Sintana Energy: Deep Dive

Buying the dip

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

Mongolian short AD: THE LINK Long AD: LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

This article does not fit in the email. Press the button that lets you read the rest when the article abruptly cuts off.

As I was writing the Eco Atlantic write-up I was also looking at other companies in the Orange Basin. One of those companies was Sintana and I concluded that Sintana has even better Risk/reward than Eco Atlantic.

Sintana’s business model is to acquire O&G exploration assets, farm them out to bigger companies, keep a small working interest, and let the big companies pay for the exploration while Sintana benefits if the exploration is successful.

Sintana has no debt and they have enough cash(14.6m USD) to pay for the company's basic running costs for years. This means Sintana does not need to do dilutive raises to keep the company running or to pay for drilling themselves which is common among commodity exploration companies.

Every exploration company in the Almostmongolian portfolio (Globex, Eco, Sintana) does not need to dilute shareholders and makes deals where other companies must pay the exploration costs. These companies avoid many of the usual issues with exploration companies which is the reason they cross my investment threshold. They are less risky, and based on my due diligence each company has a lot of upside potential.

Sintana has these assets+one asset in Colombia

Source: https://sintanaenergy.com/wp-content/uploads/2025/02/sei_corp_presentation_jan25.pdf

PEL - 83 4.9% WI(Working interest) carried to production

PEL - 87 7.3% WI carried to development

PEL - 90 4.9% WI not carried anymore. 1 well drilled. Bad well.

PEL 82 4.9% WI Carried. Details of the carry have not been fully disclosed.

PEL 79 16.7% WI, option to increase to 22,83%

PEL 103 15% WI Carried, but no details of the carry

WMM-37 Colombian asset, Legal situation, 100%?

The Stock

Their market cap is 190m USD.

As mentioned before they don’t have debt and they have cash for many years(14.6m USD) based on Q3 financials.

Their cash expenses per quarter are usually 0,5-1m USD per quarter. When it shows more than that in financials it either includes acquisitions in operating costs or there was more stock-based compensation which is of course a non-cash expense.

They have no revenue.

Source: https://sintanaenergy.com/wp-content/uploads/2025/02/sei_corp_presentation_jan25.pdf

Decently high insider ownership. Low institutional ownership and high retail ownership. This makes the stock volatile.

Source: Google

Recently the stock has fallen because of 2 reasons.

The main reason is PEL-90 bad drill results

The secondary reason is a negative spillover effect from Shell’s 400m USD write-down of certain Orange Basin discoveries. Sintana is not involved with these discoveries, but they are close to Sintana’s blocks.

Both of these events will be covered later in this article and why I think the stock has overreacted and why I think this is a buying opportunity. I have added on this dip and think it’s a great risk/reward at this price.

But first. Let’s look at the history of Sintana.

History

In the past Sintana’s only asset was WMM-37 in Colombia. That asset is in a legal situation currently, but then they made an amazing 4 million dollar investment that was announced in 2021 and closed in 2022.

Source: https://sintanaenergy.com/news-release/sintana-announces-execution-of-definitive-agreement-to-acquire-strategic-portfolio-of-petroleum-exploration-license-interests-in-namibia/

They bought a 49% stake containing these carried interests for 4 million USD in 2021. In 2022 Shell and Total had massive oil discoveries in Namibia’s Orange Basin. These discoveries were close to the assets Sintana acquired. This raised the interest and the speculative value of all of Sintana’s Orange Basin Blocks and started an exploration Boom in the area. Then in 2024, there was a massive oil discovery in Sintana’s carried-to-production PEL 83 block which was the biggest catalyst that led to the stock going up.

This 4 million USD investment changed everything. Briefly after this PP was announced Robert Bose joined in as the CEO.

Source: https://sintanaenergy.com/news-release/sintana-announces-appointment-of-robert-bose-as-president/

He saw the potential of this private placement and the timing of his entry into this position shows good instincts. Or he was lucky. Or both. Even accounting for the recent pullback the stock has gone up 414% during his term.

