Aduro Clean Technologies: Huge potential

Game Changer

Disclaimer: I’m not an investment advisor. Nothing I have written in this article should be taken as investment advice. Everything I have written here could be inaccurate. Trust nothing you just read. I’m part of the Seeking Alpha Affiliate program which means I have a financial relationship with Seeking Alpha.

Aduro has been on the move. Why?

Source: Google

Aduro is a small-cap pre-revenue technology company and Aduro claims to have a technology that can do the following.

Source: https://cdn.buttercms.com/P5WLrbSCQFKd6DqVWgEv

That is a statement. This is a very ambitious company

They claim to have a solution for plastic recycling. Of the 3 markets shown above, the world is most desperate and lacks a solution to the plastic recycling problem. If a company would come along and have the solution it would be worth a lot of money. Potentially thousands of dollars.

Source: https://www.dw.com/en/why-most-plastic-cant-be-recycled/a-64978847

Plastic is difficult to recycle. The current technologies used are insufficient. The ocean is filling up with plastic. The fish are eating plastic and we are eating fish. It’s really a vicious cycle.

Source: https://cdn.buttercms.com/P5WLrbSCQFKd6DqVWgEv

What gives some initial confidence is the 42% Insider ownership with a lot of the compensation done through warrants which the insiders are using to increase their position further.

market cap= 127m CAD

EV=Around the same. This company has no debt and as a pre-revenue company, they raise money when they need more.

This means there will be more dilution, but if the company succeeds this will not mean much.

Ad:

Get a 7-day free trial and 30$ discount on your first year of Seeking Alpha Premium with my Affiliate link: https://www.seekingalpha.link/3N9WBS8/2QZRGT/

Technology

Source: https://cdn.buttercms.com/mNsTCc0WToyNg2WDnPfZ

Aduro has a completely unique technology in the plastic recycling space.

Source: https://cdn.buttercms.com/P5WLrbSCQFKd6DqVWgEvSour

Before going public in 2021 Aduro had been working on their technology for a long time and they have 7 patents to protect it and 1 pending.

Aduro started working with heavy oil upgrading initially, but during the research process, they found that they could use their technology for other purposes like plastic recycling.

Plastic is made from hydrocarbons. Aduro’s technology returns the plastic back to its hydrocarbon form.

Source: https://cdn.buttercms.com/P5WLrbSCQFKd6DqVWgEv

Source: https://cdn.buttercms.com/unYs8UZRLyXoHFe0aOhZ

Source: https://cdn.buttercms.com/mNsTCc0WToyNg2WDnPfZ

Next, I'll put some videos up that explain the technology in more detail and show some of their facilities so you know it’s a real company.

This is the go-to video for Aduro. They show the lab and the reactor and they talk.

This video talks more about the plastic problem, but why I chose to put this up is that it’s sponsored by Aduro. Aduro part starts at 18:26.

