West Wits Mining: Emerging Giant

A lot of gold

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian AD: THE LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

This is another investment idea that Darp Research shared with me. His links: X, Seeking Alpha, ceo.ca.

$WWI.AX West Wits Mining is currently putting into production the first new underground gold mine in South Africa in 15 years. The mine is in Witwatersrand Basin, and according to various estimates, this area has produced 25-50% of all the gold ever mined, making it the most prolific gold field in history. The South African currency “rand” was named after it.

The mine is fully permitted, and West Wits is fully financed to achieve steady-state production of 70k ounces per year, with a future potential of 200k per year. Mining of the ore has already commenced, and the first gold pour is anticipated in Q1 2026. The first gold pour refers to the moment when the processing plant has produced refined gold from the mined material.

source: https://westwitsmining.com/wp-content/uploads/2025/09/WWI_Corporate_Presentation_September2025-.pdf

West Wits owns 74% of the Witwatersrand Basin Project(WBP) in South Africa. This project has a Mineral Resource Estimate of 5 million ounces (Moz) of gold at a grade of 4.66 g/t, as defined under the 2012 JORC Code, which is currently in use. Under the old JORC code, this area had a historical Mineral resource estimate of 12.8 moz at a grade of 4.6 g/t.

source: https://westwitsmining.com/wp-content/uploads/2025/09/WWI_Corporate_Presentation_September2025-.pdf

The current stock price is 0,047$ AUD, and the current market capitalization is 184m AUD, equivalent to 120m USD. My cost-basis is 0,037$ AUD. They have credit facilities of 62,5m USD available to them with 22.5m USD of potential additional capacity, and they are cashed up from recent raises.

The WBP project comprises 5 stages.

source: https://westwitsmining.com/wp-content/uploads/2025/09/WWI_Corporate_Presentation_September2025-.pdf

Stage 1= Qala Shallows 17-year life of mine, Gold

Stage 1-4=Increases the life of mine to 27 years, Gold

Stage 5=Potential standalone gold and uranium Project.

Qala Shallows

Currently, West Wits is putting Stage 1 of the WBP project into production, known as Qala Shallows, with the first gold pour expected in Q1 2026. Qala Shallows is what is really relevant for us at the moment, as it is a massive project in itself and is worth significantly more than the valuation of West Wits.

source: https://westwitsmining.com/wp-content/uploads/2025/09/WWI_Corporate_Presentation_September2025-.pdf

