Buying the lagger: Algoma Steel

It actually looks easy.

This post will not be a deep dive into Algoma Steel. I don’t even know the name of the CEO or how many tonnes of steel they produce or even exactly what steel products they produce. I think sometimes there is a situation where you don’t need that much information to make money. You just see a dollar in the ground and there is no catch. You can just pick it up. I’ll start with why I think it makes sense to look for lagging companies and then I will do a short and sweet explanation of why I think Algoma is a great example of one of these companies currently.

Buying the lagger is a simple strategy that I have started to utilize more and more and usually, it works. So basically something bullish has happened in some sector that has pulled that sector higher and most of the stocks in that sector have rallied, but for some reason there is a stock that is in that same sector, but it has not followed the other stocks in the sector higher. Maybe it has even gone down while its sector has rallied. This company also benefits from whatever has pulled every other stock in the sector up, but it has still lagged behind.

This does not happen without a reason, but many times I have noticed that this company just needs some time to work out whatever is holding them back. Maybe it’s an oil company with temporary bad hedges or a steel company with temporary operational problems. I guess this could also work on the downside. Selling or short selling a stock that refuses to go down with the sector, because of maybe some good news or good hedges, etc.

The reason that buying the lagger usually works (has worked for me atleast) especially in cyclicals is that the power of market conditions for a cyclical business usually overpowers other factors affecting the business. For a commodity producer higher commodity prices can usually completely alleviate most worries shareholders have, but when the commodity prices rise investors tend to run to the companies that benefit immediately and do not have many temporary problems. Also when you buy a lagger you don’t have to try to predict the uptrend for the sector. The uptrend has already happened. You still have to think about whether it will last, but the job is half done when the bullish event for the sector has already happened. And what you can do if got the sector call correct and made money you can possibly make money twice from the same uptrend twice if you rotate from the money from a stock that moved up with the sector to a lagger. This could have been rotating your profits from western oil stocks to YPF Argentinian state-owned in the summer of 2022 (YPF up +250% while oil kept going down) or right now rotating from another steel company into Algoma Steel.

