Western Gold Resources: The Cheapest Australian Gold Stock

Friendship ended with Beacon Minerals. Now Western Gold Resources is my best friend.

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian AD: THE LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

This is a very straightforward investment thesis. $WGR.AX Western Gold Resources owns a dime a dozen gold project in Western Australia called the Duke Gold Project. Duke doesn’t have a huge resource, and it doesn’t stand out in terms of costs or grade. However, Duke is perfectly positioned to benefit from the current gold price surge, given its very low capital expenditure and rapid development time. Considering the valuation of Western Gold Resources, this creates an asymmetric situation in my view.

Source: https://wcsecure.weblink.com.au/pdf/WGR/03006654.pdf

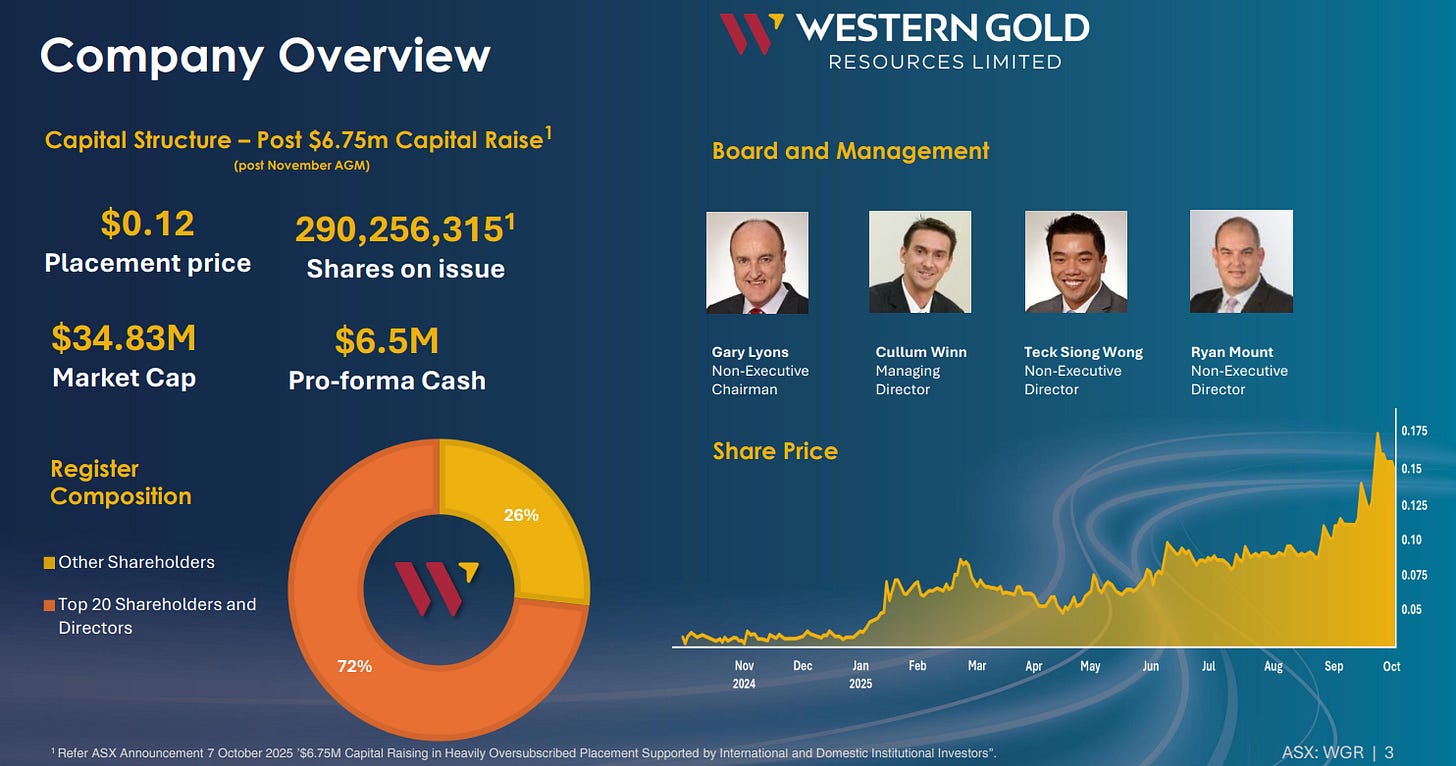

Western Gold Resources has a fully diluted market cap of 46.4m AUD. The stock is now at 0.16$. I started the position at 0.105$ and added a bit at 0.155$.