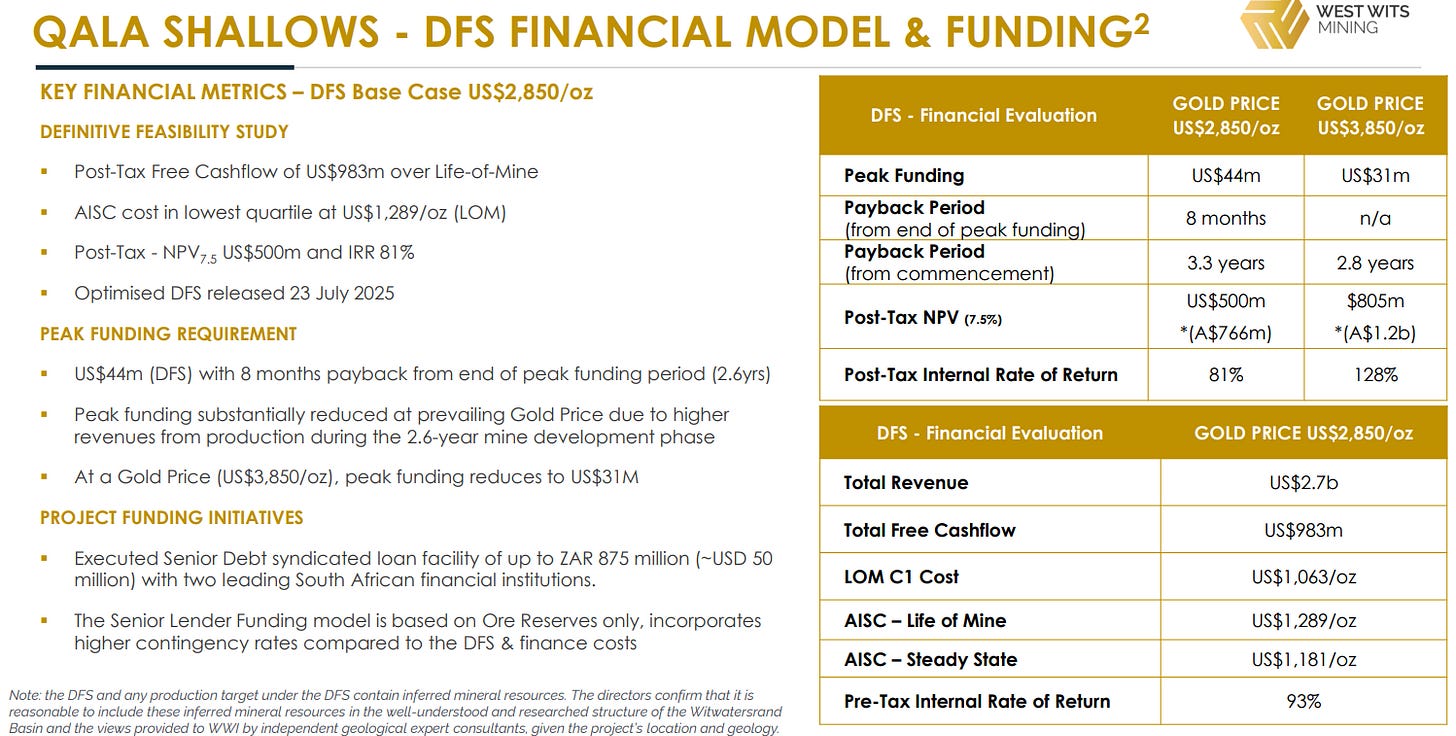

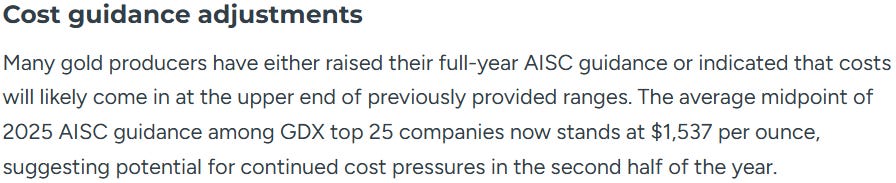

Long LOM, High IRR, and low cost. And this DFS is relevant, and the cost estimates are not outdated, as the DFS was updated in July 2025. AISC at 1,289$ over the LOM and 1,181$ steady state is materially lower than the AISC of top gold companies.

Source: https://discoveryalert.com.au/news/gold-mining-sector-historic-quarter-2025/

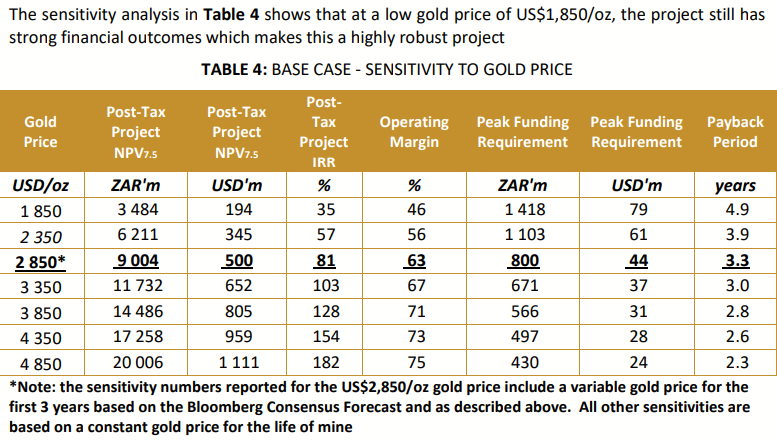

Due to the stock having a low valuation and the mine being low-cost and long LOM, this project is also successful at significantly lower gold prices. West Wits is not hedging at the moment, but being low cost offers some margin of safety if the gold price falls, if the company delivers operationally.