In June 2024 Sintana acquired an indirect interest of 16.7% of PEL 79 for 2 million USD and they have an option to increase it to 22,83% for an additional one million USD. More on this later, but I like this acquisition. We don’t yet know whether it will be successful, but the amount of money spent compared to the potential makes it a very favorable risk/reward investment for Sintana. Very likely not as good as the company maker's 4 million USD investment, but that was one in a lifetime. The Orange Basin blocks are not as cheap anymore after the massive discoveries made in 2022-2024.

Source: https://sintanaenergy.com/wp-content/uploads/2025/02/sei_corp_presentation_jan25.pdf

That’s how Sintana ended up with its current portfolio. Now let’s talk about their most important asset that’s arguably worth more than their market cap.

PEL-83 4.9% WI carried to production, Namibia, Orange Basin

Source: https://sintanaenergy.com/wp-content/uploads/2025/02/sei_corp_presentation_jan25.pdf

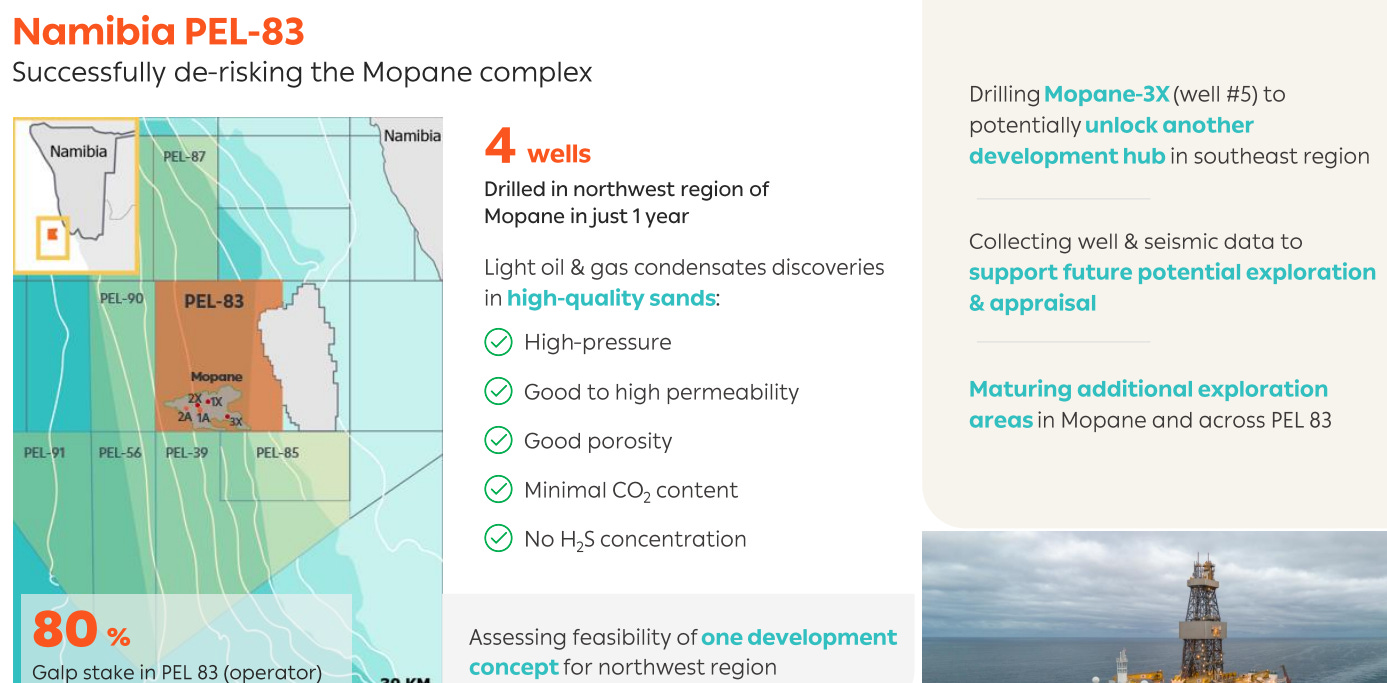

The Mopane discovery in PEL-83 was estimated to have approximately 10 billion boe(mostly light oil and condensate) or higher based on 2 exploration wells you can see in the picture above 1X and 2X. Since then Sintana has drilled 2 appraisal wells 1A and 2A and is drilling 1 exploration well 3x(no results yet). The 10 billion estimate has not been updated by the operator to include the results from 2A, 1A, and 3X yet.

