Beacon Minerals: The Cheapest Australian Gold Stock

An Australian gold miner with ~32% insider ownership, returning value to shareholders and about to double production.

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program, which means I have a financial relationship with Seeking Alpha. This article is for entertainment purposes.

Mongolian short AD: THE LINK

Get a 7-day free trial and the SUMMER SALE 60$ discount on your first year of Seeking Alpha Premium with my Affiliate link: AFFILIATE LINK

If you sign up for 1 year of SA Premium using my link and send me proof, you will receive a complimentary one-year Premium subscription to AlmostMongolian Substack.

Beacon Minerals is a gold mining company operating in Western Australia. This is another stock pick that was brought to my attention by @geodan on ceo.ca, who goes by @DarpResearch on X and Seeking Alpha. He was the one who told me about Valeura at 3$, and he was pounding the table on Beacon, so I had to take notice. Then I introduced Beacon to @Premski_SGP on X, who did his own DD on it, and collaborated with me on this write-up, so you may notice the writing style is constantly shifting within this article as there are 2 writers.

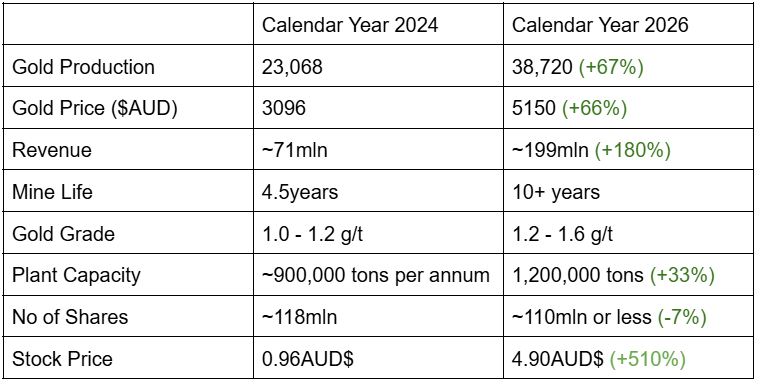

TL;DR: The Company is going through improvements in all aspects, but the stock price has not caught up yet:

4.9$ is a price target from Argonaut.

Source: It was posted on this thread on HotCopper discussion board.

This part was just to get your attention. The following deep dive will answer questions such as: How does Beacon achieve these numbers? Why is the market undervaluing Beacon?

Introduction

At first glance, Beacon Minerals is showing negative gross margins and high costs (AISC); it scans as a terrible company. We want that. We need an undiscovered gem, covered by the dust of previous mediocre quarters. But there are quite a few hidden gems under all that dust, which we are going to uncover today. We believe that the stock has a very good upside and much lower risk than other junior mining producers.

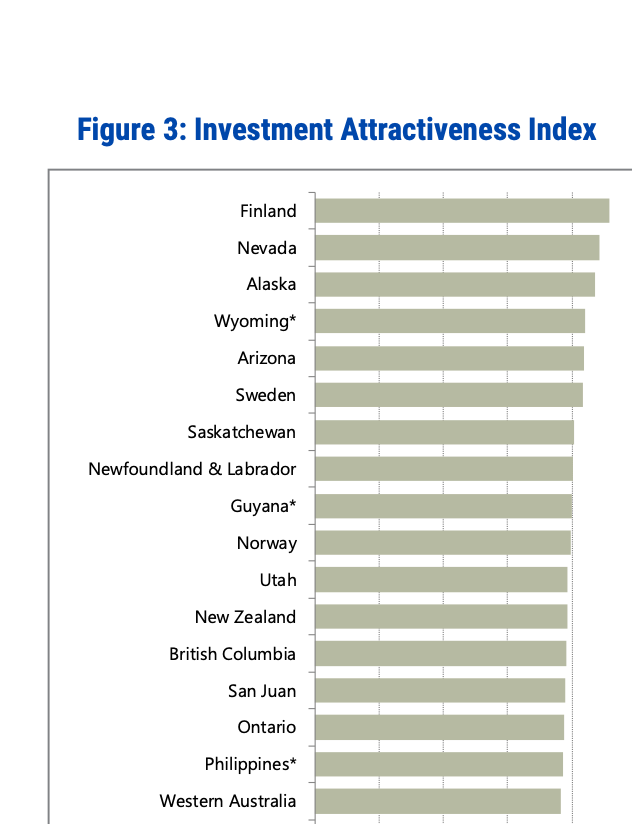

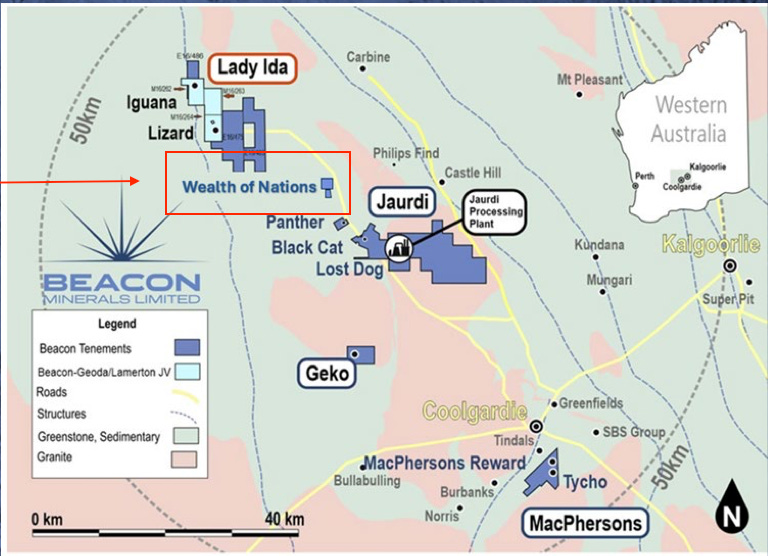

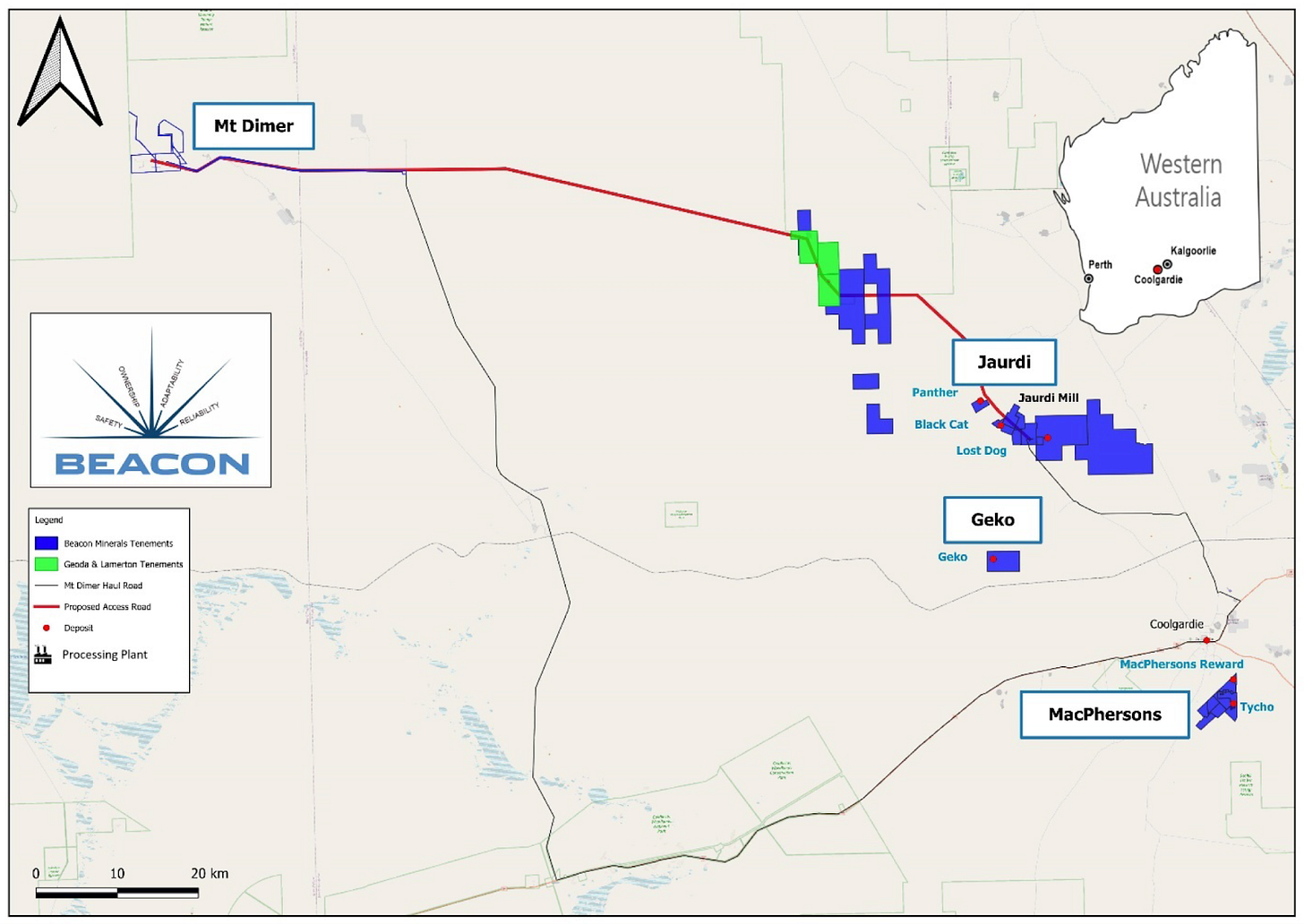

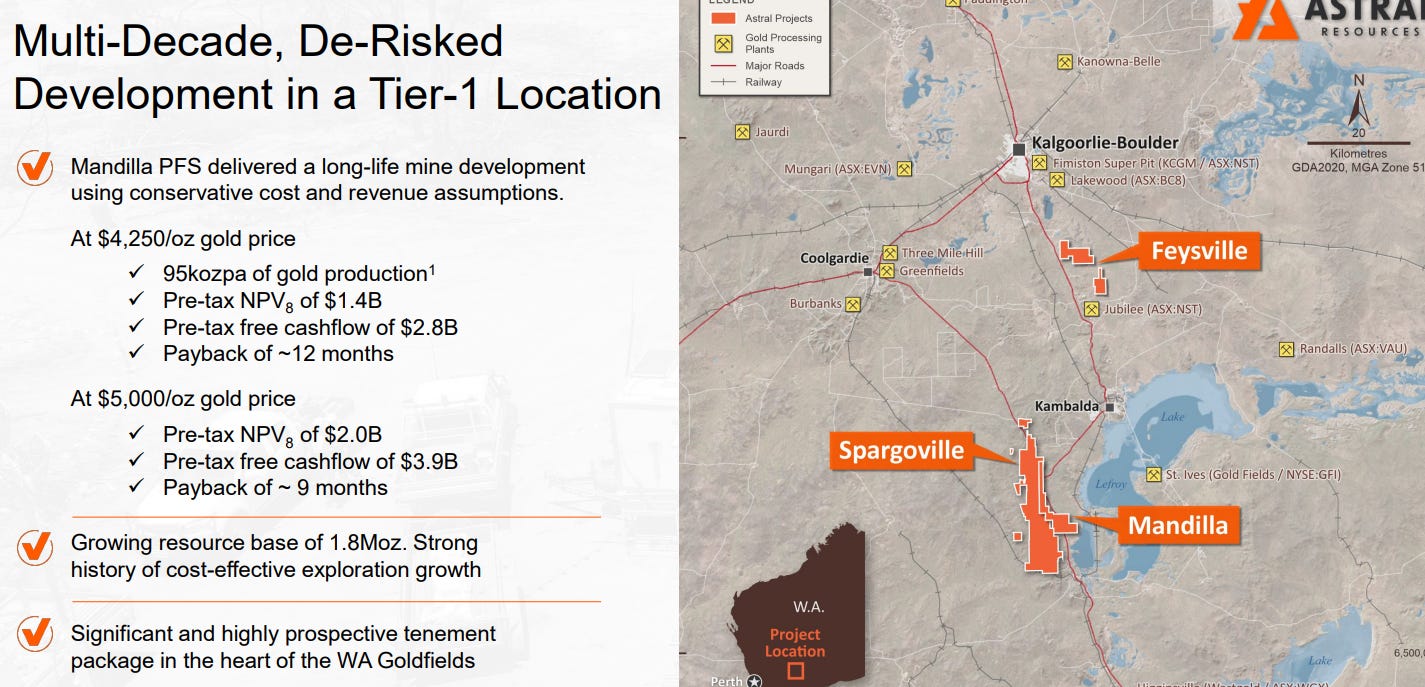

Short info about the company, they are located in the Tier 1 Mining jurisdiction of Western Australia state - Kalgoorlie area, which is famous for Gold:

Tier 1 Jurisdiction

Western Australia has ranked in the top 3 mining jurisdictions in most of the previous years. My Canadian friends can complain all they want about Australia, but I invest in South America, Africa, and Central Asia, and Australia still stands out:

With world-class infrastructure and a skilled workforce (protocols are set, and facilities to assess drilling or do the metallurgy testing are a drive away, you don't have to wait months for continental shipments of samples or lab testing to happen)

Rich mineral and exploration support, especially in Western Australia State, where Beacon is located

Political and Legal Stability (no coup risk, no helicopters venturing to take your produced gold like in Mali)

You know how much you need to pay in taxes and royalties to the state, the changes are not announced from one day to another, nobody stops your mine because of ‘supposedly’ not paying taxes

As per Fraser Institute in 2021,2022, it is a top place for mining, in 2023 they ranked top 3, and in 2024 they are still in the top 20:

Source: Fraser Institute

Note which country is number 1

Balance sheet and Enterprise value

Beacon has a market cap of $168m. All the numbers are in Australian dollars.

