I'm conflicted about uranium.

Conflicted

Why am I conflicted about uranium? At the moment I’m not invested in anything uranium-related, but I’m actually long-term bullish on the uranium price. I don’t have to explain to you the bull case, because you have already heard it many times from many people. And that is one of the problems with uranium. In this article, I will talk about why I have not invested in uranium. Despite me being bullish on the uranium price long term.

The popularity

I’m gonna list some people who are uranium bulls in the investing community.

I’m gonna stop here, because I just keep finding more of these.

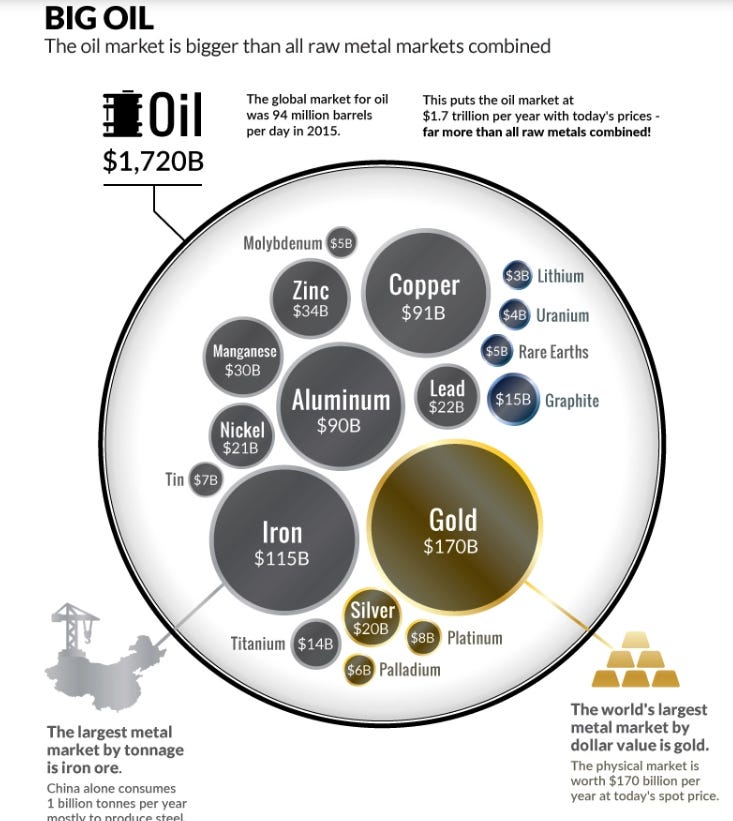

I’m not a fan of this as someone looking for investments. A lot of these are solely focused on uranium. But AlmostMongolian oil has popular Twitter personalities as well like Josh Young and Eric Nuttall and you’re still investing in oil companies. Well, a picture speaks louder than a thousand words.

Sources: Infomine, EIA, World Gold Council, Johnson Matthey, Cameco, Benchmark Minerals. Screenshot from visualcapitalist

If you can’t find it. Uranium is the little ball on the top right below lithium. Oil is the most important commodity in the world and it will always have a lot of attention. Now imagine if you would make this same comparison, but instead of market size, you would measure the popularity among retail investors. Uranium would be one of the biggest balls in there. Uranium investors might be right(I think they are), but they’re not contrarian. I say this because many people in the space think they are investing in this hidden and hated sector.

the investment options

the miners

I don’t like them. They are expensive. And here I’m talking about the producers, developers, and explorers. They are expensive because of the previous issue. The popularity. When so many retail investors are piling into a small sector like this it’s not gonna stay cheap. There is only so much juice in a fruit. And the companies have already priced in much higher levels of juice that are already present. I don’t like this. I like to invest when the market is pricing in lower levels of juice than is already present in the fruit.

Let’s go over some valuations. Cameco is a big producer in a safe jurisdiction. Let’s compare Cameco's valuation to bigger, better, more diversified, and less risky international mining companies.

Source: Yahoo Finance

Divident yield

Rio 6.64%

BHP 6.2%

Cameco 0.23%

The only uranium company that has a comparable valuation to Rio and BHP is Kazatompron. It has 4.5% dividend. It operates only in Kazakhstan and which is a close ally of Russia. Which means Geopolitical risk. We saw what happened to Russian stocks. This thing should trade at a discount to Rio and BHP because It mines one commodity in one risky jurisdiction. But as we can see it has a similar valuation because it mines uranium and people really like uranium.

