Cerrado Gold: Too Cheap To Ignore

They don't know about Cerrado

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian short AD: THE LINK

Get a 7-day free trial and the SUMMER SALE 60$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

If you sign up for 1 year of SA premium using my link, you will get a free one-year premium sub to my substack. Contact me and provide proof.

This article is long. Press “view entire message” when the article gets cut off in Gmail.

If you read my article “follow your ex-investments” you would know that I follow my ex-investments, and if you follow me on Twitter, you may know that I was in this stock briefly starting a small position at 34 cents in last december, averaged up, and then I sold it for a small profit in February at 46 cents, and during last month I returned and built a medium sized position in Cerrado at 63-65 cents.

Why this change of mind? Why re-enter at 37% higher price than I sold at? This write-up will answer these questions and more.

Cerrado Gold has a Gold mine in Argentina, a polymetallic(many metals) development stage project in Portugal, and an Iron Ore development stage Project in Quebec, Canada.

Source:https://www.cerradogold.com/images/pdf/Presentations/2025/Consolidated_Cerrado_Gold_Corporate_Presentation_-_June_2025_-_Print_Version_compressed.pdf

Argentina gold mine NPV and FCF at different gold prices.

Source:https://www.cerradogold.com/images/pdf/Presentations/2025/Consolidated_Cerrado_Gold_Corporate_Presentation_-_June_2025_-_Print_Version_compressed.pdf

Based on these images, the combined NPV of the company is 2.02 billion USD, and they make 61.1m USD of FCF per year at 3300$ gold(current price 3436$). The current market cap is 71.77m USD. The EV is 102.77m USD.

Now I have your attention.

Let’s go over some general info before diving into Cerrado’s financials, assets, and capital allocation plan.

Source: Google

This was/is a turnaround play, having already gone up +300% from the lows. The share price increase so far has been a combination of the gold price going up and the company’s deleveraging, with asset sales, which removed the bankruptcy fears.

Source:https://www.cerradogold.com/images/pdf/Presentations/2025/Consolidated_Cerrado_Gold_Corporate_Presentation_-_June_2025_-_Print_Version_compressed.pdf

Clean Capital structure with a decent insider ownership of 25%, low institutional ownership, and low analyst coverage. Which is one of the multiple reasons for the current low valuation.

Balance Sheet

There are two balance sheets that are relevant because Cerrado recently acquired Ascendant Resources, which is not reflected in the Q1 Cerrado Balance sheet. This acquisition has closed, and the dilution from the acquisition is included in the current market cap.

Source: CERT-2025-05-29-interim-financial-statementsreport-english-3fdd.pdf

Source: https://ceo.ca/content/sedar/ASND-2025-05-14-interim-financial-statementsreport-english-4a6c.pdf

There are a bunch of different liabilities, and not all of them should be counted as debt, so I will break down some of these items.

Cerrado side: the 19m of provisions are for eventual mine closure, the 25m stream is accounted for in the costs

Ascendant side: Stream of 3,746m is a stream, 4m of related party debt for Ascendant is owed to Cerrado so that has been cancelled as aqcuisition has closed, 6,158m put liability is a potential sum ascendant may have to pay to acquire 20% of their main project if the company called MF&I decides to make Ascendant pay that, Ascendant owns 80% now, and 6,158m sum is 5% of the post-tax NPV using 10,5% discount rate.

To calculate the EV, I’m including cash and liabilities that are debt.

Now I’m rounding the cash number to 20m and rounding the debt numbers to 6.5m for LT debt, 4m for ST debt,10m for promissory note and 12.5m for prepayment facility, and 18m for Ascendant note.

Our EV is 71,77(Market Cap)+51(debt)-20(Cash)=102,77m USD EV

While this EV leaves out some real liabilities, it also doesn’t include 15m USD Cerrado will be receiving from an asset sale and a potential 10m USD from an option agreement in 2025-2028.

Source:https://www.cerradogold.com/images/pdf/Presentations/2025/Consolidated_Cerrado_Gold_Corporate_Presentation_-_June_2025_-_Print_Version_compressed.pdf

15m is from the sale of their Brazilian gold assets last year. 45m have already been received, and the buyer is a big company that is solid financially.

