Globex Mining Enterprises: Great business, great CEO and extremely low valuation

Don't let the word mining deter you

I had a brief gold and silver miner phase that started in 2020 and ended at the beginning of 2022. I guess I understood that trying to predict the gold price is like trying to predict the oil price, but 10x times harder. And during this phase, I looked at many companies in that sector, but not many stuck in my mind after the phase was over, but Globex mining enterprises did and I recently entered into this position again at around 75-77 cents CAD area.

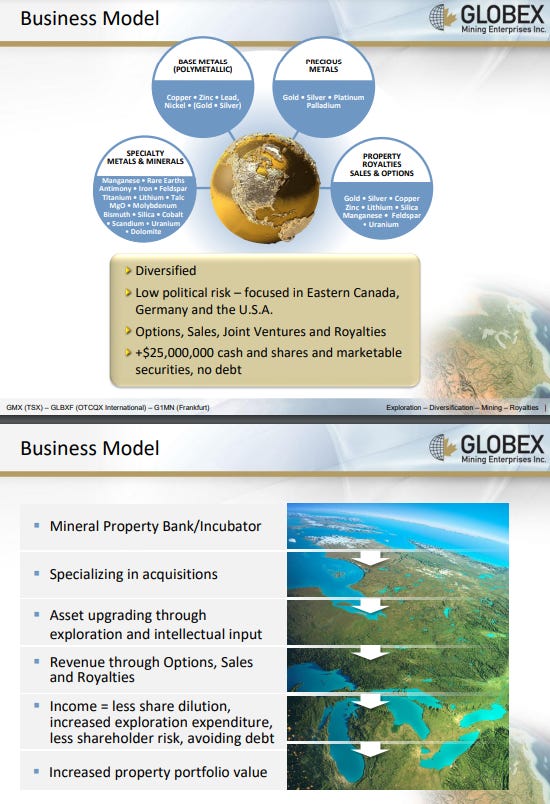

What does Globex do?

They have described themselves as a property bank and a project generator. They acquire properties and upgrade them by doing work on them like compiling information, doing surveys, and geological sampling. Things they think can increase the value of the property. They don’t really drill or do anything that capital-intensive.

Then when the market is interested in the kind of property in question they option them out for money or shares or both and keep a royalty on the property. Usually, there is also a requirement of how much the optionee (usually a junior miner) needs to spend on the property. If the optionee can’t or won’t pay fully to Globex. Globex gets the property back and keeps all the money and shares that were already paid to them by the optionee. This can sometimes be very beneficial as the other company might spend millions on the property making it more valuable. Also, the payments are usually done over the years so if the optionee pulls out they keep the payments and the property, but if the optionee pays wholly and takes the property into production that is great for Globex because Globex keeps a royalty on that property. So it’s kind of a win-win business model for Globex. They basically take advantage of junior miners for a living. They have amassed a bunch of these properties, cash, shares, and royalties and I’m gonna put some slides here from the corporate presentation. Let’s get this part over with so we can get into the real meat of it all which is the valuation.

Source: Globex Mining corporate presentation

Why I am interested?

