LibertyStream Infrastructure Partners: The Perfect Storm

Lithium from oilfield brine

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian AD: THE LINK

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

This article is a collaboration between me and Premski, who wrote most of it and also presented this investment idea to me.

Thesis

Microcap in a perfect storm to benefit from the critical minerals craze in the US

LibertyStream $Lib.v is a US company pioneering direct lithium extraction from oilfield brine, which is a waste by-product of classic horizontal oil production. The company operates in partnership with a large water mover in the Permian Basin and has completed small commercial-scale field runs processing 250,000 barrels of brine together with that Partner.

With a market cap of ~78mln US$, Liberty is a pre-revenue play on domestic lithium independence. The thesis relies on:

Tailwinds emerging from a perfect storm described below that will allow the company to:

Receive a loan from the Department of Energy

Secure offtake agreements,

Leverage state and federal grant programs

Scale production rapidly through their Partner’s existing water infrastructure.

Market Cap ($US) ~78 mln

Enterprise Value : ~78.64 mln

Net Debt $ ~0,64 mln (Oct 2nd)

Shares outstanding: 173 mln

Warrants: 10M warrants at .44CAD expiration Nov19 2026

3.4mln warrants at .35 expiry May 2026 (held by the Partner)

Insider ownership: 9%(of which CEO 6.7%)

Biggest shareholder: PathFinder Asset Management 8.23%

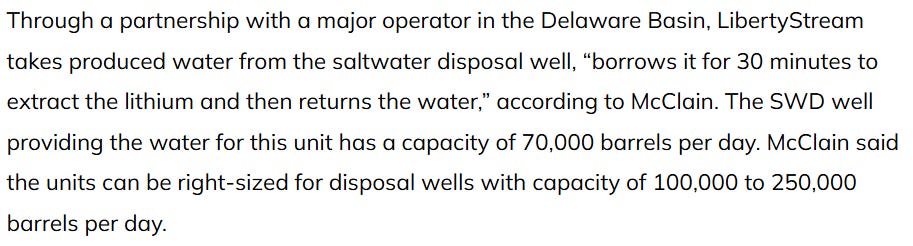

Opportunity - Projected future revenues:

Production of 6 units - 108m US$

50% of just Permian water processed - 1.4bln US$

Water of both Permian and North Dakota - ~3bln US$

Background - The Perfect Storm

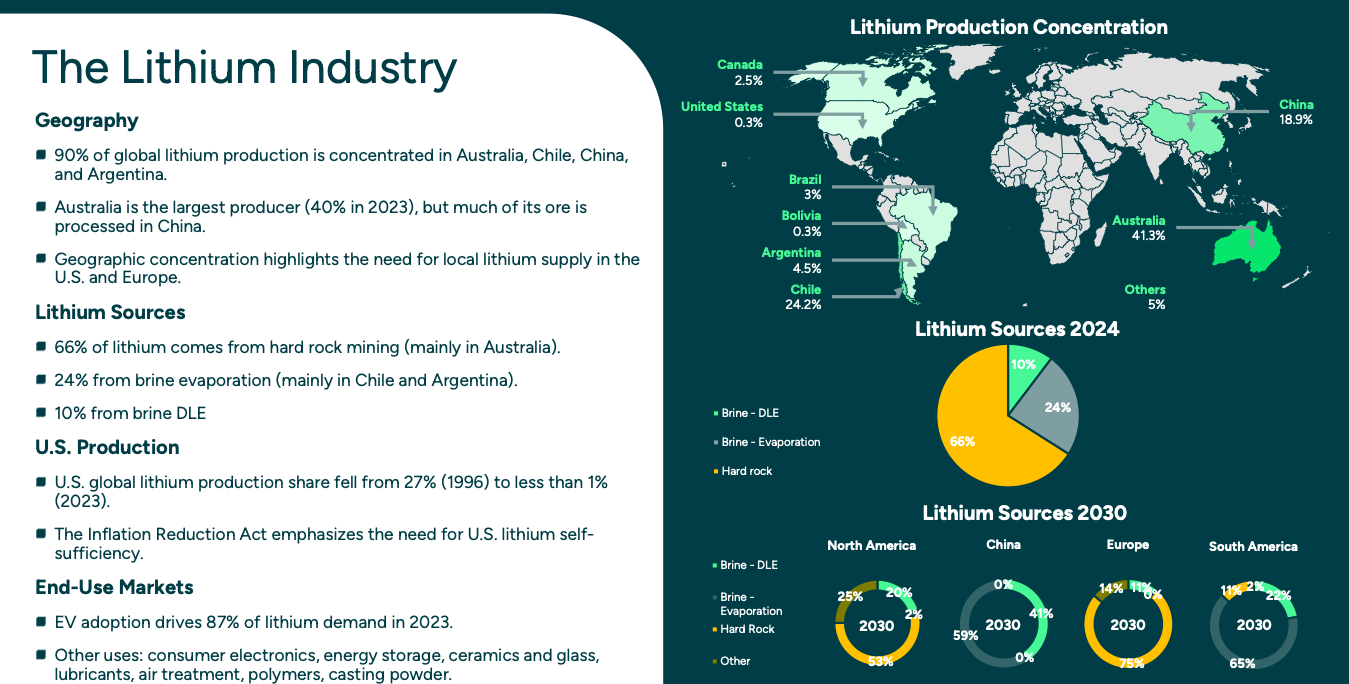

Re-shoring of the Lithium Supply Chain

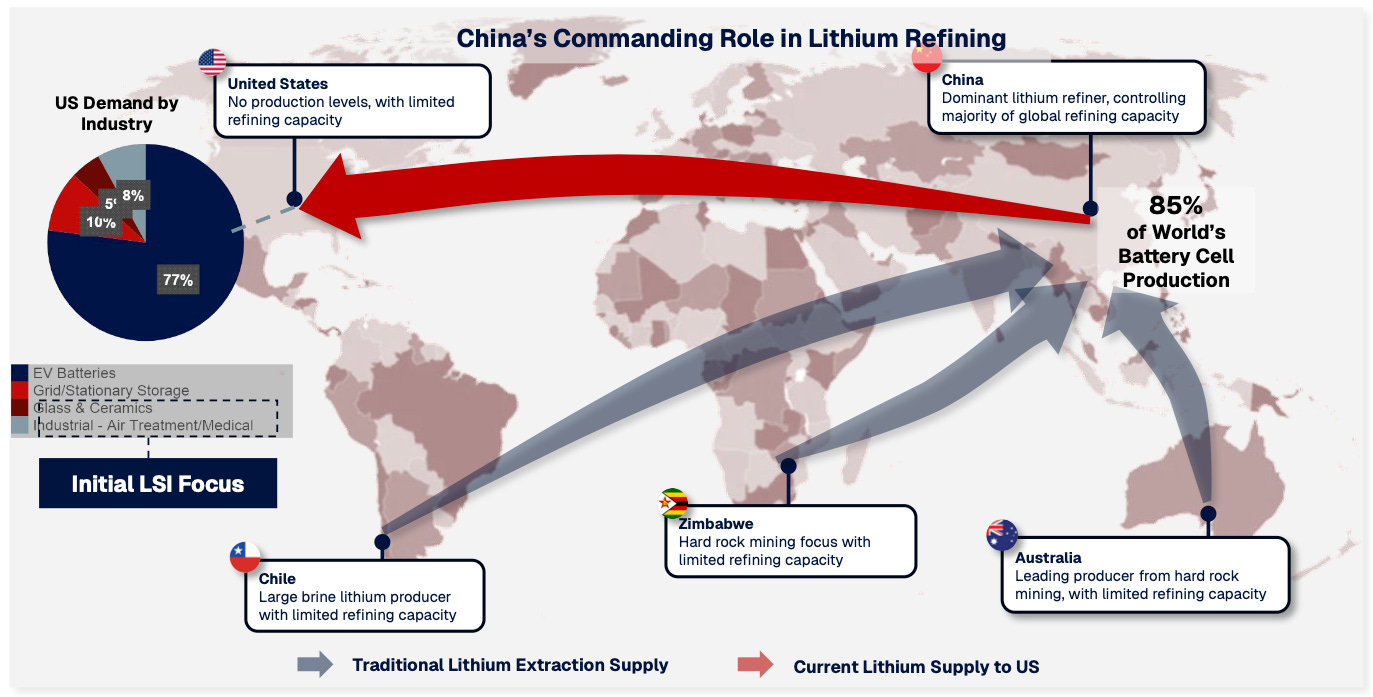

Lithium has been neglected in the US for years. Globally, it was very cheap most of the time (apart from a spike caused by the EV craze), and it is always easy to buy, as the entire supply of refined lithium comes from China (battery-grade lithium):

Source: Statista; “Global lithium mine production top countries 2019“

Source: Government of Canada. Natural Resources Canada. https://natural-resources.canada.ca/minerals-mining/mining-data-statistics-analysis/minerals-metals-facts/lithium-facts

