Hydreight/VST Combo: Hyperbolic Growth

"Shopify for healtcare"

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha.

Mongolian AD: THE LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

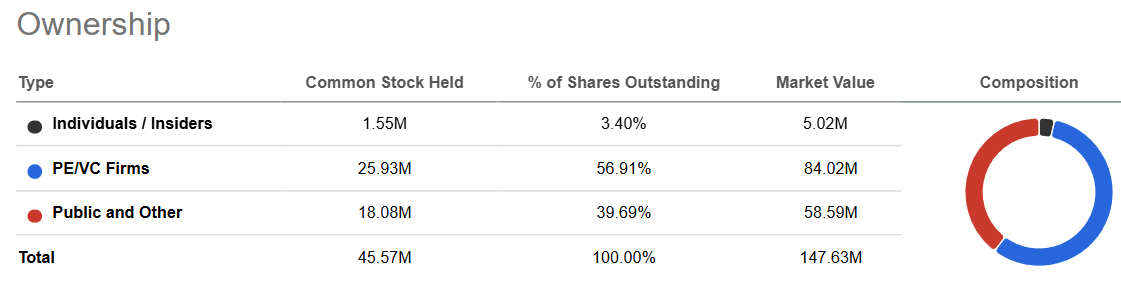

$NURS.V Hydreight Technologies is a health and wellness technology company. VST (Victory Square Technologies, ticker $VST.CN) is a publicly listed venture capital and private equity firm that previously owned Hydreight fully and now holds approximately 57% of Hydreight's shares. Investing in both is essentially investing in Hydreight in 2 ways. Currently, my Hydreight investment is split around 40% Hydreight and 60% VST, and these two stocks combined would be the largest position in The AlmostMongolian Portfolio. In other words, Hydreight is my largest position and the one I’m most excited about.

I started this position in early April. Premski, who was my co-writer on the Beacon Write-up, presented this investment idea to me, and many of the slides in this article are from his presentation. This is my first time writing about Hydreight or VST on Substack, but I have been tweeting about these stocks quite frequently.

Source: https://x.com/AlmostMongolian/status/1911401383317614680

The stock increased tenfold from October 2024 to January 2025. This was because the company unveiled a new product called VSDHone and projected massive growth for this product in 2025 onwards. Then the stock experienced a correction due to the trade war-induced market crash, capital raise, and doubts about Hydreight’s ability to deliver started to mount. Market perception has since shifted:

Source: Google

I sold Africa oil for this. Imagine if I had kept Africa Oil and hadn’t bought Hydreight. Just the thought sends shivers down my spine.

In early July, I switched 50% of my Hydreight position to VST and have recently increased my VST position even after the big run-up. The VST situation will be explained in the 2nd half of this write-up.

Source: Google

Recently, Hydreight reached a new all-time high, with VST following a similar pattern. This was because Hydreight presented data indicating that it can deliver its ambitious growth projections and even exceed them. Before covering that, some basic info.

Capital Structure and Balance Sheet

Source: Seeking Alpha

That 56.91% PE/VC owner is VST.

In addition to the 45.57m shares outstanding(or something around there). There are 3.7m warrants and 2.25m new shares committed for an Acquisition.

Market cap=160m CAD, 116m USD

Balance Sheet CAD:

Source: https://ceo.ca/content/sedar/NURS-2025-08-25-interim-financial-statementsreport-english-6bf8.pdf

A 10m CAD convertible offering was subsequently announced, which will be covered in detail later.

What does Hydreight do?

Hydreight has 3 verticals: Nurses, Stores, and the new vertical VSDHone. First, I will briefly explain the first two older and less important verticals.