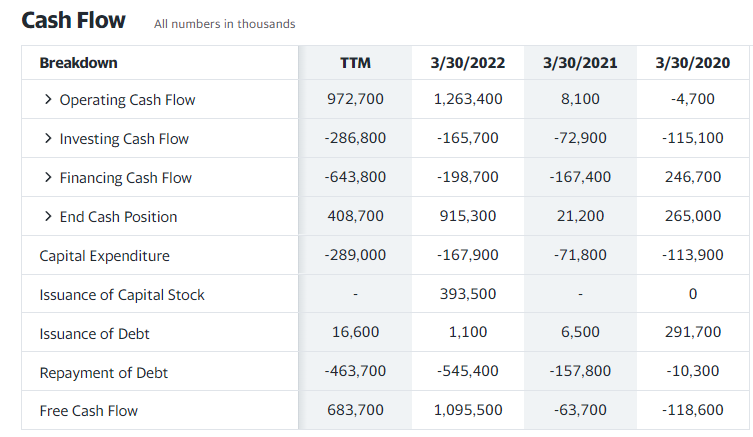

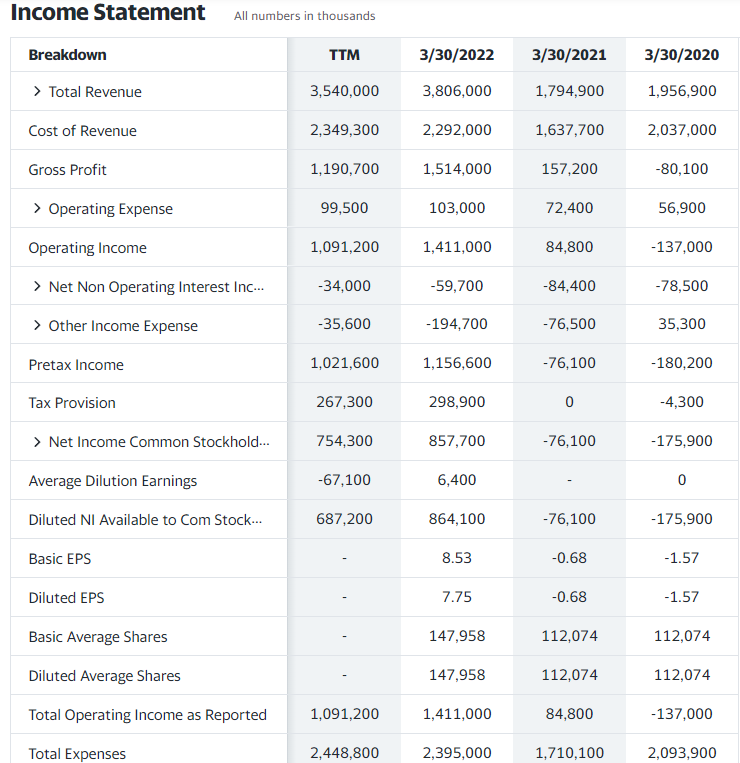

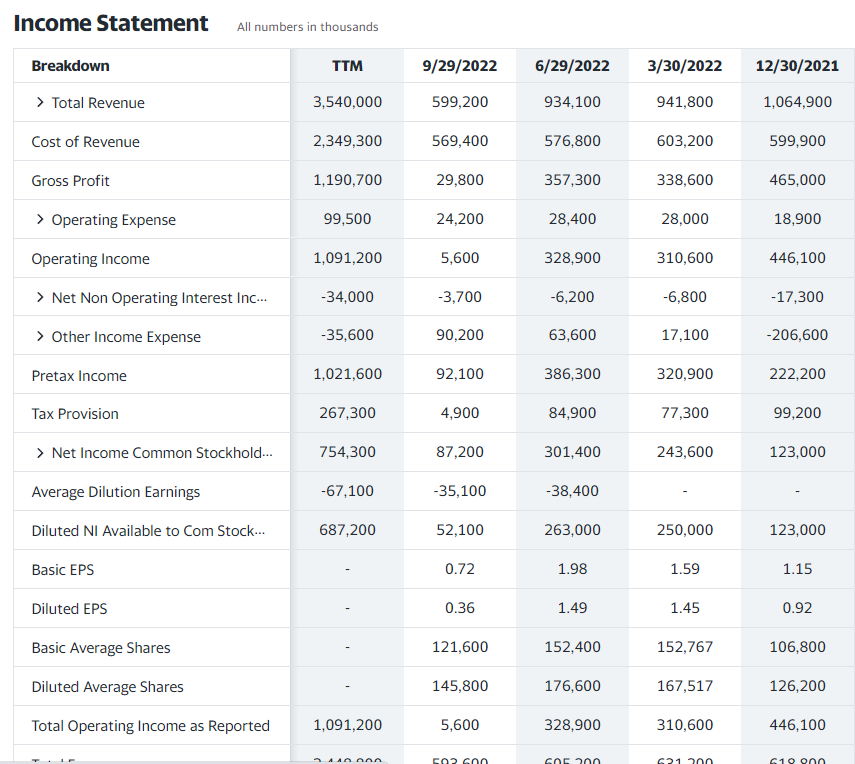

Now let’s look at the situation with Algoma Steel. Let’s start with these 2 pictures.

source: investing.com

The steel prices have been taking a beating during the last year, but the steel companies never priced in those high steel prices of 2021 and the beginning of 2022. The share prices of the steel companies still dropped while the steel price was dropping, because of the fear that steel prices would keep dropping, because of recession and the FED etc, but because of their low valuations as soon as the plunge in the steel prices ended the steel company stocks had a nice recovery rally. The market needs to be able to predict earnings somehow and if steel prices keep collapsing they can’t do it, but give them a bit of stability and with that comes predictability which causes the dirt cheap steel stocks to recover. Well, there is one dirt cheap steel stock that did not recover and that is the stock I’m writing about.

