I like tin. The odds are in favor of tin going higher. I’ll go over why real quick.

Source: Rio Tinto

This shows that the long-term demand for tin is quite secure and should most likely significantly grow in the future.

Source: Bloomberg, posted by Mark Thompson

This is like Mark says “interesting” looking at the tin price below. There is almost dare I say a correlation. Well, I’m not going to dare to say that. I would not say something like that.

Source: Trading Economics

But what we can see is that an important negative demand driver recently is turning into a positive one.

But who cares about demand? Who cares about whether people want the stuff? What is important is how much people are producing it. The supply. Of course the supply.

I will use other people’s posts again to make my point

Source: Respeculator, USGS

I’m not too familiar with Peru. However, the number 2 and 3 producers Indonesia and Burma have some serious risks to their production. They are 36,55% of the world’s production. What if they have prolonged supply disruptions in a commodity with growing demand? Like Respeculator remarks it’s a powder keg.

Source: AlmostMongolian, Illustration of a powder keg

In Indonesia, most of the tin mining is illegal or informal and there seems to be a shift starting with people and communities getting tired of its impacts and a possible crackdown starting to happen. @JeffSawick is doing an in-depth kind of a series on this on X so you should follow him if you’re interested in this.

Source: Geographical

The mining is doing a lot of damage, especially the sea mining, which is destroying the tourism and fishing industries. Because of this many groups with interests want it to stop completely.

We already saw a decent drop from 2022 to 2023 in Indonesia and now we have reports of tin Indonesian tin export plunging.

Source: Bloomberg, posted by Brandon Beylo

So that is Indonesia very quickly. Then we have Myanmar and this is how I became interested in this company.

Myanmar banned tin Mining in Wa State last August and that is a majority of their production and 10% of the world’s production. Similar to Saudi Arabia or the US for oil going offline. The reasoning was to protect their dwindling tin resources and formalize the mining.

https://www.internationaltin.org/myanmars-wa-state-announces-tin-mining-suspension-from-august/

Source: Mining Technology

This was announced in spring and then happened in August, but the tin price did not react to it at all and it has not since.

Some possible reasons for this:

The market had time to prepare.

The market doesn’t believe the ban will last.

There is very little data about what is happening in Myanmar and how well the ban is enforced. It is a country controlled by a military junta.

Source: LSEG

This is probably the best data we have at the moment, but it leaves a lot of questions. The ban has not been lifted, but we saw a rise in tin imports from Myanmar in November. Either these are old inventories being released or we have some cheating going on and the ban is not that strong.

As you can see there is some uncertainty, but when we combine the supply risk in Myanmar and Indonesia 36,55% of the world’s production with the tin demand outlook it paints a very asymmetric picture. Especially when tin is such a small part of the cost of any product it is used in it is not substituted if the price goes up. Below is a good video if you want to learn more.

Metals x and Alphamin

I have not placed a big bet on tin, because I invest mainly based on the company and not the commodity, and from the 2 companies that interest me only one I like enough to invest in and I don’t like it enough atm to make it a really large position. That company is Metals X.

Before I go into Metals X I will quickly explain why I do not think Alphamin's risk/reward is not good enough to make it into the AlmostMongolian portfolio.

I made this tweet.

Source: AlmostMongolian, Yellow Lab Life Capital

You can see peoples’ thoughts if you search this tweet and before I go into the meat of this. Notice how I use the word “powder keg” and remember that Respeculator used the word powder keg in his tweet and then I drew a powder keg on paint, but that tweet was actually later than my tweet so I said powder keg first. I said it first. but notice how this word keeps coming up in relation to tin. There is something there. Some connection. A powder keg is a keg that is just sitting there waiting to explode with the right stimuli. Somewhere there is a powder keg waiting to explode and it has something to do with tin, but I need to do more research on this. If you see the word powder keg connected with tin somehow bring this to my attention. It could be important.

But look at those FCF metrics for Alphamin after their mine expansion. It’s a pretty good yield, but not for Gongo. Especially not for the specific part of the Congo where Alphamins’ mine is located. They are located in the most violent state of Congo. The place is a powder keg.

I want something like 40-50% FCF yield at the current tin price to even think about investing in there not 17%. I will never say a place is uninvestable or unspeculatable (you just witnessed the creation of a new word) if the valuation is cheap enough I would even invest in a place like California or even Sweden.

17% at the current price is not good enough for me and I would never question the math done by a koala.

look at this place.

Source: Aclecdata

https://acleddata.com/conflict-watchlist-2023/drc/

Codeco is kind of a tribal militia. ADF is an Islamist group which is an ISIS affiliate. M23 is a Tutsi rebel group supported by DRCs neighbor Rwanda. But one thing that unites them all is their love for violence.

And Rwanda vs DRC is also a possible armed conflict in the future. What a great neighborhood. A great jurisdiction for a foreign-owned mine.

Alphamins’ mine is around where the blue circle is. We have seen battles get closer but not yet reach the mine area, but I guess all this insane violence and different armed groups desperate for funding are a bit too close. And even in general the DRC government is not great in terms of private property rights and economic freedom.

Source: OG Tin Baron

Just two days ago this was posted. Here is a link to the article

https://english.news.cn/20240209/a8b1a72c139041049d2b10283beaaa3f/c.html

So this is why I’m not picking Alphamin even thou their management and mine are better than Metals X. Valuation+jurisdiction

Metals X

This company is what I picked. So I entered in August and I’m up a spectacular +5%.

This should not take long. This company is simple.

But why is it good enough for AlmostMongolian apart from me liking tin?