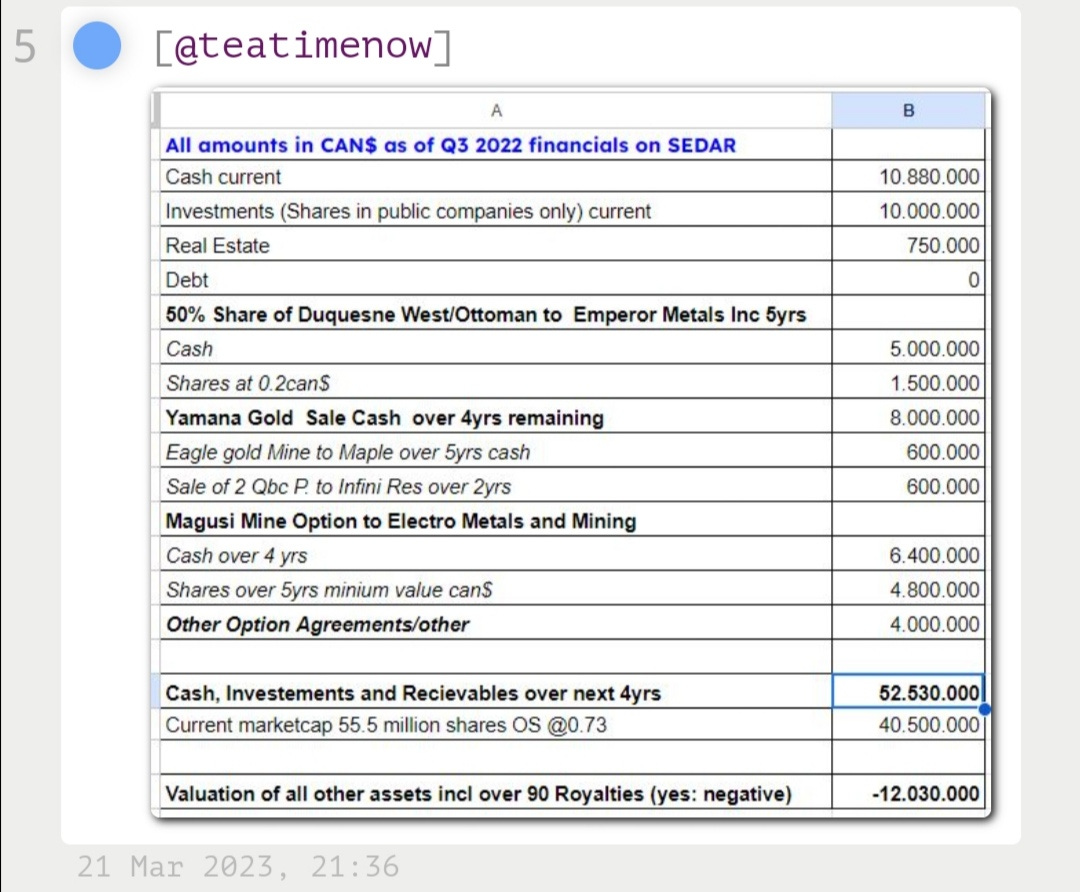

And I’m just gonna show you a picture and after you look at it you will be much more interested.

Source: ceo.ca

Thanks to teatimenow in ceo.ca for the calculation. It’s not completely up to date, but not much has changed so it is good enough to get the the message across. Here are their liquid assets and some money that will be coming in from different option agreements assuming nobody pulls out, but as I explained if some of them do it’s not the worst outcome. The Yamana payment are quaranteed, but the rest are uncertain, but I think it gives a good picture of the kind of money Globex can expect. According to their most recent corporate presentation cash and investments is now +25 million CAD. This calculation also doesn’t include operational costs so I wouldn’t just run with it, but it illustrates the cheapness quite well. What else? (following amounts are in CAD)

This company has no debt. It has total liabilities of 209k. So almost nothing really. The market cap is up to 45 million now. Their operating expenses per year are around 3-4 million. They fluctuate quarterly and the revenue fluctuates quarterly. They might have more exploration expenses in some quarters than others and they might get 4 million of revenue in some quarters if some big option payment comes through and 100-300k revenue in some quarters. They have no CAPEX. They are not involved in that part of the business. They are also buying back shares.

Someone might say “Oh it’s not that cheap that calculation from Mr. teatimenow doesn’t even include operational costs or have any kind of discount rate applied to the future income streams.” Then I might say “Did you forget they have all this stuff? All valued at zero in the balance sheet, because CEO doesn’t want to waste money to appraise it all.”