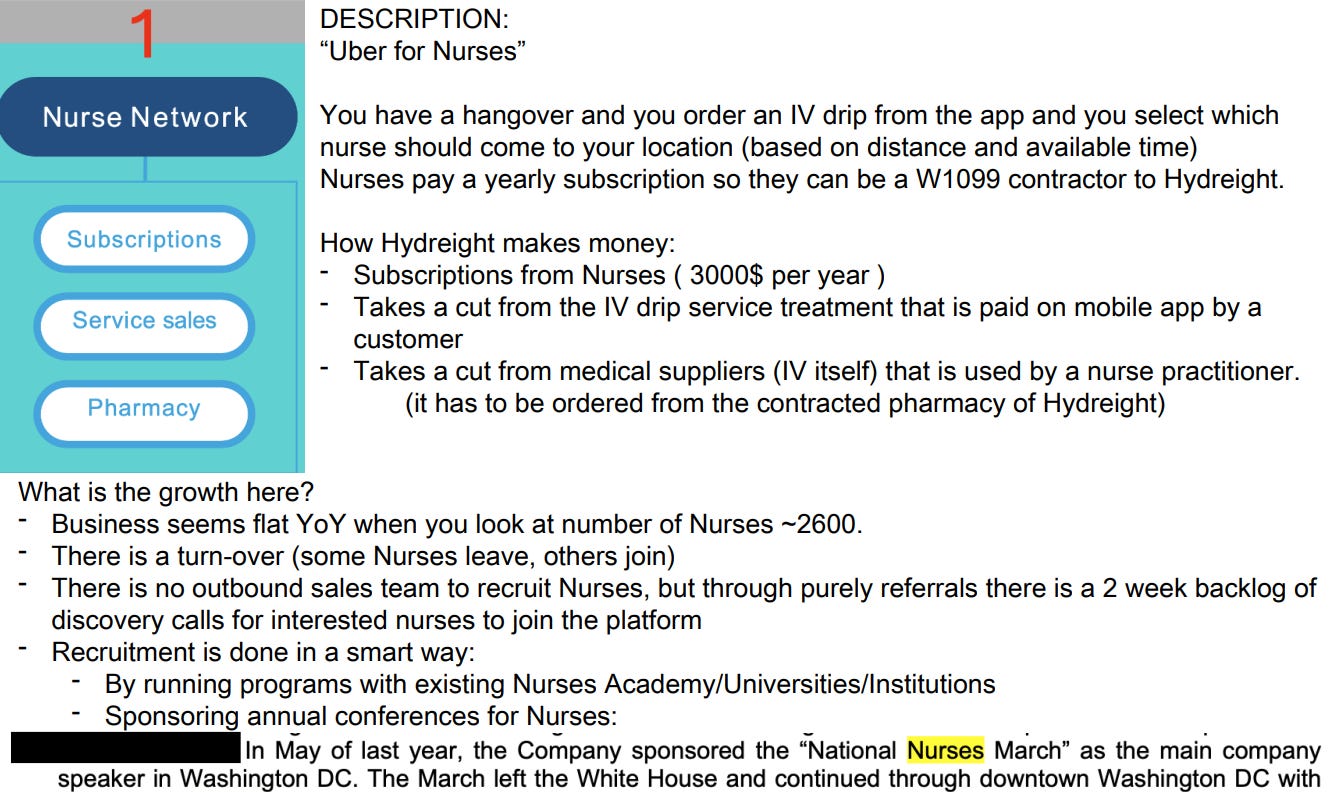

Nurses

Hydreight, “Uber for nurses,” is a platform that enables nurses to monetize their skills outside of the traditional setting. They pay Hydreight 3k per year for the platform. They are required to order supplies through Hydreight’s channels, and Hydreight receives a 10% commission from transactions on the platform.

Source: Premski

The only thing outdated about this slide is that Nurses are growing, “Approximately 77% growth in new Nurse signups compared to Q2, 2024” Q2 2025 earnings release.

Video explanation of the Nurse business:

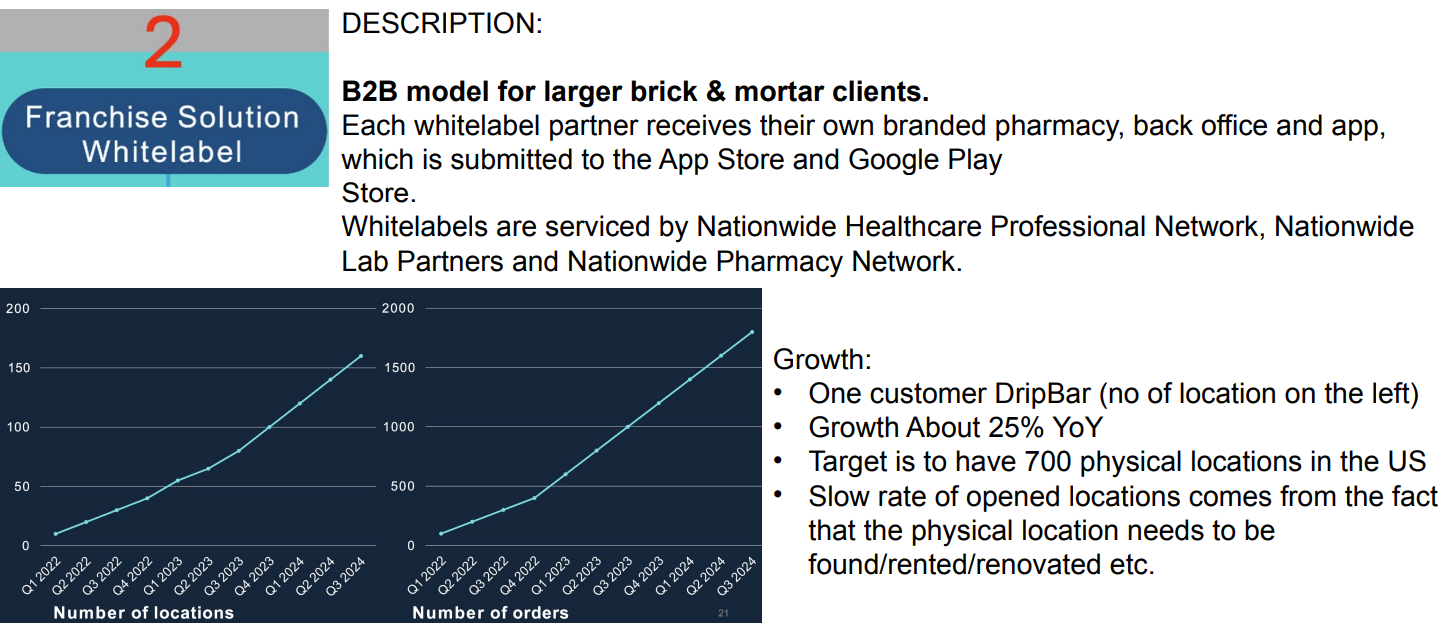

Stores

This business is called “Franchise solution Whitelabel”, I call it stores.