Cash: $6.75 million AUD from a recent raise, which is enough to fund Duke to production.

Debt: $3 million AUD non-converting loan facility secured, but I haven’t found info on how much has been drawn down, if any, as of yet.

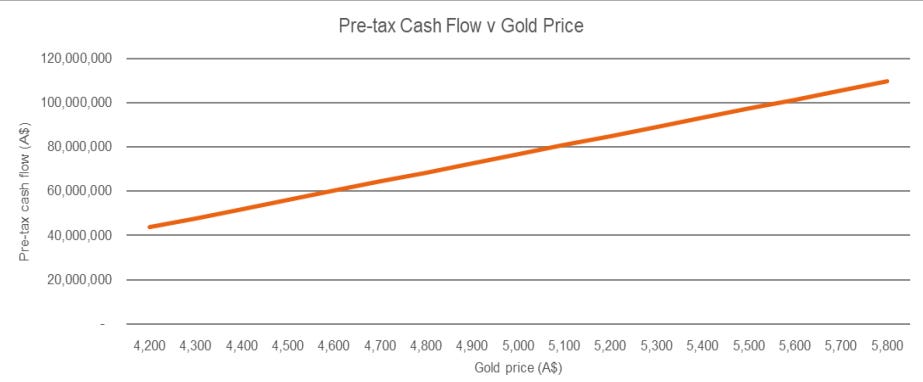

After their recent raise, they are now fully funded to start gold production for phase 1 of the Duke Gold project. The first revenues start in early 2026. Phase 1 has a mine life of 14 months. And this is how much pre-tax cash flow it will make in 14 months based on gold prices going from 4200 AUD(2726 USD) to 5800 AUD(3765 USD). Note that the current gold price is 6655 AUD=4321 USD.

Source: Recently updated scoping study https://wcsecure.weblink.com.au/pdf/WGR/02997936.pdf

This is from their scoping study that was updated in September. Tax rate is 30%. Around 5600 AUD(3635 USD) gold price and upwards, they start making +100m pre-tax, which means +70m post-tax. For a company with a market capitalization of 46.4m, fully funded and near production, with net cash.

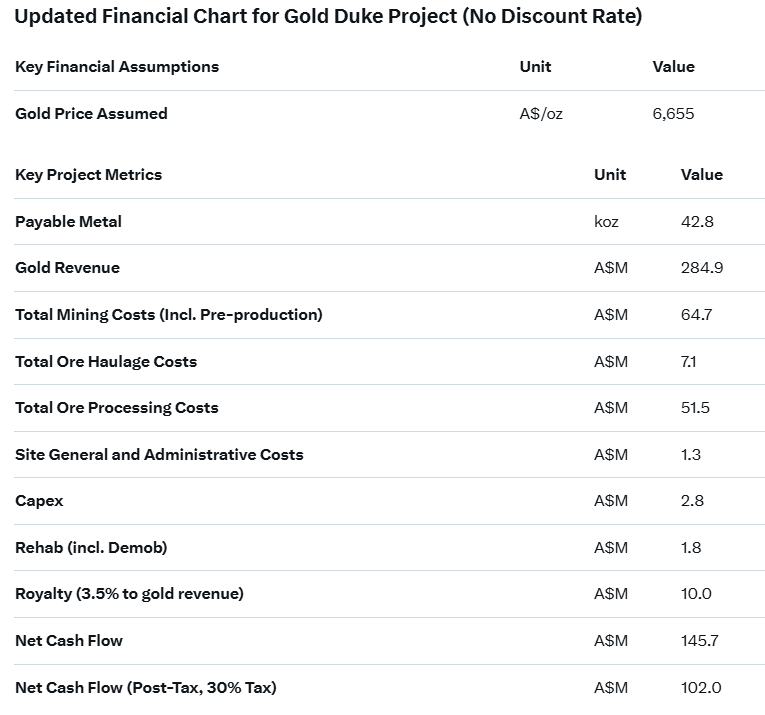

Here is the estimate using the current gold price of 6655 AUD based on the information from the scoping study.

This is what the company would make if the gold price holds at the current level in the 14-month production period of phase 1 of the Duke Gold project.

This was around 20% of this article. The 80% behind the paywall goes over the path to production, mineral resources, expansion opportunities for phases 2 and 3, main risks, comparisons to my other gold picks, and more on my positioning and closing thoughts

Bring in new free or paid AlmostMongolian subscribers with the two buttons below to earn free access to paid content.

The CAPEX is…