The 10 billion BOE-in-place would make it one of the biggest offshore hydrocarbon discoveries in history. Sintana has 4.9% of it and they don’t have to pay any costs associated with it until it starts production. It’s fully carried.

The significance of the carry to production cannot be understated when Sintana has a 190m USD market cap, no cash flow, and the development costs are in the BILLIONS for this kind of project from exploration to production.

This 10 billion BOE-in-place figure comes from Galp Energia the operator of PEL 83. Galp is a Portuguese 11 billion market cap energy company.

From Galp Q1 2024 conference call on April 30th:

“Alessandro Pozzi

And there, on Namibia, as you might have expected. The first one is on the estimates that you've given of 10 billion barrels in place. I was wondering if you can give us a bit more color on how conservative this estimate is and whether they are -- the amount of volumes is allocated to the different targets that you've announced, AVO-1 to 3 and through the EBITDA target.

And also, this is a very large discovery, 10 billion just with 2 wells. Are you concerned about heterogeneities across the field as well? And second question is on the CapEx for the next phase and the timing of the next appraisal wells, please.

Filipe Silva

Your second question, CapEx is we want to -- we're launching the campaign now. So this is going to be a late '24, early 2025 exercise for us. On the oil in place, 10 billion or higher is our BOE any place. It's our best assessment based on the information that we have so far. So we have data collected from the two wells and the DST. And all this has reinforced our pre-drill geological model that we had, which itself was based on our very extensive analysis of the area over the last decades. So this is not a new asset for Galp.

So the data covers only some of the structure that we had initially identified in the seismic. Some of this has been derisked plus some additional hydrocarbons that we found in the deeper targets. So we have calibrated or we are calibrating the model based on what we have proven so far. And this is the estimate that we get now. Could we -- is there risk associated with the estimate? Yes, up and down. So that's why we need to do more exploration and appraisal activities to better assess the full area of the Mopane complex.

So lots of information that we're still analyzing. A lot of the cores, the fluids has been sent into the labs. So all this is going to be -- we think, is going to demonstrate what we saw in the seismic. So a lot of reservoir updating has to be done. But you know Galp by now. We are a measured, conservative company when it comes to estimates and external communications.”

We have been with this estimate for a while now. As they say there is a risk to the estimate it could turn out to be higher or lower and they also say they are a conservative company when it comes to estimates.

About the quality and the product mix of the discovery. Same call:

“Ronald Doesburg

Matt, on Namibia, Ronald Doesburg, as we can -- this is light oil with gas condensate. So, these are fluids with associated gas. And we’re not guiding on GOR at this stage. And also, as we said before, the fluids are not the same everywhere where we have drills.

What is important, when you have light oil, low viscosity, we’re not expecting associated gas to be an issue for the development of the project. So, reinjection is most likely going to be prioritized during at least the initial few years.

And again, this is a very -- we haven’t seen trace of contaminants nor high level of CO2, nor any unexpected conditions that would lead to technical concerns. Again, early days, but looking good so far. Thank you.”

People tend to see red when they hear gas in an oil discovery. Gas condensate is better than gas. It’s a higher-value product. They are not providing a GOR(gas to oil) ratio yet. They have been saying the gas is not a problem also because they can reinject it to improve oil recovery.

Overall, Mopane discoveries have been characterized by good quality sands, good porosities, low viscosity, good permeability, no hydrogen, minimal CO2, no water contacts, good quality reservoirs, no contaminants, high pressures

Basically all that is good. I copied and pasted that into GROK to save me some time.

The Mopane discoveries in Namibia, as you've described, present an exceptionally favorable scenario for oil and gas development based on:

Good Quality Sands: Indicates well-sorted, clean sands which are ideal for forming good reservoirs.

Good Porosities: High porosity is crucial for storing large volumes of hydrocarbons.

Low Viscosity: The oil's low viscosity means it can flow more easily, which simplifies extraction and could reduce energy costs for production.

Good Permeability: This allows for efficient movement of fluids through the reservoir, which is vital for achieving high production rates.

No Hydrogen: Eliminates concerns related to hydrogen embrittlement or other hydrogen-related issues in production facilities.