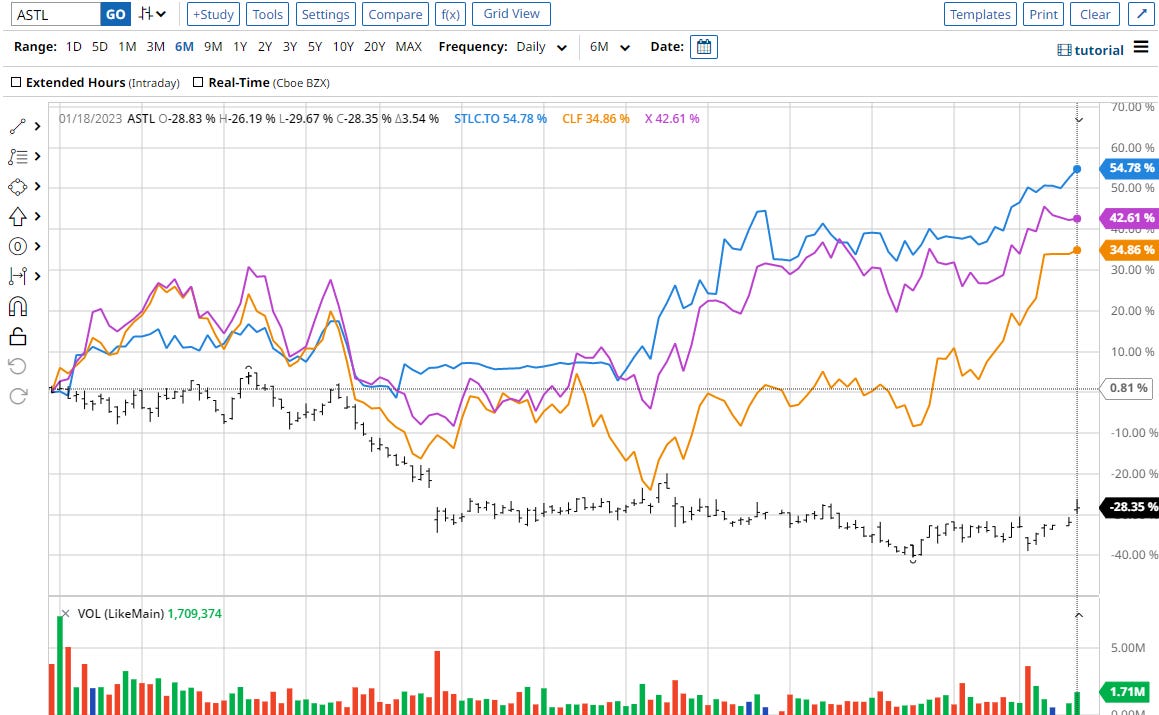

source: TradingView

We have some comparable companies to Algoma here during the last 6 months. Stelco up 54,78%, Cleveland Cliffs up 34,86% and U.S steel up 42,61%, but then we have Algoma down 28,35%. Quite a difference. Now we have to figure out why Algoma is lagging and whether the reasons for it are more likely lasting or temporary. If they are temporary eventually this stock should recover and outperform its peers. I’m going to keep this simple, because this is a simple thesis.

source: Yahoo Finance

Keep that EV of 523 million in my mind.