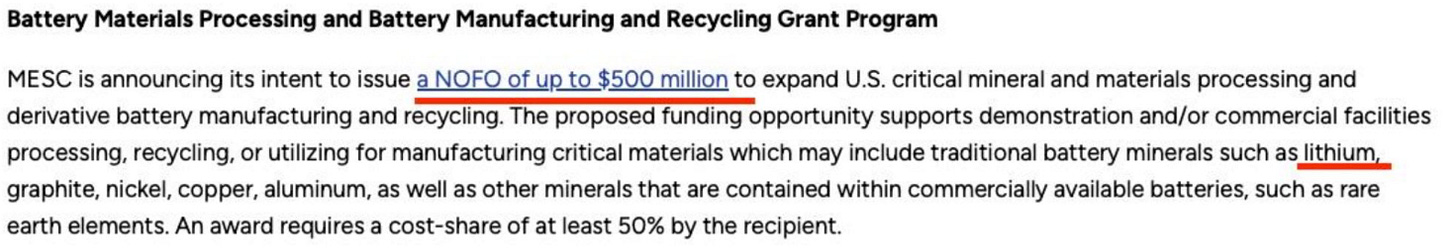

Reliance on products coming entirely from China is a big problem nowadays. Therefore, there is a huge funding opportunity announced by the Department of Energy here: Link

500 mln is dedicated to lithium (among other metals):

Source: https://www.energy.gov/articles/energy-department-announces-actions-secure-american-critical-minerals-and-materials-supply

If you are wondering why refining happens mostly in China, it is because this has a negative impact on the environment, and Western countries obviously do not like that, so as time went by, China took over the entire market. Another thing is that China is intentionally flooding the market with cheap materials to exhaust the competition.

As we are seeing global fragmentation (especially in the supply chain), Ken Griffin even confirms it here (timestamp 18:06).

The bet here is that lithium MUST BE produced and sourced from within the US, and LibertyStream will be the frontrunner coming online with production sooner than anyone else.

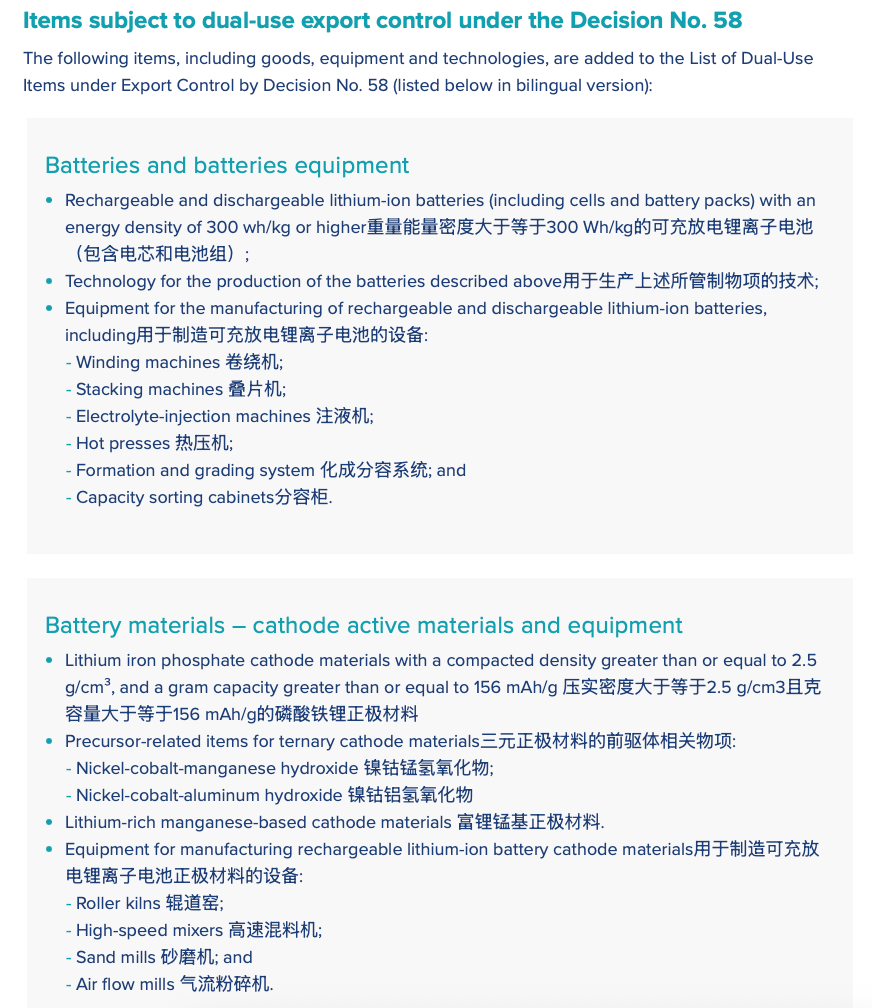

Upcoming Chinese export controls on Lithium

Beginning November 8th, lithium-ion batteries will fall under new export controls. Although refined lithium itself hasn’t been added to the list yet, the tightening regulations around the broader lithium sector are making U.S. players increasingly uneasy. Key areas to monitor include lithium carbonate exports and refining equipment used to convert lithium chloride into lithium carbonate. All the developments and atmosphere around the China-US trade war will help Liberty in all their efforts (offtake agreements with premium pricing on lithium, getting financing from the State and DOE). Domestic US manufacturers who are relying on Chinese battery-grade lithium are getting nervous. Here is what comes under export controls now:

Source: https://www.hsfkramer.com/insights/2025-10/china-export-controls-lithium-batteries-and-artificial-graphite-anode-materials

Basically, anything that is being exported from China can be held and delayed just because some authorities are asking questions or are delaying export license issuance. Don’t get me wrong, you still get your lithium, but it may come delayed, and you will not know by how many days. I am a former sourcing and procurement consultant(Premski). Securing a source of supply by having geographical diversity is extremely important in the current geopolitical environment. That is why a domestic lithium producer of battery-grade lithium will come at a premium.

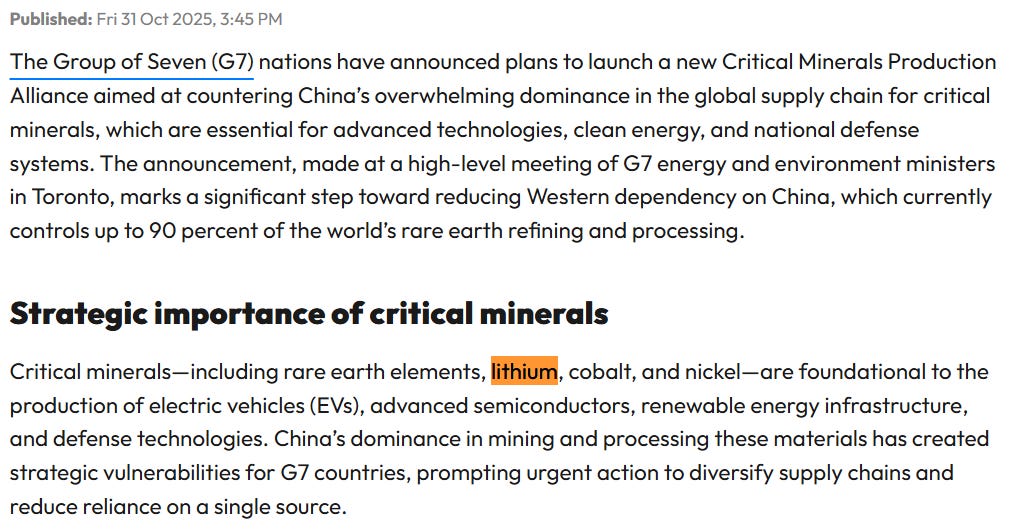

As part of a push to decouple from China, the G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States). Announced a Critical Minerals Production Alliance, which includes lithium and various beneficial measures for LibertyStream if implemented.

Source: https://economymiddleeast.com/news/g7-nations-unite-to-launch-critical-minerals-production-alliance-to-reduce-western-reliance-on-china-for-technology/

Current political backing and future DOE opportunity

While Liberty’s main focus is in Permian, senators and governors of North Dakota are supporting company efforts to stand up the business, even if it means financing equipment for operations in Texas. North Dakota will have an enclosed defense industry with an entire supply chain that is independent from China, and Lithium is part of it. Lithium will be used to manufacture small custom batteries for night vision goggles, some models of drones, etc. That Lithium will be taken from the oil brine in North Dakota. Here is one specific evidence on why there is political support behind the scenes:

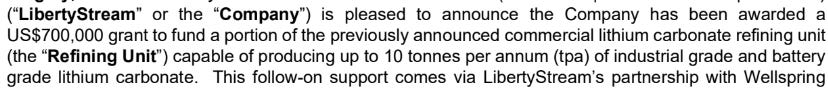

Liberty receives a grant from the state of North Dakota to purchase a refining unit that will be used in Texas

Source: https://www.dropbox.com/scl/fi/4si94389ybyt2jvho41aj/250811-PR-LibertyStream-ND-Grant-and-Refining-Unit-Final.pdf?rlkey=6q7ol77yzsyotlq2ec6wktufk&e=2&st=qrj6oer9&dl=0

It is not easy to get a grant from the state. You need to have a strong case. But to get funding from North Dakota to do refining in Texas ?!?? How common is that?