Minimal CO2: Reduces potential corrosion issues and simplifies processing, as CO2 can be problematic in high concentrations.

No Water Contacts: This implies there's no water layer directly beneath the oil, which can complicate extraction by requiring water management.

Good Quality Reservoirs: A summary of the above points, confirming that the geological formation is conducive for hydrocarbon accumulation and extraction.

No Contaminants: This simplifies the refining process and potentially increases the value of the oil.

High Pressures: High reservoir pressures can naturally drive oil to the surface, which might reduce the need for artificial lift methods early in the field's life.

These characteristics collectively suggest that the Mopane field could be developed with:

Reduced Operational Challenges: With fewer contaminants, lower viscosity, and no water contacts, the operational side of extraction should be less complex.

High Recovery Potential: Good porosity and permeability with high pressures mean that a significant portion of the oil in place might be recoverable with less intensive secondary or tertiary recovery methods.

Lower Environmental Impact: Minimal CO2 and no hydrogen mean fewer concerns about greenhouse gas emissions or special handling procedures.

Economic Advantages: The ease of extraction due to the nature of the reservoir could lead to lower capital and operational expenditures, potentially making the project more economically viable.

Mopane is also the shallowest oil discovery in the Orange Basin. Which is good. Shallower is better.

Source: https://sintanaenergy.com/wp-content/uploads/2025/02/sei_corp_presentation_jan25.pdf

Look at how stacked Mopane is.

This Picture doesn’t show Venus which is deeper than Jonker and Graff.

These are each well results from Mopane so far.

1x and 2x

”The Mopane-1X well discovered, in January, significant oil columns containing light oil in high-quality reservoir sands at two different levels: AVO-1 and AVO-2. The rig then moved to the Mopane-2X location, where in March significant light oil columns were discovered in high-quality reservoir sands across exploration and appraisal targets; AVO-3, AVO-1 and a deeper target. In particular, the Mopane-2X well found AVO-1 to be in the same pressure regime as in the Mopane-1X discovery well, around 8km to the east, confirming its lateral extension.

The reservoirs’ log measures contain good porosities, high pressures and high permeabilities in large hydrocarbon columns. Fluid samples present very low oil viscosity and contain minimum CO2 and no H2S concentrations. The flows achieved during the well test have reached the maximum allowed limits of approximately 14 thousand barrels oil equivalent per day, positioning Mopane potentially as an important commercial discovery. In the Mopane complex alone, and before drilling additional exploration and appraisal wells, hydrocarbon in-place estimates are 10 billion barrels of oil equivalent, or higher.”

Leads to a 10 billion BOE-in-place estimate

Appraisal Wells

1A= “Mopane well 1A encountered light oil and gas-condensate in high quality reservoir- bearing sands, once again indicating good porosities, high permeabilities, and high pressures, as well as low oil viscosity characteristics with minimum CO2 and no H2S concentrations.

Together with the Mopane-1X (Well #1) and Mopane-2X (Well #2) findings, this appraisal well confirms the extension and quality of AVO-1. Galp and its partners will continue to analyse and integrate all newly acquired data, while progressing with the upcoming activities, which include additional exploration and appraisal wells, and a high-resolution proprietary 3D seismic campaign set to start in December 2024.”

2a=”Mopane-2A successfully encountered hydrocarbons in two reservoirs – a column of gas-condensate in AVO-3 with a thin net pay in the reservoir sweet spot, and also a column of light oil in a smaller reservoir at AVO-4.

Both reservoirs showed good quality sands, with good porosities and permeabilities, high pressures and low fluid viscosity characteristics, with minimum CO2 and no H2S concentrations. Also, in line with all previous Mopane wells, no water contacts were found.”

The market has had a lukewarm reaction to these results despite them being called successes and confirming previous findings due to the lack of information given so far about them.

Source: https://www.galp.com/corp/Portals/0/Recursos/Inv_4Q24/Results_4Q24.pdf

This is from Galp’s presentation today(17.2.2025). They didn’t say much new about Mopane even though most of the questions in the earnings call were about it. 11 billion market cap company and Mopane is the biggest focus of the analysts. They say in the presentation “successfully re-risking the Mopane complex”. I think that means that the appraisal wells are confirming the 10 billion estimate and the commercialism of the project.