Results

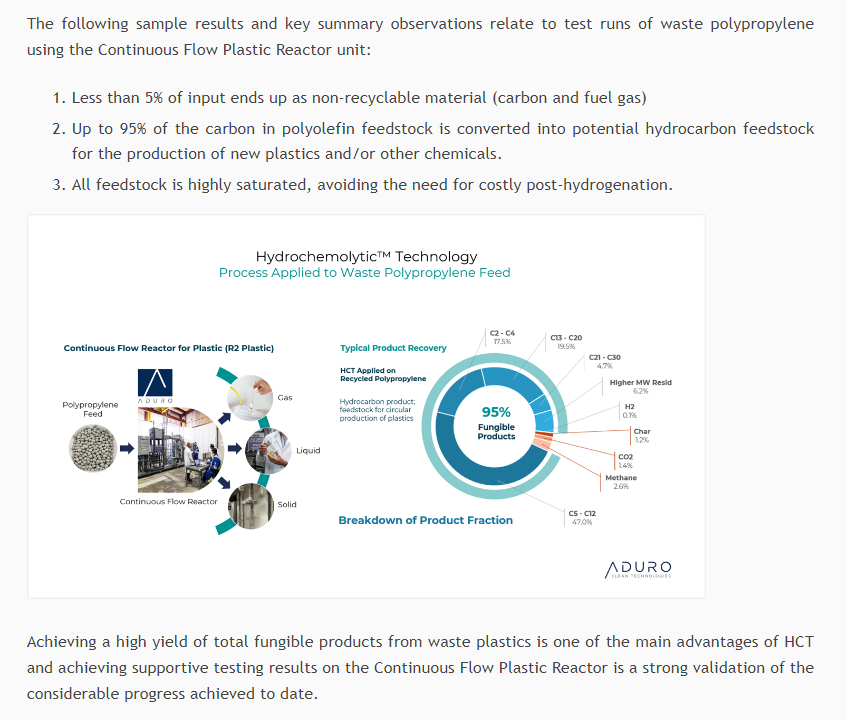

Aduro has proven its technology already on a smaller scale.

Aduro built a continuous flow reactor and has put all kinds of plastics in there and below are the results announced on 15.2.2024. This was huge news and it moved the stock up, but not nearly enough in my opinion.

I’m putting the whole Press release here.

Source: https://ceo.ca/@globenewswire/aduro-clean-technologies-shares-sample-test-results

240 test runs with a variety of different feedstocks and on average 95% was converted into potential hydrocarbon feedstock for the production of new plastics and chemicals. Nobody has results like this in this space.

A couple of months later Aduro provided more results on whether they can recycle Cross-linked polymers which are for example Car tires.

Source: https://ceo.ca/@globenewswire/aduro-clean-technologies-provides-results-on-testing

Aduro was able to convert 84% of the material back to hydrocarbons.

Source: https://www.aa.com.tr/en/environment/kuwait-struggling-to-get-rid-of-world-s-biggest-tire-graveyard/2332769#

Imagine if what is in that picture above was actually an asset, because of Aduros’ technology.

You can take a look at the Wikipedia page for Tire recycling. It’s a mess. https://en.wikipedia.org/wiki/Tire_recycling

If Aduros technology works at a big scale it will change the world. This is the next part Aduro needs to prove.