Debt=$7.8m

“The Company has a $13.27 million finance facility. As at 30 June 2025 the Company had drawn down $7.8m of the finance facility.”

Cash of $14.38m at the end of Q2

“2,744 ounces held at Perth Mint as at 30 June 2025. Gold in transit of 1,778 ounces at 30 June 2025”

At the current gold price of 5150$ AUD, this gold is worth $23.3m.

“Beacon’s holds 40,972,640 ordinary shares in Astral Resources (AAR).”

At yesterday's closing price, these shares are worth $7m. And because the market cap of Astral is 242m, this is a liquid asset.

Liquid assets=14.38+23.3+7=44,68m

Beacon has an enterprise value of = 168+7.8-44,68=$131,12m

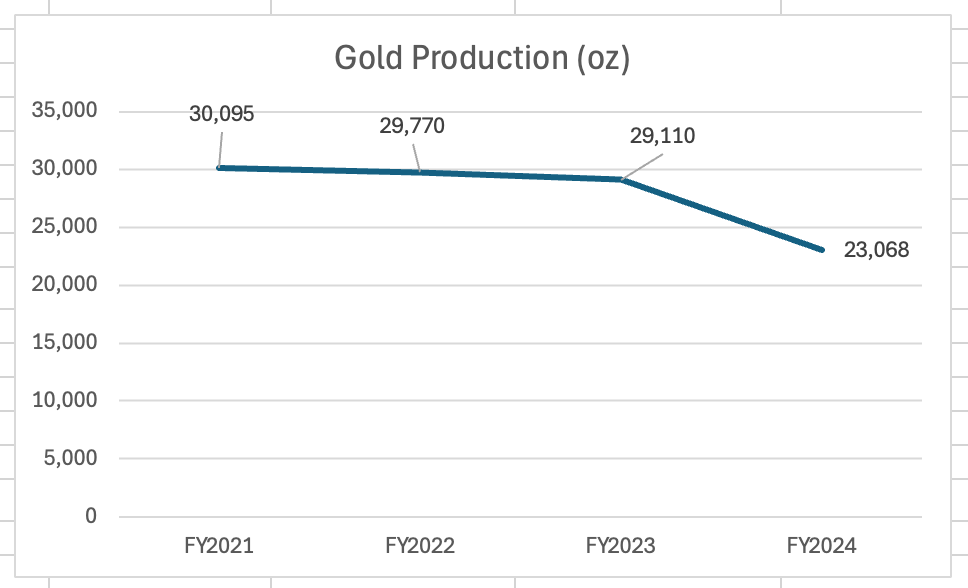

Gold Production

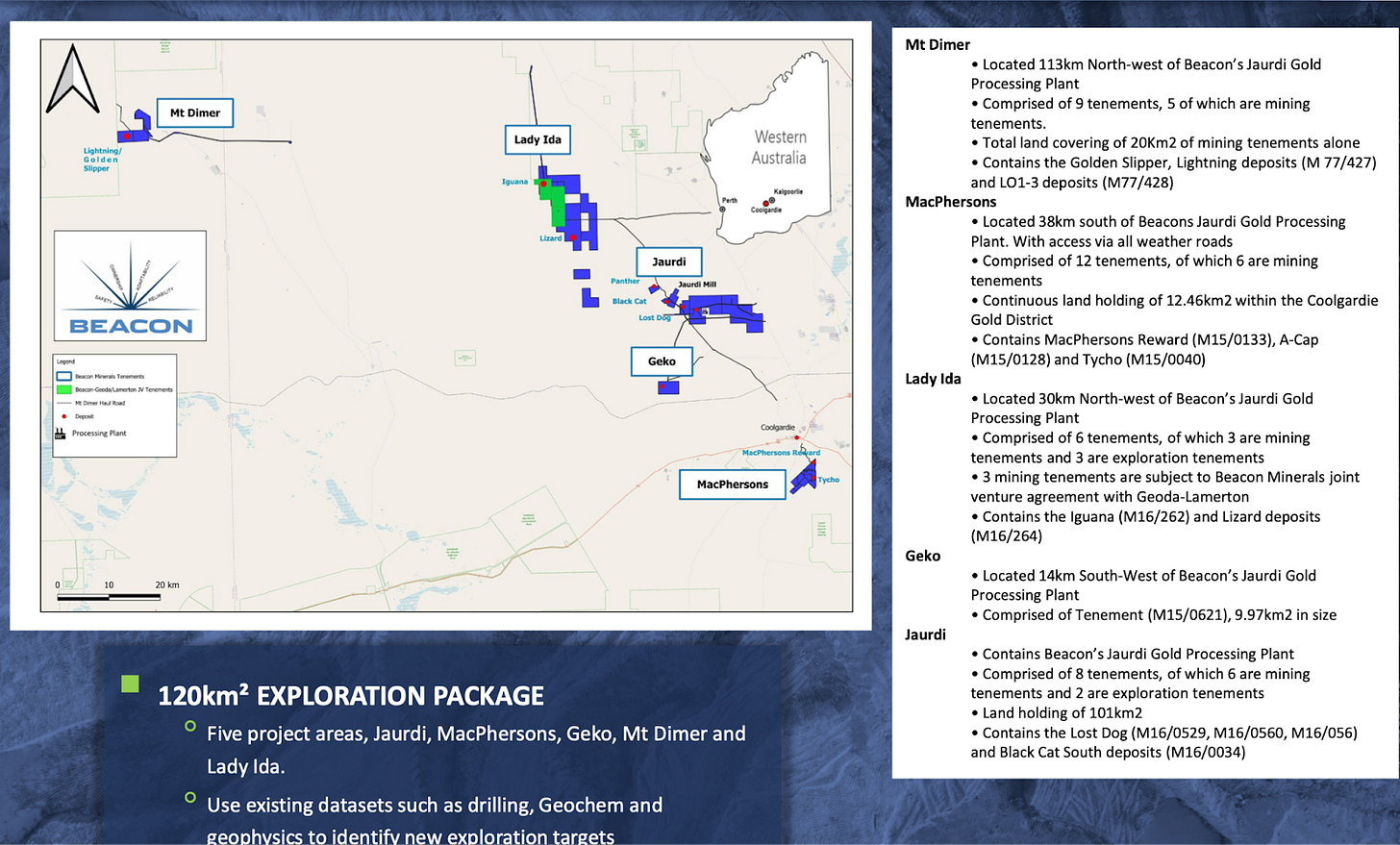

Beacon owns one processing plant called Jaurdi

and they have been mining low-grade open pits in the surroundings, 20- 60 km away from the plant to the south on the map:

Source: Beacon corporate presentation (annual one)

That low-grade problem is important to keep in mind, as we will get to that soon.

Their production in recent years was not impressive, the output was in decline, and so were the reserves.

The company was processing more ore, but because of having lower gold grades, they could not produce more gold despite the incrementally increased capacity of the plant.

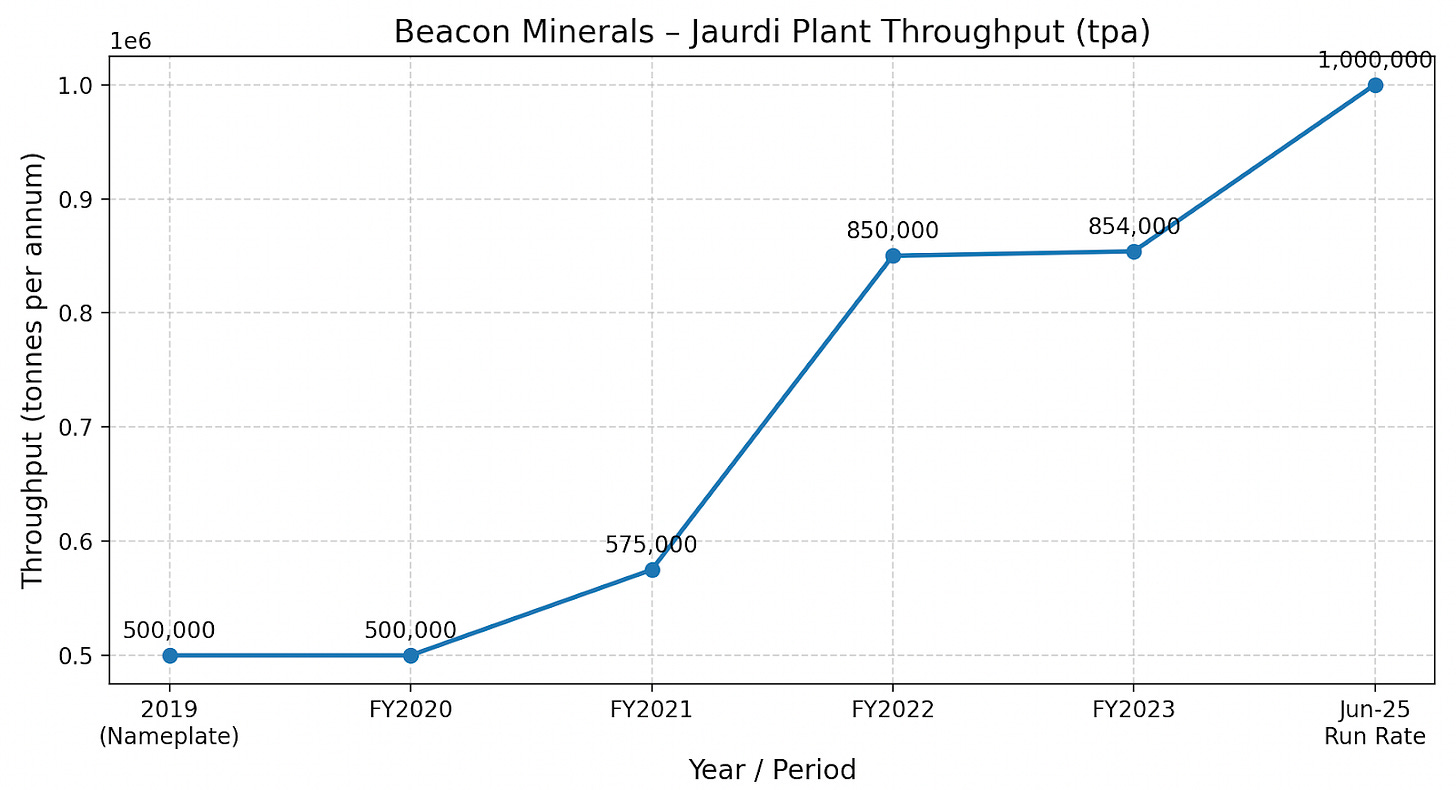

Plant capacity expanding

The Company has been steadily expanding throughput by adding parts to the plant in an incremental manner without extensive capex.

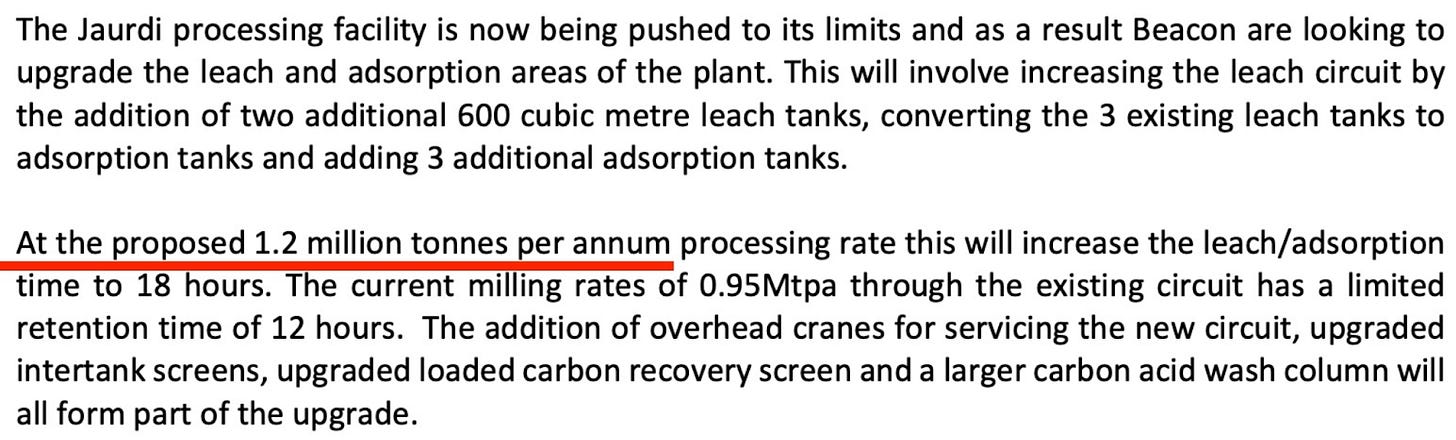

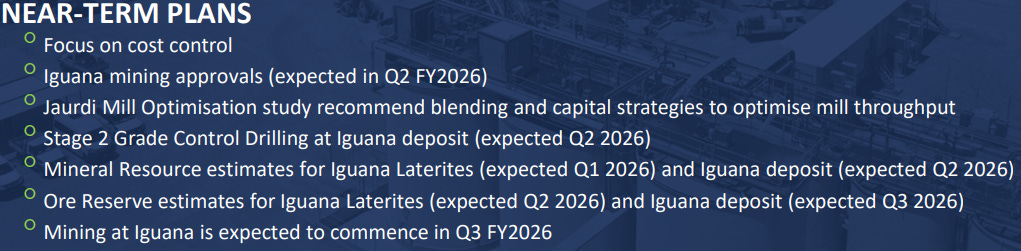

They are now at 1 million tonnes per year throughput, which is last quarter (Q2’25). Beacon will be expanding into 1.2mln soon, this is from their operational update:

That expansion will cost a bit (11.5m AUD$), but assuming the higher grade that is coming, it will be worth it.