Source: https://sintanaenergy.com/wp-content/uploads/2025/02/sei_corp_presentation_jan25.pdf

There is 1 exploration well left that is 3X. 3X will explore a new area targeting 2 large stacked prospects and it has the potential to add to the resource. It has been Spud(initial drilling) already, but we don’t have the results yet. This is the next positive or negative news event. The results are expected this month.

3X well result will be more important than the PEL-90 Kapana well result that started the -30% decline in the stock. I think psychologically many people think Kapana was more important because it’s a whole new block, but even if PEL-90 was successful the carry was going to end after that 1 well. 3X is an exploration well, like Kapana, which is exploring a new area, but Sintana will enjoy the results of 3X Sintana without any costs until production which makes it a more impactful well if successful.

@Jamesiebabie1 on X and ceo.ca tracks the drilling boats in real time. This is for 3X.

Source: ceo.ca, Jamiebabie

People are saying that because these boats have been in the area for so long. They must have found something or they would have rowed out of there.

There is also a high-density and high-resolution 3D development seismic being done at the moment for the whole Mopane complex. It is almost ready.

Source: ceo.ca, Jamesiebabie

The blue lines indicate where the seismic boat has been paddling. You can also see Santorini drilling 3X for Sintana and Noble Venturer drilling another exploration well below it for another company. If successful these 2 wells should turn around the current negative investor sentiment around Orange Basin. Results from both should be released very soon.

Update a few hours after this write-up was released

The Sagittarius well just below 3X has hit oil. Boding well for 3X. Although we don’t know if the discovery is considered commercial. The details have not been released yet.

Source: https://sintanaenergy.com/wp-content/uploads/2025/02/sei_corp_presentation_jan25.pdf

You can see how close Sagittarius is to 3X. There is a high likelihood their discovery reaches into PEL-83 and connects to Mopane.

Source: https://www.upstreamonline.com/exploration/rhino-hits-hydrocarbons-with-closely-watched-namibia-exploration-well/2-1-1780954

Rhino says that there was no water contact which is good and that the rig has already moved to a second location for another well which is another good sign. If the well was a failure(not deemed commercial) they would likely take a moment to calibrate before drilling the next well. Rhino is a private company so we will likely have a lack of details about their discoveries compared to the public companies that need to communicate with their large retail and institutional shareholder base.

You might ask. Why don’t I wait for those results before releasing this to have more information for this write-up? Same reason I’m not waiting for the results before buying the stock. The stock is at a 190m USD market cap right now. I think the opportunity is right now based on the current situation. The opportunity is created by the uncertainty and the lack of information we have right now. After new information comes out the stock could be higher or lower and the opportunity could be worse or better.

The case for margin of safety is that what has already been found on Mopane is worth more than the market cap. The stock will fall if 3X is unsuccessful. Because of the existing negative momentum, I could see it going to 50 cents, but from a value perspective that fall would be a buying opportunity if the existing discoveries more than justify the current market cap.

Mopane Farmout

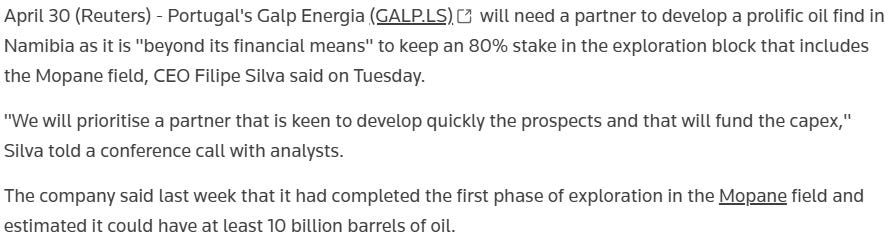

Galp has 80% WI and is funding 100% of the exploration currently. It’s a big company, but not quite big enough for a project of this size. They are looking for an even bigger company to take 40% of the project.

Article released 30.4.2024.

Source: https://www.reuters.com/business/energy/galp-ceo-says-cannot-keep-80-stake-namibia-block-2024-04-30/

“Tens of billions of dollars”, “multiple FPSO development” That puts into perspective the significance of being carried to production, but when there is first oil production Sintana will have to contribute to the costs so the carry will basically be for the first FPSO(Floating production, storage, and offload unit).

