Metro Mining: Extended Edition

BAUXITE

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

I wrote a short piece about Metro Mining in my watchlist article, but since Metro Mining has moved from the watchlist to the AlmostMongolian Portfolio I wanted to expand it.

I had to throw Metals X under the bus to get in.

In this one, I will also go into the bauxite market. Is Bauxite going up!? It has a hashtag on Twitter now. Which is one of the most bullish signs to happen to any commodity. The next step is to get a Sprott bauxite fund to squeeze the price and come up with a villain who is trying to suppress the price. “Evil smelters” or something like that.

Metro Mining

Metro Mining produces bauxite in Australia. Bauxite is mostly used in Aluminium production. It’s a simple deleveraging+production growth+cheap valuation story

Source: Google

The stock has done very well recently, but it doesn’t mean the stock is not still very cheap. I see a low effort 50-100% return and a potential 100-300% from this point with a low probability of significant losses.

Market cap =320m AU$

EV=380m AU$

They did a raise in May and gave a pro-forma net debt figure which was used to calculate EV. The most recent reported figure.

Source: Metro Mining May 2024 presentation

AD

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

Below are the projected financials from a third party.

Source: ShawandPartners report March 2024

This already looks like a cheap valuation, but it’s a lot cheaper when you account for potential higher production and the tax assets the company has that are not taken into account in the above projection.

Source: Metro Mining 2023 annual report

They have 244.2m of carried tax losses. For the next 2-3 years you should look at the profit before tax number. According to the management, they should be able to use these fully.

The company should reach a run rate of 7,000kt annually mid 2024. This means after that they should be at 100-150m AUD annually with these carried tax losses at Bauxite prices close to current prices and the company could be net cash positive by the start of 2025 or even at the end of 2024 depending on Bauxite prices and how they decide to use their profits. After the tax assets run out I assume they will be above 7mt/a of production so I assume higher than earnings than in that projection.

Forward expected multiples

P/E=2,1-3,2

EV/E=2,5-3,8

Source: Metro Mining March 2024 Petra Capital Report

Based on NPV this company is cheap and you can see the torque to the bauxite price here. It’s important to note that mining companies from my experience tend to trade at a discount to NPV so I would not rely on the gap between the share price and NPV to close. The current Metro mining stock price is 0,054 AUD

According to this website, the price is 62 USD atm

Source: Metal.com

At 60$ USD the NPV is 0,23 so that would be +430% if share price were to reach the NPV.

Just based on all this and taking a conservative view I see a 500-1000m AUD market cap company. Whether it’s in the lower or higher part of the range depends on the bauxite price.

Compared to the current market cap of 320m AUD

Source: SimplyWallStreet

Not much to be said about the above picture.