Source: https://wcsecure.weblink.com.au/pdf/WWI/02969995.pdf

A day will come when I look up what NPV means, but it is not this day! At the current gold price of 3847$, the post-tax NPV is around $805 million USD. West Wits owns 74% so it is 0,74*805=595,7m USD for them. This is just for Qala Shallows. The stage 1. This compares to a market cap of $ 120m USD, which is quite remarkable considering that this project is fully permitted, fully financed, and is on track to extract ore next month and to achieve the first gold pour in Q1 2026. You can find many junior mining companies trading at large discounts to their NPVs, but these situations are almost always paired with a lack of permits, a lack of financing, a long time until production, etc. A situation with a discount this large and production about to start, with all the roadblocks cleared, is rare.

Today, West Wits confirmed that it’s fully financed to pour gold in Q1 2026, in a press release announcing that it has executed an agreement for a previously announced loan facility.

Source: https://hotcopper.com.au/threads/ann-wwi-signs-agreements-for-usd-12-5m-loan-facility.8793763/#post-80906113

They said these things before, but the market likes to see it said officially in a press release, so the stock was up 14,63% today.

Comparisons with peers

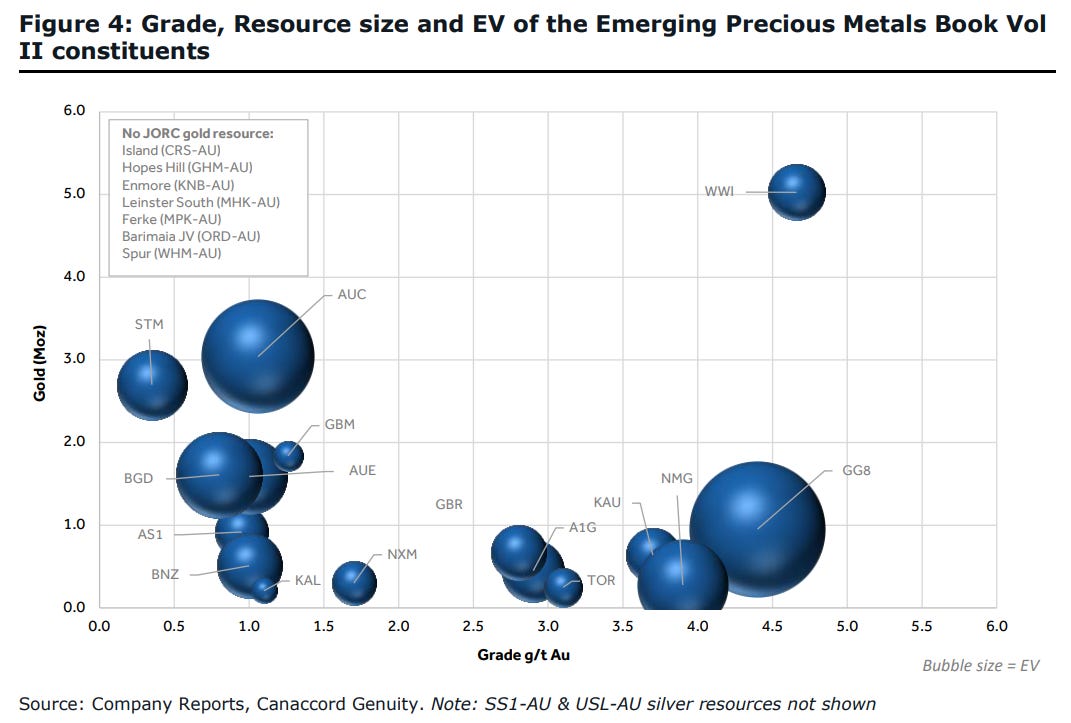