Liberty Stream has received five direct grants from the State of North Dakota, reflecting consistent state-level support for its lithium extraction technology. The funding began with an initial US $500 000 grant in late 2024 to conduct pilot testing in partnership with Wellspring Hydro, followed by a US $2 million follow-on to expand those field operations. Soon after, Liberty secured a larger state-approved facility under the Clean Sustainable Energy Authority and Renewable Energy Program, from which it drew US $700 000 to purchase its first lithium refining unit. In October 2025, the company received a further US$500,000 Renewable Energy Program grant to validate production of battery-grade lithium carbonate. These cumulative awards—each specifically granted to Liberty’s projects underscore North Dakota’s confidence in the company’s DLE process and its potential to establish a viable in-state lithium supply chain. In total, that is US $3.7 million in grants so far.

Libertystream has a strong case for receiving potential funding from the Department of Energy, as people who are granted funding from North Dakota are involved in DOE funding, too.

The company has submitted multiple applications for Department of Energy (DOE) funding. The most likely outcome is a $30 million forgivable loan, which, if approved, would be a game-changer for a microcap company like Liberty.

Important people who can play a role in support of Liberty are:

Doug Burgum, the current U.S. Secretary of the Interior and former Governor of North Dakota, previously chaired the North Dakota Industrial Commission, overseeing the state’s energy and grant programs. During his tenure as governor, he was among the officials who approved the state-backed grant facility through which LibertyStream’s North Dakota funding was authorized.

The current Secretary of Energy is from the oil & gas industry and understands the opportunity that comes from extracting minerals from oil field brine. His short bio:

Chris Wright is an engineer-entrepreneur who founded several oil & gas and energy technology companies (including hydraulic fracturing and geothermal ventures) and was confirmed as the 17th Secretary of the U.S. Department of Energy in February 2025.

His agenda emphasizes “American energy dominance,” spanning oil, natural gas, nuclear, and geothermal sources, with an expressed goal of cutting regulatory barriers and accelerating energy innovation.

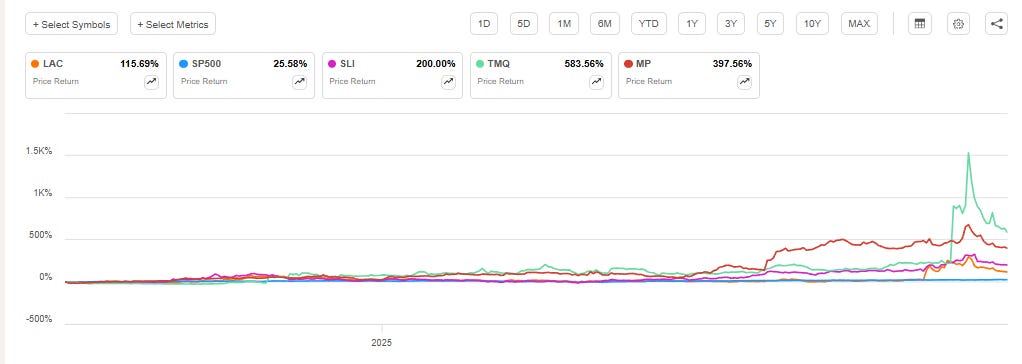

Source: Seeking Alpha Premium

Here are the share prices of some critical minerals companies that have recently received grants from the DOE, or the US government has taken a stake in the companies. 2 of these are lithium companies Standard Lithium(SLI) and Lithium Americas(LAC). And consider that a lithium bear market has been underway during this period. SLI, a Canadian company with a US project like Libertystream, received a $225m grant from the DOE. LAC got a very favorable loan from DOE, and the government took 5% stake. These examples show what is possible for Libertystream, and considering the previously mentioned lithium companies have market caps 10-30x larger than Libertystream’s. You can imagine the market’s reaction if Liberty Stream were granted benefits similar to those granted to SLI and LAC.

Water Infrastructure Tailwinds

This is related to Liberty’s Partner, which will grow in importance and will get even more water as time goes on. Water movement in the Permian, from which the lithium is extracted, is getting more restricted.

The industry is running out of space to safely inject it back into the ground. Historically, produced water was injected deep underground into disposal wells, but this led to seismic events (earthquakes), forcing a shift to shallower injection methods. Now, the remaining pore space, especially in shallow zones, is being over-pressurized, which can interfere with oil-bearing rock and cause underground disturbances from old, abandoned wells. Additionally, nearly half of the Permian production is in New Mexico. That state has enacted far more stringent environmental regulations, including banning shallow disposal, creating a need for systems to move water across the state border into Texas for disposal. These restrictions are forcing a dynamic approach to water management and disposal, which creates a competitive advantage for companies that own existing disposal infrastructure and can provide long-term solutions.

The other piece of the puzzle is that upcoming desalination and produced-water reuse directives in the states around the Permian Basin are expected to enable lithium concentration to approximately double - allowing Liberty to effectively double output at the same cost base.

Source to see more: Link

Their current Partner in Permian will be growing in size and in water quantities because water movers in existing infrastructure will rise in importance and will be able to gain more leverage over Oil producers who are paying them for oil brine disposal. See more here to get the entire background.

Structural tailwinds for offtake incentives

Liberty is providing samples to prospective customers right now. They are targeting manufacturers who need 1000 - 2500 tonnes per year.

Ignore completely Batteries from Electric Vehicles (Tesla, etc). There are a lot of devices that run on lithium batteries that are manufactured in the US and would source lithium domestically if available. Think of pacemakers, hearing aids, and night vision goggles. All these devices require a custom-made small battery, and if China blocks refining lithium shipments (export controls), these manufacturers are stuck.

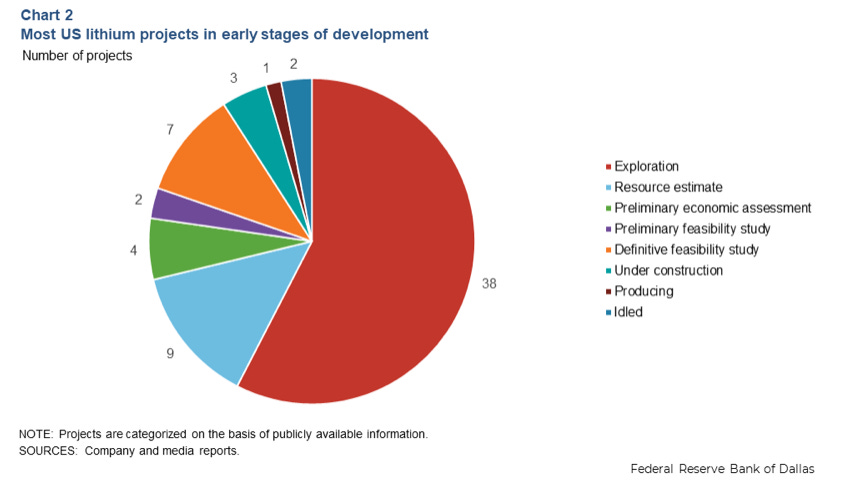

Right now, out of 66 projects in the US, hardly anything is in production!

Source: https://www.dallasfed.org/research/economics/2025/1014-plante-lithium :

“Two smaller projects in East Texas and Pennsylvania aim to start production in 2026. Their combined initial production will be less than 10,000 tons.”

Liberty is sending out samples to prospective customers right now, and they are the only ones doing it. Liberty has no competition at the moment when it comes to selling domestically produced lithium carbonate. They will be able to capture their share of the market that requires a domestic source of lithium at a different price than the global spot price, heavily governed by China.

Industry Primer:

How is lithium produced today?