They have been negotiating for a while and Galp CEO has said they are in no rush to get this deal done. They know what they have and they will want to get a favorable deal. Also, they may be stalling on purpose to drill more wells to prove the discovery more to get a better deal.

This means it could take a while to close because Galp has the financial means to do more exploration and increase the value of the discovery. From Sintana’s perspective quicker this farm out is done the better as the new supermajor would have the financial means to fast-track the development. to production. It’s also possible that a supermajor will just buy Sintana’s stake. Hard to say what the price would be exactly, but I think it would be more than the current market cap.

It has been reported/rumored/speculated in articles that I have seen that companies like Petrobras, Shell, Exxon, Woodside, Chevron, and Total are interested in Galp’s stake.

Here are some of those articles:

Petrobras bids for stake in Galp’s Namibian offshore oil discovery

ExxonMobil, Shell weighing bids for Galp Energia’s “major” Mopane oil discovery offshore Namibia

Supermajors vie for stake in Galp's huge Mopane oil find off Namibia

These companies have FU money. Galp CEO says he wants to get a partner that will pay for the capex and develop this quickly. With Sintana being carried more money spent and faster the better. This would unlock a lot of value for Sintana. Galp still has to be considerate with their spending, but a supermajor would be able to develop Mopane and at the same time explore the targets in the north.

Farm out will be bullish for Sintana, but I would not expect it to happen in the short term.

Mopane Valuation

A lot of valuations have been made for Mopane. I don’t want to make one. Here are some valuations from other people to show you how Mopane is being valued using different methods.

Source: https://sintanaenergy.com/wp-content/uploads/2025/01/SEI-16.01.2025.pdf

Auctus Advisors is the main analyst for Sintana. Their conservative estimate for Mopane alone is at 1.08$ which would still be 50% upside from the current share price.

Source: ceo.ca, drezinho, Jimmy_oil

Great work from drezinho and Jimmy_oil.

Comparison with Venus valuation

You can also compare the valuation of Impact Oil And Gas(a private company) to Sintana. This way you can see the difference in how the private market values Orange Basin discoveries to how the public market values them.

Impact Oil and Gas owns 9,5% of the Venus discovery carried interest to production. Venus is their only valuable asset. Their other assets are trivial.

Impact’s valuation according to the last transaction was 843,9m USD. Venus had an estimated 5.1 billion barrels of oil in place at the time of the valuation according to NAMCOR(Namibian National Oil Company).

Unlike Impact, Sintana has a valuable portfolio of other assets. Sintana has a better carry on Mopane than Impact has on Venus. Sintana’s carry is not repayable from production. Impact’s carry is a zero-interest loan covering the development costs that are going to have to be repaid from production. Mopane is bigger than Venus according to current estimates. Mopane is much shallower than Venus making it easier to develop and produce.

Even if we forget all that and just equate Venus and Mopane and say Impact would also have 4.9% the valuation would be 435.97m USD.

Still, Sintana’s market cap is a mere 190m USD. Are the institutional investors valuing Impact correct or are the retail investors valuing Sintana correct?

Source: https://www.bloomberg.com/news/articles/2024-05-21/exxon-shell-said-to-mull-bids-for-stake-in-galp-s-namibia-field

Could it!? It could be worth 20 billion dollars according to Bloomberg. That’s a serious newspaper and we should take this 20 billion dollars very seriously.

Wait a minute. Let me get my calculator.

20 billion times 0,049=980m USD and because Sintana is carried to production it’s worth even more than the normal 4.9%. Let’s throw in like 400m USD for that. And then and then. There are many other prospects of the north of Mopane in PEL 83 also carried for Sintana. Let’s say they find another 20 billion USD from there. And of course, we need to add another 400m USD for the carry.

980+980+400+400=2,76 Billion USD for Sintana’s stake in PEL 83 alone.

What is Sintana’s market cap again? It’s 190m USD.

What were you saying? Nothing? Yeah. That’s what I thought.

Let’s just leave it at that. No more valuations are needed. Bloomberg just blew everyone’s minds.

Shell write down

As mentioned earlier Shell did a 400m USD write-down on their Orange Basin exploration assets. This has also hurt Sintana's stock as a side effect. They unleashed a contagious decease of doubt about the Orange Basin.

