Fishing in a newly hated sector: ZIM Integrated Shipping

There are hated sectors and actually hated sectors.

When investors talk about hated sectors they usually mention coal, oil, or tobacco, but I think they are missing the point from an investing perspective. These sectors might be hated from society's ethical perspective, but being hated as an investment is completely different.

Tobacco was hated as an investment before tobacco stocks had their 20-year run. After that while tobacco still is hated as an industry by the people in society, because their products cause their consumers to die. That has not stopped tobacco from becoming a darling of investors. Everyone knows the story now no new competitors, addicted customers, stable dividend yields, etc. It is not a hated sector anymore from the perspective of investors. Same thing with coal and oil. In 2020 nobody wanted to invest in coal and oil, but now after the great performance these sectors had in 2021-2022 a lot of people are back investing in these sectors and are more familiar with the bullish case which bothers me a bit as someone who is still heavily invested in oil.

I went on this tangent, because the next company I will talk about is actually in a hated sector from investors' perspective currently, but not from society's. Do not make the mistake of mixing those two things as an investor. The reason being investor sentiment toward an industry turns like a jet ski while society's sentiment turns like a cruise ship. I think I could write much more about this subject, but now let’s dive into the actual meat of this post which is container shipping and ZIM Integrated Shipping Ltd.

Source: Freightos

Above is the FBX Global Container Index. Of all the shipping sectors container shipping must be the most hated currently. It was the darling during the pandemic, because of all the supply chain issues, port congestion, and high demand for stuff. The Pandemic was a big bull market for stuff because services were unavailable and stimulus checks were burning holes in people's pockets so they bought a lot of stuff and a lot of that stuff was imported via container ships. So rates for containers ships mooned and a lot of money was made and a lot of ships were also ordered. Then the world started going back to normal and the pandemic windfall for the container shippers ended. Now the rates have collapsed from the highs, but they are still above pre-pandemic levels.

Source: ABG Sundal Collier, Clarkson

This is the mantra you hear when you bring up container shipping. Orderbook is high, the global economy is in or going into recession and the sector will be dead for years. I believe this is most likely correct. The mistake people make is that they see this bear market in the sector and then make the conclusion that they should not invest in containers. But what you have to remember is that in investing valuation is everything.

Source: Screenshot from FreightWaves, Chart from Alphaliner

I will not go deeply into the container macro here, but we can see that there is a lot of capacity supposed to come in 2023-2024, but there is also China reopening and lower rates so there should be more scrapping of the older ships. I would think. I also read this article https://splash247.com/container-shippings-tricky-2023-outlook/ which was interesting. Some sentences to take away from that were “Making headlines this year for sure, Xeneta expects that 25% of the scheduled orderbook will be postponed, while no more than 10% is expected to be cancelled – and that would probably be options not called rather than outright and expensive cancellings.” and “Scrapping is likely to ramp up over the course of the year, according to Daniel Richards, associate director at UK consultancy Maritime Strategies International (MSI). MSI expects scrapping will reach a year-end total of around 270,000 teu, before increasing even more in subsequent years. Xeneta, meanwhile, is forecasting up to 400,000 teu worth of ships will be torched this year, still some way short of the record 696,000 teu scrapped in 2016.” But remember I’m not betting on a bullish environment for this sector. I’m betting that ZIM stock is too cheap despite the bearish environment. I think there are two times to buy a cyclical stock. When it’s completely bombed out or just before an upcycle. Sometimes you get both like with BTU stock in early 2021. That was fun. That is when you can make 5-20x gains, but usually, you don’t get both, but you can still make nice returns if you get just one of those especially if the margin of safety is good like with ZIM.

Now let’s talk about Zim Integrated Shipping. This will be similar to my Algoma Steel post in the sense that it won’t be a deep dive. I don’t even have enough information to do one. I will go over the things that are most important in getting the big picture correct. As I said containers are pretty much a contrarian play currently, but I think Zim is a contrarian play within containers because Zim did not sign these long-term contracts during high rates. Charters they call them. They are more exposed to the plunging spot market.