Further plant capacity expansion beyond 1.2mln may happen, but the management stated that this is solely based on their ability to mine enough ore for the plant and what the future gold price will look like, and how confident they will feel about it. Remember the Tier 1 jurisdiction argument? The good thing is that the experts who designed the plant and are expanding the plant are available a drive away, which means timelines get much shorter if you need to increase capacity in Western Australia.

The currently mined ore from pits is not enough to cover the whole capacity of the mill (250k quarterly today), Beacon is able to get 80-120k tons per quarter by mining (with still subpar 1.2-1.4 g/t grade), the rest needs to be taken from lower grade stockpiles of (0.6-0.8g).

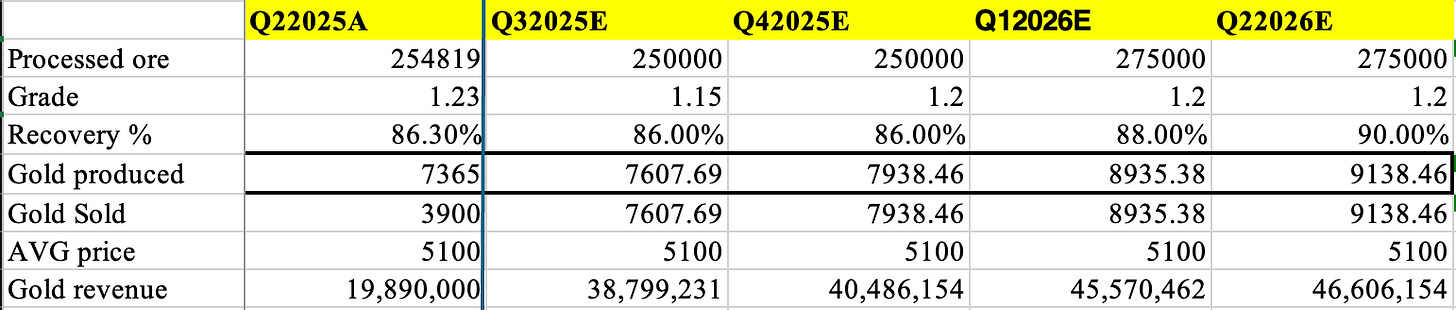

Production Forecast

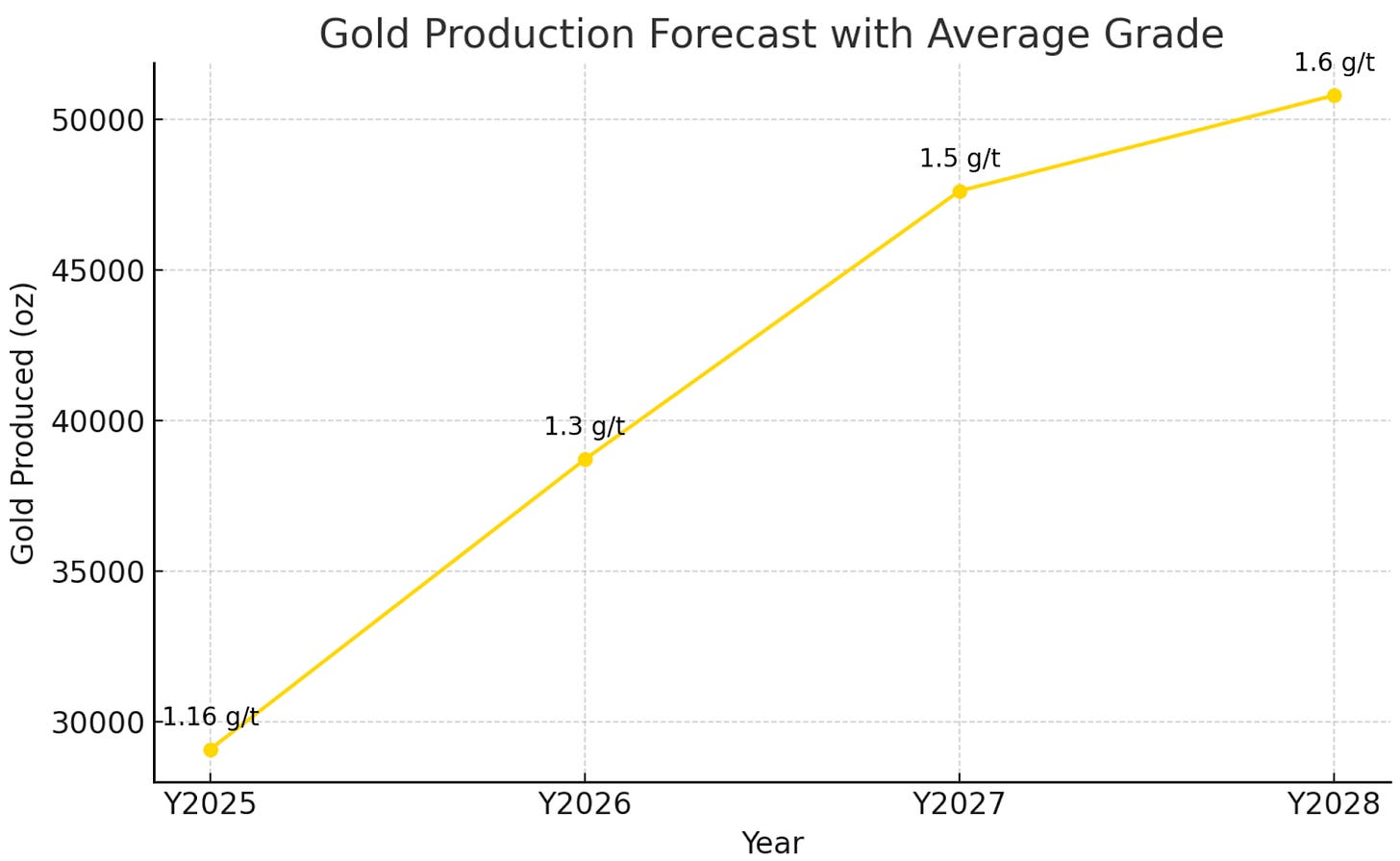

Here is the prediction of upcoming production for the next 4 quarters:

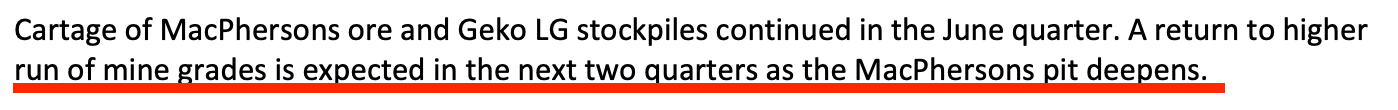

The forecast is downplayed on purpose. I am still assuming Q3 and Q4 to continue gold grades at 1.15 - 1.2 despite management being optimistic about the upcoming improvement in gold concentration in their last operational update:

https://app.sharelinktechnologies.com/announcement/asx/2271964c1d99328850395ecb2a88e3d8

Q1 and Q2 next year are assuming the same grade but with laterite oxide resources mixed in, which usually gets recovered at a rate of 95% so the average recovery rate is increased for these two quarters and should continue throughout the year.

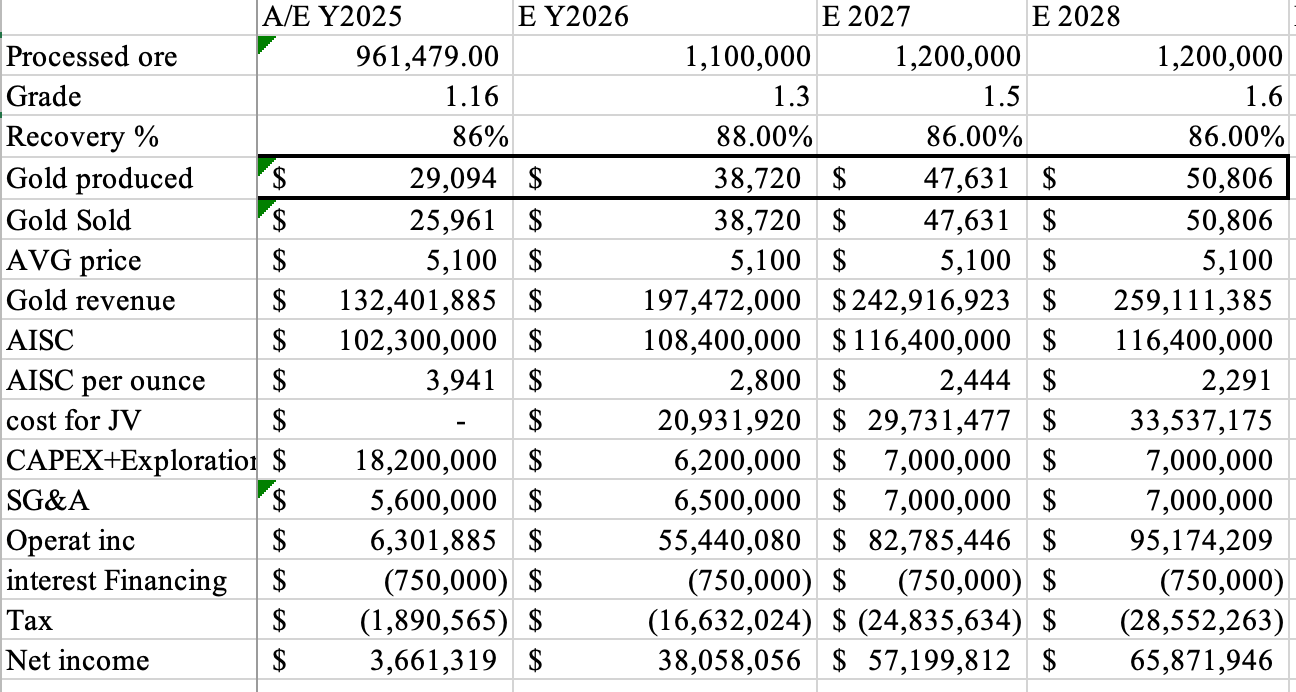

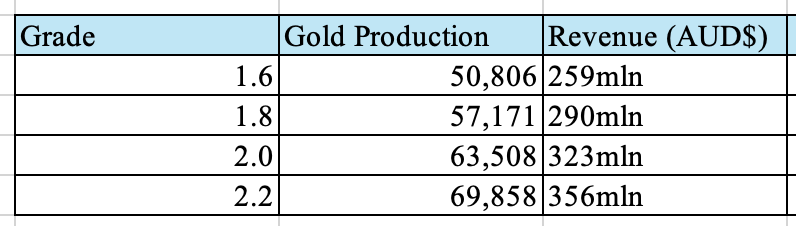

The amount of processed ore will also be increased as plant expansion will take place, which alone will make the production go to 44k ounces; any improvement in very conservative grade is an extra upside. Here is the yearly forecast with assumed grades:

Breakdown of potential revenue with a gold price staying at 5100 AUD$

The slight improvement in grade is assuming resources from Lady Ida and Mount Dimer that are of a higher grade. It is a very conservative scenario.