Here are the sources and methods of production :

Source: Lithium Harvest presentation

So we have:

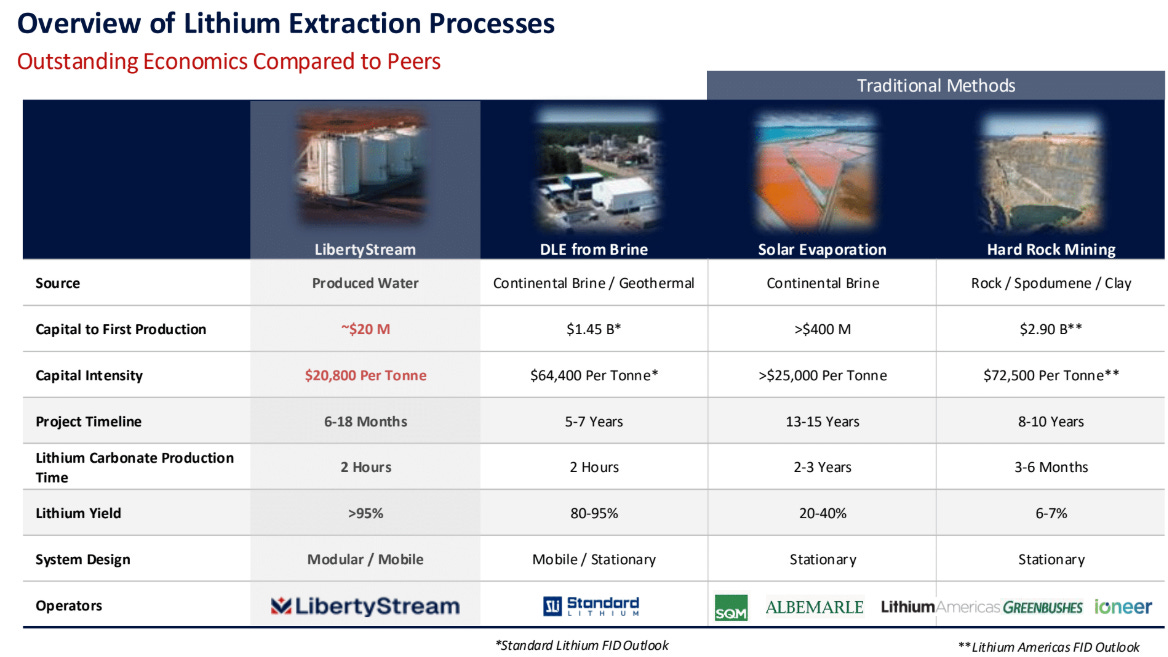

1) Hard Rock Mining:

That is what happens in Australia, for example, and is being planned in the US. To start a mine, you need a huge CAPEX investment and go through all environmental permits, not an easy task, and it takes years, as there is a lot of exploration needed to map out the asset-rich in lithium to come up with a proper mine plan.

Project timelines to get to production are around 8-10 years.

2) Brine evaporation:

Mainly done in Chile and Argentina in the deserts. Takes up a lot of space and is problematic from an environmental perspective as it is water-intensive. This segment will be shrinking over time as even LATAM countries are no longer keen to continue the extraction method. See more here at 4:14, as it is a very impressive method.

Project timelines to get to production are around 10 years+, but I would not expect any new projects of this type to appear anywhere in the US.

3) Direct Lithium Extraction (DLE) from saltwater reservoir

Multiple companies are advancing their projects in Canada and the US. Standard Lithium (recently received a grant), or E3 Lithium. They take lithium from reservoirs known for being rich in lithium. They need to pump it out from the underground and require a high level of CAPEX to set up drilling, get permits to ensure there is no seismic risk, or that the environmental impact is not significant.

Project timelines to get to production are around 5-7 years.

4) Direct Lithium Extraction from oilfield brine.

Similar to 3, but all lifting costs of taking the brine from the ground are handled by oil producers. This significantly reduces OPEX. There is no new drilling, no need for permitting either, because you plug into an existing water system at the disposal well. Such an operation produces much less lithium because your water is just simply a by-product of oil production and not really a selected water rich in lithium; this is offset by much smaller capital requirements and the ability to start operations rather quickly. Production can start running in 6 months; in fact, the first demonstration facility was set up in 5 weeks’ time.

LibertyStreams’ method compares very favorably to other extraction methods:

Source: LibertyStream corporate presentation

LibertyStream Operations:

Business Model - How Liberty Works?

To put it simply, for every oil barrel that gets extracted, there are 3-4 barrels of water coming out of the ground as well:

Exxon, Chevron, Occidental Petroleum, etc., produce oil and also bring up large volumes of this “produced water.” They need to dispose of it, which has created an entire industry focused on water handling and transportation run by companies known as midstreamers. These midstreamers are paid to collect, transport, and, in some cases, treat produced water before reinjecting it into designated underground formations called saltwater disposal wells (SWDs).

The water doesn’t come for free—you actually get paid to handle it!

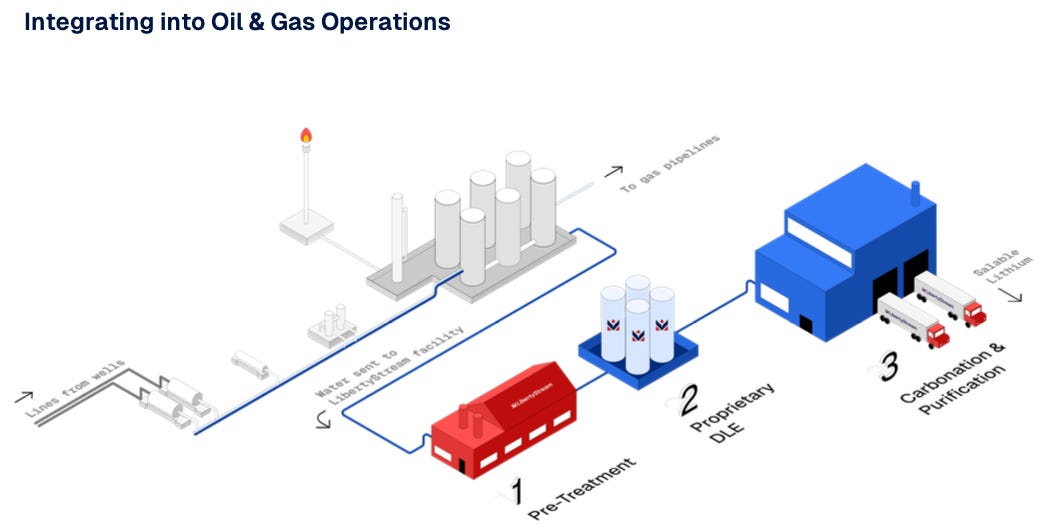

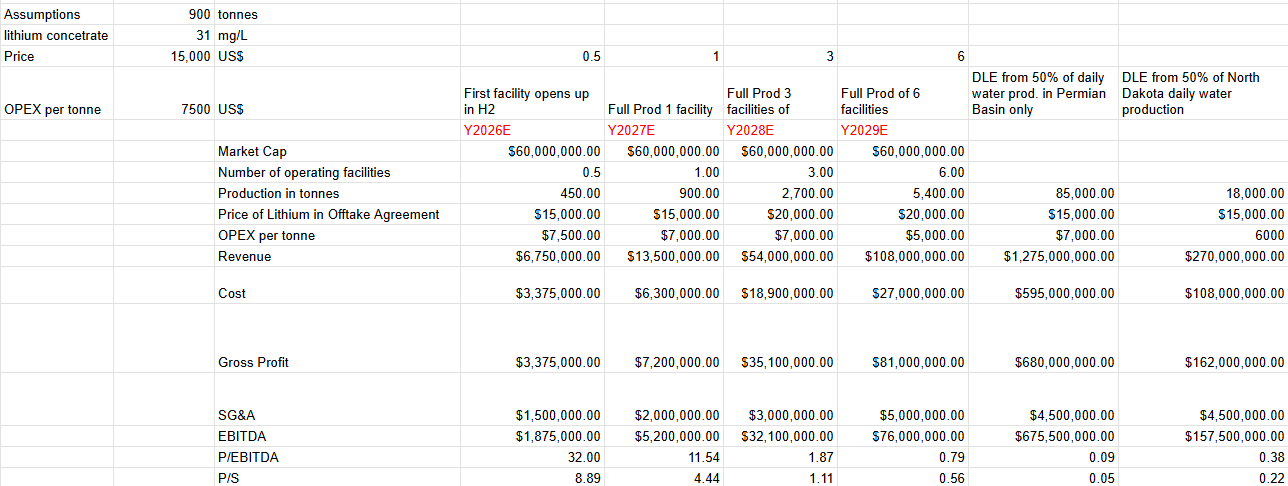

This is where LibertyStream comes in, as water goes through their extraction process for about 60-90 minutes:

How clean is the water after going through Liberty Stream’s plant? Could there be a long-term business opportunity to sell that water for agriculture or industrial processes? If re-injection becomes increasingly difficult to permit, re-purposing the water instead could be a viable alternative. Of course, someone like the midstreamer would have to build water pipelines to deliver water to large customers (e.g., mines, coal-fired power plants).