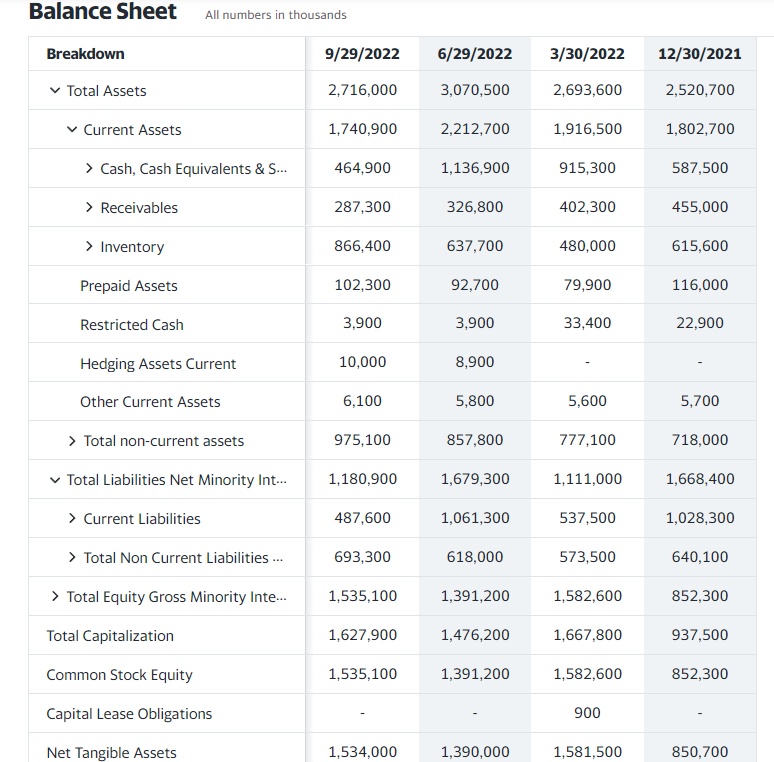

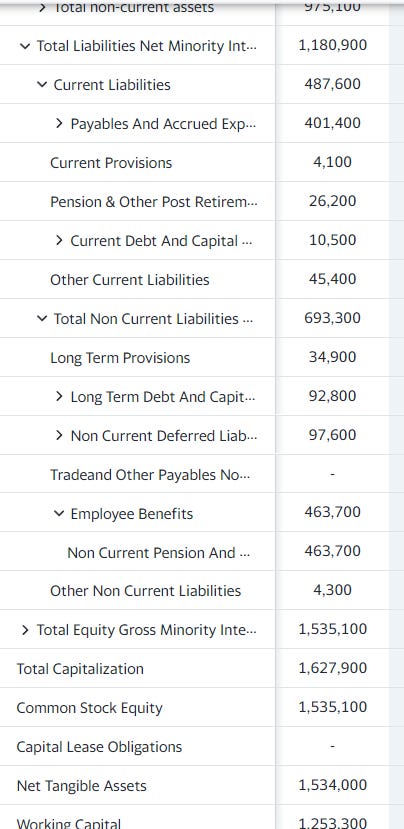

Source: Yahoo Finance

1,7 billion of current assets which includes 464 million of cash. Cash almost equals EV.

Source: Yahoo Finance

Current debt 10.5 mil, long debt 92 mil. There is basically no short- or mid-term bankruptcy risk here no matter how bad the market could get. Most liabilities are pension liabilities. This company is valued like some companies with very poor balance sheets, but clearly this company has a great balance sheet.