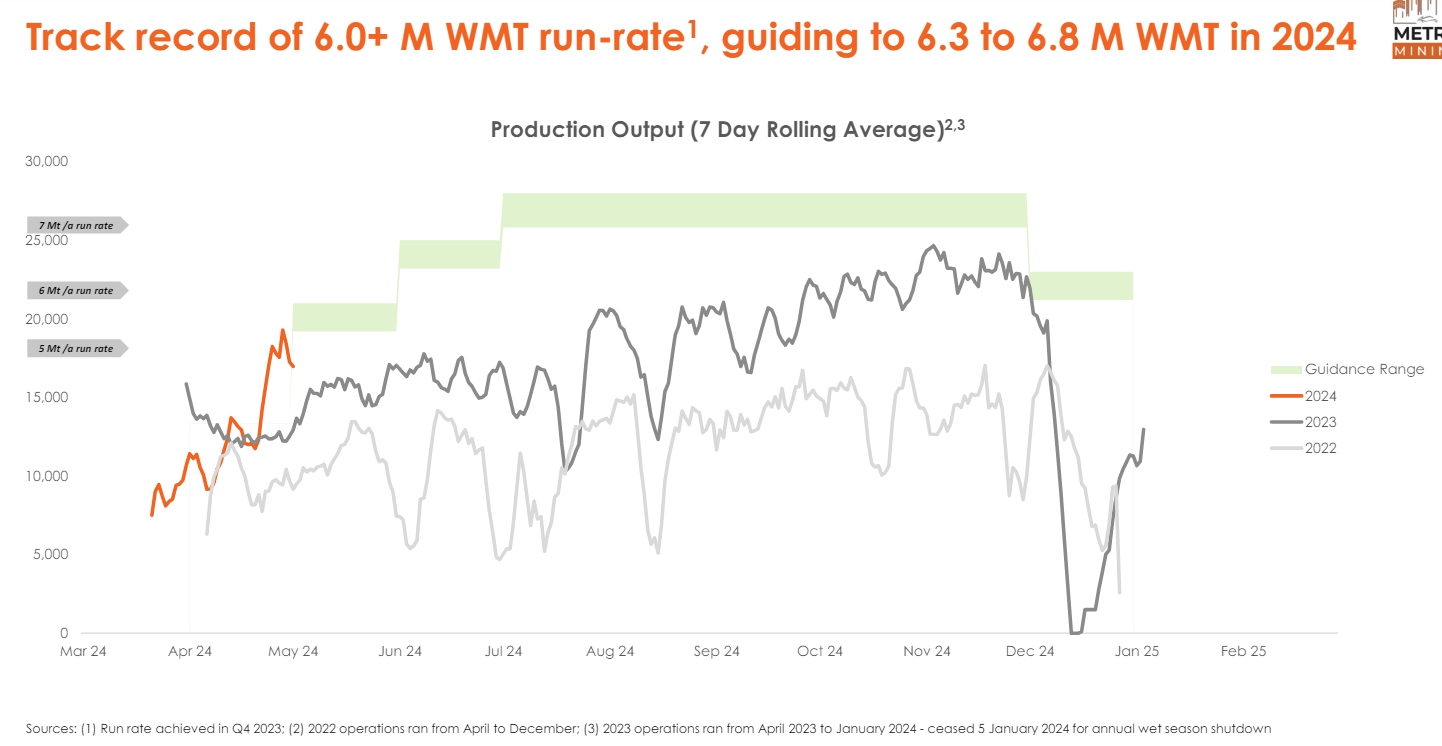

What’s the plan to get to 7 mt/a and have that as a baseline to grow from?

Source: Metro Mining May 2024 presentation

According to this slide, they should now have 7,5 mt/a production capacity. The reason that the production will be at 7 mt/a is weather-related disruption during winter. They are trying to ultimately get to a higher level of production. Get to 8-9 mt/a consistently which would mean a much bigger upside on the stock as we already see how cheap this company is at 7mt/a.

Source: Metro Mining May 2024 presentation

They also have contracts in place when it comes to selling the bauxite.

Contracts…, that’s crazy because I used to think the commodity market works like this. There is this spot market. It’s a big building where on the door it reads “the spot market”. You enter the building and they buy your metals from you at the current spot price after they check the spot price from Yahoo Finance and that’s it.

Source: Metro Mining May 2024 presentation

There seems to be an annual wet season shutdown at the end of the year. They have to shut down operations because of water. Ridiculous. These Australians must have never heard of umbrellas am I right guys? Haaa. We like to joke around here at AlmostMongolian. Me and my 9 employees running this Substack, the X account, and the YouTube channel. This is a big multi-media operation. A lot of production behind the scenes. Unfortunately a lot of drama also, but I don’t want to get into that right now you must understand. Maybe someday…

They are working on reducing the impact of weather on the operations. There is a cyclone season during the winter in northern Australia which is going to cause production disruptions.

This yearly shutdown is baked into the projected financials.

Mine characteristics and potential

Source: Metro Mining May 2024 presentation

83.2 mt reserves (discovered, commercial)

118.7 mt resources (commerciality not proven)

If we consider only reserves there are 10+ years of LOM(life of mine) left. The assumption of course is that there are significantly more on the ground. And they will start exploration again in Q3 2024 after not exploring for 4 years. Which they expect will add another 5 years of LOM.

Here they explain some potential opportunities they are looking at.

Source: Metro Mining May 2024 presentation

As I understand this they are looking at this from a baseline of 7 mt/a. As you can see these are some interesting opportunities. Potential to add 3 mt/a through the first 3, reduce costs, and increase mine life. There is a lot to be done to optimize this operation.

The pisolite hills point on the last one seems less probable. This project was…

Source: Mining Weekly

If you have followed the situation and think this could be mined someday put your research into the comments, but I’m currently not giving any value to it.

Bauxite market

Bauxite, as I mentioned earlier, is used for Aluminium production. There are some other use cases.