Assets:

Newly acquired asset - Lady Ida (the game changer)

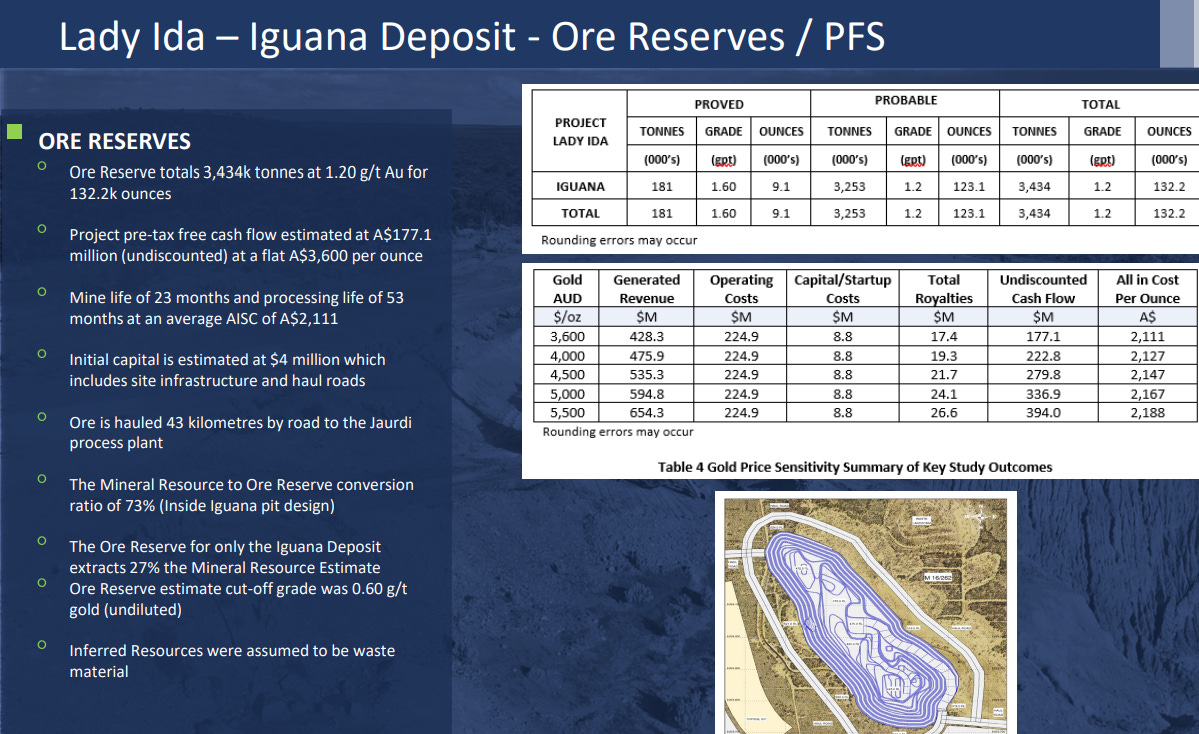

This is Beacon’s pre-feasibility study. This does not account for the laterite resource, and new data is constantly coming out, but it will give you a basic idea of the project. Look at the average grade of proved reserves, 1.60, which is huge for a company of Beacon's size that is mining now at 1.1 - 1.2 g/t.

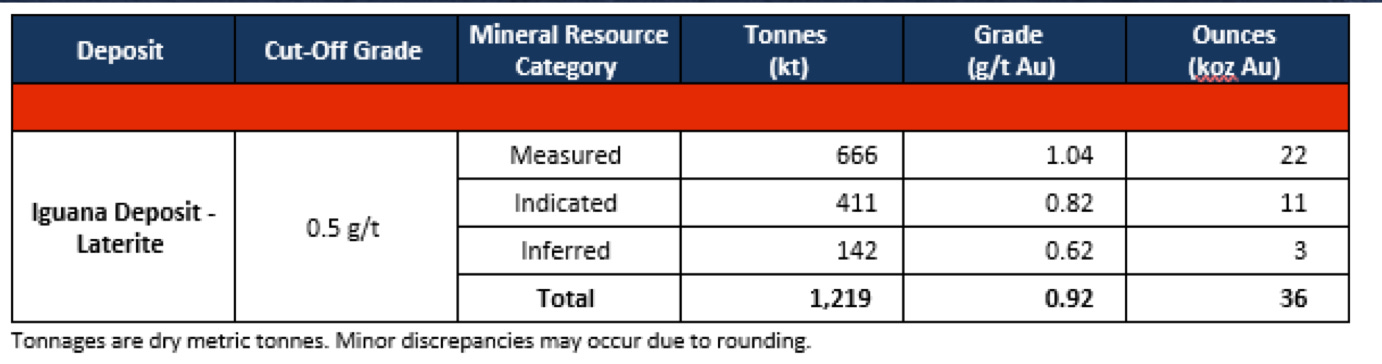

What you need to know is that the data will only get better, both resources and reserves. Their recent drilling had them put a halt on trading because these were that good (see here: Stage 2 Grade Control Program Completed at Lady Ida)

Source:https://app.sharelinktechnologies.com/announcement/asx/a28208e58ee4017cb4d5a438db59b020

This mine is planned to start production in Q1 2026. Very low Capex of 8.8m. And based on assuming only the 132.2k ounces and processing life of 53 months and AU$5,000 gold(Current gold price AU$5,200), Lady Ida would produce 29,910 ounces annually and have $76.2 million per year of cash flow. Because of a J/V that we will cover later, Beacon earns 50% from this project before producing 73,500 ounces, so based on the PFS and AU$5000 gold, Lady Ida would add $33.1 million of cash flow for Beacon in 2026.

Showing what the company is projecting is important, but note that these are not assumptions we are making for the rest of this article in regards to production and cash flow. The charts and calculations are based on analysis from Premski, taking into account the newest data.

Source: Google

This is the newest data. The stock is going up. That’s all the data you need, but seriously. Let’s be serious now. The stock was halted before the big move on Monday because of pending drilling results, and we waited for these results to come out before releasing the article to avoid releasing an article that’s immediately outdated.

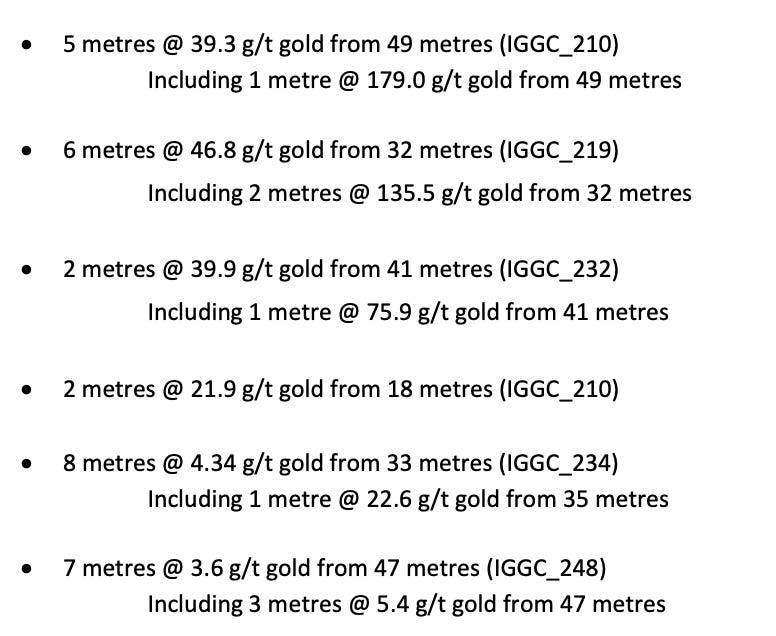

Why did these drilling results cause a +23,55% move on Monday?

Source: https://app.sharelinktechnologies.com/announcement/asx/3070d43cbd0e1393bb16b51bfd7797bb

These grades are unseen for a miner of that caliber; they immediately put Beacon on the trajectory where they can double their production.

Source: https://app.sharelinktechnologies.com/announcement/asx/3070d43cbd0e1393bb16b51bfd7797bb

This is how much their increased plant can produce with higher grades :

Remember, the costs are pretty much fixed. Beacon has a really good chance to become a cash machine.

(We are assuming 86% recovery and 1.2mln TPA plant output).

Here is the statement just sent today by the CEO to shareholders:

Ok.. from bonanza grades making stock price go up, let's get back to reality now, with what else do we have available:

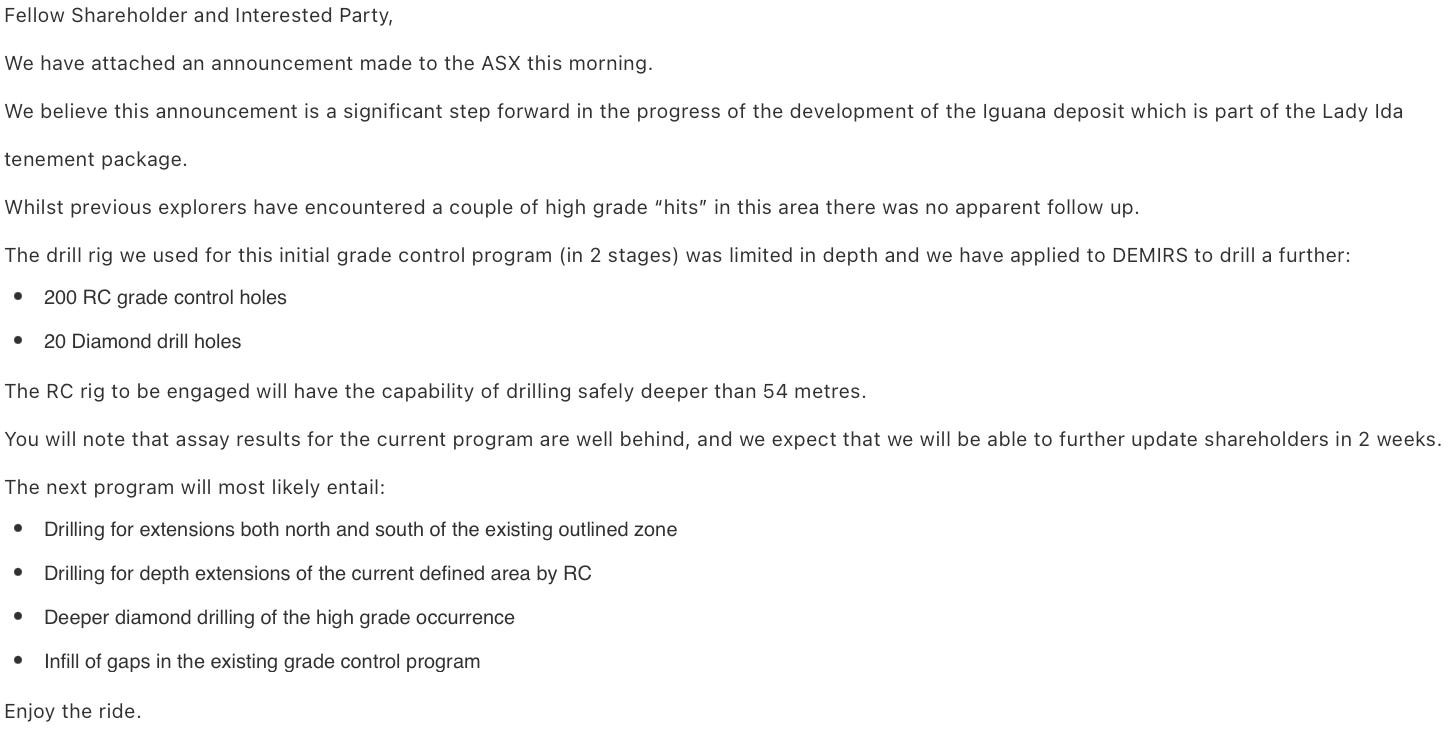

Lady Ida itself is not that far away from the plant (43 kms via a haul road), and it has two types of gold mineralisation: Super easy to mine laterite mineralisation:

Source:https://app.sharelinktechnologies.com/announcement/asx/8855921d8563cccdeafa8e303311a54b

The company drilled 232 and 215 air core drill holes (~5km total) to check how much gold is there.

Historically, the grade was very high, at about 3g/t, which their current results suggest much lower than that:

but still very economical to mine because you do not need any explosives, you just go with an excavator and mine from the surface. Reading the announcement on how the estimate was created and what sort of drilling was done, I am assuming the estimate is the lowest possible, and we may be pleasantly surprised while mining the laterite resource.

Take a look at the picture - You can go with a shovel there tomorrow and start digging, and after two meters of digging through the cover, you are going to start finding particles of gold.

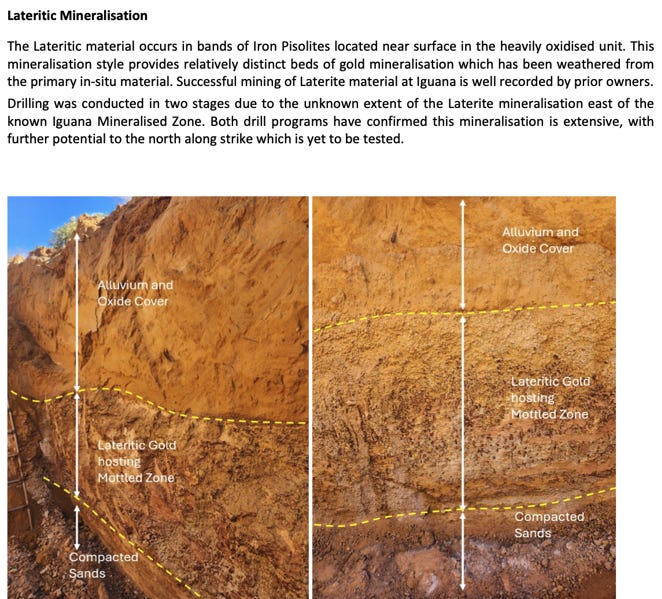

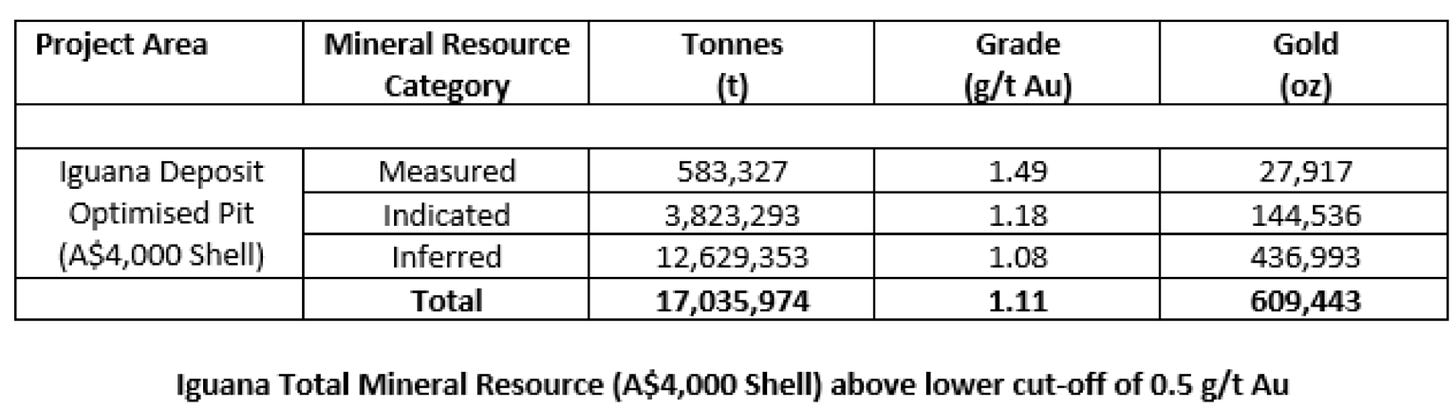

What is worth mentioning is that recoveries of gold in such ore are at 94-96% versus 86% of what the company achieves now. Also, the laterite mineralisation of gold was not defined in the original resource reserve provided with the acquisition of Lady Ida, which you see in the table below:

Grades like 1.49 or 1.18 are much better than their stockpiles at 0.6g/t.