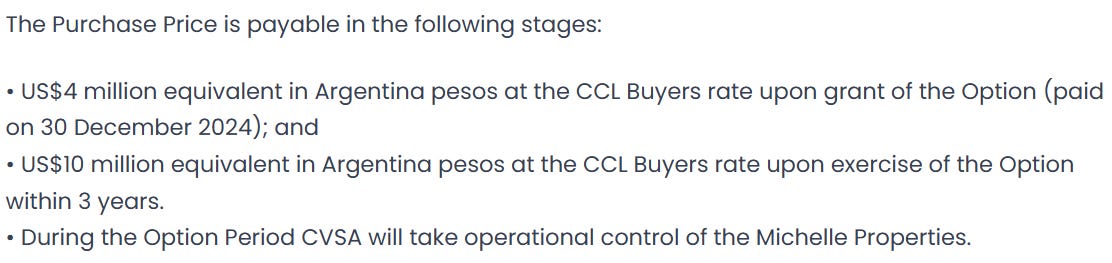

10m USD from the option agreement is for a potential sale of some of Cerrado’s exploration properties that the company considers non-core assets in Argentina and can be received at any time before December 30, 2027. Cerrado has already received 4m USD from this option.

Source: Minera Don Nicolas Enters Option Agreement with AngloGold Ashanti Argentinian Subsidiary, Cerro Vanguardia SA, for the Sale of its Michelle Exploration Properties | Panorama Minero

Empire Building Management

May 2023: Cerrado completes the acquisition of Voyager Metals using stock. 1.6 B$ NPV Mont Sorcier.

May 2025: Cerrado completes the acquisition of Ascendant Resources using stock. 147m NPV Lagoa Salgada.

Source:https://www.cerradogold.com/images/pdf/Presentations/2025/Consolidated_Cerrado_Gold_Corporate_Presentation_-_June_2025_-_Print_Version_compressed.pdf

As a full ethnic Mongolian, I’m obviously fond of empire building. It’s genetic. But in the case of Cerrado’s empire-building, I have some premonitions about it. While Cerrado did some asset sales last year to deleverage and re-focus the company, based on the official plans the company is putting out, it seems that an empire is being built, and the question is whether Mark Brennan, the CEO, is more like Genghis or Kublai, and what is the quality of his horde?

Source:https://www.cerradogold.com/images/pdf/Presentations/2025/Consolidated_Cerrado_Gold_Corporate_Presentation_-_June_2025_-_Print_Version_compressed.pdf

This management has taken it upon themselves to build a mine in Portugal, so it’s good to see a strong track record and experience in building a mine. The CEO, director, and COO all used to be at Largo Resources, and the CEO built a mine at Largo. However, I can’t let them get away with that Lassondo Curve BS(bottom left corner), that sort of visually tricks people into imagining the stock price would also look like that.

Source: Google

I didn’t take the exact days when Mark became and resigned as CEO, but those are the correct months, and while the stock is down a bit during his reign, it’s not too bad in the context of the commodity market. The stock went through the commodity supercycle bubble, the 2008 financial crisis, recovered, and then in 2014 commodity prices started dropping again, which caused the stock to drop right after Mark left, and the mine Largo had been building started production.

The CEO has built a mine at Largo, had success at Sierra and Desert Sun, and owns 5,756,422 shares, which is about 4.3% of the company’s shares.

As I said earlier, I sold this stock and then bought back in, and the reason why I sold was the acquisition of Ascendant and the plan to build a mine in Portugal. The reasoning was that it added risks and changed the thesis from “deleveraging with asset sales, focusing on core assets, buybacks, dividends, easy re-rating” to “building more mines with existing cash flow”. The first thesis was easy money at the current valuation. The second thesis has more upside potential, but the money is not as easy. And with cash flowing commodity stocks, I’m always looking for easy money. I’m not looking for a potential 10- 100x like with something like Aduro or Heartbeam. With stocks like Cerrado, my goal is a +50- 200% return and to take profits in 6-18 months and rotate to something else.

Source: AlmostMongolian

For those interested. I sold Africa Oil 2nd round couple of months ago. It’s cheap, but it doesn’t stack up with other opportunities. They have no motion. Total is dragging its feet with Africa Oil’s Orange Basin assets. Stall cityyyyy!

I still hate the Portugal acquisition. Even if it ends up being a great success, I will not say later that I should have supported it. Based on the information I had at the time and have now. It clearly raises the difficulty level of the money. We were on level 1 difficulty of money, and then they raised it to level 2 with some extra rewards for shareholders if they beat level 2, but I want them to play on level 1, because this is mining, and level 1 is difficult enough.

And the market agreed with me on this acquisition. I got out at 46 cents when it was announced, and right after the stock fell back to 35 cents. The gold price and developments with the Argentine gold mine have caused the subsequent recovery. The stock has gone to 74 cents now despite the acquisition, not because of it.