Source: Hydreight, Premski

Stores.

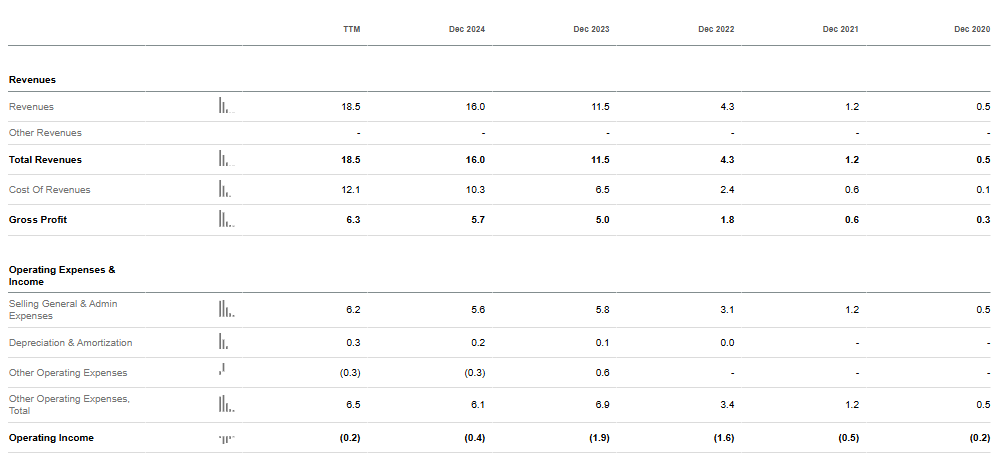

Hydreight has achieved strong growth with just nurses and stores in the past years.

Source: Seeking Alpha Premium

Hydreight has predicted 30% growth for these 2 verticals for 2025. And based on recent results, they are doing around that much. Q2 was 33% YoY growth, 5,38M GAAP revenue, 7.35M Topline revenue, and GAAP net income of 48k. These numbers were achieved without a meaningful contribution from their 3rd vertical, which will start impacting Q3 materially.

“The Company defines Top Line or Adjusted Revenue as gross cash income before adjustment for the deferred portion of business partner contract revenue and gross receipts from Hydreight App service sales.” Basically, topline is all the cash that came in during that quarter.

When I bought my first shares, the market cap was around 55m CAD, and they had already proven they could grow without VSDHone. Therefore, these businesses provided some margin of safety if VSDHone had not panned out. However, the market cap is now 160m CAD, which is based entirely on VSDHone expectations, meaning nurses and Stores do not matter as much anymore. This is why I’m spending more time with VSDHone in this article.