On top of that, the asset has more gold that is not yet included in the above table. You can see the first diamond drilling here, indicating more gold:

Results of the Iguana Diamond Drill Program

As mentioned before, Lady Ida has two types of gold mineralization; the second one, which is a bit more difficult to get to, is “in situ,” that is, deeper in the ground in a type of rock, and that will be feeding the expanded plant for years to come.

Around 60-70% of these resources should be converted into reserves, which will be a big boost to how the company is perceived by the market.d

The asset was acquired through a JV agreement instead of a cash transaction. So instead of paying upfront for it, there will be a 50-50 split of net profit from ounces sold until 72k ounces is reached

Lady Ida J/V details:

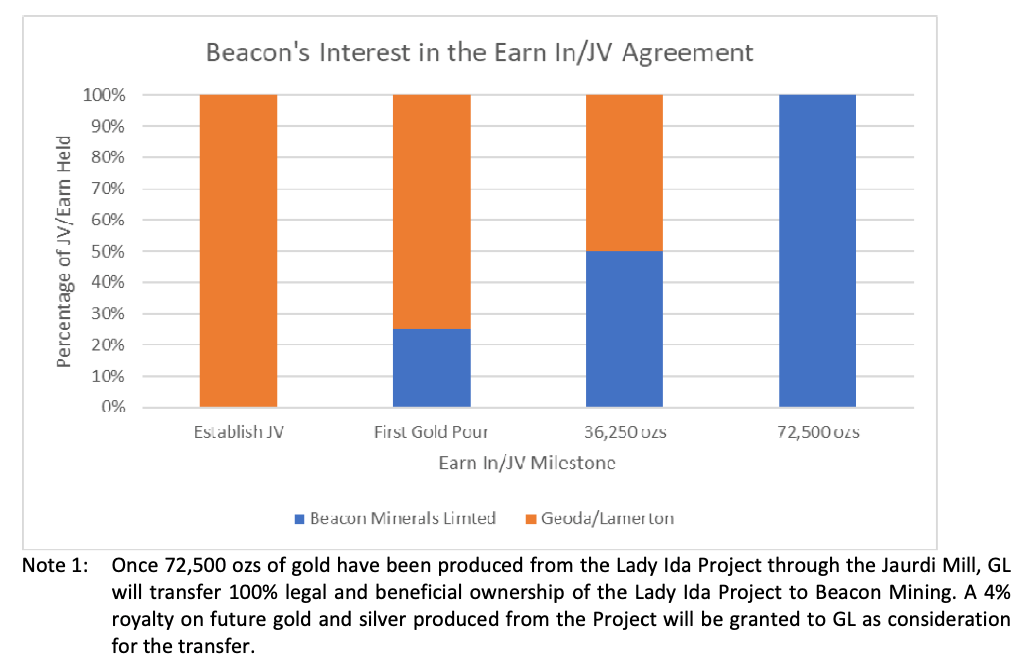

Beacon has a farm-in agreement for its Lady Ida Project. Beacon gains more interest in the project as they reach milestones. Here are the details:

source: https://app.sharelinktechnologies.com/announcement/asx/ca324e64bd54cb5634b2275544747edc (page 7)

First Milestone: The First Milestone is achieved when Beacon sole funds the project until the first gold is recovered from M16/262 and processed through the Jaurdi Mill.

Reaching this milestone, Beacon earns a 25% beneficial interest in the Lady Ida Project. It’s important to note that the revenue and costs are 50/50 upon reaching the first milestone, even if their beneficial interest is 25% at this point.

Second Milestone: Once 36,250 ounces of gold have been produced from the Lady Ida Project through the Jaurdi Mill, Beacon earns an additional 25% beneficial interest.

This brings Beacon’s total beneficial interest to 50%.

Final Milestone (100% Ownership): Once 72,500 ounces of gold are recovered from the project, GL transfers 100% legal and beneficial ownership of the Lady Ida Project to Beacon. In return, Beacon grants GL a 4.00% net smelter royalty on all gold and silver produced. Now Beacon gets all the revenue minus the royalty and is responsible for all the costs.

It is worth checking out the history of the asset. It is nicely described here: Link (page 11).

Note: The Initial deal was blocked by ASX as one that is not favourable to BCN and its shareholders. In reality, the initial deal would be much better than the one we got with the second attempt. First deal was just a pure cash transaction of 10mln AUD$, the 50-50 JV agreement will be worth way more than 10mln AUD$

Other Assets

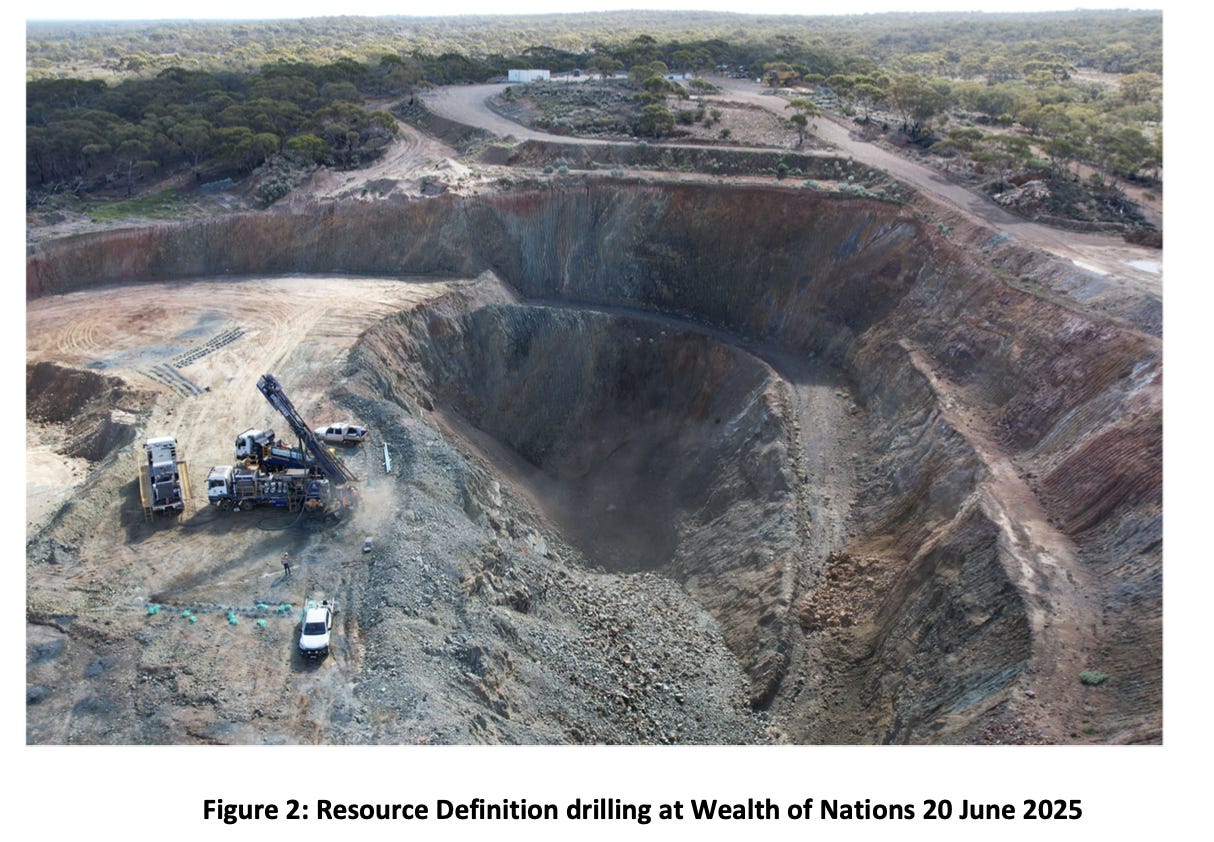

Wealth of Nations

It is located a short 11 km haul from Beacon’s Jaurdi processing plant, making it an obvious satellite feed candidate. Historic underground crews extracted about 28 koz at spectacular 19 g/t between 1894 and the 1960s, but that's long gone… recently, a 2022 test pit by Corinthian Mining produced 1.7 koz from near-surface oxide ore grading ~2.3 g/t. Corinthian deemed the asset as non-core and had to haul/track the ore 60 km away, so they dropped the mining there. In November 2024, Corinthian was close to restarting operations in a JV agreement, and they were supposed to process a 40 kt parcel of ore. It is unknown why it didn’t happen, and soon thereafter, Beacon acquired the asset. Beacon will explore the asset, and if they decide to proceed, they will pay 1.4mln in settlement and standard royalties (4%). 1.4mln AUD is about 280 ounces of gold at current prices. Not bad ;).

Beacon has begun a seven-hole RC drilling program to convert the legacy data into a JORC resource and probe the deeper high-grade shoots hinted at by the old workings. If results confirm even moderate grades, the deposit can slip seamlessly into the existing mill schedule, bolstering Jaurdi’s throughput with minimal incremental capital.

Source: Beacon corporate presentation with edits

Mount Dimer sits ~113 km NW of the Jaurdi mill on already-granted haul-road licences, making it another satellite feed for Beacon. Historic mining in 1994-97 yielded more than 125 koz from about 600 kt at an impressive 6.4 g/t Au. Beacon’s 2024 work delivered a maiden resource and reserve:

• Lightning Mineral Resource estimate - 128,000 tonnes at 4.8 g/t Au for 20,000 ounces at 0.5 g/t lower cut-off

• Golden Slipper Resource estimate - 312,000 tonnes at 3.20 g/t Au for 32,000 ounces at 0.5 g/t lower cut-off

What you can see is a very high grade that helps to offset tracking costs. Below location of Mt Dimer and the proposed route suitable for off-highway trailers (distance of 135kms).

Source: Beacon corporate presentation

The next exploration phase is temporarily paused: the air-core program was deferred for environmental reasons, and management has flagged that a focused RC-resource-definition drill campaign is now “proposed and under review,” scheduled to kick off in the second half of 2025 (targeting Q4). Given the distance and the fact that Lady Iga is closer and shaping out as an asset to mine for years to come, I would expect Mt Dimer to not be on the top of the list despite the potential for higher grades there. The current definition of the reserves stands at 21,000 ounces with a grade of 4.5g/t. Resources at the current stage point to 52k ounces at 3.65 grade.

Timor Leste

Beacon is also involved in Timor Leste(also known as “Timo”), which, as you all know, is an island north of Australia known for its organic coffee production, unique cultural heritage, and stunning natural landscapes.

Source: https://www.britannica.com/place/East-Timor

What’s interesting about Timor-Leste is that the country has massive mineral potential, but it is completely underexplored. They gained independence in 2002 after a history of conflicts and are still an impoverished and underdeveloped country. There are no producing mines in the country. Their mining code was established in 2021, and their state-owned mining company was established in 2023.

In March 2023, they launched their first licensing round for mineral exploration, 49 concessions comprising an area of more than 2,000 square kilometers.

Nine companies passed the screening, and four companies were awarded 13 concessions: 3 for Estrella Resources, 1 for Peak Everest Mining, 3 for Iron Fortune, and 6 for Beacon Minerals. Later in March 2025, Tivan Limited got 7 concessions.

Iron Fortune is Australian Private, and Peak Everest is Timorese. Tivan and Estrella are the only public companies with Beacon involved in this country. This adds to the optionality of Beacon, as if there is a gold rush in the country, there aren’t many options available for investors.

Estrella Resources has an AU$80 million market cap. They are a pure exploration company, and their Timor Leste assets are their flagship properties, comprising most of their valuation. The stock has also 4x since they got the concessions.