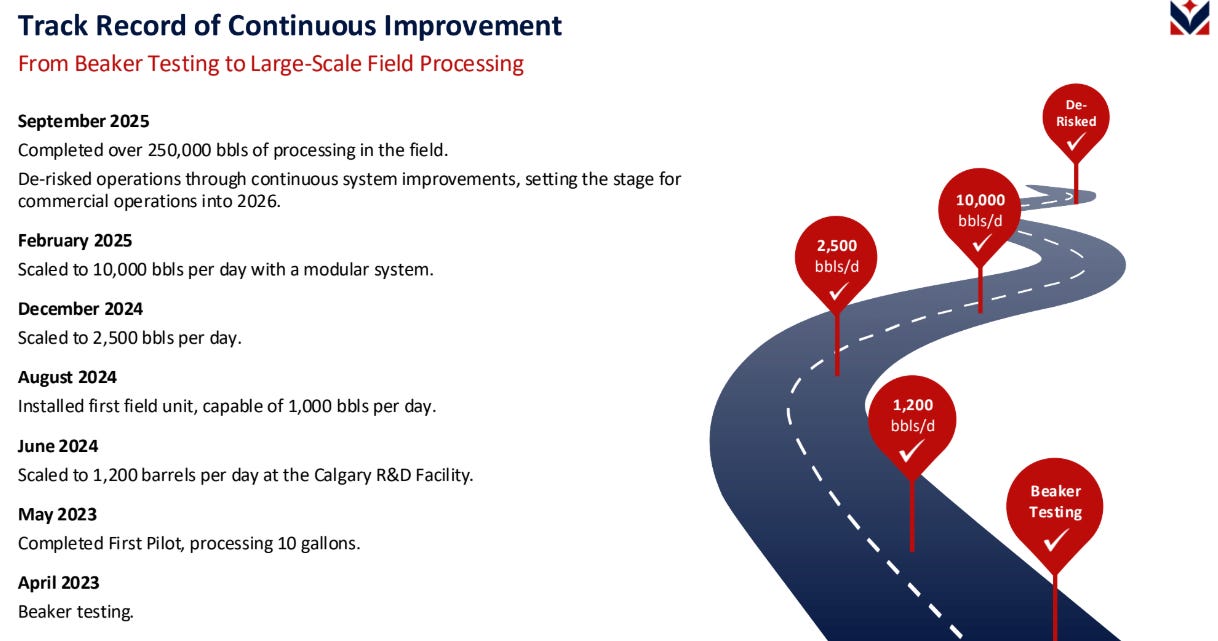

Does the technology work?

Before Liberty Stream, lithium extraction from oil-field brine had never been successfully demonstrated on a commercial scale.

While laboratory tests showed promising results, the economics quickly broke down once operations scaled to processing large volumes of water.

Source: LibertyStream corporate presentation

Libertystream has now operated continuously for over 100 days in the Permian, with both its own and its Partner’s technicians running and independently sampling each extraction tank every ten minutes. Results were double-checked in separate on-site labs, confirming consistent recoveries and validating that the system performs reliably at scale.

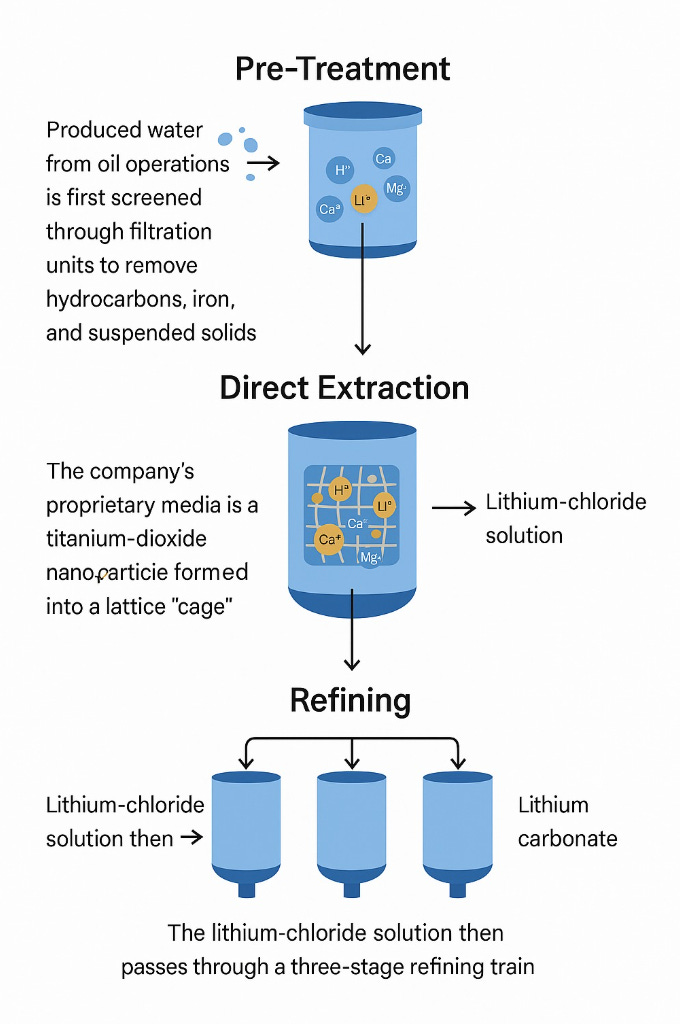

The process itself runs in three main stages:

1) Pre-Treatment:

Produced water from oil operations is first screened through filtration units to remove hydrocarbons, iron, and suspended solids that could foul the extraction media. Early field runs without filtration showed the titanium-dioxide resin darkening over time; after figuring out that the brine needs pre-treatment, reagent consumption fell sharply. What is worth knowing here is that many midstreamers already pre-treat (remove iron, organics, oil residue) from their own water for reuse or desalination, which will further reduce Liberty’s operating costs over time

2. Direct Extraction

The company’s proprietary media is a titanium-dioxide nanoparticle formed into a lattice “cage.” Only atoms small enough to fit, which are hydrogen and lithium ions, enter this cage, while larger ions like calcium and magnesium remain on the surface without blocking lithium uptake. This selectivity allows efficient extraction even from ultra-low-grade brines (~30–50 mg/L). The brine spends roughly an hour in contact with the media, yielding a lithium-chloride solution while returning water to the partner’s disposal well. The media can be chemically cleaned and reused for many cycles without performance loss.

3. Refining:

The lithium-chloride solution then passes through a three-stage refining train: softening out calcium and magnesium, dehydrating the solution, and converting it into lithium carbonate. The last step is a well-established industrial process used for decades, and it will be something that Liberty is working on now after installing a small refining unit at its pilot facilities. The company’s first dedicated refining unit—partly funded by a North Dakota grant - operates on feedstock concentrations as low as 1 % LiCl and achieves recoveries approaching 99 %.

In short, the answer to the question of “Does the technology work?” is yes, with the caveat that the refining unit is not yet commissioned.

The Moat

Source: LibertyStream corporate presentation

Liberty Stream’s extraction setup is inherently sticky by design, both physically and economically. Once installed, the company’s DLE units are plumbed directly into the midstreamer’s water-disposal network, sharing the same pipeline and pressure system used to move produced water to injection wells. Although every flow line includes a standard valve or kill switch allowing operators to isolate Liberty’s system if needed without causing downtime, the reality is that Liberty’s infrastructure becomes part of the midstreamer’s permanent steel-in-the-ground assets. Replacing them would still require re-engineering flow routes, digging up buried pipework, and disrupting an already optimized system. This physical integration creates long-term operational inertia, while the steady lithium revenue stream generated from water that was previously a cost center adds a financial incentive for partners to keep Liberty in place. In short, Liberty’s moat comes from being literally built into the flow and from helping its partners turn waste into profit. Liberty’s first mover advantage plays into this advantage perfectly, as if LibertyStream can position itself with multiple units over the coming years, even if a competitor with a better technology comes around, the cost of switching is likely not worth it for the midstreamer.