Source: Persistence market research, Global mining review

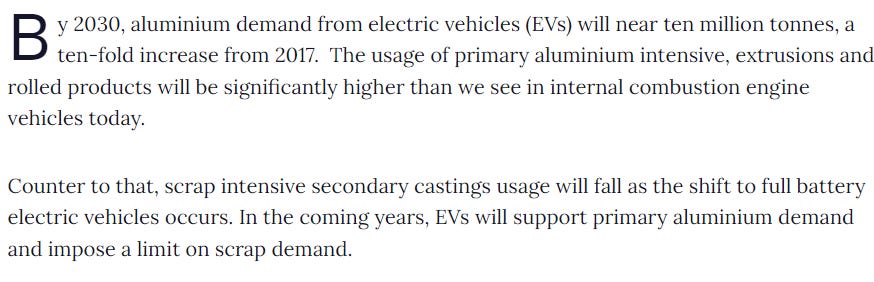

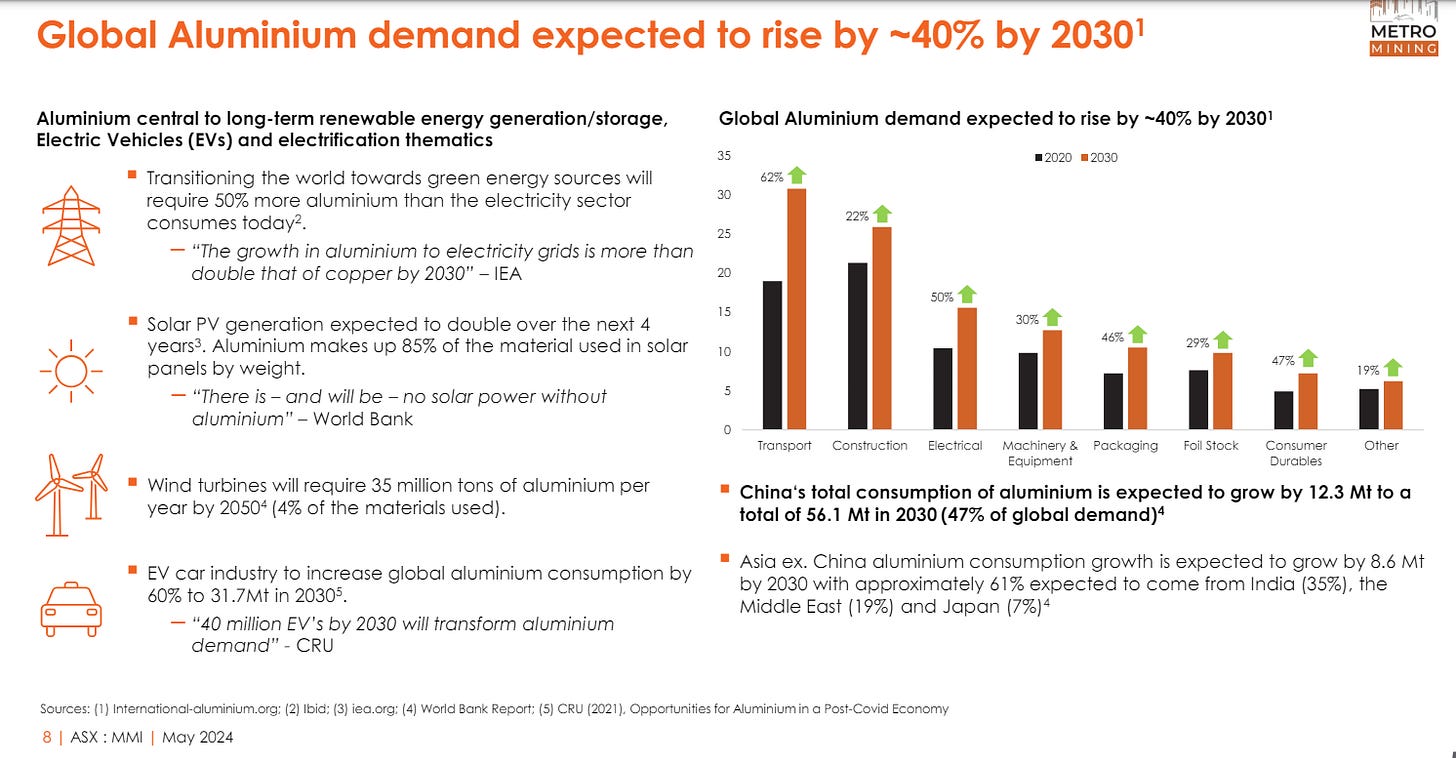

After looking at multiple projections of Aluminium and Bauxite demand growth from here to 2030 most of the projections fall into 4-7% cagr(compound annual growth rate) for both.