Source: Yahoo Finance

Then let’s look at some developers. Those who have some experience in investing in mining know that developers tend to trade at a large discount to the project NPV, because there are so many risks to actually putting a mine into production. But not uranium developers.

This is NexGen energy project NPV at different uranium prices.

Source: NexGen Corporate presentation

The company has a market cap of 3,7 billion CAD. We just spiked to 70$ most of the time this year we have spent at 50$, but even at 70$, the discount is small.

Source: Global Atomic corporate presentation

Then we have Global Atomic. The stock has dropped from its peak by a significant amount because their Dasa project is in Niger and there was just a coup and still the company is trading 428 million CAD market cap. And that is basically all there is. The Zinc joint venture is pennies. This project is in an extremely unstable jurisdiction, but the discounts are not even big if you use higher prices compared to projects of other commodities. If this was any other commodity the discount would be massive. Well if it was silver it could have a similar valuation.

Let’s compare these to some projects of other commodities. These are just 2 developers from my recent memory. So I’m not going out of my way to find the biggest discounts. Some of you probably know about Santo Tomas from Oroco. Market cap 97m USD after tax NPV8 at around current copper prices of 1.24B USD. OK jurisdiction. Mexico. It’s no Niger.

Then Colonial Coal. 300m market cap. Canada. NPV of combined projects’ most conservative estimate is probably 1.5B all the way to 4B cad for the higher estimates.

(I’m not invested in any of these companies I have mentioned so far.)

I don’t like it when the valuation is held up by high sentiment, because if the high sentiment goes away the stock will drop like a rock. I learned this lesson the hard way with Voxtur Analytics the biggest loss in my investing career, but that is still an ongoing investment. And a future article.

the physical funds

These are Yellow Cake $YCA and Sprott physical uranium trust $U-UN.TO. I like these more than the miners. If there is a large dip I might think of buying these considering my long-term bullish view on the uranium price. Still, one of the things I don’t like about these is the fact that I’m paying to the investment. I like to get paid by the investment or the investment creating value somehow. But this thing is not creating value. It’s just holding uranium in storage. Nothing is being created and it is not paying me. I’m paying a fee for holding it.

And ETFs are just a mix between physical and miners sometimes mixed with some unrelated companies with a fee attached. Not interested in the ETFs.

The squeeze narrative

After the Gamestop short squeeze happened everyone has been trying to recreate it. This is also the mentality in the uranium space. The utilities are like the shorts and the retail investors are going to squeeze them by buying the Sprott uranium trust and taking all the supply out of the market. And then buying the Sprott uranium trust is “doing my part”. There is an identical “movement” going on in the silver space with the Sprott physical silver trust. I don’t like these types of retail investor movements. They are red flags for me in investing. They work both ways. What if the popularity starts declining? All this money starts flowing out of these overvalued companies. Where is the fundamental support? Where is the margin of safety? Then the money will flow out of Yellow Cake and they can sell uranium to the market. Sprott Physical Uranium Trust can’t sell uranium(But they are considering changing this and most likely will). I don’t know how that makes sense from a shareholder value perspective. I guess the point of the trust is to Gamestop uranium and the shareholders want this more than buybacks when the fund is trading at a discount. Personally, I’m not going to enter an investment just because I think more people will buy it and drive up uranium because they think more people will buy it and drive up uranium. It could be a successful speculation, but I’m not interested considering other opportunities I see in the market.

Sometimes the lack of consideration of sentiment and valuations can make you money. I bought a bunch of uranium juniors in 2020 when I did not really understand valuations and I made 9x on Bannerman, 8x on Paladin, and 5x on Global Atomic. I sold them when I started understanding valuations and forming my current opinions about the space.

Summary

It is an interesting situation in the uranium market as you can see. At the moment I’m just interested in seeing how this plays out. Can these retail investors squeeze the utilities and make the uranium go to 200$? Or are they just dreaming? Lately, the uranium bulls are looking good. Uranium price is up around 40% this year. But I have personally learned never to celebrate before taking profits. For me, it is just interesting to see if this play can work just based on a solid supply and demand thesis when the companies are trading at high valuations and the sector is very popular.

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. It’s all opinions. Everything I have written here could be totally inaccurate. Trust nothing you just read.

Good article

The only way the current valuations of many uranium miners and developers can be justified is for uranium price to stay above $80-90 for long term. If one is bullish on commodities in general, and precious metals and uranium in particular, $SII can be a safer play. When the bull market takes off, the value of its existing AUM goes up, in addition to new money flows into its products. During the commodity bear market from 2012 to 2020, $SII was able to pay its dividends each year.