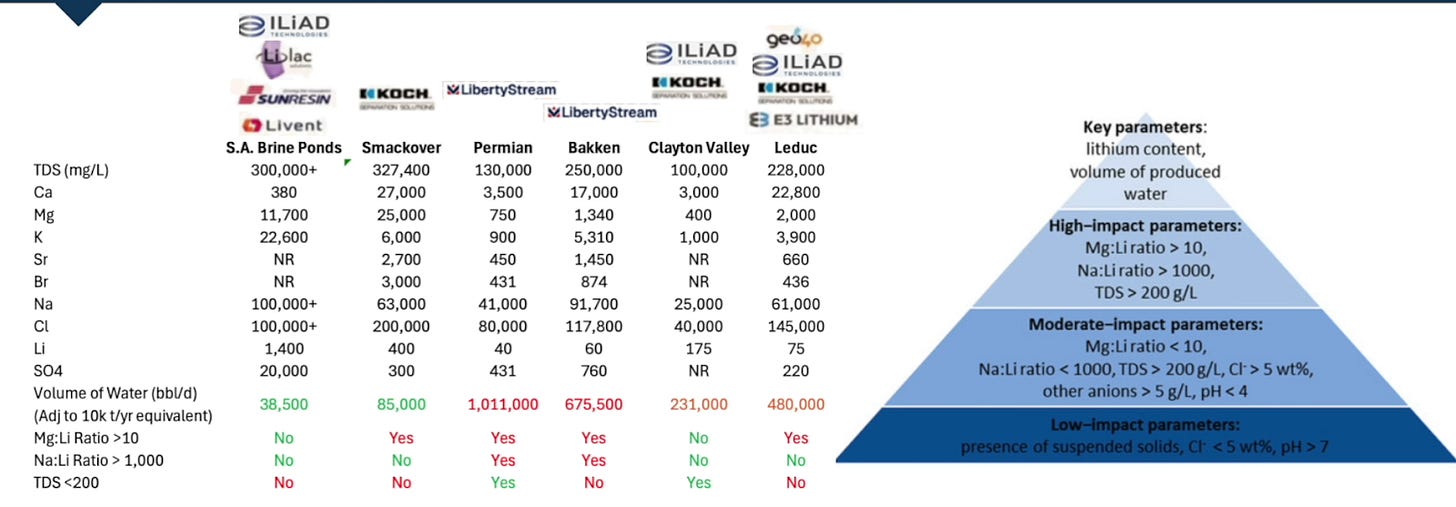

Another competitive advantage of Liberty is that its tech has been specialized for the type of low-lithium-content Brine of the Permian and Bakken.

Source: Pathfinder Planet MicroCap Showcase 2025

Here is an explanation from the Pathfinder presentation. It’s a long quote, but it’s a very good explanation:

“So basically all these people kind of working on North American brine initially in-house were technology and resource companies and they picked ion exchange because they knew it was the best chance but they don’t want to be technology companies they want to be resource companies so they’ve moved and kind of given third parties reign over the DLE and have moved to absorption which is just better understood. but it’s not going to work as well for North American brines. So, the only bespoke sorbent designed for low ppm brines, low lithium ppm brines, um that I know of is Liberty Streams. And that is important because if you take a look at these brine compositions, they’re completely different from each other. it’s tough to argue that something developed for brine ponds, like most of those Gen One absorption are, are going to work really anywhere else.

If you take a look at some of these metrics on the bottom here, they’re what qualify what a good brine might be when it comes to extraction and you can see North America across the board, which is the five rate basins of North America. The far left one is just a generic South American brine pond. They’re all terrible(NA brines). Smackover is about the only one that’s redeemable with its 400 ppm. So, we need probably new technology to do this efficiently.

If you use an inefficient technology, just look at the barrels you need to flow. You know, some of these projects in North America want to do 20,000 tons. Like we’re talking Keystone XL volumes and if your sorbent’s inefficient, scaling becomes basically uneconomical.

So, Liberty Sorbent, that’s bespoke, developed at the National Institute of Nanotechnology for them, specifically for low lithium ppm brine has allowed them to kind of leapfrog the competition in addition to them partnering with midstreamers.

So, almost everyone again that I know of in North America that has a demo facility at site running goes about to that dotted line there. And what that is is post polishing and concentration. When these companies say, “We’ve produced a battery grade carbonate,” what they’re doing is they’re taking a few liters from their site, sending it to a lab to produce a few ounces of a carbonate. And that’s fine. That validates the entire upstream process. Liberty by November will be running the whole process at site connected to the third party midstreamer who’s operating it, producing battery grade lithium carbonate at roughly a thousand barrels a day. That’s my napkin calcs. They are light years ahead of anyone else. And really what’s driving this is their partners. So these midstreamers, this is all they do. They take vast quantities of brine, they move it, they dispose of it, they do some form of pre-treatment. This is their life. And so Liberty is just leveraging that. So they can deploy technologies faster and test new technologies and scale much quicker than their competitors.

The combination of specialization, high switching costs, and first mover advantage is enabling Liberty to potentially create a monopoly in the lithium extraction from oil brines in the Permian and Bakken.

Management & Governance

CEO Field involvement

Both the CEO and the CFO live and work from a trailer for months in the middle of the desert next to their lithium extraction operations. You can go through YouTube recordings of Liberty (search for Volt Lithium Alex), and you will notice the change that the CEO is going through, no haircut, no suit anymore, but an anti-flammable shirt instead. The CEO mentions it in this interview

58:51 Quote:

“If I was sitting in Calgary right now and I’m a shareholder of Volt soon to be LibertyStream I’d be saying ‘Well why are you in Calgary? Why are you not at your operations in the field?’ Well I’m here And that’s critical because we can accelerate faster by being in the field. Is it a sacrifice? Potentially. My family would say so. (...)and I’m driven to lead from the front and will continue to be driven to lead from the front.”

Liberty is on the final stride to get to the revenue. I want to bet on a guy who spent 6 months in a trailer to get the most difficult part of the job done.

I could not find anything fishy about the management. The CEO hasn’t had tremendous successes in the past, but has seen no failures either. He had various companies, and I checked each of them from his LinkedIn profile and didn’t see any issues, failures, or signs of fraud. The CEO claims he had 8 companies, but his LinkedIn shows fewer; an extensive search does not return anything worrisome.

CEO’s ownership is at ~6.7% total, with another stake recently added of over 100k US$ while getting financing from an existing institutional investment group, Pathfinder. The CEO has an oil and gas industry background (and not the mining one), which I find very helpful here, as he understands the businesses and players and their needs well in the sector. Understanding the needs of your partners who supply you with water is essential; sharing the lingo is very valuable. Most of the lithium management you will browse through will have a mining background (all these hard rock miners) or some chemistry/scientific backgrounds (salt water extractors, I covered in the section on DLE from the underground reservoirs). That is also the reason why the company is on the path of taking Lithium from oil field brine; the management could embrace the opportunity, as they know how much water is moved daily in the US alone.

Team Expertise

Other significant figures in the management are:

Tim Frost - His addition will help out with offtake discussions and open doors to established lithium industry relationships. The structure of an offtake agreement is actually a bit complicated, with pricing ranges and formulas used that somehow make the pricing relatable to the current spot price. Depending on how much lithium is provided, different pricing applies too. Frost’s background at Albemarle, one of the world’s largest lithium producers, gives Liberty Stream access to deep operational and commercial expertise, especially in negotiating long-term supply and offtake contracts with tier-one buyers.

Huayuan Jiang

Huayuan Jiang was playing a key role in the development of Li-ion exchange resins used by Liberty, a go-to guy when it comes to customizing their extraction process to adapt to different oil brines - something that the competitors may not possess. Huayuan Jiang worked closely with John McEwen, who recently resigned and moved on to another project. John has 30 years of technical and research experience, having previously served as Senior Director of Technical Services at Solvay Chemicals. McEwen was instrumental in developing Liberty Stream’s proprietary extraction chemistry, the titanium dioxide–based system that enables efficient lithium recovery from ultra-low-grade brines.

Brief history

Source: Seeking Alpha Premium

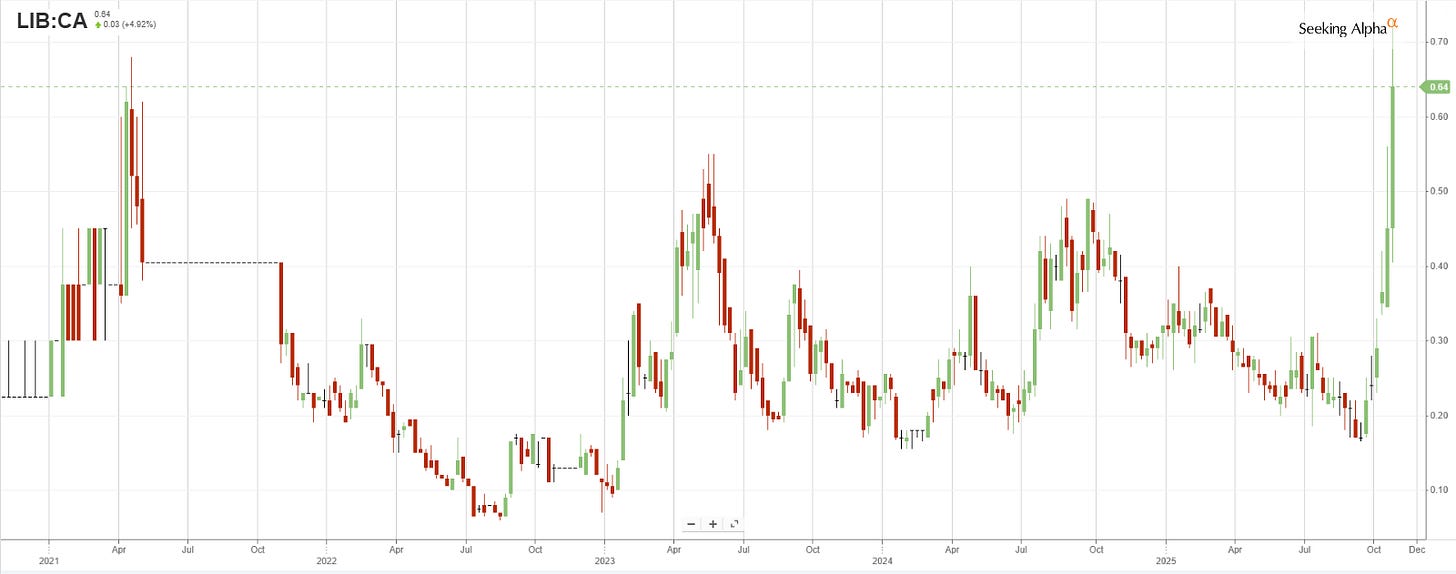

You might wonder what this company was doing all these years. If you look at LibertyStream’s long-term share price. What is important to understand is that Libertystream was a dime-a-dozen junior explorer focused on copper called Allied Copper before December of 2022, when it executed a complete pivot and bought the early-stage DLE business Volt Lithium from the current CEO, Alex Wylie.