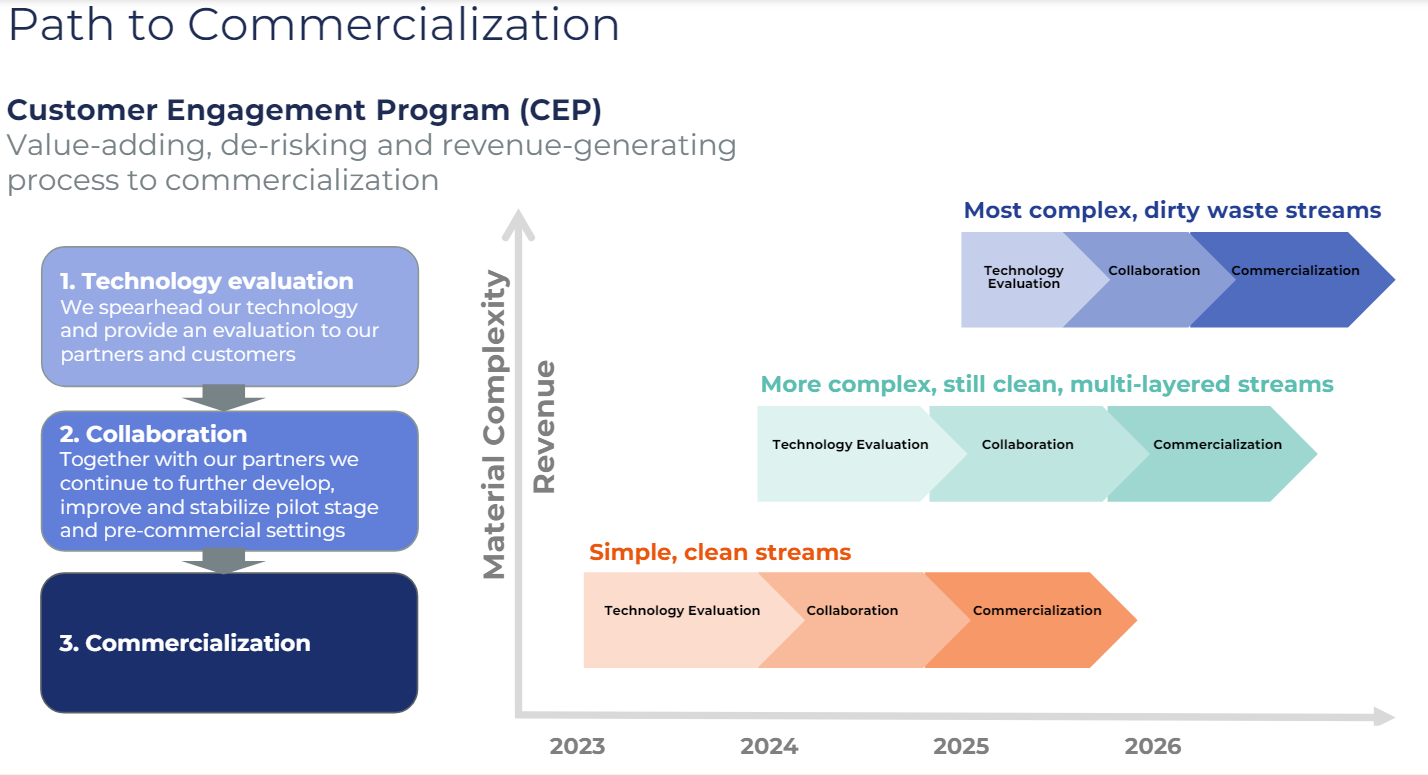

Business model

Aduro plans to use the licensing model which means other companies would be paying them to use their technology. This makes sense because building the recycling plants takes a lot of money that Aduro doesn’t have and this model is also very scalable and very high margin.

They are not at this stage yet. Currently, they have a number of major companies in their “customer engagement program”. This is a vague term, but it basically means companies are dipping their toes. They are testing the Aduro technology on their own dime. They are evaluating it. Thinking about whether to go on to the next stage.

Source: https://cdn.buttercms.com/unYs8UZRLyXoHFe0aOhZ

And I say Aduro is a pre-revenue company, because it basically is, but they actually have a little bit of revenue because the potential clients in the customer engagement program are paying Aduro for testing. But as you can see this is still largely irrelevant revenue, but it shows confidence from the potential clients.

Source: Yahoo Finance

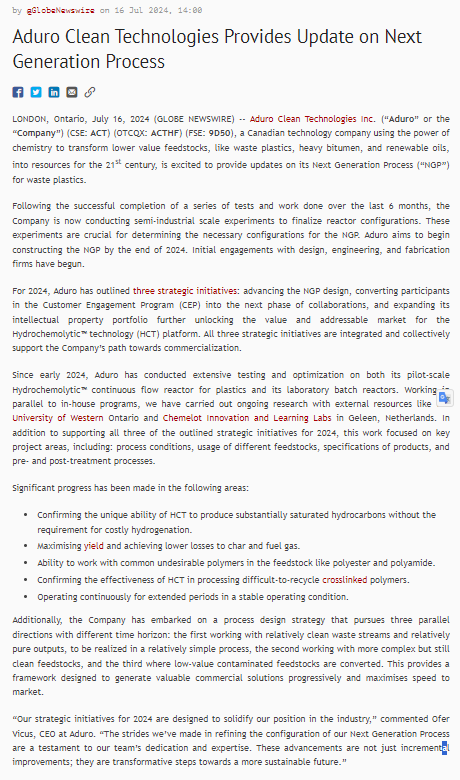

They are also building basically a model unit that should prove how the technology can work at a bigger scale and who potential licensing customers can go and look at to see how it would work for them.

Source: https://ceo.ca/@globenewswire/aduro-clean-technologies-provides-update-on-next-generation

I hate the name “Next Generation Process” Sounds generic and AI-generated. But the Next Generation Process should be a huge catalyst. Because the big question currently is. Does it work on a bigger scale? Another would be. Is it economic? But if it works on a bigger scale it’s most likely economic considering how big the subsidies are especially in the West. And the EU in particular with its big focus on the Circular economy.

But according to Aduro, it is very economic.

Source: https://cdn.buttercms.com/mNsTCc0WToyNg2WDnPfZ

Sounds almost too good to be true.