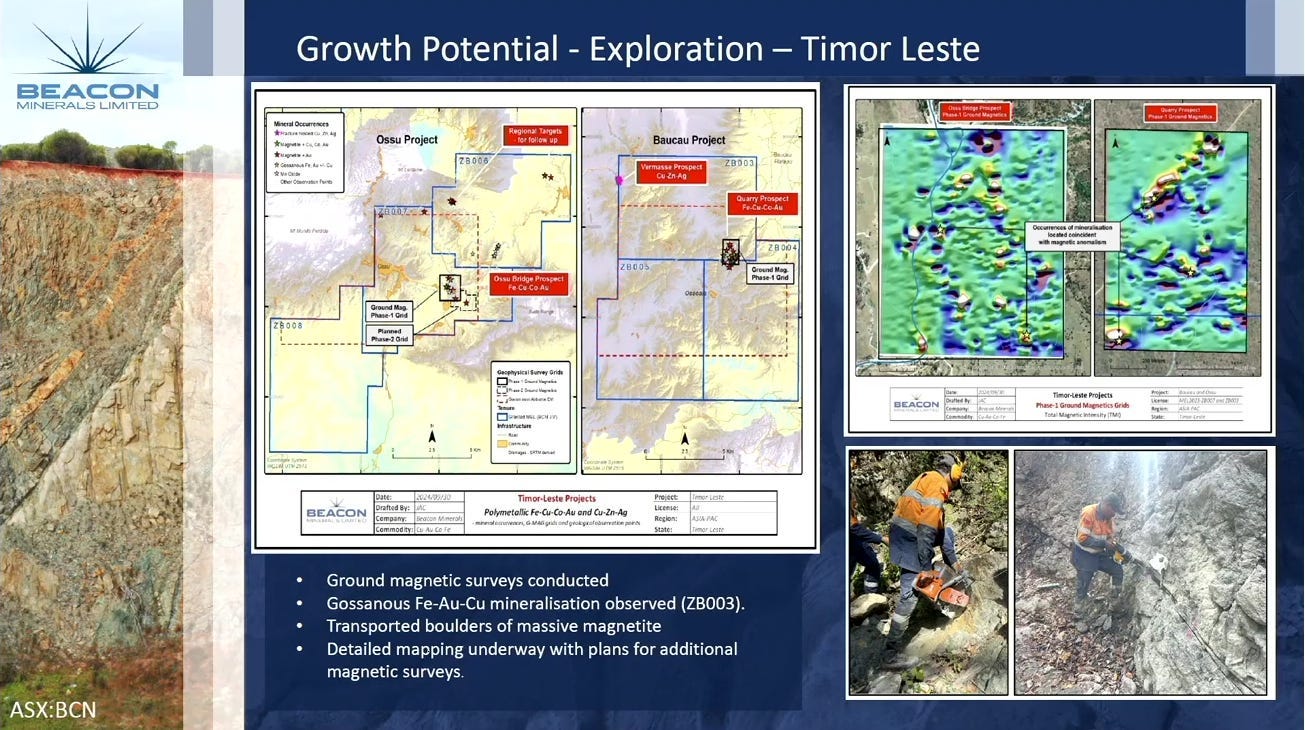

Estrella is already drilling and promoting. In contrast, Beacon is barely talking about these properties. Their current corporate presentation doesn’t even mention Timor. I found this slide from an earlier presentation.

Source: Beacon Minerals Ltd - RIU Explorers Conference 2025

Gossanous Fe-Au-Cu mineralisation observed. I always say if it's “gossanous,” it's a good sign. I always say this.

This presentation was posted on 21.2.2025, and this is all the CEO said while the above slide was up:

“Timor Leste is an early stage grassroot Prospect we've done quite a bit of work up there we have a team of four there at the moment lot of rain which is impeding progress but they are doing stream sediment sample little samples in the northern blocks and we'll see how the results go some have already been done and submitted we got another 50 to go”

They are collecting sediment samples, such as sand or gravel, from rivers and streams. These samples are analyzed, and based on the results, they can somehow locate potential areas of mineralisation, which they can further investigate to locate good spots to drill.

Source: Beacon Minerals Website

These are Beacon’s concessions, which combined are approximately 300 square kilometers. Top right, you can see that this is a decent chunk of the country. These are the details they give on the website about the two groups of concessions, Ossu and Baucau.

“At Ossu, a historical occurrence of chalcopyrite‐rich boulders associated with serpentinites has returned rock chip sample grades averaging 4.87% Cu, 0.28% Co and 1.48 g/t Au with peak values of up to 12% Cu, 0.88% Co and 2.08 g/t Au”

“At Baucau, a recent reconnaissance program has discovered multiple occurrences of polymetallic copper mineralisation at surface at the ‘Quarry’ and ‘Vermasse’ prospects with assay results pending”

At Ossu, those rock chip samples with 4.87-12% copper grades, in addition to 1.48-2 g/t gold, are very promising for surface early-stage results. Typical open pit copper grades are 0,4-1% and gold grades 1-4 g/t.

At Baucau, polymetallic copper mineralisation at the surface points to a similar copper/gold deposit.

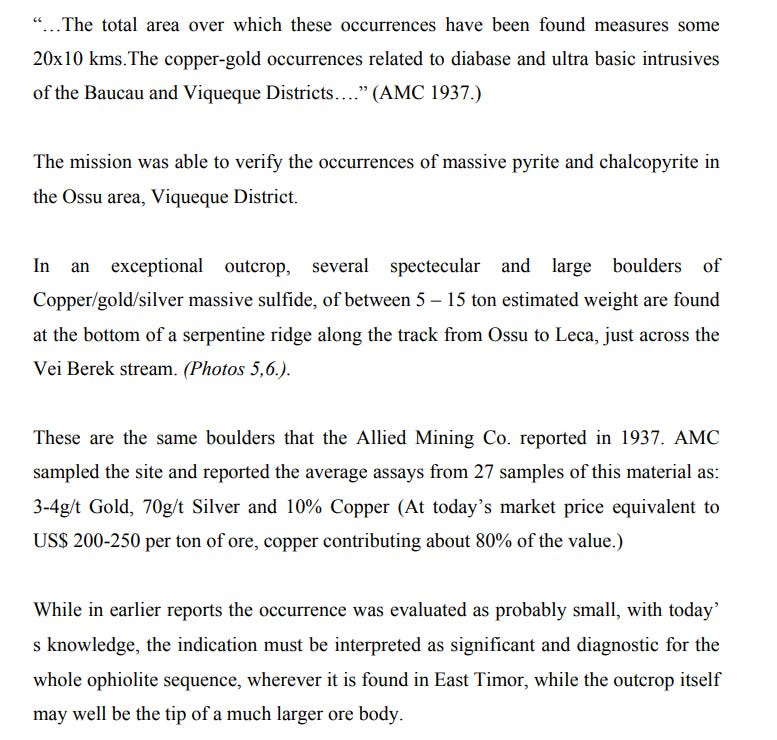

I found a massive report on the resource potential of Timor, and here is an interesting part from that report relating to the Ossu and Baucau areas.

Source: https://www.laohamutuk.org/OilWeb/RDTLdocs/ESCAP/Bakker.pdf

Source: https://app.sharelinktechnologies.com/announcement/asx/2271964c1d99328850395ecb2a88e3d8

After I wrote all that, they released their quarterly update, where they basically said they are pausing on Timor Leste. Maybe this means they want to put all the focus on Australia, where they have huge near-term opportunities, or maybe the results of the exploration work on Timor weren’t that promising.

Management and Capital Allocation:

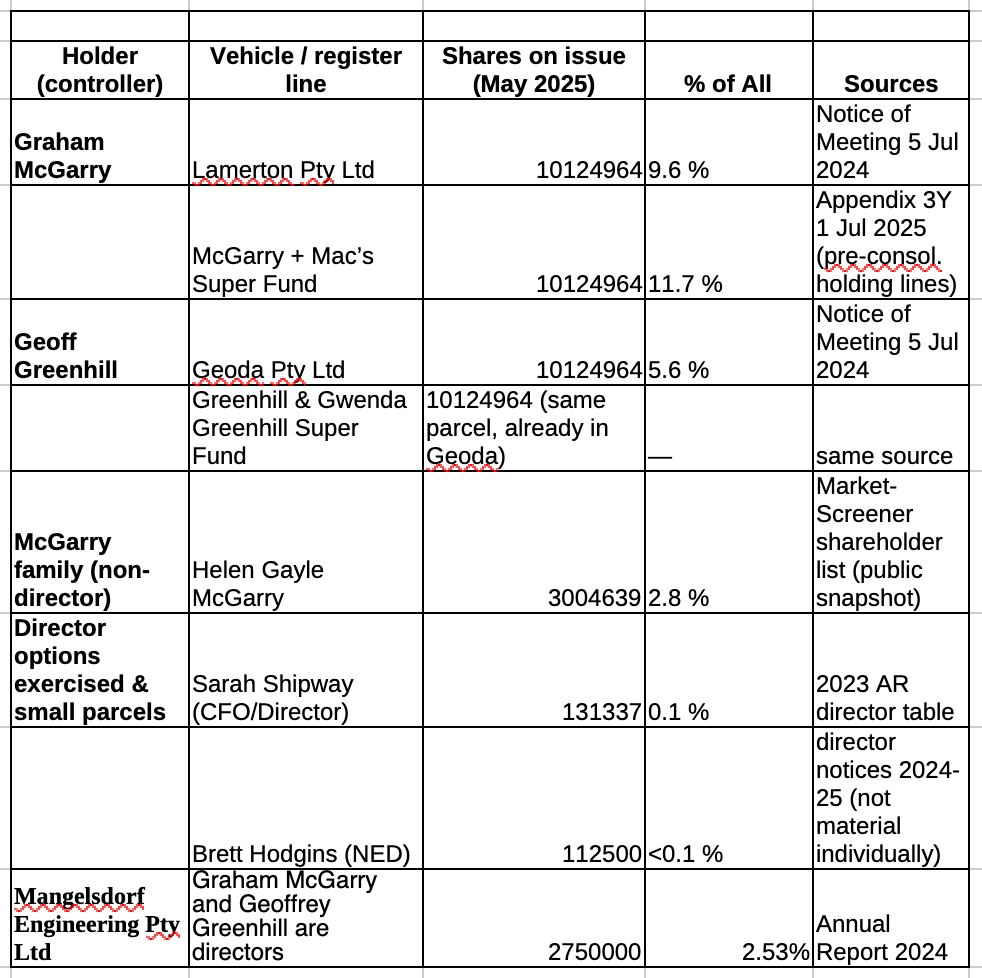

Insider ownership is at 32% which is quite high for mining companies of their size.

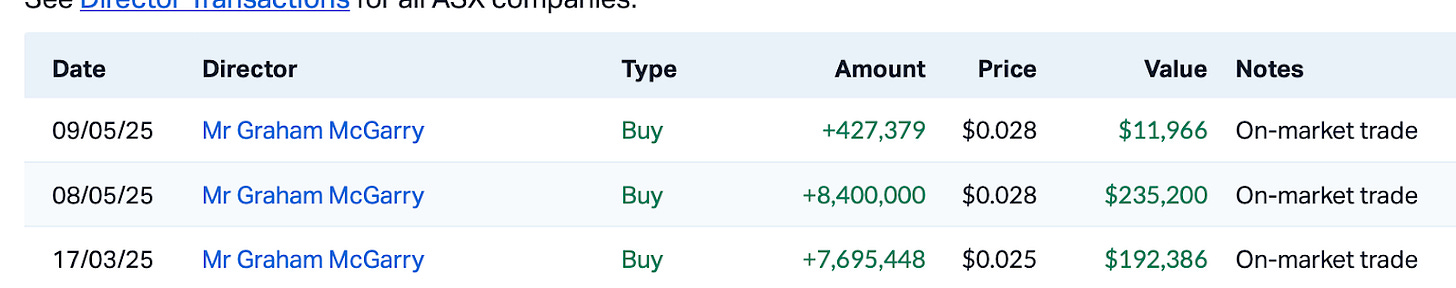

There has also been insider buying during 2025; the managing director(Beacon’s CEO equivalent) bought AUD $439,552.81 worth of shares during March and May.

I recommend that you watch two presentations of the company after finishing this article to get a vibe around the managing director:

My impression is that this is a straight shooter, keen to do what is right and wants to return value to shareholders. Returning value to shareholders is important, and it is a problem with junior gold miners that I face constantly.

Recently, Beacon initiated a share buyback, although the company is allowed to buy back shares, we do not see any filing about that happening (in Australia, the company needs to report in 2-3 days about buyback activity). We are assuming now that the capital may be allocated to extra exploration rather than buybacks, it is the best way of allocating the capital in our opinion, nevertheless company is still allowed to buy shares for the next fiscal year (these in Australia start in July):

Source:https://app.sharelinktechnologies.com/announcement/asx/a16f73a291cf98b65a3dd3218286493f

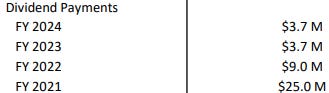

While currently not paying a dividend. They are capable of paying out a regular and special dividend (once in the past). Dividends are fully franked, and for most countries, there is no withholding tax.

Source:https://app.sharelinktechnologies.com/announcement/asx/a28208e58ee4017cb4d5a438db59b020

In here, the CEO explains his approach to dividends:

“I'm a bit of a believer in the old school the business a has to be profitable then B should pay some dividends to shareholders now whether that's the right approach or not I'm not sure I do have some doubts at times but fully Franked dividends appeal to me and I try to put myself in the shoes of my other shareholders and say well if we can pay even a modest fully Franked dividend and return a fair bit of money for growth that's a fair result”

Trust me, I have a lot of junior miners(Premski), and some of them have much more cash in the bank but are not willing to pay out anything to their shareholders.