Source: Seeking Alpha Premium

Volt Lithium was renamed Libertystream Infrastructure Partners in June 2025 to adopt a more patriotic-sounding name to attract US government money and to better reflect the company’s focus on partnering with O&G infrastructure. Since late 22, during the DLE period, the stock has multibagged

What explains the lackluster share price after the 2023 peak is a combination of the company being in the slower phase of testing and validating, combined with a lithium bear market and a weak oil market. The latest share price run reflects the nearing of commercialization.

Source: TradingEconomics

The DLE acquisition from Allied Copper came at the peak of the lithium market. In most similar situations, the stock would have collapsed after a company made an acquisition at the top. But this acquisition ultimately defined the company, and the copper assets were disposed of.

Competitors

Watching Shark Tank taught me one thing: If there is no competition, it means that something with the business fundamentals or industry is wrong, and you just don’t know it yet. Specifically, in lithium extraction directly from oil field brine in the US, I was able to find two other companies. Both of them seem to be a bit behind Liberty:

Element3

Seems to be at a similar stage of the journey as Liberty - about to start a commercialization with battery-grade lithium products. A few differences here where Liberty has its advantages:

They are private vs Liberty being public

Their recovery rates seem to be lower (85% vs 95%+)

Their Partner is in the upstream segment of the oil industry and has rather smaller water quantities

Elements3 tech is not proprietary; it is licensed. Liberty has its own tech developed by a group of PhDs who are either in the company or are collaborating

Present only in the Permian Basin, versus Liberty being in North Dakota and the Permian Basin

No grants vs Liberty’s grants from North Dakota

In summary:

The partner is much worse, not exposed to large quantities of water

Tech is licensed (so they are not in control to make the tech better if needed; customizations/adaptability may be an issue).

Lithium Harvest

Not as advanced as Liberty. They have gone a little bit quiet and are not responding to my emails sent to IR. It seems they have a smaller Partner in the North Dakota basin (which moves 10x less water than Permian and requires slightly higher OPEX due to different weather conditions). Their tech is patented, and it is worth observing what they are up to.

They have not been seen in terms of sending out samples to any customers. We suspect that the company was created to benefit from financing promises created during Biden’s administration related to green/sustainable projects around EVs and battery metals. Since then, they lost the momentum as they did not get any significant funding. Based on their presentation, this company would be the closest comparable to Lib.

Strategic Partnerships & Pipeline

The Partner (Permian)

The partner landed by Liberty is a “major operator in the Delaware Basin”(Part of the Permian Basin). The partner’s name has not been revealed. When it’s revealed likely next year, it will prompt investors to start digging deeper.

There are a lot of institutional investors who are invested in midstreamers, betting on tailwinds that will come to the sector. These guys will notice Liberty and quickly understand how undervalued the company is. Pre-revenue or not.

As for the Partner, they are lending some of the equipment to Liberty, and they own some shares of the company. They help out in efforts to land the first prospective customers.

Having that Partner by your side when negotiating offtake agreement(s) reinforces the strength of the proposal to US manufacturers, because it is not just a small, unknown company offering lithium, but a much larger, much more established company putting its name behind it. The agreement with Partner regarding future profits is currently unknown; I will assume a JV with a 50/50 split of operating costs and profits from common operations in my financial modelling. The Partner’s name is intentionally not disclosed, as this is a wish from the Partner that the CEO would like to honor. I suspect that the Partner wants to acquire more companies that move water in the Permian and does not want to reveal all the cards during negotiations on how to value the water that is being disposed of on a daily basis.

We are assuming a 50/50 split because Pathfinder, the largest shareholder of Liberty, said this in their recent presentation:

“It’s still not exactly dialed in. In general, it seems like this first partner is going to be a 50/50 split um in terms of revenue. That’s also a 50/50 split on OPEX costs.”

Other Partners and Brine Sources

4 major water movers are in discussion with Liberty and are under NDA. Samples of water have been provided to Liberty to run lab tests for lithium content. This is significant as it outlines the opportunity that comes with the fact of being the first mover in DLE from oil brines. Liberty can become a monopoly in the Permian; one of the projections shows how much revenue $LIB can generate for 50% of daily water being processed - the number is at 1.2 billion US$.

Commercialization Path

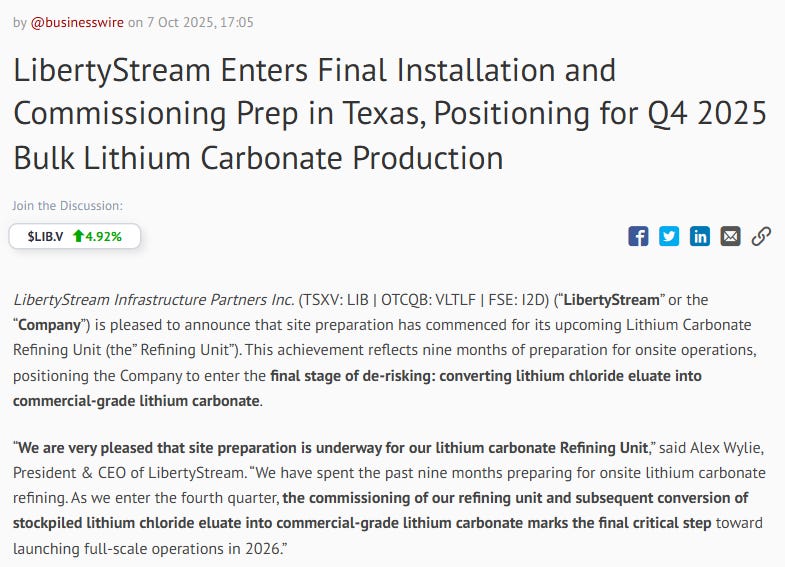

Refining unit commissioning Q4

Source:https://ceo.ca/@businesswire/libertystream-enters-final-installation-and-commissioning

They have stockpiled a lot of lithium chloride from their 250,000 barrels of testing. The refining unit that is being commissioned is basically a demonstration unit of only 10 tonnes per annum. 15k lithium that would be 150k per year if revenue, which is not material. The point of this unit is to produce bulk samples and send them to prospective customers. After that, based on the demand and the deal they can land, they will be scaling up the operation. Most of the CAPEX is going to the larger refining unit. Refining is the bottleneck for higher production, as they are confident in their ability to scale their extraction process:

Source: https://www.mrt.com/business/article/reeves-county-lithium-libertystream-21095148.php

Offtake Agreement – Progress So Far

Liberty Stream plans to use its first offtake agreements as the foundation for financing the CAPEX required to scale up its initial production facilities. There are 7 prospective customers, and the company expects auction-like price dynamics to get the best deal possible. Liberty cannot sign all customers as demand already exceeds what Liberty can supply in its first year, meaning that buyers most desperate for secure domestic lithium may effectively bid prices higher during contract negotiations. Rather than limiting itself to a single initial customer, Liberty intends to sign as many offtakes as its production capacity can support, expanding in parallel with available funding. To date, some of the prospective customers have requested bulk samples ranging from 100 kg to 1.5 tons to validate lithium purity and performance. These include:

a medical equipment manufacturer (for applications such as air/oxygen purification systems),

a ceramics producer,

a glass manufacturer that uses lithium to lower melting points and improve thermal stability.

Financials & Valuation:

The company’s market cap is 78mln US$. Once the company starts posting revenue numbers and releasing estimates, the wider investment community should wake up to the opportunity.