Source: https://cdn.buttercms.com/mNsTCc0WToyNg2WDnPfZ

Imagine the revenue and net income multiple if they can do something like this. I mean…

Source: https://cdn.buttercms.com/unYs8UZRLyXoHFe0aOhZ

Customer engagement and Partnerships

Source: https://cdn.buttercms.com/mNsTCc0WToyNg2WDnPfZ

They are all in the countries where it makes sense to be and planning to be in India where this problem is the most severe also makes sense.

With many of these customer discussions, the names are confidential.

Who is Aduro engaging with that we know of?

Here is everything that is not part of the customer engagement program.

Source: https://adurocleantech.com/partners

The Shell GameChanger could be big of course. Shell is a 225 billion USD market cap company. Prospera is a smaller oil producer(30m market cap) they produce heavy oil and Aduro’s technology should be able to convert it to higher-value light oil. While Prospera is one of the less important engagements, the Prospera CEO has said some interesting things in interviews about Aduro.

Prospera CEO in an interview by Mining Stock Education released 26.1.2024.

link to the interview: https://x.com/MiningStockEdu/status/1750860719828930686

“We've been working with Aduro and you know it's still in its innovation process and they're fairly busy with some of the majors"

What I get from that is that Prospera is somewhat on the back burner while Aduro is working with oil majors.

What oil majors?

Prospera CEO said something else in another interview from 2023 he said.

“Aduro’s objectives are well received by especially bigger companies like CONOCO and Shell. So there has been a very good demand for their testing to see if they can appreciate the oil quality so that they’ve been inundated with a higher demand of testing”

Link to the clip: https://x.com/grn_investing/status/1727456815485727093

Conoco would mean ConocoPhillips US oil company with a 129 billion USD market cap. Conoco working with Aduro has not been officially confirmed, but it would be weird if Prospera's CEO slipped the wrong company. Usually, when someone slips something it’s true. Usually.

Source: https://adurocleantech.com/partners

Aduro is doing the research engagements in a similar way to how they do customer engagement. Other entities are mostly paying for it.

Source: https://ceo.ca/@globenewswire/aduro-clean-technologies-provides-update-on-joint-western

When Aduro went to Brightlands the Business Development Director and Chief technology officer at Brighlands Eric Appelman was so impressed that he decided to join Aduro as the new Chief Revenue Officer.

Source: https://adurocleantech.com/news/aduro-clean-technologies-welcomes-eric-appelman-as-chief-revenue-officer

Source: https://adurocleantech.com/partners

These are some of the companies in the customer engagement program that Aduro has announced. There are others that are unannounced.

Source: https://ceo.ca/@globenewswire/aduro-clean-technologies-expands-technology-evaluation

Source: https://ceo.ca/@GlobeNewswire/aduro-clean-technologies-welcomes-a-global-multinational

Source: https://ceo.ca/@GlobeNewswire/aduro-clean-technologies-welcomes-a-multinational-building

This is the one Aduro successfully tested recycling tires with.

You can see Aduro is getting interest from some big players. If a single one of these goes to the next stage. The licensing stage. It will be a huge bullish catalyst for Aduro.

This is an update I made on 30.7.2024. I released the article on 29.7.2024, but this was such an important announcement and there are still new people reading this so I will update the article a bit.

Source: https://adurocleantech.com/news/aduro-clean-technologies-enters-new-phase-of-collaboration-with-totalenergies

1. Technical evaluation phase

2. Collaboration phase

3. Commercialization phase

This is the first company in the collaboration phase and it’s one of the biggest energy companies in the world.

Having Total move forward from the technical evaluation phase and also deciding to not stay anonymous is quite a vindication for Aduro's technology.

This will give Aduro a lot of exposure. Others will look at what Total is doing and get interested in Aduro.

If Total moves to the commercialization phase from here. I think this will be at least a 10x and then who knows how much more.

They have many companies in the technical evaluation phase. If Total moved to the collaboration phase we might see some others follow suit soon.

Source: https://companiesmarketcap.com/energy/largest-companies-by-market-cap/ + some editing from me

So now from the biggest energy companies we officially have Shell and Total with Aduro and a reason to speculate about Conoco.