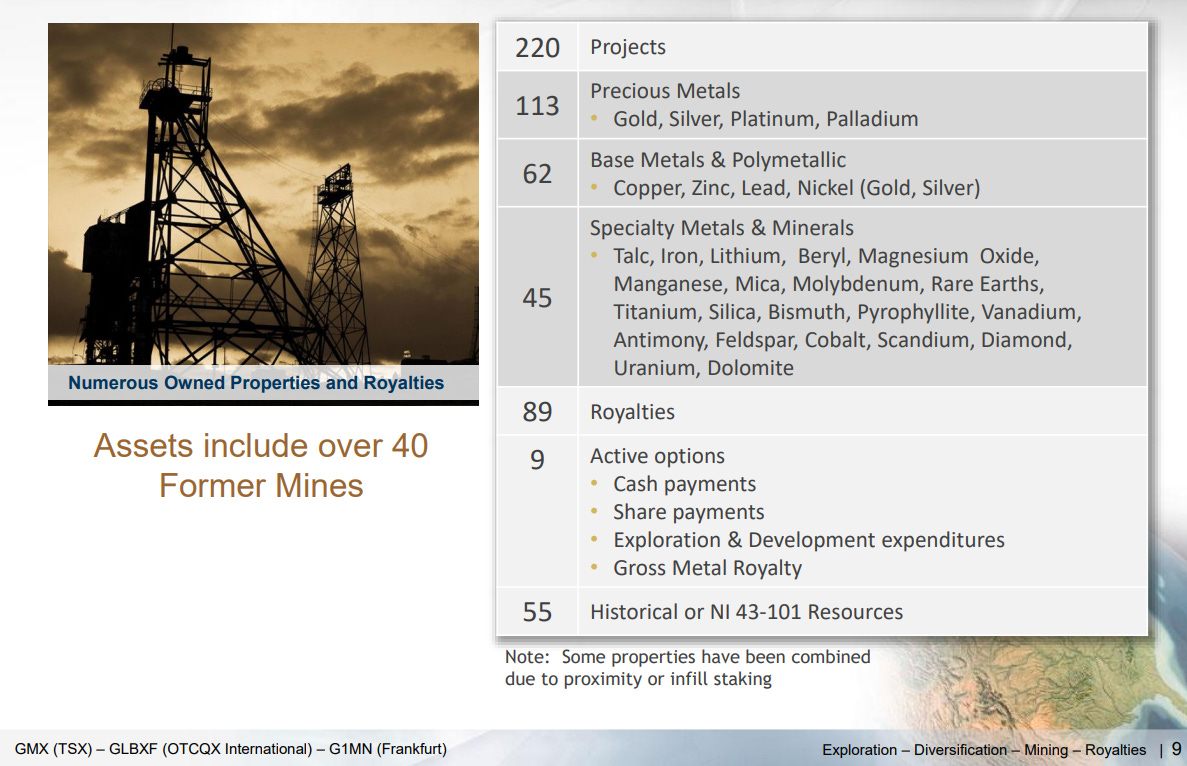

Source: Globex Mining corporate presentation

This is all not in the balance sheet. What is it all worth? Nobody knows exactly could be 10 million could be 500 million, but let’s forget the 30.9 million coming in during the next 5 years and just subtract current cash and investments from the market cap 45-25=20 million CAD. So the market is valuing 30,9 million of incoming cash and shares over the next 5 years and 220 projects which includes 89 royalties at 20 million CAD.

And if you look at that chart they had 160 projects in 2017 they also had only 3 million of cash and investments back then. Now they have 220 projects and 25 million of cash and investments and the 30,9 million coming in over the coming years. How did they achieve this? Their diluted share count has gone up 9% since then and of course no debt. The stock has gone up around 50% since then, but the EV is lower now than it was back then. I would say they have been creating value and the stock is cheaper now at 83 cents than back then at 55 cents.

The President and CEO Jack Stoch

This is a great interview with the CEO Jack Stoch and I like the way he is approaching this busines and his shareholder-friendly mindset. If you got interested in Globex I recommend listening to the whole thing.

Some quotes from the interview above

a question about book value

“I don't like excuse my language don't like pissing money away so. we have so many assets and each year when you do your annual report the Auditors want to assign a value to each individual property well you have to pay them to sit and argue with you about what the value of a property is. Imagine the nightmare of trying to evaluate 221 assets and it's variable from things that are a good expiration place the things that have over 800 000 ounces of gold things that are under option things that aren't other options things which are metals in demand things that are not Metals in demand so it got to be hugely expensive to argue with our Auditors of on what value to assign on each individual property so what we said we said can we look can we value everything at zero and just write off everything unlike other companies where other companies for example will have a property that they spend 10 million dollars on and got nothing but they value it at 10 million. If we've spent 10 million on it and if we've got something we still value it at zero because we want to save several hundreds of thousands of dollars each year which would have gone to the Auditors as much as I like our Auditors. I don't like them enough to give them money just for the hell of it”

18:48

“We option out the properties when people are interested in that commodity” 5:40

“What’s a lousy market for other people is a great market for us, because we can acquire assets cheaply. When it’s a good market for them they got money and they need assets” 12:15

“We don't have a brokerage following like we've never been recommended for example by any brokerage firms and that would be because we never do financings well never but we don't do financings we make money because we make money they don't make fees if they don't make fees we don't exist” 13:03

“There is no other company I think really exactly like us that views the final product as money rather than the mineral” 10:17

“I'm going to say something which probably is going to be a bit weird but I think you should value us on your gut feeling” 16:52

Well, I will stop now with the quotes the interview is there. It also explains the revenue spike in 2021 and some things that have been affecting the share price recently.

Source: Globex Mining corporate presentation

In addition to stock buybacks insiders have been buying. The last insider sale according to SEDI was in 2016. Recently one of their directors made big purchases. A very experienced person.

From the website of Globex “Johannes H. C. van Hoof – Director

Hans van Hoof is Executive Chairman and a director of NS Gold Corporation, companies listed on the TSX Venture Exchange. Mr. van Hoof has held senior positions at various European financial institutions, including PVF Pension Funds, Paribas Capital Markets and Bankers Trust. His roles during the past 22 years include senior Portfolio Manager, senior Risk Manager, Deputy Head of global equity derivatives, Managing Director responsible for M&A arbitrage, derivatives arbitrage and venture capital investments as well as Chairman and Senior Executive Officer of Soros Funds Limited in London. In 2002, Mr. van Hoof founded VHC Partners alternative investment management group, active in hedge fund management, corporate and project finance advisory services, private equity investments and charitable projects.”