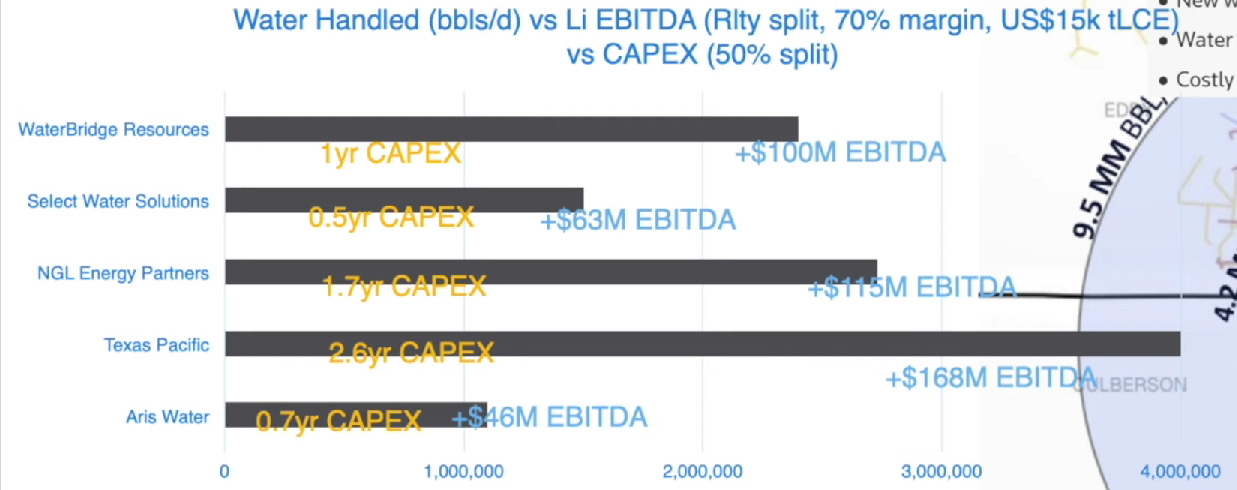

Here are three long-term scenarios:

Below more detailed analysis:

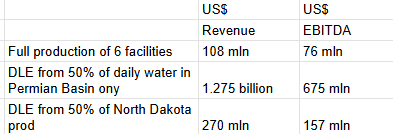

Here is Pathfinder’s estimate of the EBITDA potential from ramping up with different major midstreamers:

Source: Pathfinder Planet MicroCap Showcase 2025

Our calculations also used the same price as Pathfinder, 15k per tonne. NA lithium trades at a premium to Chinese and lithium in an offtake agreement trades at a premium to spot. And considering the future political factors highlighted before, such as export restrictions, price floors, etc. These are likely to increase the premium of NA-produced battery-grade lithium even more.

Each facility that could produce 900 tonnes annually would cost about 20mln in CAPEX.

Once financing is secured, Liberty Stream can move from funding to full operations in as little as six months. The company has already demonstrated how quickly its systems can be deployed, as its first extraction setup was stood up in about five weeks earlier this year, with the refining unit entering commissioning only a few weeks later. The DLE modules and refining units can also be built in parallel, further compressing startup time. While future refining units will require some lead time for shipment to arrive, the field installation itself remains rapid and modular. In practical terms, this means Liberty could have a facility capable of processing roughly 100,000 barrels per day and producing about 900 tonnes of lithium carbonate per year within half a year of funding. The timeline aligns well with customer expectations, as industrial buyers typically maintain several quarters of buffer supply from existing contracts—giving Liberty sufficient room to ramp up smoothly into commercial production.

Full return of invested capex comes in ~3 years.

Financing CAPEX

If LibertyStream doesn’t receive enough support from the states or the DOE, how will it finance the 20 million CAPEX required to build the commercial plant? Assuming they have a 50/50 deal with a partner, they would need 10 million. And for a company with a market cap of Xm USD, what kind of dilution risk does this present?

At the end of Q2, LibertyStream had only 136k in cash. Their quarterly expenses, excluding CAPEX, are about 1-1.4 million. On August 8th, they closed US$ 3.53 million promissory note financing. This note has a 12% interest rate and matures one year from closing. The bonus shares included caused only 1.8% dilution. The 2nd-largest shareholder, with a 6.7% stake, the CEO contributed 130k to this financing, and the rest came from Pathfinder Asset Management, the largest shareholder of LibertyStream, which owns 8.2% of the company. This shows strong conviction from the largest shareholders.

The CEO has been vocal about minimizing dilution. Quotes from an interview:

“Well, what we have to do is scaling up takes money. And again, I’m the largest shareholder. I don’t want to dilute it. The fear for any company our size is completely diluting the shareholder base and destroying all value. I’m not prepared to do that. So, what we have to do is be real smart about how we access capital and what type of non-dilutive capital that we’re working from.”

“Can we scale it? I’m highly confident we can, but I’m not going to scale us at the risk of completely diluting all our shareholders.”

Given the pre-revenue nature of their business, they have been successful in keeping dilution to a minimum. Last Private Placement closed in November 2024 and raised only 483k. After this, they have been able to finance their scale-up with Grants US$ 3.7m and a Promissory note US$ 3.53m.

This shows that the CEO is serious about keeping dilution to a minimum and that massive dilution to finance growth seems unlikely given the track record and statements. Still, some dilution is likely, or at least we should not be surprised by it, due to the financial demands of the scale-up.

And the recent surge in valuation gives them the option to raise money with significantly less dilution than before. In pre-revenue companies, a higher valuation is very beneficial in this regard.

Risks and near-term catalysts summarized

Risks:

The Partner decides to either acquire the company or process things on their own

Not meeting the specifications of a high-tech battery company. There is still plenty of demand from easily meetable specifications

Small company, still some hiccups on the last steps of refining may occur, although this is a rather easier step and has been done in the industry for 30-40 years

Dilution risk is reduced by CEO incentives and a track record of raising non-dilutive capital, but it’s still a risk in any small-market-cap, pre-revenue growth company.

Delays. Kills momentum.

Sourcing the refining unit and parts for it may be subject to export controls. It makes Liberty rely on third parties that, if delayed, may impact the execution of the offtake agreement

OPEX is higher than what we see in all the other Libertystream write-ups. It is about 8k US$ per tonne. Long-term OPEX is 4-5k after the scale-up. In case of lower pricing agreed in the off-take agreement, this will put a strain on the margin.

Oil/Brent price going down to 40$ or lower - making Permian operations slowly shut down and having less and less water to get Lithium from.

Near- and Mid-term expected catalysts:

Refining unit commissioning Q4

Offtake agreement Q4-Q1

Partner reveal. 2026

DOE grant, loan, or more grants from North Dakota State. Any day.

Expansion of the first unit to 900 tpa. 2026

You may notice from the risks and the catalyst that the bull and bear cases are quite uncorrelated with the general economic situation. In this way, LibertyStream can have a diversifying effect on one’s portfolio.

AlmostMongolian’s positioning and price action thoughts

I bought a small position at 0,255 and 0,29 cents. I was planning to get more, but then the stock took off. Due to the share price surge, it’s now it’s a mid-sized position. The recent stock price action has been wild. There have been many +20-30% daily moves with no news and massive volume. The stock is up +169,76% in the last month. The news flow has been positive(new 500k grants, refining unit commissioning updates), but not significant enough to alone explain such a large move, on top of that we have seen some institutional buying and a lot of media exposure in a short period, write-ups, articles, and the Pathfinder presentation. I would say it’s a combination of these things that has ignited the up move.

I’m neutral on the stock price in the short term, but I would not be surprised by a significant dip. If it gets back under 40 cents, I’ll likely add again. Now that I understand the thesis better, my adding zone is higher, and I remain bullish mid- and long-term.

Summary

What makes LibertyStream’s investment thesis appealing is a combination of the following factors: perfect political environment(grants, favorable policies), many near-term catalysts, competitive advantages(first mover, specialised tech, sticky business model), committed CEO aligned with shareholders, and low market valuation compared to future potential.

I took a look at this one early in the year and took a pass. The economics looked solid enough at the lithium price deck they were assuming, but that price was roughly double the market price. At the market price, the margins were not enough to get excited about and I think this is still true today so then it becomes a bet on the lithium price which I'm not too keen on. This is the problem with all these China-restricted metals. As long is the tap is flowing from China, no one can compete with them on cost.

That said, you've made a good case for why this technology could have strategic value. I'd like the stock more if they were pursuing a capital-light or build-to-sell model. The technology makes much more sense being owned by the midstream partner with a lower cost of capital. Definitely one to keep an eye on. Wish I had been paying closer attention to it.

The midstream water infrastructure angle here is underappreciated. Energy Transfer and other major pipeline operators handle massive volumes of produced water in the Permian, and the fact that LibertyStream's tech gets plumbed directly into existing disposal networks means these midstreamers could essentially monetize a waste stream. With the article noting shallow disposal zones getting over-pressurized and New Mexico banning certain disposal methods, midstreamers with cross-border infrastructure and the ability to integrate lithium extraction are going to have a strucural advantage going forward.