Beacon seems fairly aggressive when it comes to working capital and spending on Capex and exploration. Which is likely why the dividend is not being paid at the moment.

Source: https://app.sharelinktechnologies.com/announcement/asx/a28208e58ee4017cb4d5a438db59b020

Q3 FY2026=Q1 calendar year 2026.

The last capital allocation point is Beacon’s strategy to hold some of its gold at Perth Mint as an alternative to cash. Which seems to be a new strategy starting last quarter, with 7365 ounces produced and 3900 ounces sold.

“The Board has reviewed its strategy of spot gold sales. Gold is a high-quality liquid asset that retains its purchasing power, in contrast to cash that is losing its purchasing power. The gold price could go down, however Beacon continues to hold sufficient cash to cover such a contingency.”

This strategy has tax advantages. They don’t have to pay tax on the gold before selling it. As it is not recognized as revenue before it’s sold. Although this causes Beacon to screen poorly, because the topline revenue seems much lower due to Beacon’s gold storing. I think this is one of the reasons for their lower valuation.

This strategy also makes Beacon much more leveraged to the gold price in comparison to peers who hold mostly cash, and adding to their leverage to the gold price, Beacon is not hedging its production.

Does the management deliver on what they say?

“There is a way for us next year to look at growth in the share price is to do a consolidation of the shares and do a buyback, and we have mentioned that, and that will be looked at at the appropriate time.” CEO quote from the presentation in November 2023

In November 2023, the managing director mentioned the issue with the low stock price and said that they will address this issue in 2024 with a buyback and share consolidation. Mid-2025, the buybacks are starting, and share consolidation has been completed.

They had instances of lower production in 2024 due to clay ore issues and rainfalls, so their forecasted production does not always check out, but most of the time it does, and many times it exceeds the forecast.

Source:https://app.sharelinktechnologies.com/announcement/asx/a28208e58ee4017cb4d5a438db59b020

Other notable achievements:

Built the processing plant in-house and on budget, took their deposit called Lost Dog from discovery to production in just 2.9 years, and production was in line with the PFS.

Lady Ida's acquisition took two attempts to make it happen, which proves a go-getter type of attitude when there is a good asset in play. More on that acquisition in the due diligence section below.

Charts and Projections

You can talk all you want, but does the data justify improving the situation of the company?

It does already, and we are thinking that 2026 will be much better.

You will not see this stuff on the scanner when looking at the company at first glance.

Here is the cash position trend (up is good)

Here are their yearly estimates for closure of 2025 and 2026:

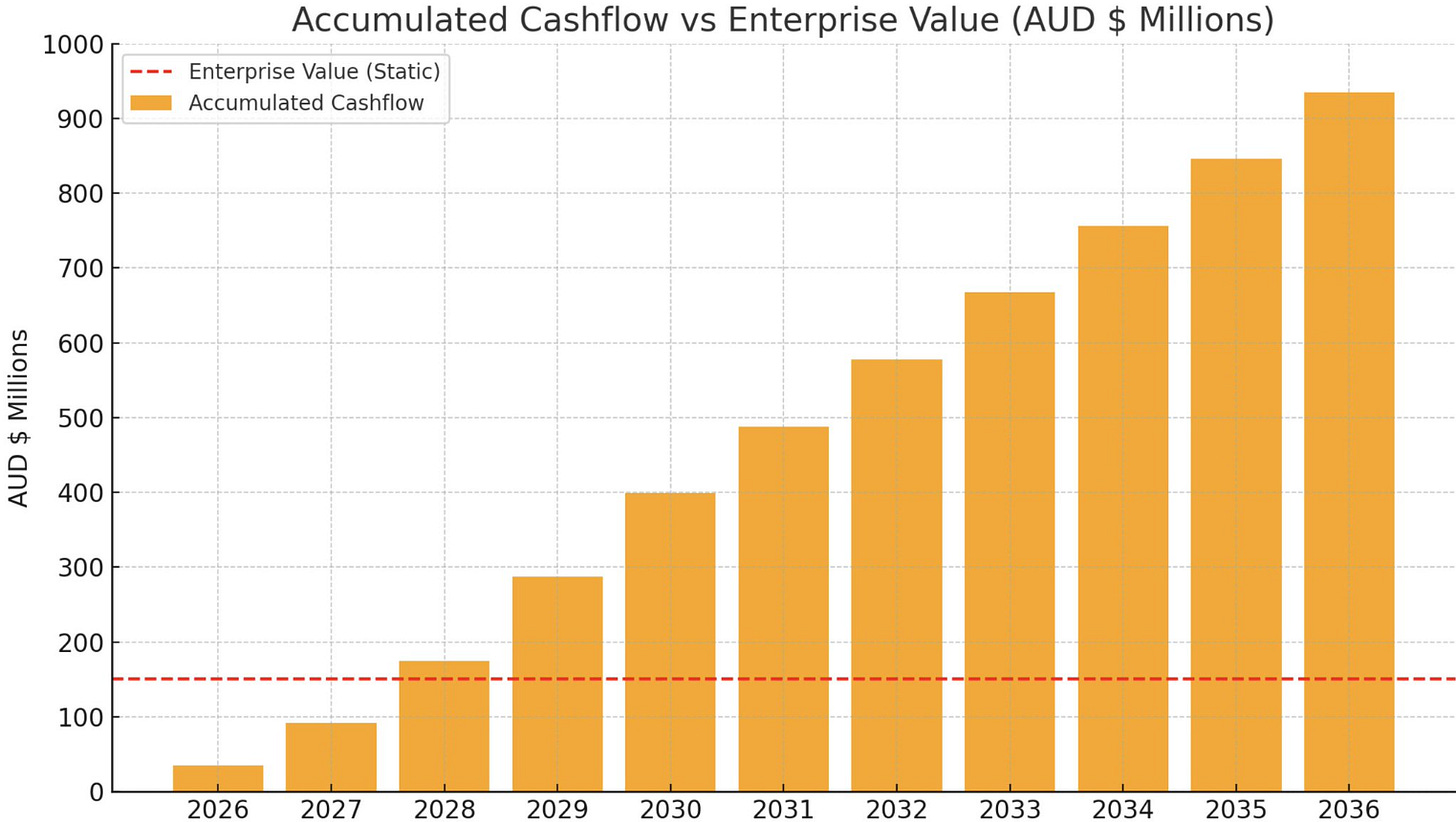

NPV with a 10% discount rate is 347mln AUD at a 10-year mine life.

Discounted cash flow (10%):

Their leverage to gold is at a whopping 6.66X, one of the highest in the industry. The higher the gold price - this miner makes more and more profit.

Important to note about these calculations is that they are speculative in nature. Lady Ida starts Q1 2026. They are still drilling. They just released amazing results as we covered earlier. We don’t really know how it will perform, the grade it will achieve when in production, but even with what we think are conservative estimates the stock is very cheap.

Due Diligence, Miscellaneous items

This section goes through various items that have not been covered yet, but are of some importance.

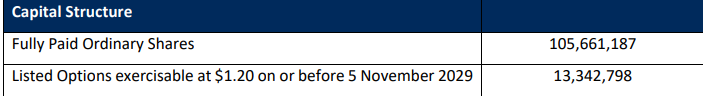

Source:https://app.sharelinktechnologies.com/announcement/asx/2271964c1d99328850395ecb2a88e3d8

Overall, the capital structure is quite clean. There is some dilution above $1.2 from options; we are above that right now, but the buyback will somewhat counteract this effect.

“We have 3,000 shareholders, but I would say 2,600 of them are West Australian shareholders.” CEO quote from 2023 presentation

This is an interesting “factoid” if you will. Most of their shareholders are from one area of Australia. And I think Beacon’s story would be very attractive to the gold bull crowd because of their bullion holding strategy and unhedged production. If the story gets exposed more to that crowd, I see some re-rating potential just from that.

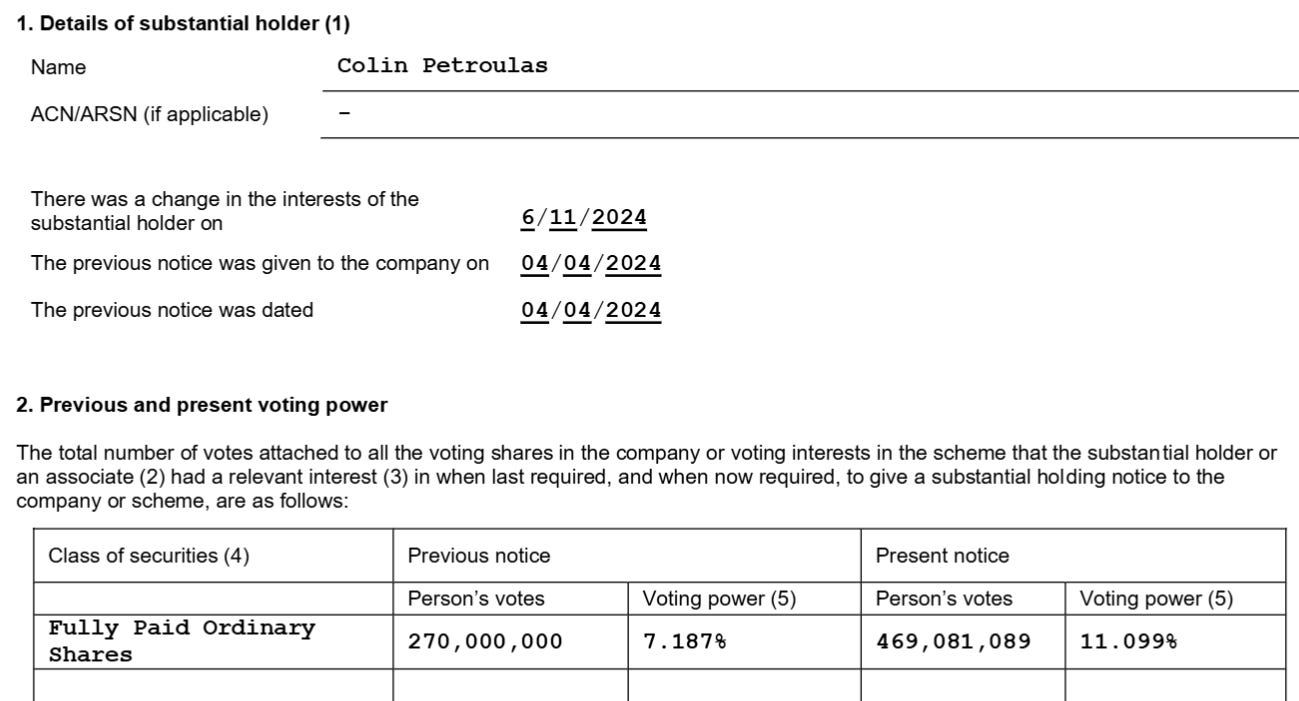

Beacon’s largest shareholder has been loading up

Source:https://app.sharelinktechnologies.com/announcement/asx/e20b9a1a275c0d9cfc71b9b3a65b3b04

Source:https://www.listcorp.com/asx/bcn/beacon-minerals-limited/news/change-in-substantial-holding-3113753.html

Based on the most recent data, Colin Petroulas owns 20% of Beacon based on data from 30 May 2025. He started buying in 202,3 and we see him with 5% at the time. Next year in June, we see his stake at 7.67% and over the duration when the Lady Ida deal was in the works, he increased his stake to 16% Sep-Dec of 2024.

From what we know, Colin Petroulas is just a high-net-worth investor. Lives in Western Australia, but the registered address is in Sydney.

He owns other gold miners (Westgold Resources 2% and Regis Resources 1.24%).

He is often seen to be trading alongside Graham’s moves, too. Although owning 20% I would assume he knows more than most shareholders.

Reach out Colin, if you are reading this! Keen to talk about BCN for sure!

There is only one public connection, which is that Beacon and Colin Both owned Maximus Resources shares. And Astral Resources acquired Maximus shares through a share swap. This is how Beacon ended up owning Astral shares worth AU$7m.

Astral is developing a large gold project. They have no production. +200m AUD market cap.

Source: https://investorhub.astralresources.com.au/announcements/7090683

Astral stock has roughly doubled from last year. The position is still pretty immaterial for Beacon unless it multibags from here, so this is enough of Astral coverage for this article.

Confidence in resources and pit design - Snowden and MineCor.

Snowden was the company doing the PFS on Lady Ida resources. They have done a few full studies before and quite a few resource updates to existing resources for various companies around the world. There isn’t anything fishy about the company. You always want to check who did the reserves estimate and if they know what they are doing.

Minecomp did a lot of work around pit design and optimisation for Lady Ida and Iguana deposit, and other Beacon’s assets as well. It is a local company located in Kalgoorlie (not far from Beacon’s office). Do not see a high risk here, but if there are issues around surprising cut-backs to the pit design that were not planned before, we would know the reason.

Some concerns were raised to us over the pit design for the Iguana pit and currently mined Macpherson, but nothing to classify as a red flag.