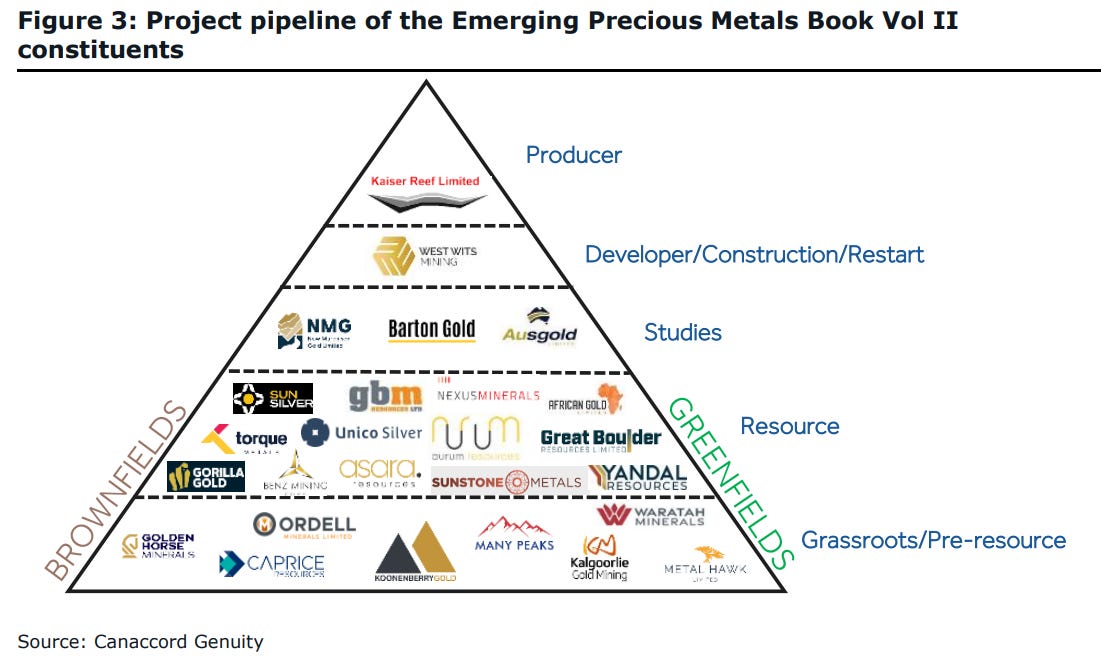

This is from Canacord’s The Emerging Precious Metals Book, Vol. II (Vol. 1 was published in 2024 and doesn’t include WWI), published on 12.5.2025, where they compare and highlight 26 precious metals companies exploring or planning to move into/increase production in the coming years.

Source: https://bartongold.com.au/wp-content/uploads/CanaccorGenuityReport12May25.pdf

The size of the blue ball represents the EV, and West Wits has the largest JORC resource and the best grade of the group, although it has a lower EV than most. The EV of West Wits has increased since then, but so has the EV of almost every other company here due to rabidly rising gold prices. Therefore, the valuation difference has not changed significantly based on examining the stock prices of these companies. The jurisdictions of these companies were a mix of 1st, 2nd, and 3rd world countries, although weighted towards Western Australia.

Within this group, there is one producer, Kaiser Reef ($KAU.AX), and the rest are not in production. Among those that are not in production, West Wits is the closest.

Source: https://bartongold.com.au/wp-content/uploads/CanaccorGenuityReport12May25.pdf

Not only is West Wits beating its peers in grade and resource size, but also in closeness to production, and it is still valued cheaper than them.