What are the reasons for Shell’s write-down and do they apply to Mopane?

Source: https://sintanaenergy.com/wp-content/uploads/2025/01/SEI-06.01.2025.pdf

That’s good. I guess we can all have a sigh of relief. Autus Advisors coming in with the rescue. The Shell reservoir is bad. The Mopane reservoir is good. Mopane reservoir is better than Reservoir Dogs.

I’m sure Mopane wanted to flow 100000 mboe/d, but it was constrained to 8 mboe/d by the pathetic surface equipment.

Also Fracking?! I’m against fracking. It causes environmental damage and oppresses the oil price. Unless it’s done in Colombia. In particular in Sintana’s WMM-37 block which is ripe for fracking. I support fracking in WMM-37, but nowhere else.

Source: https://www.observer24.com.na/namcor-and-partners-forge-ahead-with-promising-offshore-oil-projects/

I agree with Dubai. Nobody should be sending out these negative signals about Orange Basin that could hurt the stock prices of Sintana, Eco Atlantic, and Africa Oil. It’s wrong.

According to Dubai, the write-down was done because of internal and financial considerations. Interesting.

Source: https://www.upstreamonline.com/exploration/shell-boss-restates-majors-interest-in-namibia-opportunities-despite-write-down/2-1-1772677

To my dismay, I encountered a paywall, but you can see in the part that is about to be engulfed by the paywall that Shell is saying the problems are with porosity and permeability which are components of reservoir quality and associated gas.

It’s subsurface issues, porosity, permeability, and associated gas.

Mopane is very porous and permeable. These are not a problem. Galp has said that the gas is not a problem and they can reinject it to improve recovery.

“What is important, when you have light oil, low viscosity, we’re not expecting associated gas to be an issue for the development of the project. So, reinjection is most likely going to be prioritized during at least the initial few years.” Galp

Pancontinetal also talks about Poor reservoir quality and the gas, but they also say that PEL 83 drilling “continues to support 10 billion barrel resource” and note that they say barrel, not BOE which includes gas. And that Sintana’s current valuation is not even pricing in 10 billion BOE. Pancontinental tends to have the best reports about Orange Basin activity which means them saying this is meaningful.

Source: https://africanminingmarket.com/namibia-responds-to-shell-orange-basin-write-down/20827/

Then Namibian government comes to the rescue and says Shell’s projects are commercially viable.

What did we learn here? Maybe Shell’s discoveries are commercial or not, but Mopane does not have the problems Shell’s discoveries have. This is why the spillover effect from Shell’s write-down causing Sintana’s stock price to fall provides a buying opportunity in my opinion.

There was a lot about PEL-83. I think based on current data it’s worth more than Sintana’s market cap and has the potential to multibag Sintana’s stock with further exploration, development, and proving current estimates. Turning them from resources to reserves. All this without any costs to Sintana and I haven’t even talked about the significant potential contained in Sintana’s other assets yet.

That was the free part which was around 60% of the article. The next part is 40% of the article where I cover all of the other assets Sintana has(PEL-87, PEL-79, PEL-90, PEL-82, PEL-103, and WMM-37). If the current market cap doesn’t even account for PEL-83 these other assets are free upside potential. And these are not trash assets some of these assets have Mopane-like potential. In particular PEL-87.

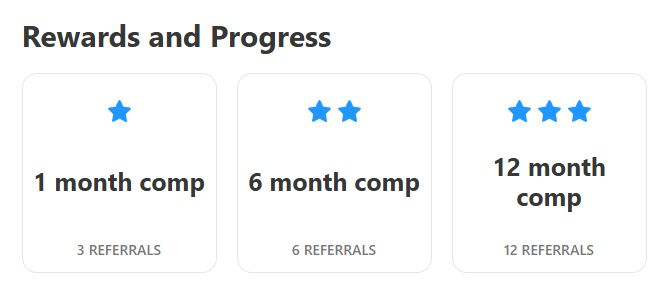

If you don’t want to pay but do want to continue reading. You need to bring me souls. Using the buttons below will count as referrals. The rewards are stackable.

PEL 87, Orange Basin, Namibia, 7.3% WI

…