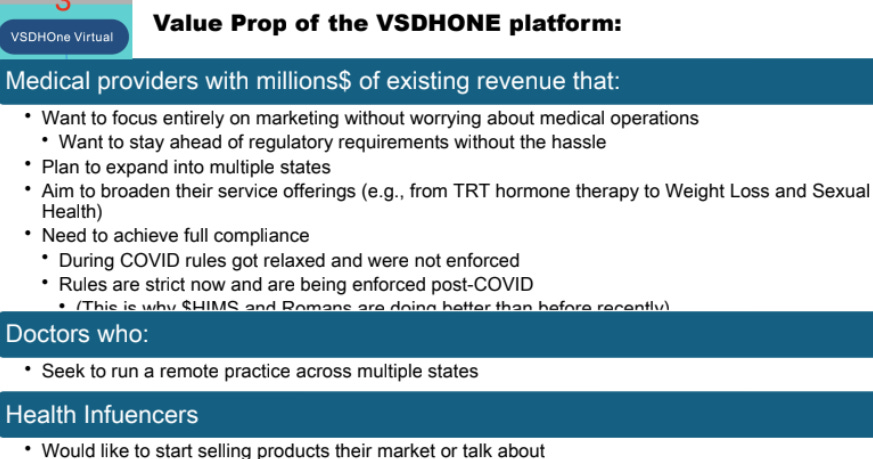

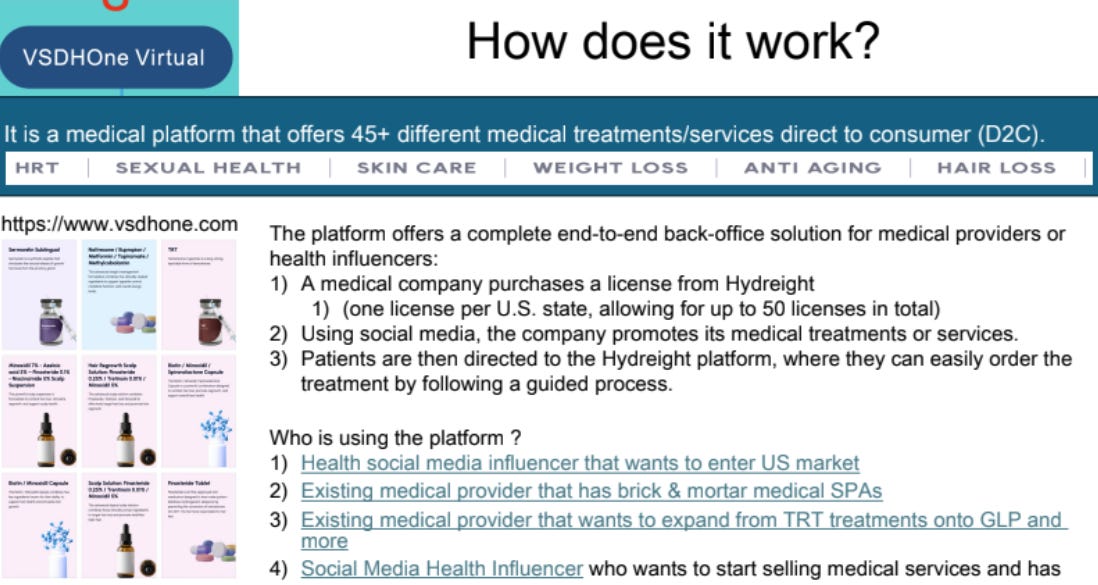

VSHDHone

VSDHone is a Direct-To-Consumer healthcare platform that provides the infrastructure for health and Wellness companies to start offering medical services online nationwide in all 50 states of the USA. Hydreight provides everything other brands need (telemedicine, pharmacy, compliance, payments, logistics) to sell essential, life-saving medicines like TRT and Ozempic alternatives in all 50 states, and Hydreight is the only one offering this type of service at the moment.

Companies like Hims and Hers are not direct competitors to Hydreight. They sell products under their own brand. Hims and Hers is like Amazon, while Hydreight is like Shopify. Hydreight allows other companies to launch their own version of Hims and Hers.

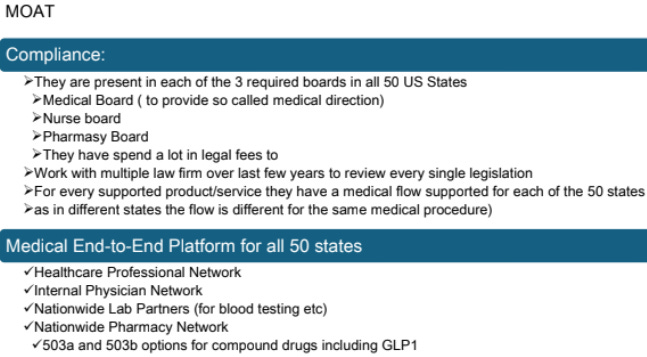

The biggest moat for Hydreight is its ability to navigate the complex regulatory landscape of the US healthcare system on behalf of its clients. For years, they have built their medical infrastructure, and VSDHone is the culmination of that work.

Source: Premski. For all of these slides in this section

How does VSDHone make money?