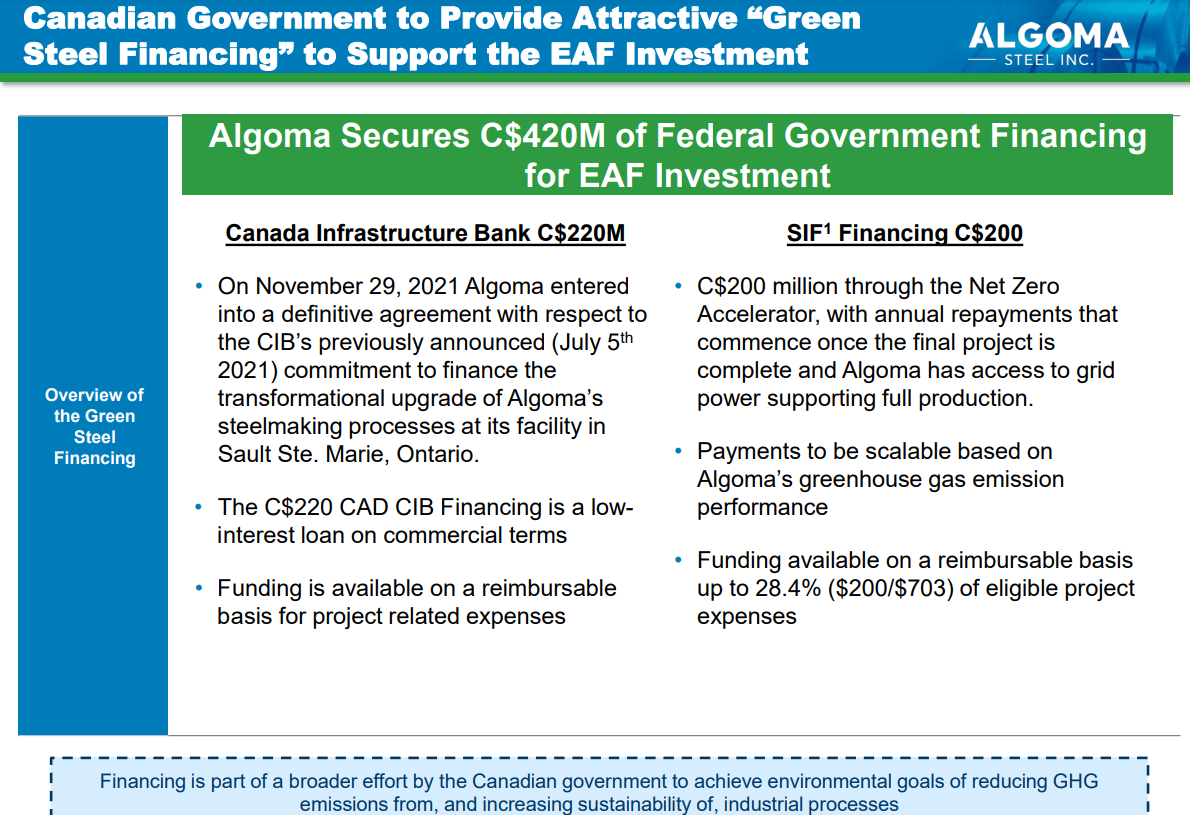

Source: Algoma Steel corporate presentation

They have the Canadian government financing their new EAF, because they want to lower carbon emissions. It should be done in 2024. Another investor told me on Twitter that the 200 mil on the right side is basically forgivable, but don’t take mine or his word for it. I have not really looked at this very deeply and I won’t likely do that before the stock goes up at least 50%. This is not crucial right now. Lower the valuation the less important this kind of stuff is. When a stock is priced very cheaply you only need incremental improvement to get significant gains.

Source: Yahoo Finance

Shares outstanding has decreased a lot due to buybacks to 103 million. This company prefers buybacks, but they still have 3% dividend yield at the current share price. Insider ownership is 10,64%. I would expect more buybacks in the future.

Source: Yahoo Finance

Source: Yahoo Finance

You can see how much money this company can make when things are running smoothly and steel prices are high, but Algoma does not need these kinds of numbers. for the stock price to rally.

Source: Yahoo Finance

Last quarter was bad because of “plate mill modernization commissioning delay”, “coal conveyor that was damaged by fire” and “temporary workforce availability events”. The Stock had already been drifting lower before they announced these problems in their last quarters’ guidance and it kept drifting lower since then, but recently they announced guidance for the next quarter and, again it was bad and again they had temporary problems hurting their profitability, but the stock has gone higher since then. It is a good sign that a stock has potentially bottomed when it reacts well to bad news. It means the market has very low expectations and most tourists have left the stock.

Next quarter we should expect negative adjusted EBITDA, because of “lower than expected plate shipments, continued softening in steel pricing, and normal seasonal maintenance activities ahead of winter” and “total plate shipments were adversely impacted by temporary downstream finishing constraints as we ramped up plate production”. Most of these problems do seem temporary.

So investors are frustrated, because this stuff is happening and the stock is lagging, but think about this. This is happening and the stock goes up and the valuation is insanely low. So what is the downside? This is why I like this stock. The margin of safety. I don’t see an amazing upside here, but I see a 50-200% upside with a very low downside. I have many investments where I’m looking for 5-20x returns, but they carry much more risk.

So in summary. Sector recovering, share price weighed down by temporary issues, great balance sheet, stable jurisdiction, dividends+buybacks, receiving taxpayers’ money for CAPEX and it’s dirt cheap.

Alright, I think I’m done. Must go to sleep. Should I release this yet? This is pretty rudimentary. This is embryonic. I’ll release it. It might be embryonic, but I think it will age well.

"Minor" typo from you

There is basically short- or mid-term bankruptcy risk here no matter how bad the market could be.

its missing a NO

I’m long ASTL warrants for this reason. Unfortunately, they need another SIB to be the catalyst for value change.

Management is very conservative and they will only spend cash on buybacks over and above the fully loaded EAF project cost. By my math that means soonest SIB will be announced is April or possibly July after Q1 in the new fiscal year. I would have preferred they would be more aggressive and pre spend a bit knowing they have $100-200M in cash flow coming in for the next 6 months.

Expect to see a big draw on cash due to capex from this quarter with a delayed refresh from govt financing and reimbursements.