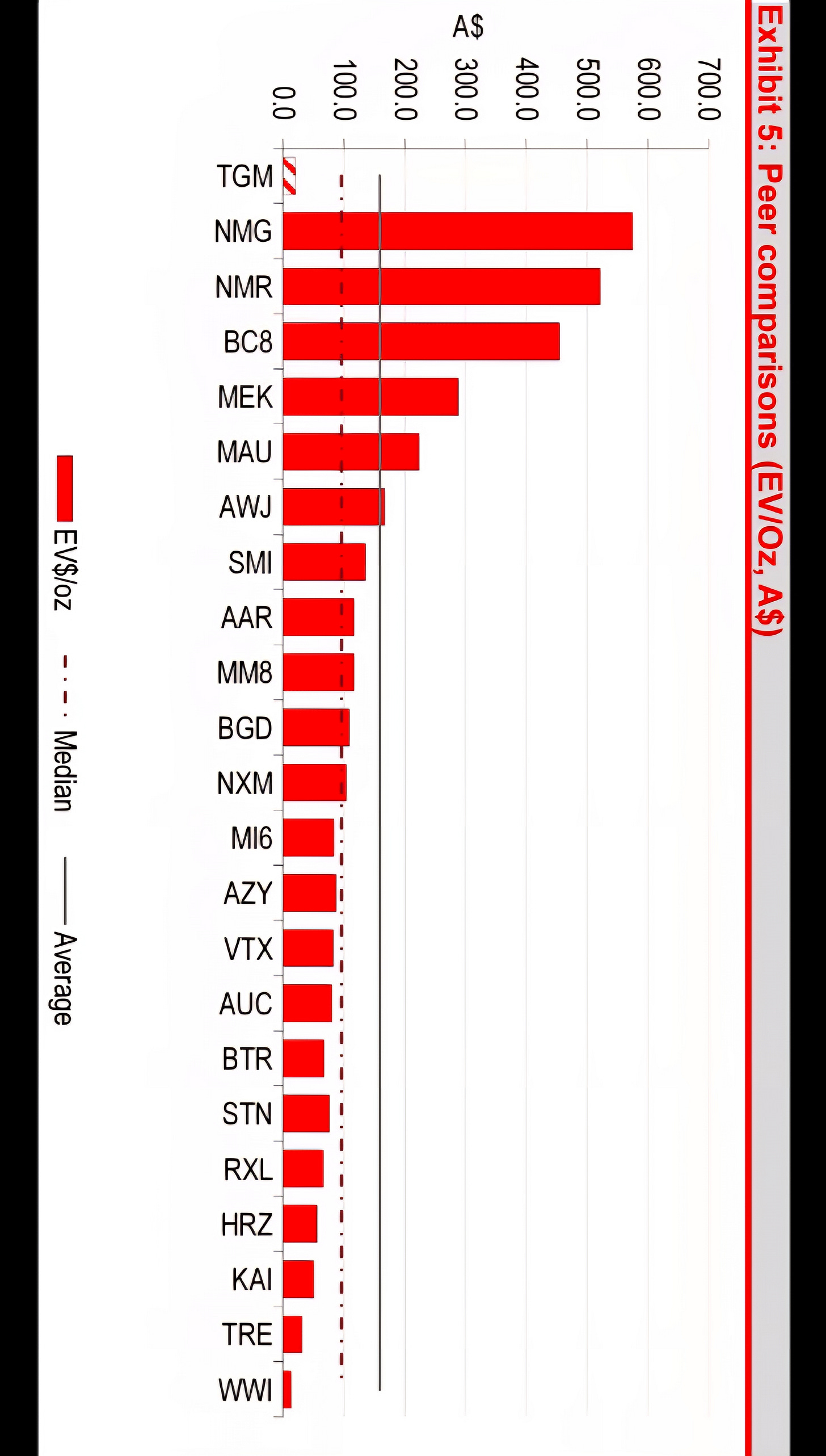

Source: Posted on hotcopper.com

This was posted on the Hotcopper WWI discussion. I am unsure of the source or the date of publication. Seems to be even older than the previous comparison, as West Wits EV is lower than in that one, but I assume WWI would still have the cheapest EV/OZ of this group, due to my assumption that gold price rise has also multibagged the share prices of all the other stocks here(possibly with 1-2 exceptions).

From what I have found, only the jurisdiction risk of SA seems to explain the valuation difference, but looking at all the factors, West Wits is also cheaper and superior to its 2nd and 3rd world peers. SA is like a mix of 1st and 3rd world, but more on that in the jurisdiction section.

This was around 1/4 of the Article. 3/4 are behind the paywall, covering production projections, Project 200, earning projections, more on resources and reserves, financing, jurisdiction risks, and a summary.

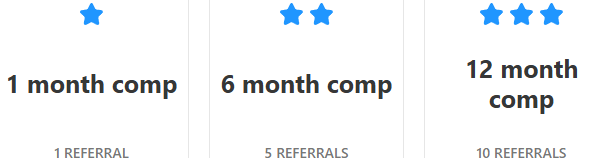

Bring in new free or paid AlmostMongolian subscribers with the two buttons below to gain free access to paid content.

Production projections

…