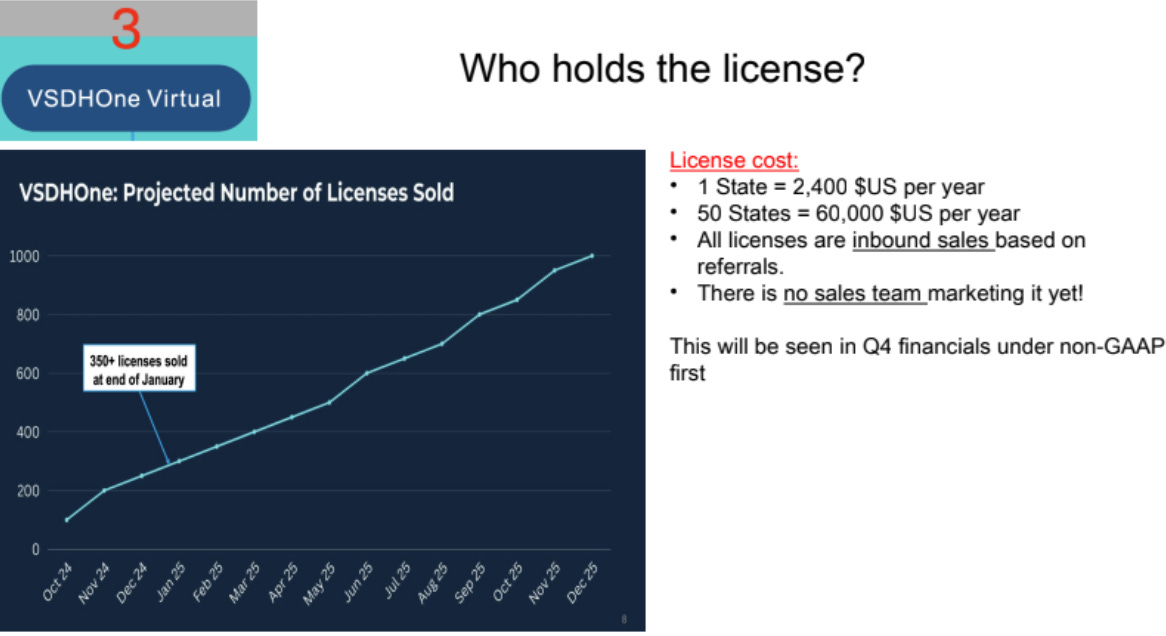

VSDHone generates revenue through licenses and orders. Selling licenses leads to orders, and most of the revenue will come from orders. Here is what VSDHone makes from licenses:

Source: Premski

This is recurring revenue, as the customer must renew the license annually. They project 1,000 licensees by year-end, and based on the chart, they should have around 700 licensees at the moment.

Revenue from selling these licenses is not significant, at best 2-4 million CAD for 2025, and they likely waived initial fees for some large clients and first adopters.

What is much more important is the number of orders they receive from these licensees.

Source: Hydreight Corporate presentation

Orders are projected to explode by the end of the year. With the assumption of continued strong growth going into next year. The projection for 2025 is 1.3 million total orders, with a December exit rate of 400,000 per month. These projections do not assume new licensees. The management states that the ramp-up expectations are primarily based on current licensees onboarding their businesses to VSDHone.

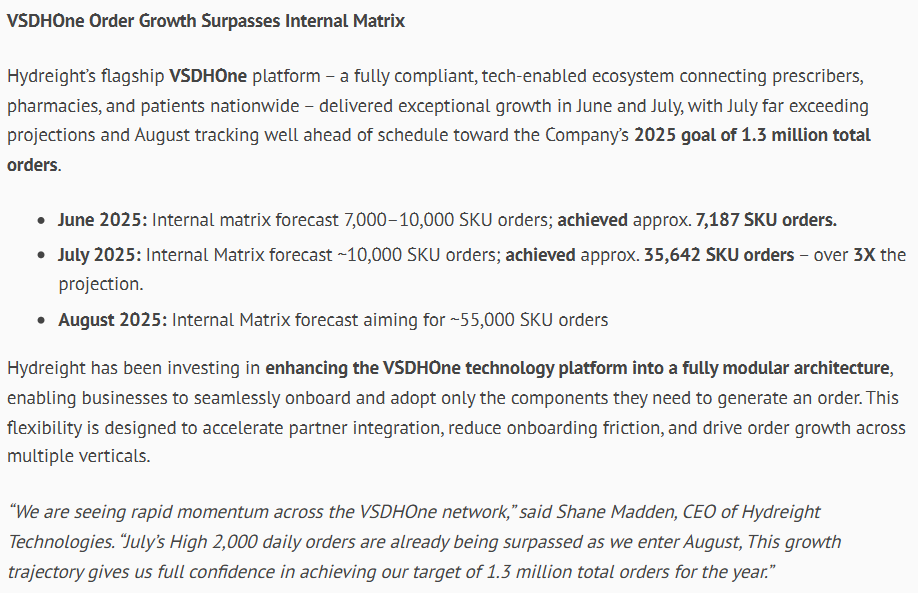

These were seen as wild projections when they were announced. In the past, Hydreight has hit its projected numbers, but this was such an ambitious projection, unlike anything they projected in the past, that it’s going to take execution for the market to believe it. Now the company is starting to show execution as they released order numbers for the first time on August 12th:

Source: https://ceo.ca/@GlobeNewswire/hydreight-posts-record-vsdhone-growth-ahead-of-2025

“July’s high of 2,000 daily orders are already being surpassed as we enter august,”. Over 2,000 daily orders would mean a run rate of more than 60,000 orders per month, and this run rate was already achieved as they entered August. Based on the growth rates we are seeing, I would expect them to surpass their Internal forecasts of 55k again in August, just as they did in July.