One of the big reasons for this is the green transition.

Source: European Aluminium

Source: https://www.mining-technology.com/contractors/data//pressreleases/evs-aluminium-demand/

Source: Metro Mining May 2024 presentation

The price differential between the Guinean and Australian bauxite has been higher than the norm in recent years. Usually, it’s around 10$ and we are seeing how the gap is getting back to the norm.

Source: Metal.com

Now only 11$ difference. Very good for Metro.

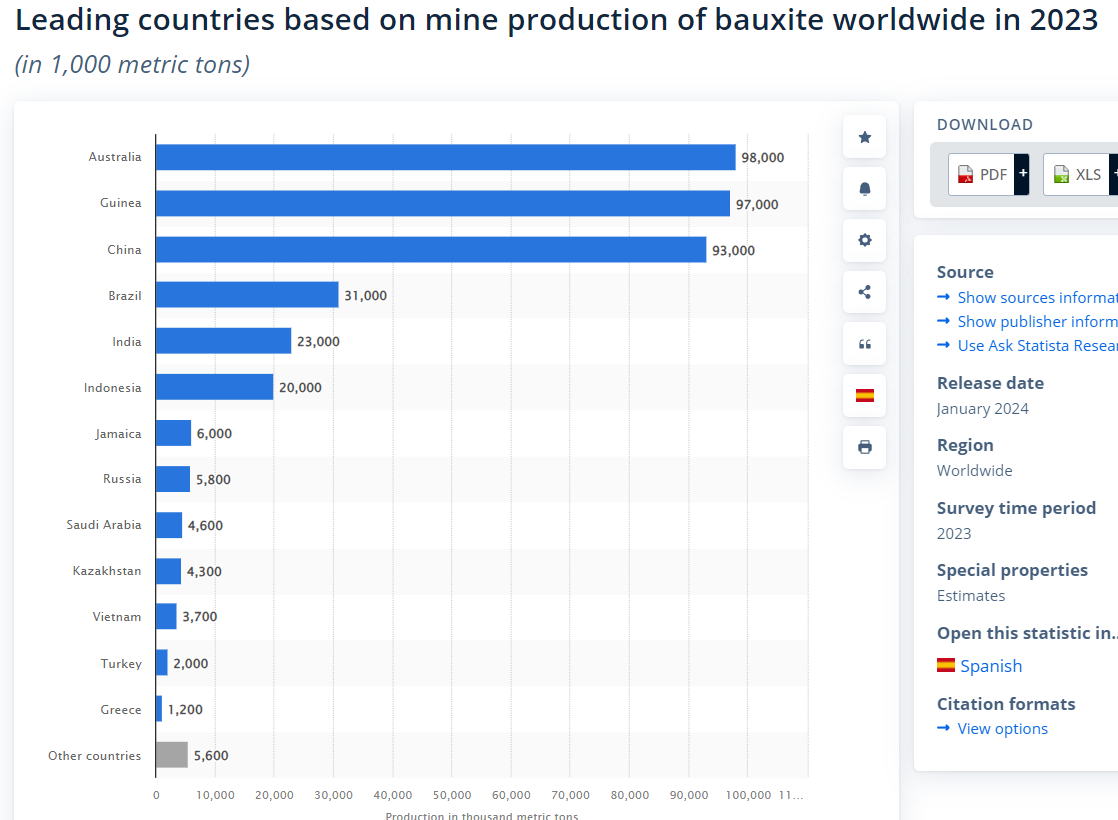

On the supply side.

Source: Statista.com

The bull case for bauxite is that demand will continue to grow and the supply won’t grow as much. China is the biggest consumer and Chinese production of Bauxite is starting to go down while China is building more aluminium-producing capacity which means China will have to import more and more Bauxite.

Source: https://www.kpler.com/blog/chinas-aluminium-industry-now-has-a-bauxite-tightness-headache

Quote from the article above.