To provide some context I sent this tweet on 19.1.2023 and since then I have added and my cost-basis is 17,8$. I’m happy with the current position if it goes lower than my cost-basis without the thesis changing I might add more. My hilarious comment “Pray for me” relates to the stock price performance of Zim during the last year. Down 71% during the last year and down 78% from the top.

Source: Google

This 1-year chart shows perfectly how all the tourists are shaken out during the process of stock going from a hero to a zero. There have been 4 big dips and 3 rebounds. I think if I tell you the numbers it puts this into perspective quite well. These are rough amounts. First dip -41% from top to bottom, then 35% rebound, then 2nd dip -40% and rebound of 26%, then 3rd dip 56% with a 17% rebound, and then another 38% dip and we have rebounded around 14% from that bottom. As you can guess this kind of stock price movement destroys the mental of the bulls and the people who tried to time the bottom and then got taken out. You get the mentality that this will just keep happening, but if you think with logic and you come to the conclusion that the company is not worthless it won't just keep happening forever. There will be a bottom at some point. I don’t know if this was it, but I think buying where I bought is a great risk/reward when we are thinking about total returns, and with Zim, the words total returns are very important.

Source: ZIM

As you can see the total return was not nearly as bad as the return without dividends during the last year. It was still bad, but not nearly as bad. Zim does not really do buybacks. I don’t know if it has something to do with the law in Israel, but I’m not gonna bother looking that up, because I don’t think whether they will do dividends or buybacks is that important at the current valuation. It’s not crucial. They pay dividends and I think they will continue to pay dividends. That is my expectation. I find it funny how obsessed some people on Twitter and investment forums are about how they need to do buybacks to stop the stock price from falling. First of all, it is not certain that the stock would stop falling if you did that and it does not matter cos it’s the same money returned to shareholders no matter if it’s dividends or buybacks. There is some tax stuff that can make a bit of difference, but for the sake of this post, I will treat the 2 things as equal from a tax perspective because it is different based on where you live or are holding the stock in a tax-advantaged account, etc. And if you have a positive total return you can still have a capital loss when selling the stock that you can deduct from your capital gains. So when I talk about the total return I will not talk about tax implications, because they are different for different people.

It’s funny I have noticed how when a stock is going down if the company is doing buybacks and the stock is still going down the investors start complaining about buybacks and want the company to do dividends instead. I noticed this with US steel and Algoma Steel when those stocks were going down while they were doing buybacks and now with ZIM, it’s the other way. The main point I’m making is that it does not really matter. The stock goes down because of bigger reasons and whether you do dividends or buybacks does not really matter during that time, but the investors will complain and want you to do the other because the stock is going down and they mistakenly think it will make a difference. So this whole tangent was to explain why I don’t really care which capital return method ZIM will use.

Now I will explain this thesis in a similar way that I did Algoma Steel because this is a very simple and very similar thesis. While both are heavily asset plays, Zim is more of an asset play than Algoma. I expect better future earnings from Algoma, but ZIM is cheaper compared to assets, especially cash. Both are situations where a windfall brought them a lot of cash and now the windfall is over. Everyone sees this and they sold the stock. The stock is very cheap compared to the cash they made during the windfall and the businesses themselves are priced very cheaply. The businesses are priced like they are going to do very poorly during the next years. So if the situation is not as bad as the market thinks it will be, these investments most likely work out very well from the current valuations. But now ZIM. As I am writing this on 29.1.2023 market cap is 2.24 billion USD. Keep that in mind.

Source: SEC

Here is the important part of this investment. Look at this sentence in the context of a 2.24 billion USD market cap “ZIM’s total cash position (which includes cash and cash equivalents and investments in bank deposits and other investment instruments) increased by $634 million from $3.81 billion as of December 31, 2021 to $4.44 billion at September 30, 2022”. So there has to be a catch right? Some massive debt. Well yes and no. I mean you have eyes so you see the pictures above that they have these lease liabilities of around 3.4 billion USD, but they are basically offset by the right-of-use assets of 4.6 billion. These are just mostly vessels that have been leased there is obviously cost to that, but to get rid of that lease liability you just give the vessel back at the end of the lease, or maybe you can do it earlier I don’t know the specifics. The point is that it’s not the same as debt. It can’t really take them bankrupt. You don’t have to come up with cash to get rid of it. Don’t take my word for any of this I could be wrong I just googled this stuff.

