Petrobras preferred stock: Still cheap

Gradually re-rating while paying big dividends

Petrobras preferred shares are the biggest position in the revered AlmostMongolian Portfolio if I count the whole thing and I say that because it’s on the margin account. So excluding the margin, it would not be the biggest. But if it increases or decreases in value it makes the biggest impact atm.

I made this tweet, which is my most popular tweet so far, and I got around 90 followers right after it so I will give these new people what they want by writing a Petrobras write-up. Even though the world does not need another Petrobras write-up. There are so many already, but this won’t take long.

The tweet makes a good point. 396 people thought so too. 40 of the most fanatic fans of the tweet even bookmarked it. They wanted to save it and treasure it. Also, remember there has been no dilution since 2019. So the market cap was also the same in 2019 as it is now. People were paying the same market cap, but a higher EV of Petrobras in 2019 even though by all metrics the company is doing better now.

Some people pointed out that they have sold some assets since 2019. This is true. You can see on the balance sheet total assets have gone down 23.5 B$, but around 10 B$ of that is depreciation. Still, we can see this did not affect the cash flow much at all. As the cash flow has surged and what is important so has oil production. They have sold some onshore fields, shallow water offshore fields, refineries, and stakes in power plants. They want to focus on deepwater offshore which seems to be working quite well. Although there won’t be as many more asset sales from here as the new administration doesn’t want that. But there has still been some.

They also have higher reserves than in 2019.

Source: Petrobras

The new administration

This is still the largest reason for the discount to other majors along with just the company being Brazilian, but the valuation was higher during the previous administration. The discount is not as big as it was at 9$ which is my cost basis, that was extremely cheap. Now it’s still very cheap, but not extremely.

Source: Seeking Alpha

The administration is not a big worry for me. I thought the discount would start to narrow as the market sees it’s not that bad and it has. We have the Lula administration and this was the stock price last time Lula was in power.

Source: Google

Up 905%. Most of this was the oil price impact, but the key is Lula did not deny Petrobras shareholders the benefits of high oil prices by excessive taxation or taking away dividends which is what people are fearing because Lula is left-wing. Now when the green stuff is on the agenda. People have been fearing that he will redirect a large part of the company’s resources to green transition investments. Which we know would not be good for the shareholders. But he is not extreme left-wing. He seems to understand that he needs the money from oil, he needs confidence from the markets, etc. They are saying their 2024-2028 plan is to have 6% to 15% of CAPEX in “low-carbon investments”. I would expect it to be closer to 6% based on how attractive investments the deepwater fields are. Also, low carbon can mean many things. It’s very vague so it offers them a lot of room to maneuver instead of saying something like renewable energy.

Lula appointed Jean-Paul Prates as the new CEO and this is the kind of stuff he has been saying. “We will get market share” meaning in the oil market, not in the renewables market, “We may be the last to produce oil in the world.” and “We have to worry about replenishing reserves. We can’t simply [say] no more oil and it’s over. For an oil company, this is not possible.” This is what he said about not replenishing oil reserves “You would be making the biggest mistake of your life. That would be a fatal error, which would decree the death of the company in 30 years.” Does this sound like he appointed some green transition activist?

So this is what Rystad is projecting. Brazil is looking to seriously ramp production towards 2030 as many other producers are declining or stagnating while the oil demand keeps rising. Brazil is positioning itself very well.

Source: Rystad Energy Screenshot from FT

I don’t think it’s gonna fall off the cliff in 2030. The oil phase-out will be forever kicking the can.

Source: Rystad Energy Screenshot from Offshore Magazine

All these companies have worse production profiles than Petrobras, but higher valuations except probably Rosneft has a lower valuation, but I’m not even sure about that cos Rosneft is Russian and I didn't find up-to-date data on that one.

So what has actually happened to the company since the new administration? Less asset sales, but there will still be asset sales. They ended the internationality pricing parity policy for domestic fuel pricing, but they are basically still doing a soft version of it. Recently in August when international prices rose they raised gasoline by 16% and diesel by 26%. They announced a 1B$ buyback just for the preferred shares. The dividend policy was changed from 60% of FCF to 45% of FCF which is still a high dividend. However, it was not changed to fund the green transition. It was changed to drill more oil deepwater offshore which is getting great results. They are even trying to get permits to drill Amazon. And Lula the leftist who said he will protect the Amazon is open to the idea.

Source: Reuters

People in his own transition team are not happy about how pro-oil Lula is. One member of the transition team said “The Lula government's great contradiction is oil".

I’ll quickly go over why I like the Petrobras preferred shares $pbr.a more than the common shares PBR 0.00%↑ . Both shares get the same dividend. Preferred shares are first in line to get it. Preferred shares have the buyback. The preferred shares trade at about 8% discount to the common shares so you get a higher dividend yield than common shares. Preferred shares do not have voting rights, but I do not see that as very important, because the government basically controls the company anyway, because they have the majority of voting shares.