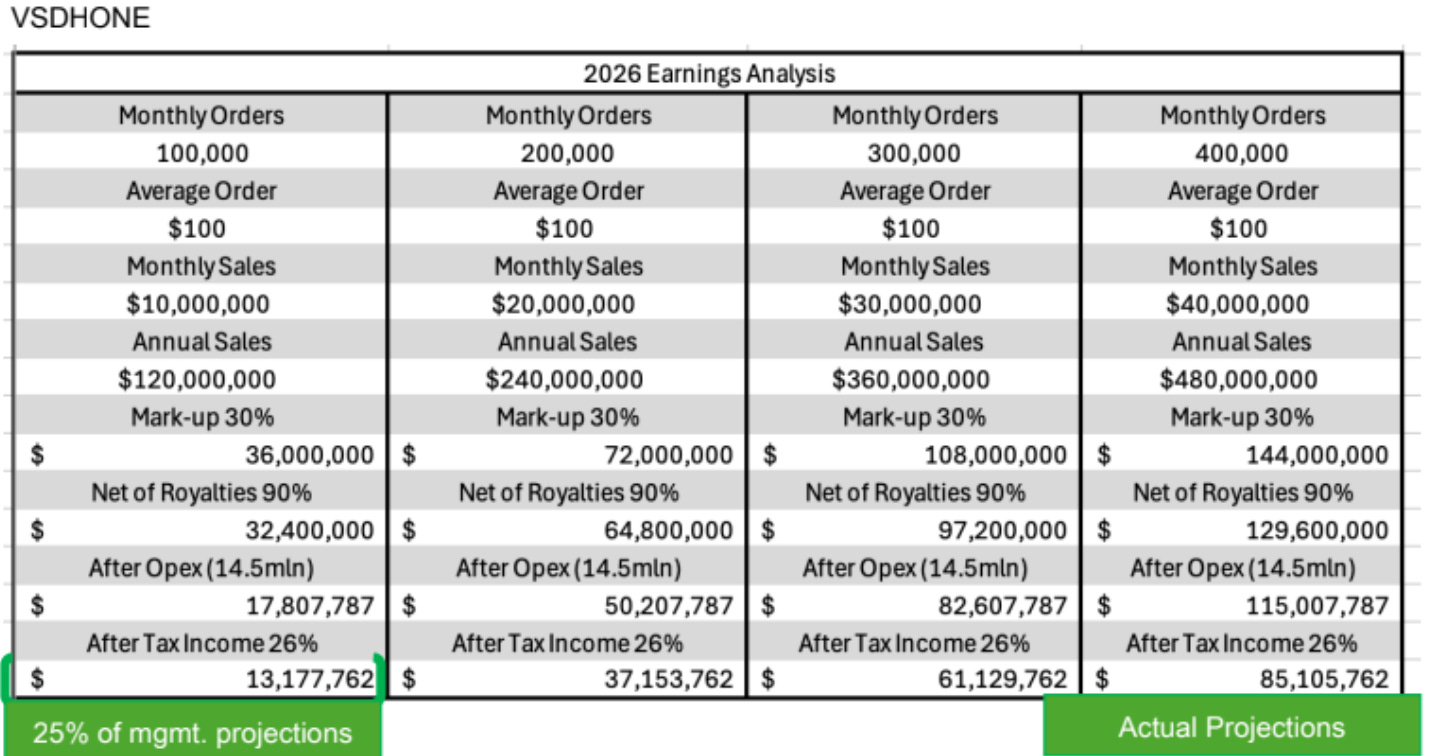

VSDHone future earnings analysis

The first question is “How many orders?” and, naturally, the second question is “How much money does Hydreight make per order?” We don’t have official data for this yet, but we can use a combination of management statements, analyst statements, and online information about the prices of the products they sell to make some speculative projections if Hydreight reaches its order goals for 2025.

AOV(average order value)

We don’t have data for this yet, but we can try to estimate it based on what they sell. CEO answering questions about product split:

“The other third vertical, which is self-administered, has over 45 treatments. TRT is obviously one of the big ones, GLP one, of course, and obviously, the peptides, sexual health, things like that. So the IVs wouldn’t fall into that category whatsoever. But I would say pretty evenly spread between TRT and GLP, one at the moment. TRT is huge.”

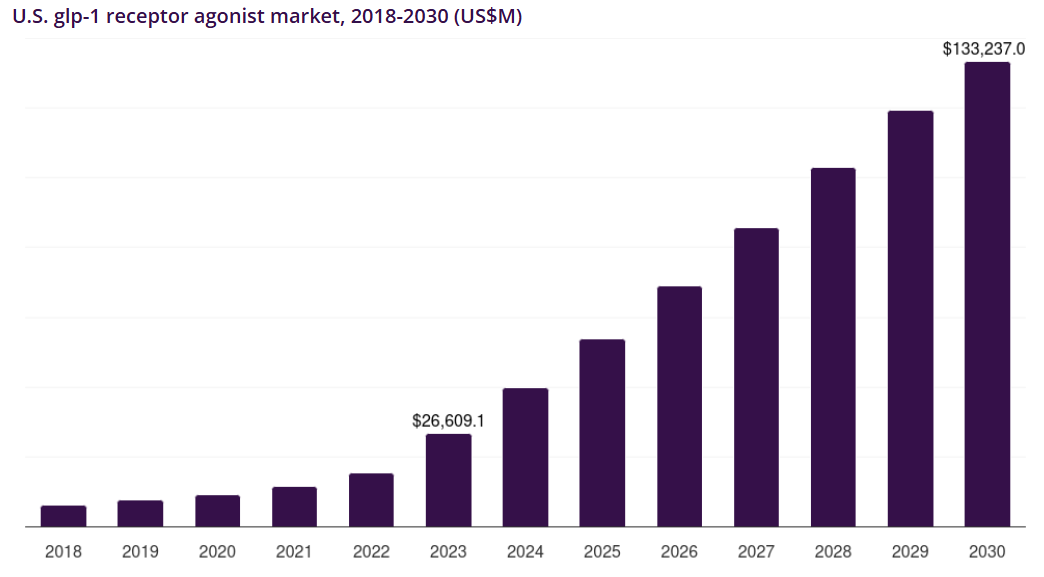

TRT and GLP are the big ones, and they are “pretty evenly spread”, and then there are 45 other treatments. So let’s say 1/3 GLP, 1/3 TRT, and 1/3 other. In the future, GLP-1s are expected to capture a larger share, driven by projected massive growth.