But anyway you have basically no debt. There are some little loans in there, but they are insignificant sums in the big picture. If this company were to liquidate itself, which is not gonna happen but it’s a good exercise to determine your margin of safety you would more than double your money. I mean just the total cash position of 4.44 billion is almost double the current market cap of 2.24 billion. I mean it basically is double. With insignificant loans and all the lease liabilities offset by ROU assets. I’m just saying the same thing over and over again, but the point is you’re basically paying nothing for the business itself and the future earnings so who cares about earnings declining or the dividend getting reduced from ridiculously high levels. You have to put everything in the context of the valuation. I want to hear what I’m missing because I’m feeling the urge to add to this position as I’m writing this.

Source: Yahoo Finance

Source: MarketBeat

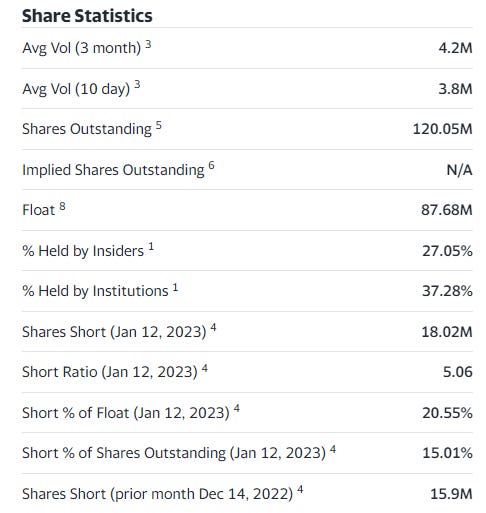

Here is some more stuff. Insider ownership is quite high. Management is definitely incentivized to keep returning money to shareholders because they own a lot of shares. This sector is very hated at the moment and this stock is very heavily shorted. As you can see the short% of float has increased over time as people have been getting very bearish about the container shipping sector and ZIM has been kind of a proxy for it. This sets up for a possibility of some violent moves to the upside if the situation ends up not being so bad for ZIM as the shorts seem to think.

Source: Yahoo Finance

So here are income- and cash flow statements for the last few years. As you can see the earnings have been crazy high and massive dividends have been distributed, but this is not important right now. We know those days are over. Now we must look at 2019.

Source: US Inflation Calculator

We know that rates for container shipping were lower in 2019 even inflation adjusted. That is using the CPI so make of that what you will. That is the FBX Global Container index which hovered around 1400$ during 2019 and currently as of writing this on 29.1.2023 inflation adjusted it’s 1934$. And as we can see ZIM was a net income negative of 18 million in 2019 when we had lower rates inflation adjusted than now. So the market is saying the business is basically worthless currently, but even if we go into 2019 levels of rates it’s not a disaster and It’s not worthless. And if we get into that situation where the business is close to breaking even the company could still pay us for the current market cap in dividends over the coming years from their liquid assets without putting the company into financial trouble. So this is why it is hard for me to see negative total returns from the current market cap and cash position if you hold for let’s say 1-3 years.

In conclusion, I think it’s hard to lose money from this stock at this point. This is why ZIM is one of my most conservative picks because I’m approaching it from that angle. I have positions where I’m looking for the ten-bagger, but those could potentially go to zero. For this one, I’m looking for a 50-200% return consisting of mostly dividends and some share price appreciation, but I’m not gonna mind if share price ends up doing most of the work.

The dollar is strong- all foreign-based stocks have dropped over the past several months.

Management has reasons for not doing buybacks, which is basically, "we sold shares at $15 to the public, so we don't think we should be using our money to buy them back higher than that."

I'm not as dismissive as you with respect to their leases. I think you should include them as debt in an enterprise valuation as they are necessary for the company to stay in business. As net income falls with renewals and spot rates, I'd expect dividends to come down to 5-10% of the existing share price. I just can't see this one recovering rapidly.