Exposure to Investors

Aduro does the usual stuff. They have an IR firm and they do conferences.

They also try to get on TV sometimes and occasionally they might sponsor a YouTube video like the Jake Tran video I showed earlier. They are opportunistic when it comes to IR.

Source: Youtube

A more unique characteristic is that Aduro has a crew of Youtubers ready to pounce when the eventual bullish trigger happens. This trigger could be a drop in interest rates, a big collaboration announced, uplisting coupled with positive news, NGP completion, or really anything that gets Aduro closer to real revenue.

I would normally consider this type of YouTube exposure a massive red flag, but I just don’t really see big flaws in the investment thesis. I mean I learned about this stock from Mariusz Skonieczny’s YouTube channel.

These Youtubers can throw fuel to the fire when the stock gets going. When a new investor wants to know about Aduro and types it on Youtube there is a lot of content for them.

This sets up a potential massive run for Aduro at some point I don’t know when, but if they execute it’s inevitable to happen at some point.

This also adds to the volatility of the stock because it will get introduced to a lot of retail investors who are generally less educated, less committed, and much more manic than institutional investors, but I don’t have to tell you that.

The exposure to retail sets up a potential massive run for Aduro at some point I don’t know when, but if they execute it’s inevitable to happen at some point.

Uplisting

Source: https://ceo.ca/@globenewswire/aduro-clean-technologies-announces-filing-of-registration

The company is also looking to uplist to the New York Stock Exchange which will increase its reach among retail investors. Currently, a lot of retail investors do not have access to the stock because it trades on OTC(Over the counter) and CSE(Canadian Securities Exchange) which is more inaccessible than the TSX Venture exchange. Speaking from experience Accessing Aduro is especially cumbersome for Europeans. Imagine having to use Interactive Brokers.

The stock went up 18% after this announcement. Why? This is just a filing of a registration statement and this means most likely share consolidation and most definitely higher costs. The reason for the positive response is that there is an expectation of a big positive development that has given the management the confidence to go for the uplisting. That it will be worth it. Because if there was nothing coming up there would not be a good reason to uplist yet. The positive expectation is also there because this management has gained the trust of the investors. They do not have a record of making irrational decisions.

Update 30.7.2024

Aduro announces collaboration with Total. The positive news is here.

Summary

If they can prove their technology works at scale and its economic Aduro will be a huge success. Insiders are loaded up. I have only seen positive development with Aduro. I have never seen this company take a step back since I got involved in 2022. They’re always progressing.

It’s a Youtube popular pre-revenue company in a hot industry with high valuations. So I would normally avoid a company like this.

I have tried to find a reason why I should not like the risk/reward here. But I haven’t found it.

I hope they can solve the plastic issue, would be great for the world.

However:

"very ambitous company", "claim to have a solution for plastic recycling", "Potentially thousands of dollars", "as a pre-revenue company, they raise money when they need more.", "there will be more dilution, but if the company succeeds this will not mean much.", "has proven its technology already on a smaller scale.", "But if it works", "almost too good to be true", "Imagine the revenue", "If a single one of these goes to the next stage", "a potential massive run ", "If they can prove their technology works at scale "

A lot of ifs potential's, imagination, etc etc. It sounds very much like a speculative biotech bet. 1000x or 0. If the product doesn't work, insider ownership 43% or 4.3% wouldn't matter. I was also impressed when I first ready about this in a previous write-up here https://www.greeninvesting.eco/p/aduro-clean-technologies

But there are a couple issues.

1) The basics of thermodynamics of the chemical reaction dictates that oil->plastic will always be cheaper than plastic->oil. Making new plastic takes less energy than recycling. Therefore, Unless there is a forced tax or regulations of some sort, it will probably never be economically viable.

2) I read somewhere that all reactors face the same issue; reactors clog with toxic tar made up of the dirt made up of the dirt that comes with the plastic and and the chemicals added to the process.

Unless you can disprove these points, this feels like a hyped up speculative bet. But obviously if it works, investors will be massively rewarded. Even if it's not economically viable, investors may still be rewarded if big players decide that a small percentage of their FCF will go towards recycling of plastics with Aduro's tech to boost marketing by claiming they are carbon neutral or whatever.

Cheers!