not.

This new estimate is for contingent resources, which means recoverable, but the company is not yet willing to put them in reserves, which means they are commercially recoverable.

Mopane has five hydrocarbon discoveries, and this estimate only considers 2 of them fully and one partly. And only considers information provided up to 30.11.2024. It excludes data from 2A and 3X, which may be the biggest of them all.

“Namibia assessment considers data from the first three wells, Mopane 1X, 2X and 1A (partial data), with the independent assessment by DeGolyer and MacNaughton only considering information provided up to 30 November 2024.” Galp 2024 annual report

It also won't take into account the new 3D seismic recently concluded

“Additionally in 2025, in March, Galp concluded a proprietary 3D high-resolution seismic shooting over the southern part of PEL 83.” Galp 2024 annual report

And it won’t take into account prospective resources that would be within the 10 billion or higher boe-in-place estimate.

“So again, very different methodologies, DMACC and our models, and again very different scope,”

“numbers that DMAC presented, but they do not stand for the whole of the complex, the whole of mopane”

The contingent resource estimate doesn’t apply to the whole complex and was done with a different methodology than the barrels in place estimate.

“This is the information that DMACC has, which refers back to November, so again that is very partial.”

“they’re compatible with our models, but they’re very, very partial and they’re early days in terms of estimates.”

And they say twice that the 10 billion barrels still stands.

In conclusion, the contingent resource number is a very incomplete number that created confusion among retail shareholders. The contingent resource number will go up the more they drill and include more data in it. We don’t know how much recoverable oil is there. We didn’t know before, we don’t know now. There is a lot of drilling to be done without incurring costs for Sintana.

BOE in place estimate was +10 billion or higher before 3X discovery that they say it’s in an oilier region of the block, and they are doing a development concept for it, I would guess the BOE-in-place estimate is much higher now unofficially, even though they haven’t changed it yet as they haven’t even gone through all the data from 3X. As they said earlier regarding 3X, “there’s still a lot of information coming”.

Additionally, considering that 3X is closer to the Rhino resources discovery than it is to the other Mopane discoveries also suggests that the entire Southeast area of PEL 83 is packed with hydrocarbons.

-Woodside leaving PEL 87

I released a Pancontinental Energy write-up(paywalled) today that covers this situation extensively. Shortly, Woodside decided not to exercise their option to acquire 56% of PEL 87 and go forward with drilling a well that would have happened in 2025, even after spending 35m USD for a seismic study, which was part of the agreement. They gave it up.

Now we don’t know when it will be drilled. Pancontinental and the joint venture are pursuing a farm-out with a major because they don’t have the financial means to drill by themselves. I think the farm out is inevitable.

I think Woodside's leaving left Pancontinental Energy the operator of the block with 75% working interest in a great position, but Pancontinental stock still went down a lot as a reaction to it. I didn’t like Pancontinental before, but now I think Pancontinental is in an asymmetric situation, and I added it to the AlmostMongolian Portfolio.

-No new drilling in the short term

“we have in our plan for 2025 concerning further CapEx in Namibia. We have around 100 to 155 that concern both the well and the seismic, so no further major CapEx spend expected there.” Galp Q1 earnings call

I’m thinking what comment in the Galp earnings call the market didn’t like, because Sintana was down on the day of the earnings call despite overall very positive comments. Maybe it was this. 3D seismic is done, and the one well is done. No more CAPEX from here. This should have been priced in already based on previous statements, but maybe it needed to be said clearly before it sank in.

Galp is currently focusing on finding a major oil company as a partner. They expect this to be done later this year. When the partner has been found, the CAPEX should ramp up massively.

“The natural step in Namibia is, of course, to advance on the partnership. We are already engaging with several parties that have been signalling interest, all highly credible top tier operators.

At this time, GALP is initiating data sharing. We’re mindful of the fact that the alignment necessary for a value accretive partnership will likely take time, as we’ve always expected, and with no delays to our game plan. And to be clear, no procrastination but also no rush. All in all, our base expectation is a firm decision only later in the year, even though we’re not committing to a strict timeline”

“Again, a set of potential partners that tick the boxes, if I may say so, in terms of their experience, their potential role as an operator, their manifested interests and their availability towards exploring the assets at the right pace. So data is now being shared. We expect to be sharing data until mid summer. Priority is ensuring the alignment of interests. So that’s what we are going for.” quotes from Galp Q1 earnings call

There is no drilling scheduled at the moment on Sintana’s blocks. There will be drilling inevitably, but atm there is a pause. We don’t know when the next well will be drilled on PEL 90, PEL 83 or PEL 87.

This means there are fewer short-term catalysts. There are other catalysts, such as multiple assets that could have farm-out news(PEL 87, PEL 79, PEL 83) and announcements of new drilling plans. PEL 83 farmout is the biggest catalyst and also the most likely to happen catalyst within this year.

One good thing about less drilling activity is that it means fewer short-term risks. What could cause Sintana to have a new leg down to 30-40 cents? Not many things.

And the positive catalysts from here are less risky. Announcing new drilling will cause the stock price to increase. Not announcing new drilling means neutral/slow decline in stock price, same thing with farmout announcements. Announcement of a farmout will make the stock go up, and not getting a farmout is a neutral/slow decline in stock price, as opposed to drilling, which results in either the stock shooting up or crashing down.

These developments will lead to drilling, but the key point is that if asymmetric catalysts, such as drilling announcements and farmouts, occur, they will cause the stock price to be higher when we reach the riskier catalyst, that is, drilling.

And these asymmetric catalysts, like the farmouts for PEL 83 and PEL 87, are, in my opinion, 99% likely to happen at some point. And let’s say 80% likely to happen within 12 months. And should alone without drilling risks provide 50-150% upside from the current price. Doesn’t throwing percentages around make everything clear?

This is why I like the current situation for building my position in Sintana.

In Summary, since my article, the stock is down 29%, and these are the developments that have happened since.

Positives

3X result=Amazing

Calp Q1 earnings call=promising

Rhino results next to PEL 83=Good

Chevron PEL 82=Net good, but not a big deal atm

PEL 87 Prospective resource estimate=good, more later

negatives

-CEO selling 2,45% of his position = Most likely meaningless

-Oil price and the market went down = Short-term negative for the stock price, unpredictable

-Galp releasing contingent resource estimate = incomplete estimate, meaningless, 10 billion stands

-Woodside leaving PEL 87, meaning PEL 87 drilling is pushed back = Bad for Sintana, at least for the short term, Good for Pancontinental for the long term

-No new scheduled drilling in the short term = Bad, but also kind of good

Overall, I think the developments have been positive, mainly due to 3X. The market doesn’t agree, but the market is wrong; I’m right. In my opinion, I’m right. I think the risk/reward is better now than it has been at any other time I have known about this stock, and I have bought the dip.

Nice overview, I've also been adding. I'm not sure how high Mopane will be valued though. But it's very good to see interest from multiple parties.

I think one factor that's overlooked is the taxation when Sintana monetizes PEL-83. I'm not an expert but it could be as high as 32%. I think their analysts target of $1.19 is fair, maybe even slightly optimistic.

The current price implies around 25% recover rate for $2/boe which is low-ish but not completely unreasonable. To get above NPV of C$1.00 we should get closer to 30% recovery rate and $3/boe. Bull case maybe around 35% recovery, $4/boe which would be C$1.70 per share. I don't think we can expect much more than that assuming taxes of 32% .

Bloomberg's 20B has to be the undiscounted value which is something very different.

Hoping for a farm-out announcement soon!