When to sell?

I’m looking to get out at something like fair value in the context of Brazil. This company is one of the best oil companies on the planet. They have the best or at least one of the best production growth profiles of any of the majors. They have been one of the most shareholder-friendly majors. In 2022 only oil company that paid more dividends than Petrobras was Saudi Aramco which is the world’s largest oil company by far. But they are in Brazil. Which has a stigma and it’s not completely without reason. So they will trade at a discount to Exxon and Chevron. One could argue Brazilian government is more oil-friendly than the UK and one would be right imo, but it still trades at a discount to UK oil producers. This is just something that is part of investing in 2nd world and 3rd world countries. They will trade at a discount regardless of the fundamentals. It takes decades maybe even centuries for a country to gain the confidence of the markets.

So I would say 10% forward dividend yield. I would be looking to get out. It’s still cheap, but it seems reasonable for cyclical in 2nd world country. But it also depends on what other stocks I like are doing. If I have some extremely cheap opportunity I might have to sell moderately cheap $pbr.a to buy that extremely cheap stock. So it depends. It’s all about what is the best value I can find at the moment.

The dividend will probably be 10-13B$ a year at the low-end 70-80$ Brent and higher prices from 13-25B$ a year. If we look at 2022 FCF and use the new dividend policy that would be around 18B but considering the production is increasing if we get another year of oil prices like 2022 Petrobras will make more FCF than in 2022.

When to buy? If I didn’t have any exposure I would buy some personally, but I don’t like averaging up and this is a big position already so I’m not adding.

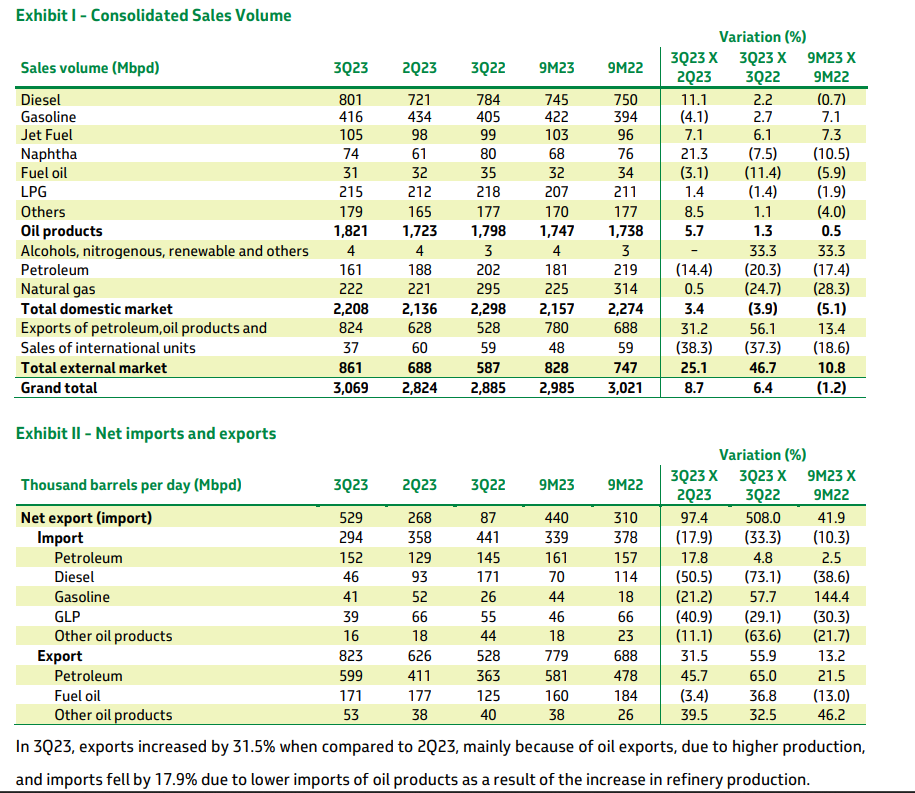

We just got the Q3 2023 production and sales results which were surprisingly good.

Source: Petrobras Production&Sales report

+9.1% Quarter-Over-Quarter!!

Source: Petrobras production&sales report

Ah yes. The Finish market. Very important indeed. This is a big deal for Petrobras. To even get access to a supreme market like Finland is quite a feat. Bodes well for the future.

Source: Petrobras production&sales report

Domestic demand is strong.

summary

Something to note. I would not be in this stock if I was bearish or neutral on the oil price. My conservative expectation would be that Brent averages at least +90$ for the next few years with some years +100$. I think this for a few reasons. But that is a long topic. Maybe an article in the future. But if you do not share this view this does not look as cheap. I’m waiting for a rerating of Petrobras in this favorable oil price environment while production is going up and the company is paying big dividends.

Have you reviewed the norwegian company vår energi? 15% dividend yield and is aiming go grow production by 100% by end 2025.

I just saw that you are also holding Prospera Energy. I see a lot of upside.