Metals X has their mine in Australia which is one of the best mining jurisdictions in the world.

And despite being there the valuation is cheap.

Numbers

Market Cap=272,18m AUD

EV=129,15m AUD

We have no debt and a lot of cash situation.

By the end of 2023, they had 143,03m AUD of cash in the bank.

and then in addition they have these assets

Source: Metals X

Tanami gold stock is still a 0,03 cents.

Their Nico Shares are worth roughly 1,6m AUD atm, their options are out of money and too irrelevant for me to take time trying to calculate their value.

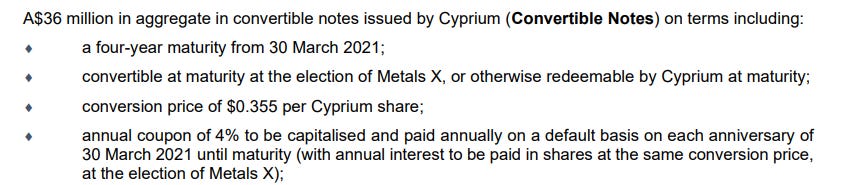

More on the convertibles

Source: 21.3.2021 Metals X PR

Considering the financial position of Cyprium Metals and the fact that their share price has dropped more than 90% to 0,018 AUD since their transaction with Metals X. The value of this asset is questionable. But I’m not familiar with their situation.

These assets the convertible bonds and the other investments are not included in the EV of 129,15m AUD.

Source: Metals X year-end

Before you get excited this is 100% of Renison's tin operation. Metals X owns 50% of this operation. So cut every number in half to know what is going to Metals X.

And I guess Australia is using this “imputed” revenue and cash flow which you can read what it means above. But alright Australia we will use your weird methods. Maassa maan tavalla.

Still, if we look at TTM cash flow MLX gets around 40m which is quite decent considering the weakness in tin price this year and the fact that q1 had only 3m of cash flow for MLX. But if we annualize the last 2 quarters we get 53,84m of cash flow for MLX which makes it EV/FCF of 2,4 at a tin price of 24-26k USD.

The company has an all-in sustaining cost of 17.3k USD tin and an all-in cost of 18.3k USD tin. And with the Cash cushion they have it’s hard to see a significant downside even in a more bearish scenario.

But the torque this company offers to tin price appreciation is significant. Let’s say the Myanmar ban continues for a longer time and is enforced or there is a crackdown on illegal mining in Indonesia or supply simply will not grow fast enough to keep up with the demand for EVs, computer chips, renewable energy, etc.

So the tin price doubles and let’s use q4 of this year.

2714(production)*74 000(AUD tin price)=200 836 000AUD revenue

200 836 000-(2714*28 112 AUD all in cost)=124 540 032 cash flow for 100% of Renison and Metals X owns 50%

124 540 032/2=62 270 016m AUD for Metals X per quarter

Annualized 249 080 064m of *imputed"* cash flow to MLX per year P/FCF of 1,1 and EV/FCF of 0,5.

Comment if that calculation is flawed somehow.

But you can see the torque MLX has a higher tin price with relatively low risk because of their cash reserve and jurisdiction. And that calculation was made with 48.27k USD tin at the same tin price Alphamin has a P/FCF of around 2 located in a powder keg.

Concerns

One concern is that this management is not eager to do buybacks even thou they should do everyone thinks they should do buybacks. And they are hoarding this pile of money. A flip side of that is that it does increase the margin of safety in a bearish scenario.

Also, they bought shares in a gold junior recently Not a lot around 1 million AUD worth, but why?

Source: Metals X reserves report

And here is the life of mine. They will of course try to extend this with exploration, but it’s good enough for me. If we see strong tin pricing this decade they should make many times their market cap before a significant decline even if they fail to extend the life of mine.

Summary

If Metals X management would be willing to aggressively buy back shares I could make this a large position in the AlmostMongolian portfolio, but because they do not seem to want to do this it is one of the smaller positions, but not insignificant in size.

But considering my bullish outlook for tin, the cheap valuation of Metals X, and the decent Margin of safety. I see this stock as a very favorable risk/reward.

Nice write-up. I've some details to add.

About capital allocation, the bad about the purchase of the 3% stake in Tanami Gold, is that Tanami is majority owned by APAC, MLX’s 20%+ shareholder. The good is however, at the time of the purchase the AUD 0.034 price represented a slightly negative EV. At USD 2000 gold the recent scoping study provides an NPV8 of AUDm 17m, so big upside, particularly in light of the negative EV (and even for the AUD 1m market value of the stake). Yes, I hear you scoping studies are just fantasy. However, in July 2015 Northern Star bought a 25% stake in the Central Tanami Gold project for AUD 20m, said otherwise at the bottom of the recent gold bear market (USD 1200) a major miner assigned an EV of AUD 40m to Tanami Gold, or an EV of AUD 1.2m for MLX’s stake. So even using this valuation MLX recently paid AUD 1m to get AUD 1.2m project value + slightly more than AUD 1.0m in cash & securities. I.e. these guys are good capital allocators (although buying back their own shares would have been certainly better for the share price). http://clients3.weblink.com.au/pdf/TAM/01646849.pdf

By, the way MLX comes with a lottery ticket attached.

Should Nico’s CMP project ever get developed that should the value of MLX’s 1.75% royalty should be easily as large as the current market cap. CMP contains 1.56mt of Nickel and 122kt of Cobalt in 2P reserves, at prices of USD 15k per ton of Nickel and USD 25k per ton of Cobalt that is an in-situ metal value of more than USD 26bn.

Great call - well done