And I can’t ignore the fact that they acquired a related party and its implications. Was it the best acquisition they could have made that just happened to be a related party that was founded and chaired by the CEO of Cerrado?

The optimistic argument would be that the CEO knows the asset inside and out, and knew it was undervalued, and it was only a modest premium, and it was a shrewd play because the dirt on the project has metykogplfinic rock, which means with more drilling it will quadrupple the research. You must do your research.

The pessimistic argument would be that the CEO bailed out his failing Portugal project by using his cash-flowing company Cerrado, and is now using Cerrado’s cash flows that could be going to, for example, massive buybacks for his risky pipe dream, possibly for emotional and selfish reasons based on his long involvement with the Portugal Project and his own shareholding in it prior to the acquistion.

Source: https://ceo.ca/asnd

This is the stock performance of Ascendant before Cerrado acquired it. Later in the asset deep dive section, I will talk about this asset more. Even some positive things.

Their Capital allocation plan also includes stock buybacks. They have a normal course issuer bid in place, but they have not been utilizing it.

Source: https://ceo.ca/@accesswire/cerrado-files-notice-to-implement-normal-course-issuer

In February, they said they would start the buybacks once the acquisition closed. It closed, and they haven’t bought back anything. June 2nd, according to some guy in ceo.ca, they are supposedly starting it after the underground development goes according to plan, and I will not verify this information.

Source: tsxventurewatch, ceo.ca

This is starting to sound negative, so it’s time to move on to why I like this stock and why I bought back in, which is due to their other assets and some recent developments with those assets. If they never acquired Portugal, and this company would be just Argentina and Quebec, this would be a top 3 position of mine; now that they did, it’s 7th among the 11 positions in The AlmostMongolian portfolio, which is still a major achievement for any company. Only around 0,00099% of the world’s companies ever get there.

Argentina

The Argentina gold mine, Minera Don Nicolas, which I will refer to as MDN for the rest of the article, is the core of this investment thesis. If the gold price hovers around 2500-3500$(current price 3452$) and Cerrado doesn’t fumble operationally, the stock is very cheap based on just MDN.

Source: https://www.cerradogold.com/images/pdf/Presentations/2025/Consolidated_Cerrado_Gold_Corporate_Presentation_-_June_2025_-_Print_Version_compressed.pdf

At 3300$ gold and producing 55,263k GEO(gold equivalent ounces) per year, they make 61.1m USD of FCF. Their guidance for 2025 is 55-60k GEO. The company uses GEO because the mine also produces some silver, but the majority of revenue comes from gold.

With this lower than the current gold price and the low end of production guidance number, the P/FCF=1.17 and EV/FCF=1.68 (using my EV calculation)

MDN 111m USD NPV at 2100$ gold and 273m USD NPV at 3300$ gold. NPV is not that high because, at the moment, the official LOM(life of mine) is only 5 years. Cerrado is working on extending that significantly. To be honest, I don’t care about NPV, because I’m not a nerd with science books and a calculator going “Erm, what is the NPV on this?”, “I need to calculate the NPV before investing in anything”. I don’t even know what NPV means.

Whatever NPV is, Cerrado has 2,02 billion USD of it: Argentina 273 m+Portugal 147 m+Canada 1,6B. Huge discount to market cap and EV. Usually you see discounts like this with companies that have a development project, but no cash flow, because the market is taking into account the fact that a company will have to do a lot of dilution or give up a large % of the project to a larger company to be able to develop it, but Cerrado has significant cash flow and lender support for project development.

There is a lot more potential in MDN than 55k ounces per year and 5 years of LOM, as it’s shown as the base case on the slides. A collection of factors caused the past 12 months’ financials not to be as good as one would think based on the gold price, and I will go over why that is and why Cerrado is projecting much higher cash flows going forward, starting with Q2. Some of these factors are definitely going to improve their numbers, and some are up to Cerrado to execute.

Rough estimate, this was around 28.74% of this article. The 71,26% are behind a paywall. The rest of the article goes in-depth on Argentina operations, production growth plans, Life of mine increase plans, costs, hedging, Argentina government policy change benefits, and after that, I’m covering Lagoa Salgada and Mont Sorcier and summarizing my outlook on why I think the stock is such a great risk/reward.

If you want access to the paid content without paying, use the two buttons below to generate AlmostMongolian subscribers. Free subscribers count. The rewards are stacked. You can track your referrals on the new Leaderboard page.

MDN production growth

…