Gold price risk/opportunity(AlmostMongolian perspective)

Beacon doesn’t have a lot of operational, jurisdictional, or management risk. The most significant risk to the investment thesis is a decline in the gold price as Beacon mines low-grade pits, and their fixed costs are on the higher side.

Source: https://goldprice.org/gold-price-australia.html

If gold holds above $3,300, this stock will be a multibagger given its 6.6x leverage to the gold price (among the highest among peers). It’s just a fact of life given their earnings at that gold price. But this gold price is a new phenomenon. If it falls back to last year’s gold prices, the stock will go down.

I don’t generally like the idea of buying a commodity producer after the commodity the company produces has surged in price. Because with most commodities, higher prices lead to demand destruction, substitution with other commodities, and incentivize new supply. This means the commodity prices are naturally mean-reverting and range-bound over time. Unlikely to stay at the very high price due to demand destruction and supply incentivization, and unlikely to stay at the very low price due to demand incentivization and supply destruction.

But gold is an exception. And I don’t say that because I’m bullish on gold, I’m not, I’m indifferent. Gold is an exception because it does not have the same supply and demand dynamics as other commodities.

Source: https://howmuch.net/articles/global-gold-demand-2019

Source: https://auronum.co.uk/where-the-worlds-gold-lives-a-breakdown-of-above-ground-reserves/

Source: https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2024

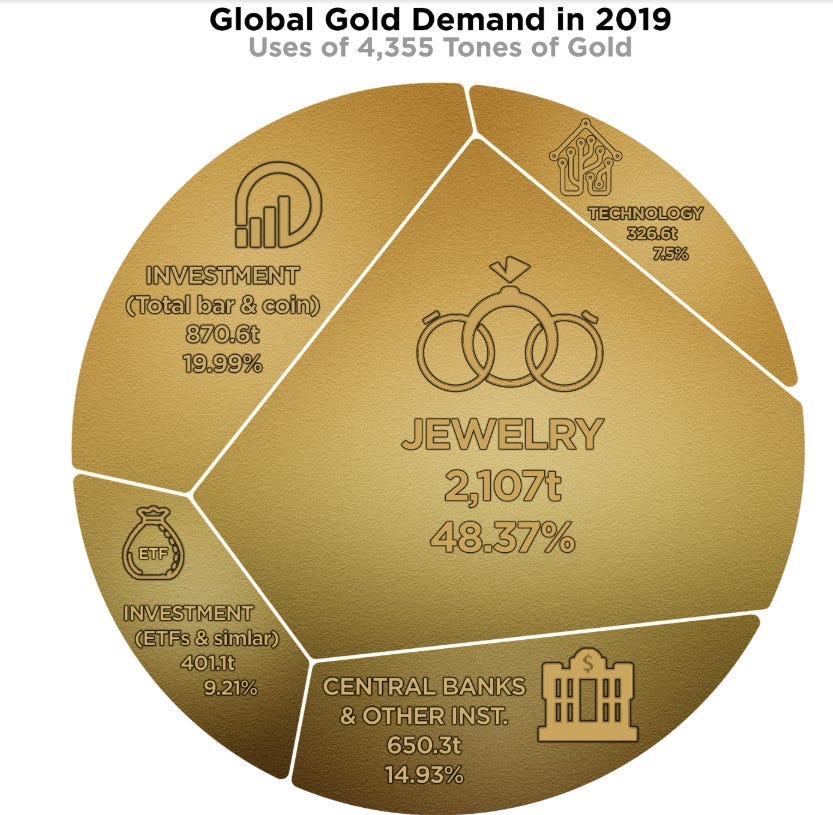

We can draw several conclusions from the four images above.

There are 212,582 tonnes of above-ground stocks. This means that investors are mostly trading these above-ground stocks, rather than new supply from mines. Mining adds about 3,600 tonnes per year, and recycling adds about 1,300 tonnes. Demand was approximately 5,000 tonnes. Around half of the demand is comprised of jewelry and technology, which are stable demand sources. The other half of this demand is driven by investment demand, including purchases of bars, gold ETFs, and central bank purchases, but this demand will fluctuate heavily based on market sentiment, which makes it the deciding factor of the gold price.

Because investor demand is the deciding factor in the gold price, and the above-ground stocks are so high, mining and recycling rates are almost irrelevant due to their low amounts in comparison.

If mining were to increase by 50% next year due to high gold prices, which would be basically impossible, it would barely make a dent in the above-ground stocks. Instead of the normal 1,7% increase in global gold stocks, it would be 2,5% increase.

Compared to a normal commodity like oil. We see the stark difference. Oil production per year is around 35 billion barrels, and global oil stocks are about 4,5 billion barrels. The yearly oil production is more than 7x the global oil stocks. In comparison, the global gold stocks are more than 60x the yearly gold mine production. This means that for oil, small changes in demand and supply make a significant difference in inventories and oil price, while with gold, they don’t impact inventories, and the gold price is determined by investors trading gold, of which only a small part is new supply from gold mines, most it having being mined a long time ago and derivatives backed by that gold.

In summary:

-The changes in mine production don’t matter for price, due to the large above-ground stocks. The mining creates an annual inflation rate for gold of around 1.5%.

-Recycling doesn’t matter, less than mining, and it’s mostly just gold changing form from jewelry to bars, not even affecting the global stocks

-Jewelry demand is relatively stable and small compared to global above-ground gold stocks, hence it doesn’t matter

-Technology demand is relatively stable and much less than jewelry demand, so it doesn’t matter

-Institutional and retail investors trading the existing gold stocks and gold derivatives determine the gold price. This factor will always outweigh the factors above, which only matter if investment demand remains unchanged, which it never does, as market sentiment for gold is constantly changing.

Due to these factors, the price of gold is more comparable to the price of Bitcoin (an investor-driven price and an annual inflation rate of approximately 1.5%) than to the prices of other commodities.

It’s not self-correcting in the same way as other commodities. The high prices do not have to lead to low prices or vice versa, in the long run. If investors really want gold, it can reach $10,000 and stay there. If they don’t want it, it can stay at 500$.

And this is why I’m comfortable chasing gold stocks like Cerrado and Beacon at $3,400 gold more than I would be chasing oil stocks above $100 oil. At $100 oil, supply is ramping up(OPEC+ space capacity, Shale, Oil sands), and gasoline demand is falling. These are huge factors and predictable, while I don’t believe you can accurately time exactly when the oil self-corrects after all oil producers become highly profitable, it will eventually self-correct due to supply/demand. Gold went to 3400$ because of investor demand. There is no self-correcting mechanism to take it down. The gold price itself is not indicative of future prices. If investors start selling, it will fall; if they continue to buy more, it will rise.

Predicting whether investors will buy or sell gold and gold derivatives in the future is a futile endeavor. Analysts dedicate their lives to it, yet still can’t get it consistently right. They talk about positive and negative correlations with gold price and real rates, dollar index, fed policy, inflation, etc, which are strong to moderate correlations at best, with real rates being the highest correlation. However, one would have to predict real rates or the US dollar index, which is another impossible task to accomplish consistently, only to achieve a non-perfect correlation with gold.

I take an approach to gold stocks that I simply assume roughly the current gold price and require an insanely good risk/reward at that price. The gold price becomes a random factor that will either benefit or harm the investment. I’m choosing to deal with this random factor due to the risk/reward of the stocks.

This is how I approach my gold investments in Beacon Minerals and Cerrado Gold.

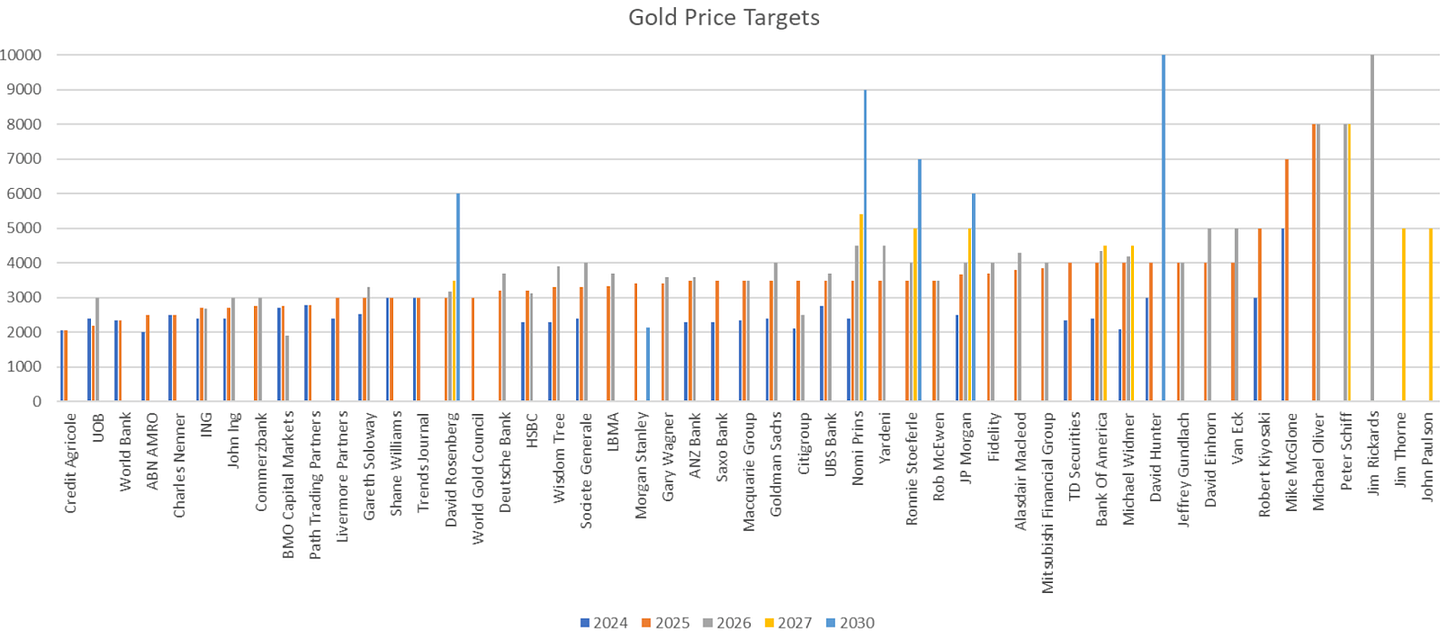

That being said, here is a collection of gold price predictions from various large financial institutions and famous analysts. Compiled by @GoldForecast on X.

Source: https://x.com/GoldForecast

Grey lines are 2026 predictions, and only 2 grey lines are under 3000$. Most of it is in the range 3000-3500$ and more for the years to come. By and large, the analysts of prestigious banks think that the gold is going to continue going up or hold above 3000$.

Short comparison between Cerrado and Beacon:

I recently wrote about another gold miner that I think also has a great risk/reward: Cerrado gold write-up. How does Beacon compare to Cerrado?

Beacon’s upside and downside are more reliant on the gold price because it has modest operational risk, low jurisdictional risk, and low management risk. Best jurisdiction, good management, who doesn’t make reckless self-serving moves, returns capital to shareholders. Operational risk is not anything different from the norm; the problems they sometimes have, such as those caused by rain, are not out of the ordinary for mining companies. Beacon also holds a significant amount of bullion and employs a bullion holding strategy. Beacon is also not hedging. When the gold price rises or falls, they feel it fully in their earnings and the value of their bullion. Making this is the dream stock for the gold bulls.

Cerrado is hedging a decent amount of its gold production, and I obviously like that, even though its old hedges ended up hurting its earnings. I wish they had hedged even more at the current prices, considering their need to secure cash flows for different projects. Cerrado is a polymetallic company, while their current production is mainly gold(some silver). Cerrado upside case is more about production ramp-up, which is not priced in, Mine Life increase, which is not priced in, Portugal permitting, Mont Sorcier, etc. They also have more management risk(Questionable Portugal acquisition, some old blunders) and jurisdictional risk with Argentina, which is also a jurisdictional catalyst, as the horrible jurisdiction is becoming a decent one. In contrast, Beacon’s great jurisdiction remains roughly the same, which provides no further upside itself, but does underpin re-rating potential as their jurisdictional peers are trading at a higher valuation. Cerrado has more upside and also more risks, but the risks are less about the gold price and more about other factors, while the gold price still remains important.

There are also commonalities between these stocks: laggers, cheap, screen badly at the moment, increasing production with low capex, and doing high-impact exploration, which is increasing mine life.

A few words on my Beacon positioning(AlmostMongolian)

This is a mid-sized position. My cost basis is AU$1.28. I’m in holding mode. The biggest reason why I’m not making this a large position is that I don’t want too much gold price risk in the portfolio, considering I already have Cerrado Gold in there.

Summary

Beacon represents an attractive risk/reward due to the high probability of a rerating if the gold price holds around the current prices. It’s trading at a discount to peers. The largest shareholder and the managing director have been buying.

For Beacon to re-rate the catalysts would be: Gold price holding, Buyback starting, Production increasing due to Lady Ida and plant capacity expansion, Mine Life increasing, more amazing drilling results, and the stock getting more exposure.

The production growth is achieved with relatively low capex. The financial situation is solid, and so is the management and the jurisdiction.

Let’s finish with words of the CEO’s last email: “Enjoy the ride.”

Great write-up, guys! Love that you looked at many different aspects of it. I concur with gold market being radically different from that gold market, and I like how you pointed that out. Also going into Timor, insider ownership, etc. Cheers