Source:https://www.grandviewresearch.com/horizon/outlook/glp-1-receptor-agonist-market/united-states

Pricing for this product split: When I searched the internet, I found a lot of variance in monthly GLP pricing, based on product, etc., with a range of $200-$1,500. I’m using $300 for GLP, as that was the Number the chairman used as an example for the GLP order on Discord.

Self-administered TRT injections in the US are 30-150$. Let’s say 90$ for TRT.

Here is an AI estimate of what some of the other products could cost:

Peptides (e.g., sermorelin, BPC-157): $100–$500/month.

Hair Loss Treatments (e.g., minoxidil, finasteride): $30–$150/month.

Skincare Treatments (e.g., tretinoin, serums): $20–$200/month.

Sexual Health (e.g., sildenafil, PT-141): $20–$200/month.

NAD+ Therapy (injections, sprays, patches): $100–$500/month.

Genetic Testing: $100–$300 per test, $50–$200/month for plans.

Supplements: $10–$100/month.

Other Personalized Treatments: $50–$500/month.

The midpoint for these would be $171, but I’m using $50 because the cheaper ones would most likely receive way more orders.

If orders are split as 1/3 $300 GLP, 1/3 $90 TRT, and 1/3 $50, the average order would be $146.67. Let’s round that up to $150. Based on management statements, the Licensee would take 1/3 of that, meaning Hydreight would make $100 in revenue per order. USD.

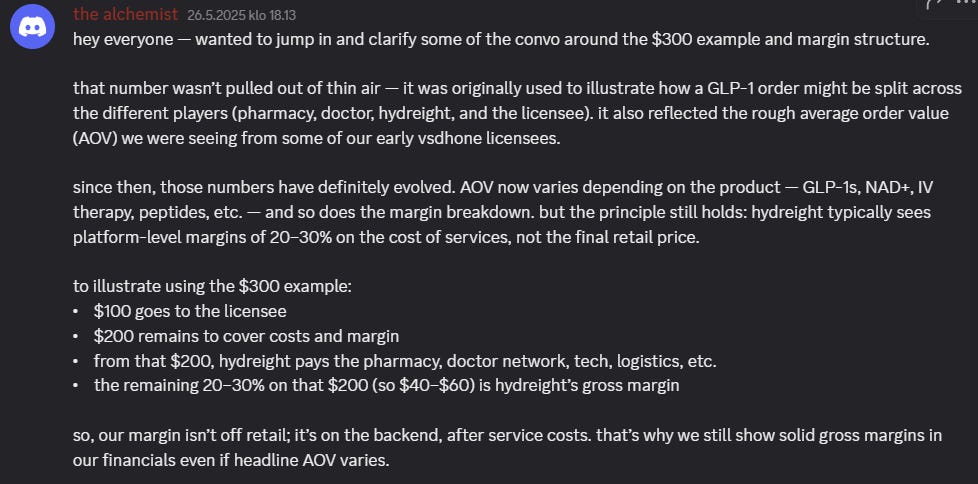

↓Why I used 300$ for GLP and took 1/3 of the price to get Hydreigh’s revenue per order↓

Source: VST Discord

This is a message from the Chairman of Hydreight and Chairman and CEO of VST, who communicates with shareholders through a VST Discord channel with the username The Alchemist. Only in Canadian Micro-caps.

other estimates

“Based on Hydreight’s previous disclosure of expecting to generate ~$80–$120 per order, combined with the company’s goal of hitting 1.3M in orders, this would imply ~$100M in revenues to Hydreight from VSDHOne alone in CY25,” Beacon Securities analyst Gabriel Leung.

“Beacon Securities” This is a sign

“Assuming average order price of C$60 represents additional revenue of C$78M.” Maxim Group. That would be 44$ USD.

Both Beacon and Maxim are assuming that those prices are Hydreight’s cut, not the price for the customer, and we know that from their revenue projections.

The chairman gave some comments about this AOV:

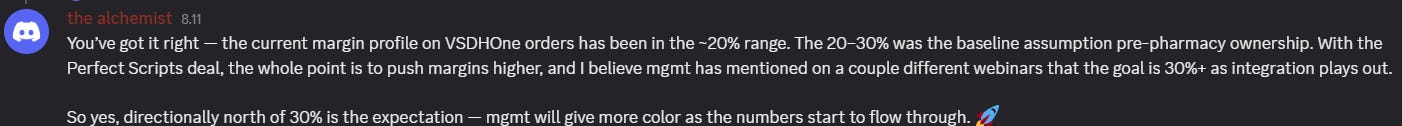

On the AOV: while it’s true that individual products like TRT, GLP1s, and genetic testing are priced well above $100 USD, there are also many lower-priced SKUs. With 50+ products in the mix, the blended AOV will likely settle closer to what Maxim used (~C$60). That’s why Vahid noted on the Q2 webinar that mgmt wants to wait until September’s numbers to have three months of data before providing investors with an official figure. So bottom line — mgmt is holding firm on the 400K Dec run-rate, and the AOV figure will be disclosed with more precision after Q3, but the ~$60 baseline is a fair placeholder for now.