Source: ceo.ca

Jack the CEO has also been buying consistently over the years and he owns around 9% of the company.

Why so cheap?

Hard to value. So many royalties, properties, and deals. I’m an investor, but I’m not gonna dig through every single thing. It takes forever and I can see the stock is cheap just from what I have shown so far.

The lack of consistent predictable revenue and profits. Option payments are irregular and uncertain. Their royalties are not producing income yet.

Globex doesn’t promote much. Jack did this Crux interview recently, but the last long interview he did was a while ago. I don’t think they do many conferences either. And as was explained in the interview they don’t have a brokerage following.

Potential

If some of these properties they have royalties in get to production the revenue can be significant and considering that causes no extra costs to Globex who have mostly fixed costs this would make Globex a cash flow machine on steroids, but that is the long-term super bullish case. And we know how highly royalty companies get valued in the market, but Globex is not at that stage yet.

For example they have is the Manganese X Battery hills Projects 1% GMR royalty.

“PEA Highlights:

Robust Economics

After-tax net present value using a 10% discount rate (“NPV10“): $486 million

25% internal rate of return (“IRR”)

Capital costs (“CAPEX”) of $350 million with a payback of 2.8 years

Average annual gross revenue of $177 million per year over the 47 years Project life

Average annual gross revenue of $220 million over the first seven years

So they would get 1% GMR royalty from this mine if it was to become operational.

and what is GMR royalty? Well, a simple way to say this is that it comes from the top line, not the bottom line. So whether the revenue is profitable or not for the miner Globex gets the same %. A more detailed explanation is in the interview at 6:10

If this mine gets into production and starts making 220m USD annually over the first 7 years Globex would get 2,2 million USD annually which is 3 million CAD annually of pure profit over those first 7 years and then it would decline to 2,41 million CAD annually. That royalty would also increase with commodity prices so it is inflation-protected income. What would that royalty be worth in that scenario? Definitely more than the current EV.

This write-up could be 100 times longer if I went through every royalty and property. If you get interested there is a lot to dig through. There are many JVs, royalties, and properties with the potential to add a lot of value.

This was just to show what kind of potential these royalties have if some of them make it into mines and they have 89 royalties. I think over the years some of them will become mines, but if not it’s not like these royalties are worthless to Globex even if they are worthless in reality. They can be sold to other people who think they have value. Like options. Most of them are fundamentally worthless. I mean a royalty on a property that will never produce any metal is worthless, but the belief and the potential give them some market value. For example, Globex sold a pack of royalties to Electric Royalties for cash and shares. They got around 1,5 million CAD for non-income generating royalties.

If the royalty doesn’t start generating income it’s not a big deal. They can hold onto it or they can sell it. If it starts generating income it’s amazing. That would be a way to get to those nice hefty royalty company valuations for this stock.

Safe way to play commodity prices

If you’re in the commodity super cycle camp I don’t think you can go wrong with Globex. I’m one foot in that camp I used to be 2 feet in, but then I realized the future is hard to predict. I think there are good arguments about why commodities especially metals could do well this decade.

Source: Globex Mining corporate presentation

And as you can see they cover a decent chunk of the periodic table. Globex stock went 10-30x depending on how early an investor bought it during the early 2000s commodity boom. If you’re bullish on the periodic table Globex is a pretty safe way to play that move and even if the move you’re expecting in metals does not happen I think you’ll still do fine with Globex compared to some random junior explorers who print shares like it’s their day job or some developer forever locked in the purgatory with the regulators.

Conclusion

I really like Globex. I would even like to get even more shares, but Gold is around to 2000$ and every time that has happened it has not been a good time to buy gold-related stocks and Gold is the metal Globex has the most exposure in. So a bit of a warning there. I’m just holding the current position and waiting for dips to buy more. The CEO is great. The margin of safety is amazing as you have seen no debt, a large cash position, and a very low valuation. The upside can be huge or it can be decent depending on commodity prices and the development of their properties and royalties. The value of their assets and future income streams way exceeds the current market cap in my opinion.

Wouldn't higher Gold prices be beneficial for Gold mining & related companies ? Risked project NPVs should be higher I guess ? Might be silly question but I have started looking into mining just recently ..

Looks like a company the CEO, assuming can make it happen, could get a nice big salary and maybe some performance shares ontop for not a lot of work.