“However, the bad news is that potential bauxite shortages could curb the resumption of primary aluminium production in China and add fuel to currently elevated global aluminium prices.

Official data show that from January to April this year, China’s primary aluminium output reached 14.24 Mt, marking a 7.10% y/y jump. This growth is primarily attributed to an unsustainable surge in imports of alumina (+75% y/y to 1.06 Mt), the product between bauxite and metal in the primary aluminium production chain. On the other hand, industry data show that the domestic alumina output was almost flat in the first four months of this year, with some capacity idled due to bauxite supply constraints. During the same period, domestic bauxite production plunged by 20% to below 18 Mt. The bauxite supply deficit is evident, as the year-on-year increase of 2.54 Mt in imports from January to April is insufficient to bridge the gap, resulting in stockpiles falling to a near 28-month low.”

Source:https://www.reuters.com/article/markets/currencies/china-needs-to-mine-more-bauxite-at-home-industry-official-says-idUSKBN2WH0WD/

Quotes from the article above

"Reliance on overseas resources has been on an uptrend and we expect it to go up further," Meng told delegates at the SMM International Aluminium Summit in China's Zhengzhou city.

China's reliance on bauxite imports grew to 55% in 2022, from 2.8% in 2002, Meng's presentation showed.

Last year, China imported 125 million tonnes of bauxite, up 16.8% year-on-year. Just over half came from Guinea, while 27% came from Australia and 15% from Indonesia, China's customs data showed.

"We need to explore with a long-term plan to make sure we take good advantage of the resources," Meng said, adding that China should also set up strategic reserves of bauxite and coordinate overseas development.

They mention that last year 15% of imports came from Indonesia, but that is not going to be the case this year.

Source: https://english.news.cn/asiapacific/20230621/c9c3686e451b443ea8d6f8076d66aba6/c.html

Indonesia 6th biggest producer in the world is trying to build its own aluminium production and banning exports of bauxite to help to make this happen.

The second biggest producer Guinea has been the biggest source of growth for Bauxite production

Source: ResearchGate

Guinea is planning to get its production up to 130,000 mt, but this is an unstable 3rd world country in Sub-saharan Africa with a GDP per capita of 1 500$ and which had a coup in 2021. A lot can happen in there and if there is a disruption it should raise the bauxite price.

“In addition, bauxite supply in Guinea remains vulnerable to the country’s political and social instability as well as infrastructure unreliability. In mid-December, a blast at the primary depot of Guinea's state oil company in the capital resulted in a nationwide fuel shortage and temporarily affected some bauxite mining and transportation activities. Earlier this month, installations of the Simandou iron ore project were attacked by local communities. As December elections in Guinea approach, the potential for further incidents increases. Disruption to Guinean production could exacerbate the tightness of bauxite supply in China and potentially affect global aluminium production, even if these impacts are short-term.”

Quote from this article: https://www.kpler.com/blog/chinas-aluminium-industry-now-has-a-bauxite-tightness-headache

Australian production seems quite steady overall. Although there are problems with a huge mine in Australia which produces more than the whole of Indonesia

“However, exporting bauxite from the Huntly mine (with a nameplate capacity of 23Mtpy), which supplies the Kwinana refinery, is not straightforward. The world's second-largest bauxite mine has struggled with declining grades and permitting delays in recent years. The environmental regulator has been carrying out an unprecedented two-year rigorous assessment of Huntly's bauxite operations since last year, which could lead to future suspensions.”

Quote from this article: https://www.kpler.com/blog/chinas-aluminium-industry-now-has-a-bauxite-tightness-headache

Growing demand with uncertain supply.

Summary

Let’s look at the risk/reward. With current or even a bit lower Bauxite prices and the 7 mt/a production this company is a winner. It’s very likely the company will eventually get to 8-9 mt/a consistently and the supply and demand for Bauxite looks good. What I expect is an easy 50-100% return from here with a potential 100-300% return if certain things line up. This is of course my opinion which could be completely wrong.

What the next catalyst outside of Bauxite going higher? Next earnings? Always enjoy reading your work.

Thank you for the great article, and h/t Respeculator for linking it.

Cheap valuation, solid demand growth, supply risks — altogether that’s very bullish, as you clearly demonstrate. So what’s the bear case?