You’ve got it exactly right — the ~$60 AOV assumption Maxim used is on Hydreight’s side (what we book as revenue), before any markup by VSDHOne clients.

AOV will move around as new products roll out and the mix evolves, so $60 is really just a conservative modeling assumption. We should have a much better sample size and clearer read by the end of September

He says the AOV will likely settle closer to Maxim’s assumption of $60 CAD ($44 USD) than $100 USD, but also that $60 CAD is a conservative modeling assumption. So the eventual number will likely end up being something in between.

Gross Margin per order

The original expectation was 20-30% margins. Since then, the company has initiated a strategic partnership with a pharmacy, which they expect to push margins above 30% once the integration is complete.

Source: VST Discord

Calculations of future earnings at different monthly order amounts that the company expects to achieve during this year. Calculation at 100$ per order and 44$ per order. USD for both. Using 30% gross margin as they expect to get there and higher OPEX based on ramp-up in marketing, hiring, etc. 100$ USD per order:

Source: Premski. Conveniently, I was able to calculate the AOV in such a way that made this old calculation by Premski work for this article, so I didn’t have to make one myself.

Same calculation but for 44$ USD(Maxim estimate) per order:

Hydreight has a market cap of 116M USD. Assuming the company reaches its goal run-rate of 400k orders per month in December, the P/E at that run-rate just from VSDHone would be 3.7 at 44$ per order and 1.36 at 100$ per order. Assuming continued fast growth going forward, I would expect PE to be at least 20. In the range of 20-100.

These calculations are more illustrative of the potential if they reach their order goals. Exact AOV, operating costs, and the margin are still uncertain going forward.

The larger point is: They had 35,642 orders in June, and they already achieved 2000 orders per day(60,000 monthly run-rate) in early August. They are growing rapidly, and if they reach their goal of 400,000 orders by December, they will generate a significant net income, and the stock will not be valued at its current level. Even if they massively underperform their goal and reach their 400k goal a year later, this investment should still be a multibagger in that scenario.

However, fixating on a certain order goal in a certain time frame, given the future potential, is missing the forest for the trees. The trend is what is most important. Whether they are on track to reach 1, 3, 5, or 10 million monthly orders in the coming years. Here are some Bluesky scenarios, with the only change being that OPEX increased from $14.5m to $50m.

Q3 revenue estimates based on 100$ and 44$ AOV USD

Q3 revenue estimate based on 30% y-o-y growth from the old verticals and for VSDHone using the order numbers and stated goals: orders July=35,642, August=60,000(2k daily reached early August), September=100,000(rough goal)=195,642 orders for Q3.

3.3*1,3=4.29m USD revenue without VSDHone 1.5m Gross profit

195 642*100$=19,56m+4.29m=23,85m

195 642*44$=8.6m+4.29m=12.29m USD = 16.9m CAD. Maxim's estimate was 15.2m CAD using 44$, meaning they must have assumed fewer orders or less growth from the other verticals

Whether we consider the high AOV (456.18% revenue Y-O-Y) or the conservative AOV (186.48% revenue growth Y-O-Y), it’s impressive revenue growth as VSDHone is just ramping up.

Sector tailwinds

Telehealth is one of the fastest-growing industries in the US and in the world. Although in Hydreight’s case, what matters is the US because their MOAT is dealing with the US regulatory environment.

The CAGR (compound annual growth rate) estimates generally fall within the range of 20-30% from today to 2030. According to some estimates, it exceeds the CAGR of the most hyped industry in the world, AI, although AI CAGR estimates are generally higher, with a typical range of 25-40%.

Source: https://www.grandviewresearch.com/industry-analysis/telehealth-market-report

The North American Telehealth market is generally estimated to be in the range of 60-80 billion USD market size now. There is considerable room for growth in telehealth, as the US total healthcare market is valued at around $ 5 trillion, and telehealth is poised to be the future of medicine. Especially self-administered telehealth, which is what VSDHone does.

This was around 45% of this article. The rest covers the recent convertible, Perfect Scripts deal, Capital allocation, licensees, VST investment case, VST’s portfolio, VST advantages and disadvantages over Hydreight, and why I prefer it at the moment to Hydreight.

If you want access to the paid content without paying, use the two buttons below to generate AlmostMongolian subscribers. Free subscribers count. The rewards are stacked

Convertible and Capital Allocation

Despite being profitable and having a strong balance sheet, on August 18th, Hydreight announced a convertible offering…